Lazing about at the beach? Sitting on a dock? Stuck in the office? Wherever you’re reading from this week, here is a roundup of the latest state clean energy policy actions to keep you up to date.

To kick it off, we take a quick look at the distributed solar and rate design changes that defined the second quarter, thanks to the North Carolina Clean Energy Technology Center, followed by a general rate case update from EQ Research. And, finally, a summary of the latest state-level clean energy news.

Q2 policy actions

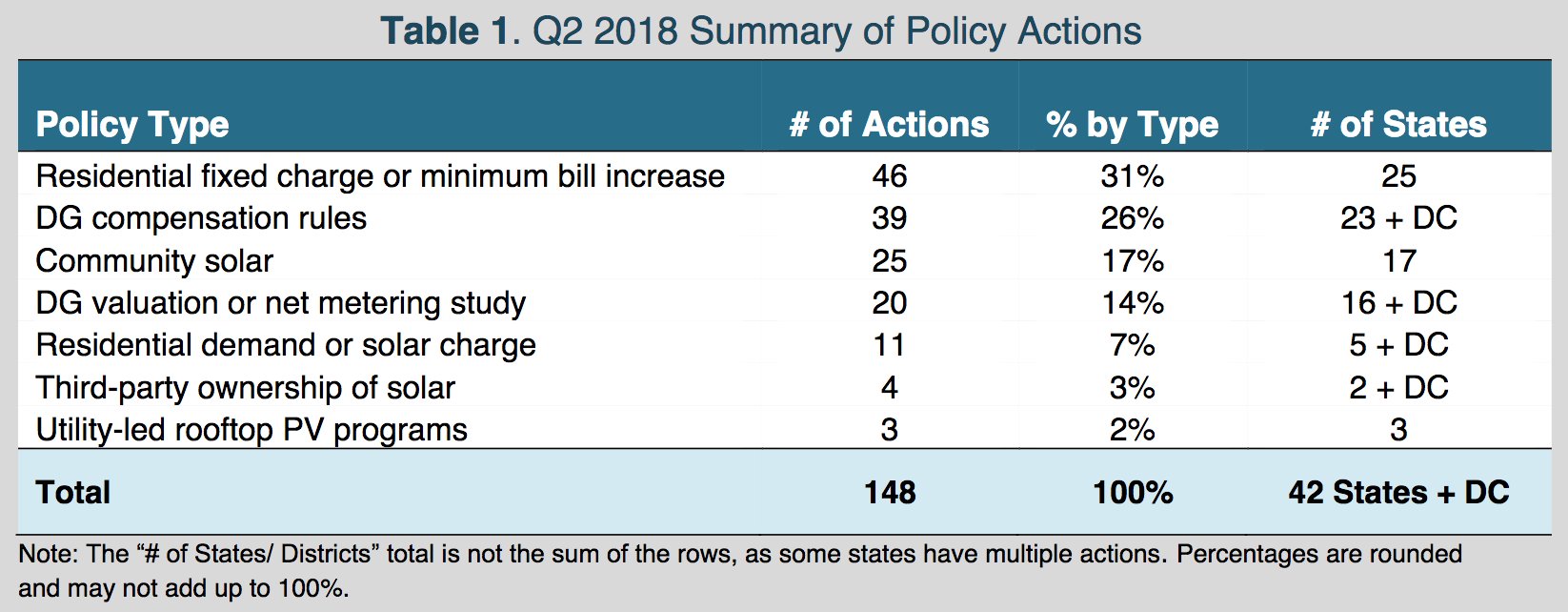

NCCETC’s Q2 2018 edition of The 50 States of Solar found that 42 states and the District of Columbia took some type of distributed solar policy action during the second quarter. A total of 148 distributed solar policy actions were taken during the period, with the greatest number of actions taken in California, Arizona, New York, Virginia and Massachusetts.

The report identifies three major solar policy trends from the quarter: 1) states working to increase low-income customer participation in community solar programs; 2) state legislatures considering bills effectively undoing or amending regulatory decisions; and 3) regulators approving residential fixed charge reductions.

Autumn Proudlove, lead author of the report and senior manager of policy research at NCCETC, noted that many state solar policy and rate design decisions of late have been very controversial. As a result, lawmakers are stepping in. “We’re finding that a number of state legislatures are taking up these issues and considering changes that would effectively reverse or significantly amend recent decisions made by state regulators,” she said.

