It's a question that's dogged the electricity sector for years: how to meet growing demand for energy efficiency and distributed energy resources in a way that meets the needs of customers, utilities and third parties at the same time.

The traditional utility business model is often criticized for stifling innovation -- but regulators and legislators across the country are starting to do something about it.

Several reports to have been published in recent weeks profiling utility regulation and policymaking in a changing energy landscape, and we'll be delving into several of them in the next few State Bulletins. In this week’s column, we look at a new paper from CLEAResult highlighting regulatory changes to align utility interests with energy-saving technologies. Plus, updates from Illinois, California, the Northeast and Washington state.

How to create value for both utilities and customers

A new paper from energy-efficiency services provider CLEAResult explores some of the mechanisms states have put in place to incentivize utilities to deploy energy-efficiency solutions and distributed energy resources (DERs), or at least help address the opportunity cost (read: lost revenues) of pursuing alternatives to traditional infrastructure investments. The key issue is that traditional regulatory models based on volumetric electricity sales make customer efforts to save energy a drag on profits.

The CLEAResult paper highlights four states -- Michigan, Illinois, Utah and Maryland -- that have successfully redesigned their regulatory systems in order to give utilities meaningful financial incentives to empower their customers to use less energy, while increasing shareholder value and earned returns.

In Michigan, for instance, policymakers recently approved a new comprehensive energy policy that includes an energy-efficiency goal and enhanced incentive mechanism. The new policy passed in 2016 actually removes the state’s energy-efficiency mandate after 2021, but allows utilities to earn incentives as long as they maintain a 1 percent reduction in retail sales each year. If they exceed that goal the incentives multiply. For instance, if the utility reduces sales by 1.5 percent, they could then earn the lesser of either 20 percent of energy-efficiency spending or 30 percent of net benefits.

If Michigan utilities hit these aggressive goals, it could amount to $3 million to $6 million in additional incentives for utilities, while their customers would save approximately an additional $30 million per year.

While helping to reduce the strain on utilities’ bottom lines, the new law also gives flexibility to the Michigan Public Service Commission to develop an alternative methodology for decoupling and/or other incentives if the current methods are deemed insufficient to ensure that energy efficiency and demand response are not “disfavored compared to utility supply-side investments.”

“Customer preferences and expectations are changing rapidly, and energy efficiency gives us tools to better serve and empower customers to manage their energy use and monthly bills,” said DTE Energy Manager for Strategy in Michigan, Manish Rukadikar, who participated in a May webinar about the CLEAResult white paper. “We’re very excited about the 2016 Michigan energy legislation, which we believe will yield better outcomes for customers, enable more rapid deployment of new technologies, and help us adapt to the changing energy landscape.”

In general, Doug Lewin, vice president of regulatory affairs and market development at CLEAResult, sees three main ways to look at utility regulatory innovation.

The first is to rate-base energy efficiency and DERs and allow the utility to earn a return on them. The second is some form of decoupling and lost-revenue adjustment or performance incentives, like in the Michigan case. The third model, which is still unproven but advancing in New York and other places, is the platform service revenue idea, where utilities can earn revenues from activities conducted by third-party providers within their territory. This is the model being deployed under California’s IDER proceeding.

“Our basic point is that there is no one perfect solution,” said Lewin. Every state should adapt its regulations to its specific scenario. But one thing is universal, he said: “When you have disruptive innovation, you need regulatory adaptation.”

Decoupling has become an increasingly popular topic given that utility electricity sales in the U.S. have leveled off, Lewin said. The problem is that decoupling only removes the disincentive from efficiency and DERs; it does not give a positive incentive to encourage the use of these clean energy solutions.

“Decoupling removes that downside of declining sales exacerbated by efficiency measures, but it doesn’t remove the need to build capital infrastructure and earn a [return] on it,” he said.

Maryland overcame this by combining decoupling with the ability for utilities to rate-base energy efficiency (EE) improvements and demand response (DR). “Operating expenses for EE and DR were converted into capital expenditures that were able to earn a full authorized return on investment (ROI) amortized over five years. In practice, investing roughly $125 million per year into EE creates a five-year, $500 million regulatory asset-earning ROI,” the report explains.

“For all DR that exceeds 200 MW in a given year, the utilities can bid the aggregated savings into the PJM capacity market and keep a portion of the earnings,” it continues. “The total revenue from EE and DR over the last eight auctions exceeds $300 million. Customers retain most of the savings, while the utilities earn a portion, providing them more incentive to push for even deeper efficiency and cost savings.”

