Residential installations grew 7 percent last year, more than expected by analysts at energy research and consulting company Wood Mackenzie Power & Renewables.

But there’s still a good bit of uncertainty in the market considering global module oversupply and declining module tariffs, as well as the coming step-down of the federal Investment Tax Credit. Through 2021, analysts at WoodMac say residential growth could range from 4 to 19 percent.

It’s within that context that EnergySage, an online solar shopping marketplace, released its latest Solar Marketplace Intel report this week, which focuses on the residential market.

The results offer valuable takeaways about price declines for residential systems, the increasing interest in residential solar across the U.S. and how U.S. panel manufacturers are faring post-Section 201 tariffs. But analysts say the report's results should be considered according to the portion of the market that EnergySage’s transactions represent. Though it’s among just a few online platforms for selling and buying solar, the marketplace still encompasses just a small segment of total residential sales — about 3 to 4 percent of the residential market, according to EnergySage.

Allison Mond, a senior solar analyst at WoodMac, said the site mostly caters to small local installers selling customer-owned systems through a certain set of loan partners. Those partners do not include Mosaic, for instance, which Mond said is the largest residential solar loan provider in the country.

“These [EnergySage sales] are basically all customer-owned systems, and the whole market is not customer-owned systems,” said Mond. “It’s a small sample.”

WoodMac’s latest Solar Market Insight report, released in March, notes a relaxing of the customer-ownership trend. Third-party ownership, however, is increasing. It accounted for 31 percent of the market in Q4 2018.

“We know that about a third of the market is still third-party-owned,” said Mond. “But those systems are nowhere to be seen on the EnergySage platform.”