The report notes the top five policy developments of Q2 2018 were:

- Connecticut becoming the latest state to move away from net metering

- The New Jersey legislature adopting a statewide community solar policy

- The Florida Public Service Commission opening the door to residential solar leasing

- Idaho regulators approving Idaho Power’s request to separate distributed generation customers into a unique class

- Colorado, Connecticut and New York regulators approving residential fixed charge reductions

I would also add California's new — first in the nation — rooftop solar mandate to the list of top policy developments in Q2. Starting in 2020, all new homes under three stories will be required to install solar panels under the state's new building codes. The codes also help to incentivize energy storage and include a host of energy efficiency upgrades that are expected to slash energy use in new homes by more than 50 percent.

For more information on the mandate, Iet me direct you to this 8,000-word explainer I recently wrote. It's fair to say I went down a rabbit hole with this one.

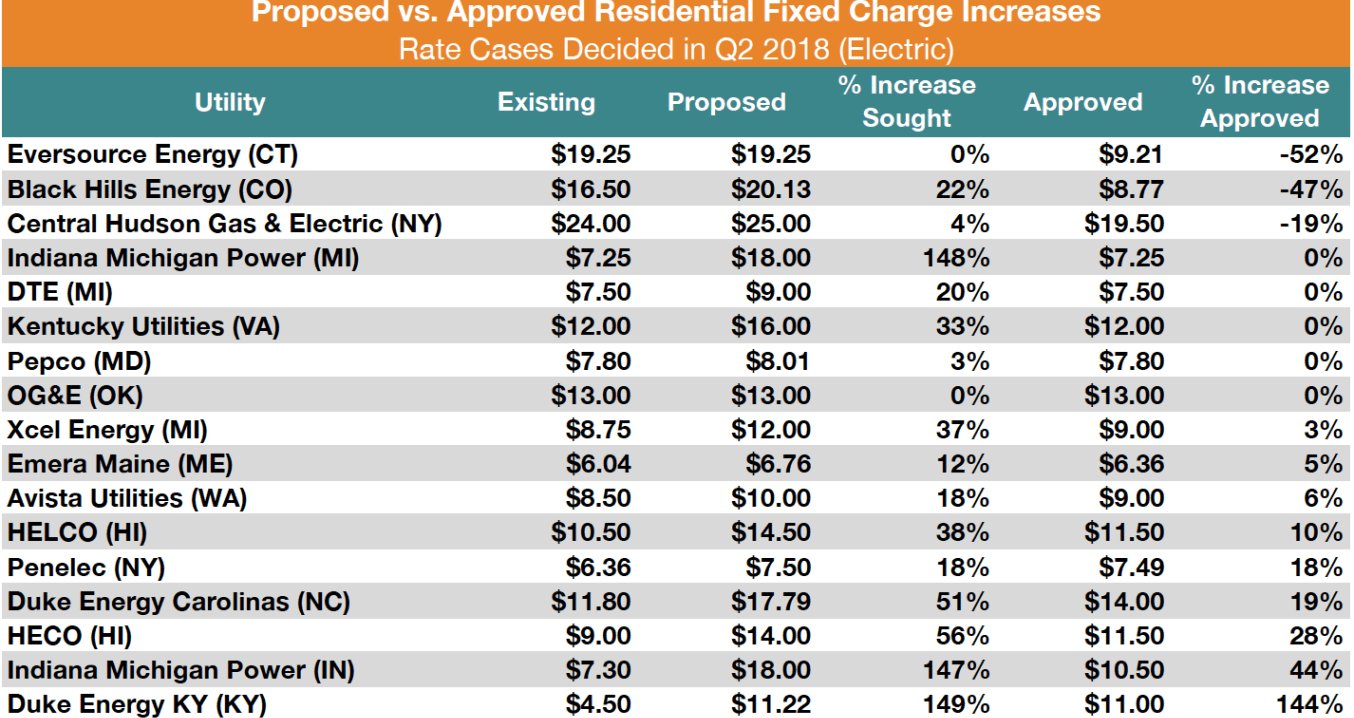

In EQ Research's Q2 policy update, the firm found that 14 utilities initiated new general rate cases in the last quarter. And of those that include proposed rate-design revisions, all but one aimed to raise the monthly fixed charge for residential customers. Six utilities proposed raising their charge by 50 percent or more. One utility — Entergy Texas — sought to nearly double its charge, from $7.00 to $13.64.