Similar to utilities in Maryland, Rocky Mountain Power in Utah can now also earn a return on the investment it makes in energy-efficiency programs, putting efficiency on an equal footing with other capital investments. Senate Bill 115, passed in March 2016, allows Rocky Mountain Power to “capitalize the annual costs incurred for demand-side management” and to “amortize the annual cost for demand-side management over a period of 10 years.”

Utilities often pay for energy-efficiency measures upfront, and they’re expected to be cost-effective in the first year; although installations like LED lights and HVAC upgrades produce savings over a decade or more. Making efficiency programs a 10-year regulatory asset greatly improves their cost-effectiveness relative to other energy resources, the paper states.

At the same time, Rocky Mountain Power can use a portion of its efficiency funds as accelerated depreciation for an older, economically inefficient power plant. “This way, Rocky Mountain Power can recover the cost of an aging power plant and retire it early, replacing it with an EE asset,” the report states.

Illinois also recently approved an energy-efficiency policy that allows utilities to rate-base efficiency, but it also went a step further by allowing utilities to earn higher returns for implementing demand-side management over traditional grid investments. The Future Energy Jobs Act of 2016 (widely known as the bill that created zero-emissions credits for Exelon’s aging nuclear plants -- more on that below) allows Illinois electric utilities to earn a return on equity for energy-efficiency spending that’s equal to the capital they put in, if they reach 10 percent of their efficiency goals. Previously, efficiency investments were treated as operating expenses and could be recovered, but without any added return.

“Today, what happens with energy efficiency is we recover dollar-for-dollar what we spend on energy efficiency,” said ComEd CEO Anne Pramaggiore, in an interview with Utility Dive last year. “This [bill] would actually put [efficiency programs] into a regulatory asset. They would look like poles and wires that we recover over a longer period of time, and we earn a return on it. So it really treats a service like energy efficiency as an asset.”

For every 1 percent a utility goes beyond its goal, it can earn 8 additional basis points. For example, a utility that achieves 125 percent of its goal would be entitled to a return on equity that’s 200 basis points (2 percent) higher than its normal return.

“The Illinois framework positions utilities as service providers as opposed to the deliverers of a commodity, and incentivizes them as such,” the CLEAResult paper states. “It’s an elegant solution that other states might want to replicate.”

There are a lot of technologies and services on the market that could be disruptive to the electricity system -- in a good way -- but they’ll never see widespread adoption because of traditional utility regulatory structures, said Lewin.

“What we need are regulatory models to help utilities in the transition,” he said. “But even more important than utilities, really, is the customer. How do we make sure customers have the ability to use less when they want to and to control their energy when want to?”

“It’s self-evident that if utilities have more financial motivation to pursue efficiency and distributed energy that it’s going to happen faster than if they don’t,” Lewin added. “That’s what were trying to work on -- to find regulatory models that aren’t just palatable, but are exciting.”

More on the Illinois Future Energy Jobs Act

As I noted in the previous section, the Illinois Future Energy Jobs Act (FEJA) is about much more than a nuclear subsidy program. In addition to the efficiency program changes referenced in the CLEAResult paper, FEJA includes important fixes to the state's renewable portfolio standard. The bill retains the current 25 percent renewable energy target, but remedies quirks in the program that caused funds for renewable energy projects to go unused and allowed Illinois to meet the RPS criteria by investing in clean energy projects out of state -- causing the state to lose out on the local benefits.

On July 12, the Illinois Commerce Commission hosted a policy session in which a diverse range of experts assessed the current renewable energy landscape in Illinois and forecasted the impact that FEJA -- which went into effect on June 1 -- will have on the state’s economy, energy markets and emerging technologies. Presentations were given by Accelerate, Invenergy, the Illinois Power Agency, Vote Solar, the State Attorney General, ELPC, Ameren and ComEd and are available for download here.