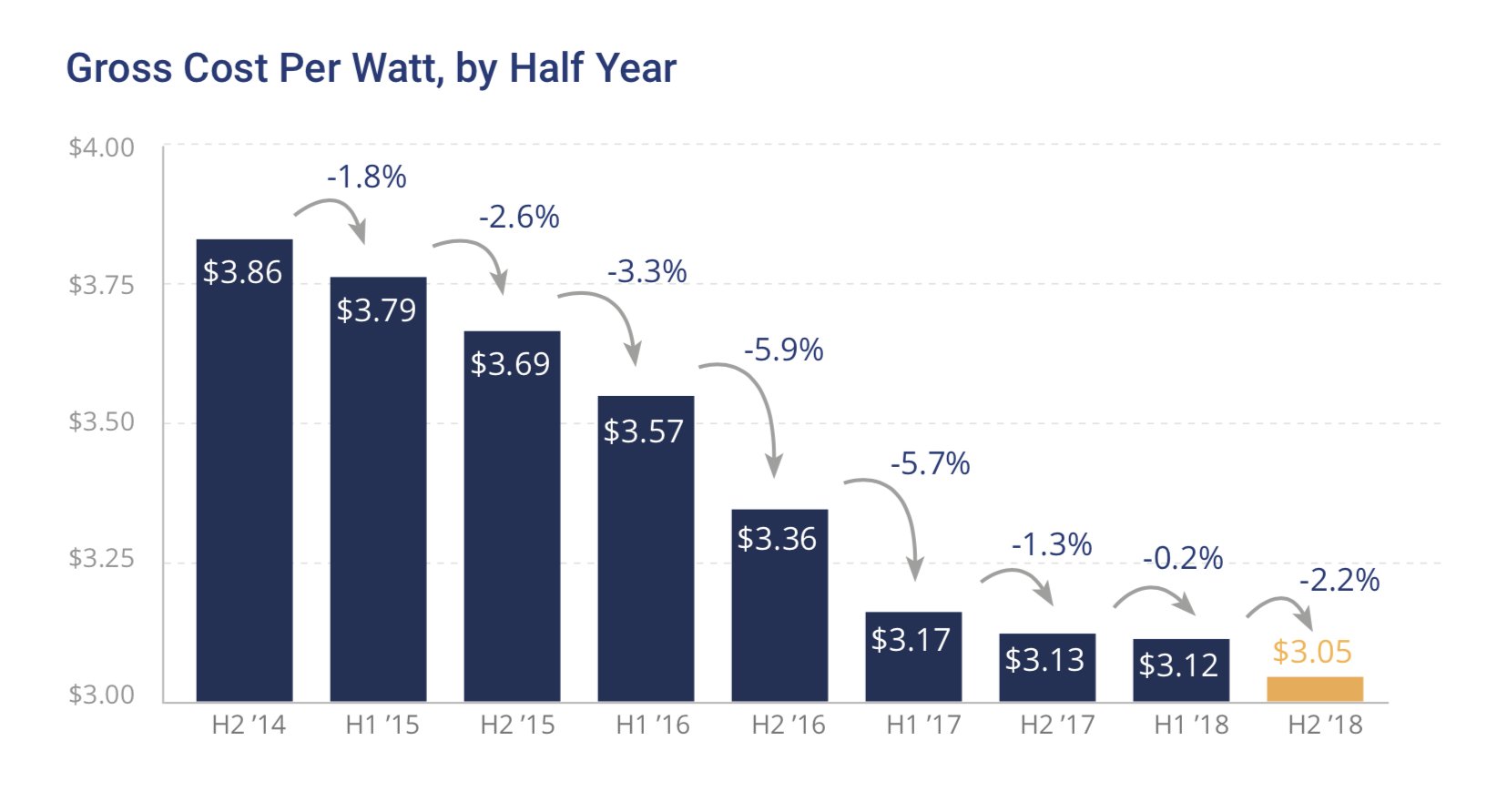

That said, many of EnergySage's findings affirm trends noted elsewhere, like continuing cost declines. EnergySage recorded its largest system price drop since the record-breaking year of 2016, with costs dropping over 2 percent from the first half of 2018 to $3.05 per watt.

Source: EnergySage

WoodMac puts current residential prices even lower, at $2.98 per watt.

EnergySage CEO and founder, Vikram Aggarwal, recognizes that the marketplace offers a partial portrait of sales, but said the site’s comparison shopping can nudge prices lower, much as Kayak and Expedia do for flights.

“That [structure] pushes downward pressure on the prices that...any company can charge a customer,” said Aggarwal. “We are not the whole market by any means, but what we’re finding now is the prices that are available on our platform are having an impact on how some of the larger companies are pricing.”