In 10 of the 17 general rate cases that concluded in the second quarter of 2018, regulators did not allow residential fixed charge increases greater than 5 percent. The average increase approved by regulators in these cases was 9 percent, compared to the average proposed increase of 44 percent. As noted above, regulators meaningfully reduced monthly fixed charges in three states last quarter: Colorado, Connecticut and New York.

The reason fixed charges are so important to track is because the inescapable fees directly impact customers' pocketbooks, and directly impact the business case for third-party-owned distributed solar. The fact that state regulators are not permitting utilities to hike their fixed fees in most cases, is beneficial to the rooftop solar industry.

EQ also noted that general rate cases, "in addition to addressing utility revenue requirements and rate design — have become vehicles for major proposals related to distributed solar, battery storage, EVs and other DERs; grid modernization; performance-based regulation; and new pricing options and opportunities, including TOU rates."

The latest state policy developments

Solar advocates lobby Massachusetts policymakers on net metering and demand charges: With just a couple of days remaining in the legislative session, solar advocates are urging Massachusetts state lawmakers to pass legislation that would abolish caps on net metering and undo a residential demand charge utility regulators permitted Eversource to put in place starting next year. SEIA and other renewable energy stakeholders are also advocating for the state to boost its RPS by 3 percent per year, up from the current 1 percent per year.

Last month, the Massachusetts Senate passed a bill that removes the state’s net metering caps, sets a 100 percent by 2047 renewable energy mandate, and boosts the state’s energy storage procurement target to 2 gigawatts, among other things. The House has passed its own set of energy bills, which are now in conference committee with the Senate. One of the House bills would increase the RPS to 35 percent by 2030.

Environmental groups oppose energy choice initiative in Nevada: Four prominent environmental groups have come out in opposition to Nevada’s Energy Choice Initiative. Question 3 on the state’s ballot in this November’s election would end NV Energy’s monopoly and open up the electricity market to competition. The Natural Resources Defense Council, the Sierra Club, Southwest Energy Efficiency Project, and Western Resource Advocates argue that deregulating Nevada’s electricity market will create uncertainty and the state's clean energy progress.

APS-backed group challenges renewable energy ballot effort in Arizona: A lawsuit filed earlier this month by a utility-backed group, contends that close to 70 percent of the signatures submitted in support of a ballot initiative to set a 50 percent renewable energy standard in Arizona are invalid. Arizonans for Affordable Energy claims that about 270,000 of the 480,000 signatures are from supporters who are not registered to vote in the state or have other issues. Pinnacle West, the parent company of Arizona Public Service, is backing AAE. APS has spent more than $10 million to fight the renewables proposal over the past year, including $6.4 million in the last three months. The group advocating for the ballot initiative, Clean Energy for a Healthy Arizona, is backed by activist billionaire Tom Steyer. Steyer’s super PAC, NextGen America, is supporting similar ballot initiatives in Nevada and Michigan. The group says it’s not worried about the legal challenge in Arizona.

California reforms San Onofre plan: California regulators approved a new deal on July 26 that trims $750 million from a plan to charge ratepayers for the premature closing of the San Onofre nuclear plant. The cost-sharing settlement halts customer payments for the power plant that shut down after a radiation leak. Under the original 2014 agreement payments were scheduled to continue through 2022.

Vermont weighs alternative regulations: The Vermont Public Utility Commission recently issued an order that provides guiding principles for future electric or natural gas utility regulation plans, and encourages utilities to be creative in proposing future plans. The Commission may approve an alternative regulation plan if it finds that the proposed plan will “offer incentives for innovations and improved performance that advance State energy policy.” The Commission envisions that alternative regulation can also help break the connection between a utility’s sales and profits, which can be an important tool for promoting innovation and flexibility in achieving the state’s policy goals. Examples include efficiency, conservation, load management, time-of-use rate design, and the deployment of innovative, customer-based technology and energy services. The order concludes a workshop process on emerging trends in the utility sector and related regulatory reforms, as requested by the Vermont Department of Public Service.

Dominion files to add renewables in Virginia: Dominion Energy Virginia has filed its first set of plans required under the Grid Transformation & Security Act, landmark legislation for Virginia’s energy future that became effective July 1. Dominion’s plan includes committed to 3 gigawatts of new solar and wind under development or in operation by 2022. The new law also directs Dominion Energy to propose at least $870 million in energy efficiency programs over the next decade. In a related filing with the State Corporation Commission, Dominion Energy seeks to add 240 megawatts of solar energy. The company is also gathering input from stakeholders this summer on the next phase of its solar strategy. In the coming months Dominion will also seek regulatory approval for its proposed 12 megawatt Coastal Virginia Offshore Wind project.