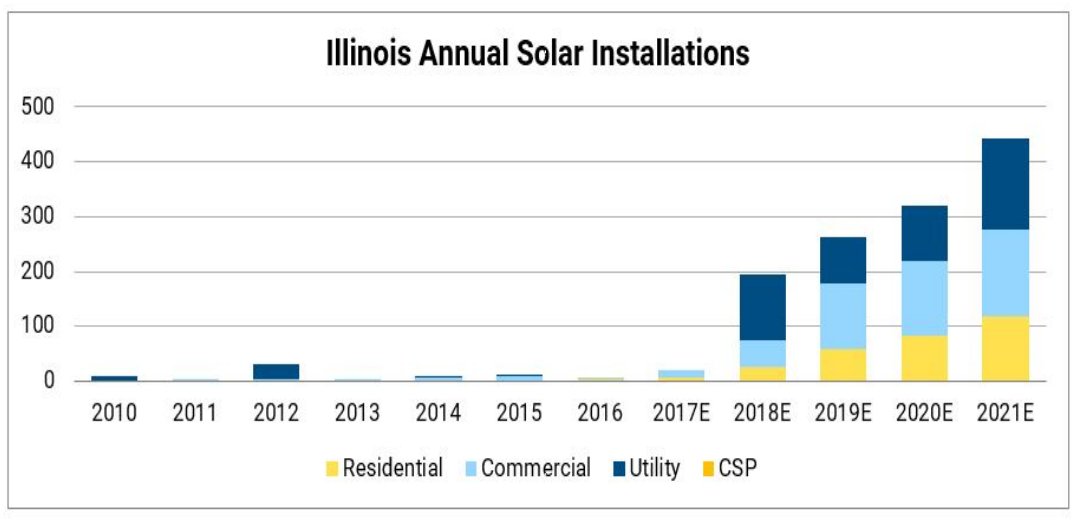

Becky Stanfield, senior director of Western states at Vote Solar, underscored that the law puts Illinois on a path to accelerated renewable energy deployment. There are currently 75 megawatts of total installed solar capacity in Illinois, putting the state 37th in a ranking of solar installations in 2016. But the market is expect to ramp quickly.

“The demand and supply for renewables are there,” said Stanfield, according to a report on the meeting. “We are ready for liftoff in Illinois.”

In other policy news…

Illinois court dismisses lawsuit against nuclear subsidies

On July 14, a federal Northern Illinois District Court dismissed a challenge of Illinois’ zero-emission nuclear credits brought by independent power producers Calpine, Dynegy and NRG Energy. Opponents have vowed to appeal the decision.

The Illinois zero-emissions credit (ZEC) program was approved as part of a major energy bill passed in December 2016. The Future Energy Jobs Bill (SB 2814) directs $235 million in annual ratepayer subsidies to Exelon’s struggling Clinton and Quad Cities nuclear power plants, as part of a broader package of measures to support clean energy in the state.

Calpine, Dynegy and NRG filed a lawsuit in February against the director of the Illinois Power Agency, arguing the new credit system amounts to a bailout for uneconomic assets that undermines market competition. A separate legal suit was brought by a group of Commonwealth Edison (owned by Exelon) electricity consumers over concerns the ZEC program will force customers to pay higher rates. The lawsuits argued that Illinois’ ZEC system oversteps the state’s constitutional authority to regulate electricity markets regulated by the Federal Energy Regulatory Commission.

New York state has also approved subsidies for struggling nuclear power plants and is facing legal pushback.

According to Washington Analysis, the June 14 ruling represents the first interpretation of a ZEC program by a federal court. The analysis firm forecast a favorable ruling in the Illinois case and believes an appeal will ultimately uphold last week's decision. Language in the ruling also bodes well for the New York program, which the Southern District of New York is expected to rule on soon. Specifically, the ruling states ZECs are effectively a new class of renewable energy credit and, therefore, outside the realm of regional energy markets and federal jurisdiction.

“The ZEC transactions required by the Illinois statute are distinct from wholesale energy sales. While not dispositive, FERC’s acknowledgment that RECs are outside its jurisdiction indicates that similar programs that authorize transactions in state-created credits that are distinct from wholesale transactions are not preempted,” the ruling states.

The Natural Resources Defense Council, which supported the Future Energy Jobs Act because it contains a broad and ambitious package of policies to advance energy efficiency and renewables, cheered the Illinois court’s decision. “The case is important far beyond the nuclear context because it demonstrates that states have many strong tools to dictate their energy mix (including advancing renewable energy) without violating the Constitution or federal energy laws,” NRDC wrote in an emailed statement. (NRDC attorney Miles Farmer wrote about the decision here.)

Earlier this year, GTM put together a rundown of the challenges nuclear energy faces in the U.S., and how policymakers are trying to overcome them. You can read that here.

Report: Do state actions on climate violate the constitution?

Following President Trump's decision to pull out of the Paris Agreement, a consortium of more than 200 cities, at least 12 states and dozens business groups came together and pledged to continue cutting carbon pollution in line with the climate accord's guidelines. For instance, Michael Bloomberg spearheaded the "We Are Still In" campaign following the U.S. withdrawal, where states, cities, colleges and universities, businesses and investors pledged to "provide the leadership necessary to meet our Paris commitment." State-level actions on climate in particular could be a problem, however.