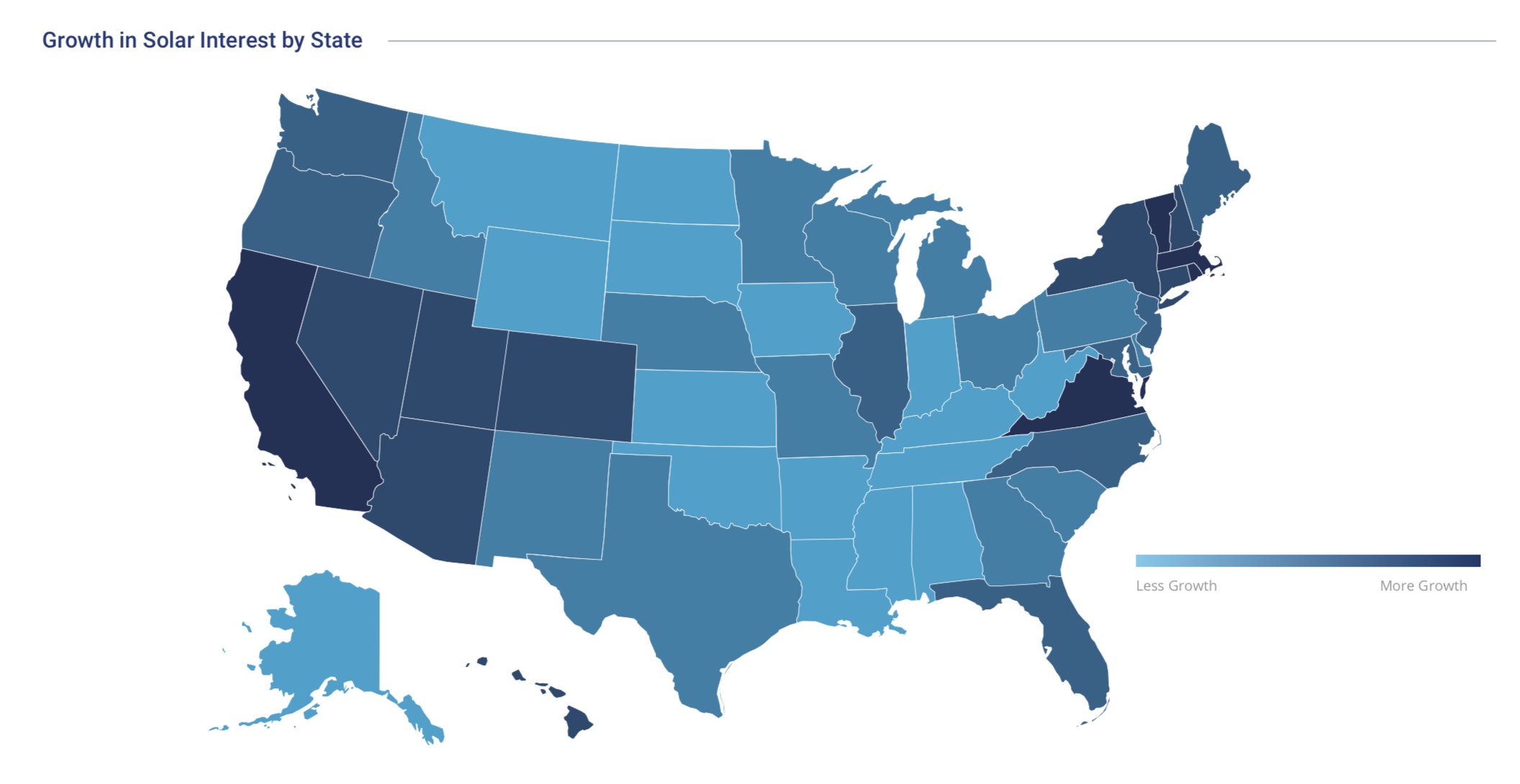

The site’s recent results also show solar interest, which EnergySage measures through web traffic, increasing in every state in 2018.

Source: EnergySage

Perhaps unsurprisingly, interest grew the most in states with strong solar incentives, like California and Hawaii, and with strong solar markets, like North Carolina and Arizona.

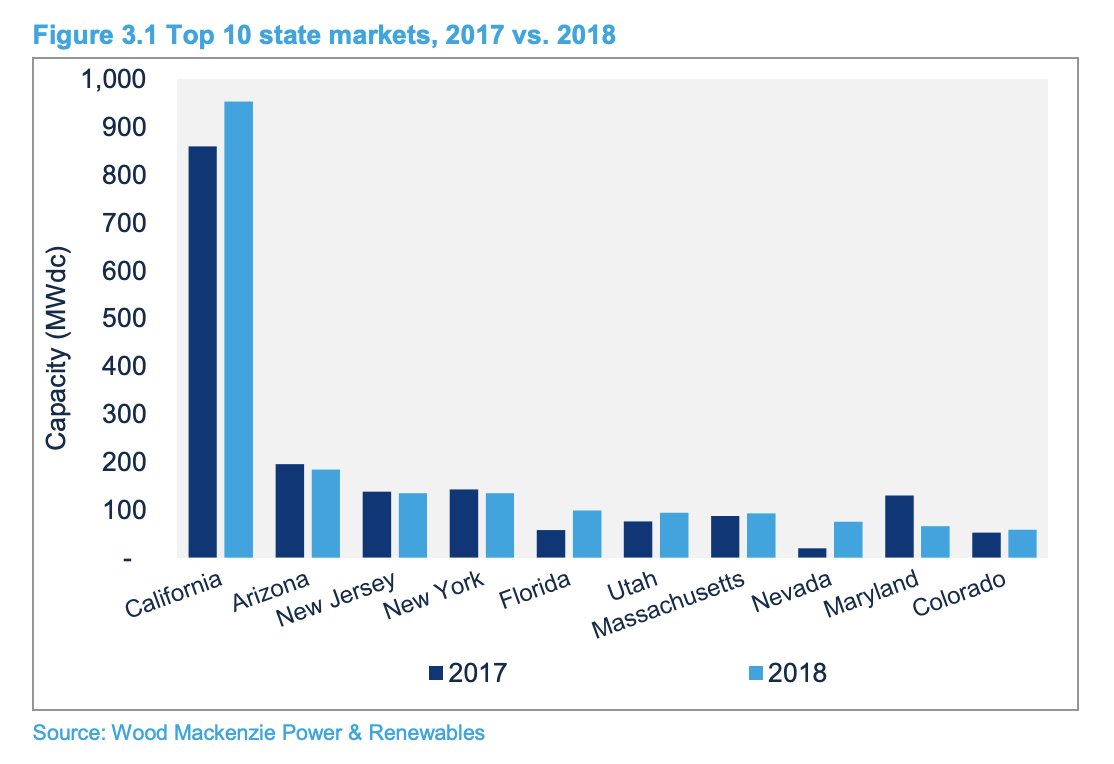

WoodMac’s latest ranking of top state markets for residential solar aligns closely with the states where EnergySage registered high growth in interest. California is again the largest residential market by far, with Arizona and New Jersey trailing in second and third place, respectively.