Georgia seeks distributed solar projects: Georgia Power is soliciting more than 100 megawatts of new distributed solar. Eligible projects will range from 1 kilowatt to up to 3 megawatts. The RFP is part of the Renewable Energy Development Initiative, initially approved by the Georgia Public Service Commission in 2016. Through REDI, as well as other solar projects and programs, Georgia Power expects to add up to 1.6 gigawatts of additional renewable capacity by the end of 2021.

Duke looks to extend solar rebates in North Carolina: Duke Energy North Carolina is seeking regulatory approval to give residential and nonresidential customers who installed solar systems between January 1, 2018 and July 26, 2018 another opportunity to apply for the utility’s rebate program in 2019. There is still capacity left for nonprofit customers this year.

New Jersey weighs new offshore wind rule: The New Jersey Board of Public Utilities has proposed a rule by which an offshore wind project receives funds and how revenues earned flow back to ratepayers. The Offshore Wind Energy Certificate will help the state meet its immediate goal of deploying 1,100 megawatts of offshore wind capacity, and Governor Murphy’s long-term goal of 3,500 megawatts.

New York to launch offshore wind solicitation: On July 12, New York Governor Andrew Cuomo announced the state will launch its debut offshore wind solicitation, targeting 800 megawatts of capacity, in the last quarter of this year. The solicitation will help to achieve New York state’s target to deploy 2,400 megawatts of offshore wind by 2030.

Kansas regulators approve Westar renewable energy agreement: The Kansas Corporation Commission gave its stamp of approval this month to Westar Energy's proposed C&I renewables program. With that decision, Westar subsequently announced that it had reached a 20-year agreement with an affiliate of NextEra Energy Resources to purchase energy from a new 300-megawatt wind farm. Businesses that want to participate in Westar's renewable energy program will be able to claim a portion of the energy from the wind project.

Pennsylvania plans to expand solar resources: Earlier this month, the Pennsylvania Department of Environmental Protection published a draft plan to expand in-state solar resources. "Finding Pennsylvania’s Solar Future" sets a goal to have solar supply 10 percent of the state’s electric retail sales by 2030. That plan would boost Pennsylvania’s solar capacity to 11 gigawatts by the target date, which is a significant increase from the 300 megawatts currently installed. Comments on the draft plan are due August 20. A final plan will be published in December.

California's 100 percent renewable energy bill advances: On July 3, the California Assembly Committee on Utilities and Energy passed SB 100 — which would increase California's renewable energy standard to 100 percent clean energy by 2045 — out of committee. The term "clean energy" is notable, as it could be defined more broadly than the current definition of renewable energy, to include energy resources such as large-scale hydro power. SB 100 failed to pass in 2017. As law firm Latham & Watkins writes, the bill is expected to reach the California Assembly floor again this summer for a vote.

Washington's Puget Sound Energy seeks to replace coal capacity: On June 28, regulators approved Puget Sound Energy's all-source request for proposals for new renewable and capacity resources by 2022. PSE says it is seeking to replace the energy capacity shortfall of 272 megawatts from the coal-fired Colstrip Units 1 and 2 in Montana when they shut down. According to AEE's Powersuite, intent to bid forms are due by August 3, offers are due by August 17, and PSE is expected to select a final short list of RFPs by late first quarter 2019.

Connecticut picks out clean energy projects: Last month, Connecticut selected over 250 megawatts of clean and renewable energy projects as part of the state’s recent Clean Energy Request for Proposals (release). The projects include the state’s first procurement of offshore wind, in addition to multiple fuel cell projects and a new anaerobic digestion facility.

The projects selected are:

- 200 megawatts (824,830 megawatt-hours) offshore wind from the Revolution Wind Project (Deepwater Wind). This will be incremental to the 400 megawatts from the same project selected by Rhode Island.

-

52 megawatts (450,011 megawatt-hours) fuel cells including:

- Energy and Innovation Park New Britain (Doosan): 19.98 megawatts

- Colchester (Bloom): 10 megawatts

- Hartford Fuel Cell (Fuel Cell Energy): 7.4 megawatts

- Derby Fuel Cell (Fuel Cell Energy): 14.8 megawatts

- 1.6 megawatts (10,519 megawatt-hours): Anaerobic Digestion Southington (Turning Earth)