A recent report from the Congressional Research Service noted that a climate alliance could be interpreted as states entering into treaties with foreign nations, which is prohibited under the Constitution under Article I, Section 10 and the doctrine of foreign affairs pre-emption. As CNBC reported, the relevant clauses of Article I, Section 10 provide that "No State shall enter into any Treaty, Alliance, or Confederation" and that "No State shall, without the Consent of Congress…enter into any Agreement or Compact with another State, or with a foreign power."

The legal note specifically references Hawaii Senate Bill 559, signed days after Trump pulled out of the Paris Agreement, that requires the state to expand strategies to reduce greenhouse gas emissions. While Hawaii has not formally entered into the Paris accord, the CRS report suggests that laws focused on responding to a foreign affairs event, rather than an "area of traditional state responsibility," could be subject to judicial scrutiny.

California passes cap-and-trade

Late in the evening on Monday, July 17, California lawmakers passed a set of high-profile bills to extend the state’s landmark cap-and-trade program (AB 398) and curb local air pollution (AB 617). The vote was pivotal for the state’s cap-and-trade system, which was on track to expire in 2020 and needed to be extended.

According to the governor’s office, more than 150 stakeholders, including environmental, public health, agriculture and business organizations from across California, came out in support of the legislation. The businesses urging legislators to pass AB 398 and AB 617 contribute more than $3 trillion to the global economy.

Not everyone was pleased with the legislation, however. Some environmental groups said AB 398 is a “giveaway” to fossil fuel companies and doesn’t do enough to help communities in need. According to the Greenlining Institute, a number of the bill’s provisions could limit revenues paid by polluters and impede funding for clean energy projects from the Greenhouse Gas Reduction Fund. “These include extensive use of free carbon allowances and a provision that uses GGRF moneys to backfill the loss of revenue from the cancellation of the Fire Prevention Fee and from extending a tax break for manufacturers and energy producers,” according to a press release.

Meanwhile, SunPower and a consortium of cleantech companies represented by Advanced Energy Economy praised the passage of AB 398. "This says to the market, 'We know where we’re going, and we can start to build on that objective,'” said Steve Chadima, senior vice president of AEE. Read our full story here.

Will the Northeast follow California's lead?

In the wake of California's cap-and-trade vote, nine states in the Northeast Regional Greenhouse Gas Initiative (RGGI) -- Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island and Vermont -- will soon complete a year-long negotiation process to determine how much they'll reduce carbon pollution in the coming years. According to Climate Nexus, a final decision could come as early as next week.

Climate groups are now wondering if the nine states will grab the leadership baton from California, and make more ambitious cuts in the RGGI region’s cap on power-plant carbon pollution. Because RGGI is a consensus process, just one or two states could bring down the targets for the entire region. Maine, for instance, appears to be pushing for less ambitious emissions targets. The decision could also affect other states, since New Jersey and Virginia are expected to join RGGI in the coming years. The Natural Resources Defense Council offers more background info on the stakes here.

Corporate procurement gets creative with Microsoft deal

The Washington Utilities and Transportation Commission approved a settlement earlier this month that will allow Microsoft to purchase clean energy directly from competitive power markets, instead of the incumbent utility. Puget Sound Energy (PSE) created a new tariff last October that allows C&I customers to buy energy from alternative suppliers. The settlement agreement was reached in April. Microsoft agreed to limit its wholesale market purchases to carbon-neutral and renewable energy sources resources and pay a $23.6 million transition fee to ensure PSE's other customers are not harmed.

The agreement covers approximately 80 percent of Microsoft’s total energy load in the Puget Sound area; the remaining 20 percent will continue to be serviced by PSE. In addition, PSE will also continue to provide distribution and related services to Microsoft, which will remain one of PSE’s largest customers. There is some lingering uncertainty, however, around whether or not Microsoft will help pay to retire PSE's Colstrip coal-fired units, The Seattle Times reports.

The Microsoft deal builds on the emerging trend of corporate players looking for new ways to meet their electricity needs with clean energy. Several big casinos in Nevada agreed to pay hefty fees to leave NV Energy territory in order to procure alternative energy from retail providers. Utilities and regulators are also coming up with unique ways to meet corporate clean energy needs while keeping them as customers, like PSE's new subscriber-style green tariff designed for retailers and small governments.