Looking ahead, WoodMac analysts note an upside to its forecast in states eyeing higher renewable portfolio standards, even if they don’t specifically target distributed solar.

New Mexico, for example, recently passed legislation targeting 100 percent carbon-free electricity by 2045. In February, the House of Representatives also approved a community solar program with a size cap among the highest in the U.S.

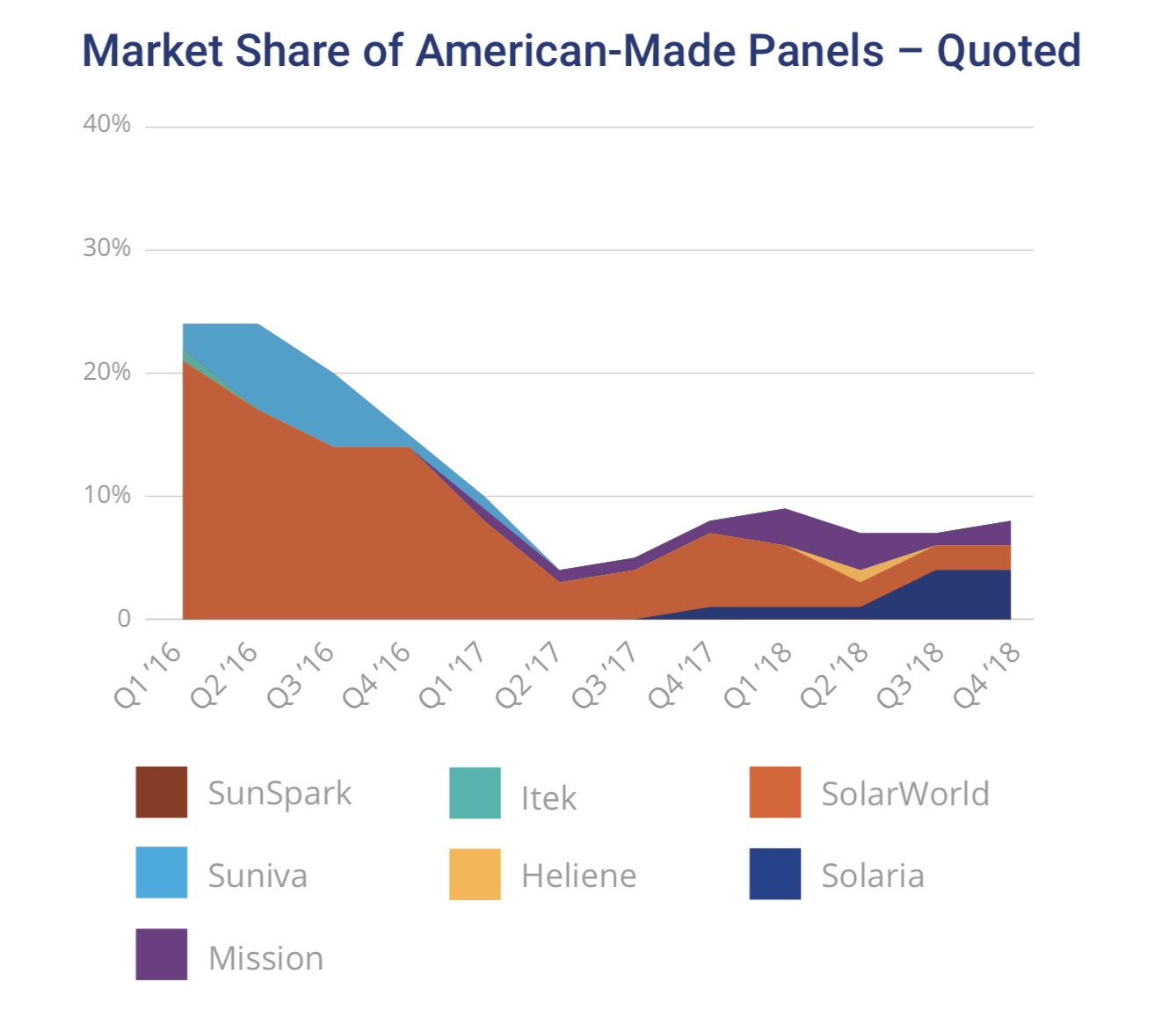

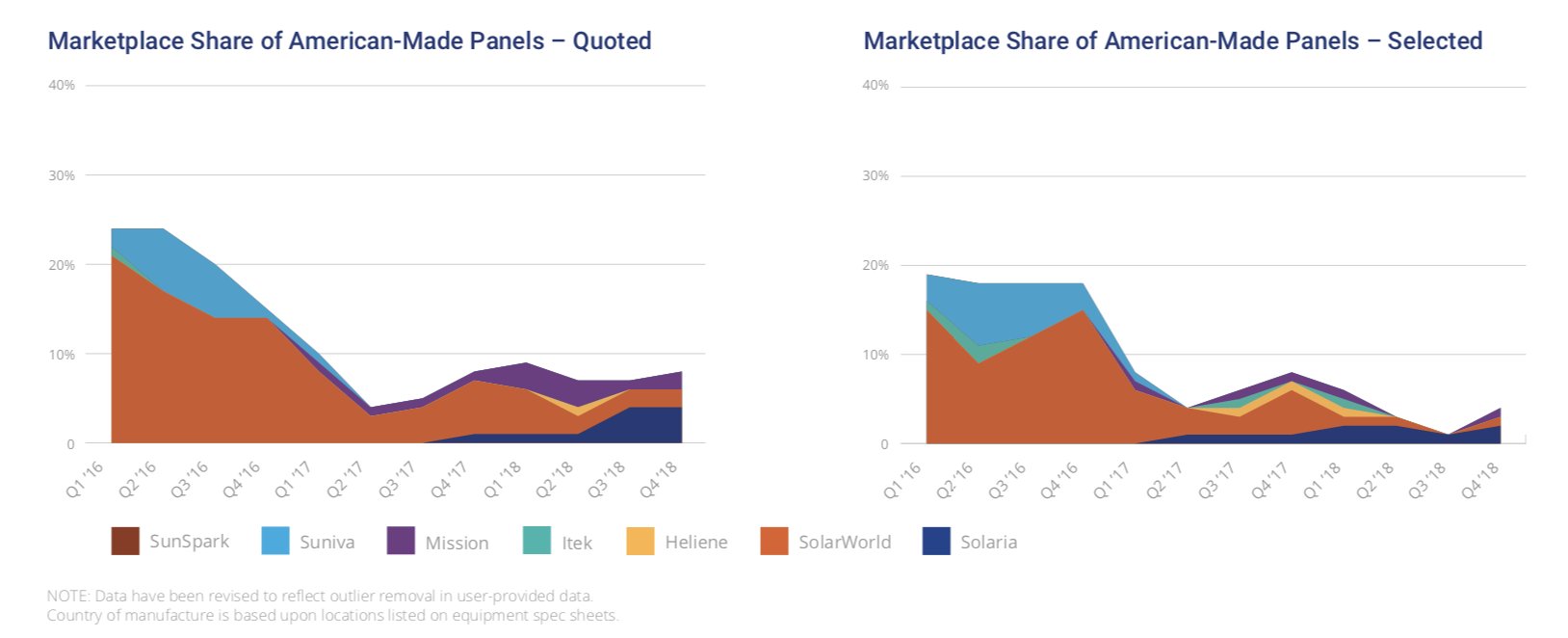

In its report, EnergySage also points to a trend suggesting that tariffs haven’t yet caused a significant increase in the popularity of U.S.-made panels among its customers.

Source: EnergySage

According to the marketplace, U.S.-made panels accounted for only 7 percent of the quotes customers received in the second half of 2018.

Source: EnergySage

EnergySage notes that the portion of U.S.-made panels selected has also fallen since a high of 24 percent in the first half of 2016. Quotes for U.S.-made panels jumped by 9 percent after the International Trade Commission unveiled its recommendations at the end of 2017 and by 10 percent when tariffs were announced in January 2018. But since then, the share has dropped, remaining down significantly from 2016. U.S.-made panels accounted for just 3 percent of selected quotes in the second half of 2018.

Ben Gallagher, a senior solar analyst at WoodMac, said that result “might be a bit of an anomaly,” because U.S. panels saw some rebound in Q4 over Q3.

“[It] looks like a decent chunk of the market is still interested in ‘made-in-America’ product,” he said.

That number will also likely increase with the ramp of U.S. manufacturing facilities from foreign-owned companies such as Jinko and Hanwha Q Cells.

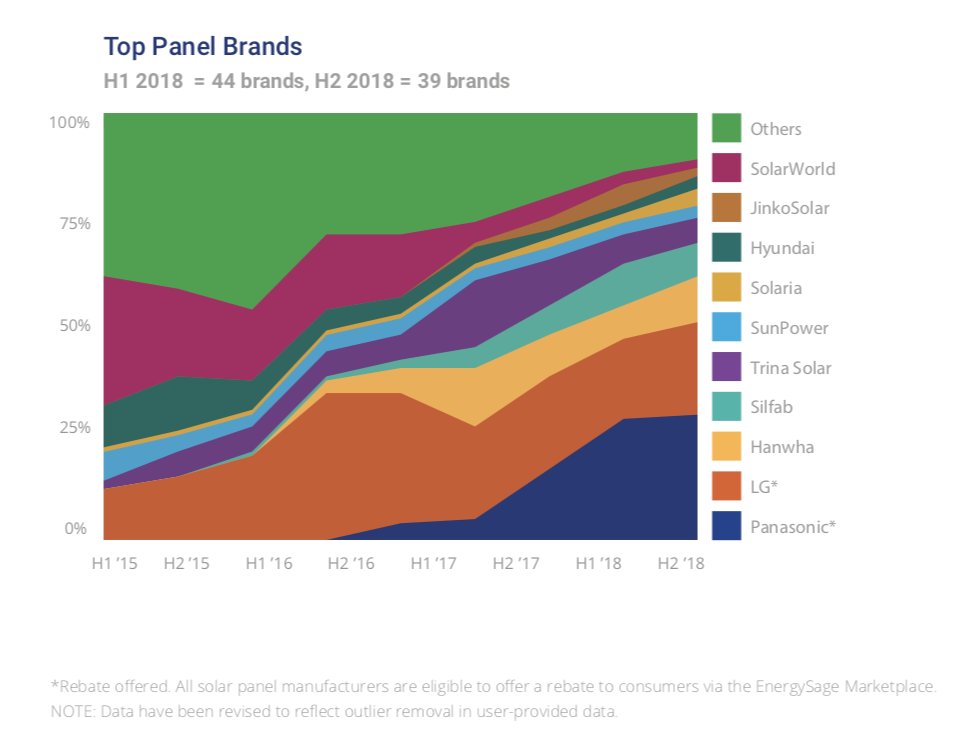

In its latest report, EnergySage notes Panasonic and LG (which has a solar plant in the works in Alabama) were the most quoted panels on its marketplace.

Source: EnergySage

But Hanwha and Silfab Solar — two foreign-owned companies also moving into U.S. manufacturing — climbed to the third and fourth spots for quoted panels, respectively.

“A number of these manufacturers have announced their plans to manufacture panels in the U.S., and guess what? Companies like Hanwha, Silfab and LG…those are the No. 2, No. 3 and No. 4 solar panel brands on our marketplace,” said Aggarwal. “These companies seem to be doing really well in the American market with the American consumer.”

Wood Mackenzie’s 2018 numbers, which analysts say represent 60 to 70 percent of the U.S. residential market, show LG and Panasonic ranking third and fourth for total market share, respectively. According to WoodMac, Hanwha claims the top spot at 14.3 percent of the market for the year. That’s a climb from 12 percent in 2017.

WoodMac’s numbers also show companies with announced or ramping U.S. manufacturing sites growing market share. Jinko, for instance, increased from 6 percent of the market in 2017 to 8.7 percent in 2018; LG grew from 13.1 percent in 2017 to 14 percent in 2018; and Silfab came in at 2.3 percent last year, up from 1.8 percent in 2017.

But the tariffs, as we know, haven’t saved SolarWorld. WoodMac’s data shows the Section 201 petitioner losing market share. In 2018 its portion of the market dropped to 4.3 percent, down from 6.8 percent in 2017. EnergySage notes that “the portion of installers quoting SolarWorld panels on EnergySage has dropped precipitously since...[the company filed] for insolvency.”