Electric buses offer a way to clean up the air in communities and mitigate carbon dioxide emissions, all while saving bus operators money. But those buses come at a premium, which can deter cities, schools, business and other potential buyers from making the switch.

A recent report by the U.S. Public Interest Research Group (PIRG) Education Fund notes that electric transit buses cost roughly $200,000 more than diesel buses, but the lifetime fuel and maintenance savings of an electric transit bus amounts to around $400,000. Electric school buses cost roughly $120,000 more than their diesel counterparts, but can save $170,000 over their lifetime. So the potential savings are significant, but the upfront purchase price is a barrier.

To overcome that hurdle, the PIRG report recommends that transit agencies and school districts explore using financing mechanisms such as municipal bonds and local option transportation taxes. Bus operators can also take advantage of federal, regional, state, and local grant and incentive programs. For instance, Pioneer Valley Transit Authority and Martha’s Vineyard Transit Authority in Massachusetts are using Volkswagen “Dieselgate” settlement funds to purchase electric buses. In some places, bus operators may be able to use a cap-and-trade policy to generate revenue for clean transportation.

Agencies and school districts may also be able to use vehicle-to-grid technology to offset their electric bus costs. In that scenario, electric bus batteries equipped with vehicle-to-grid technology can provide services to the grid by storing up electricity and selling it back to system at times of high demand.

In addition, cities and schools can partner with local utilities to obtain beneficial rate structures to help them save on charging costs. Bus operators an also work with utilities to secure investments in charging infrastructure.

Transit agencies and school districts are already putting these financing tools to work — from Dallas, Texas to King County, Washington to White Plains, New York. Several more have taken steps to electrify their bus fleet in recent weeks. At the same time, utilities and bus manufacturers have introduced new programs and products to better serve the electric bus market.

Here’s a look at the latest electric bus news to leave the station.

New city and state investments

U.S. cities drive up procurement numbers

Attitudes are shifting rapidly around electric buses, according to a new report by the Environmental and Energy Study Institute. The report notes that most U.S. transit agencies were still skeptical about transitioning to battery electric buses as recently as last year due to cost and performance issues. It’s estimated that less than 0.1 percent of the 386,000 electric buses deployed around the world are in the U.S., with 99 percent located in China.

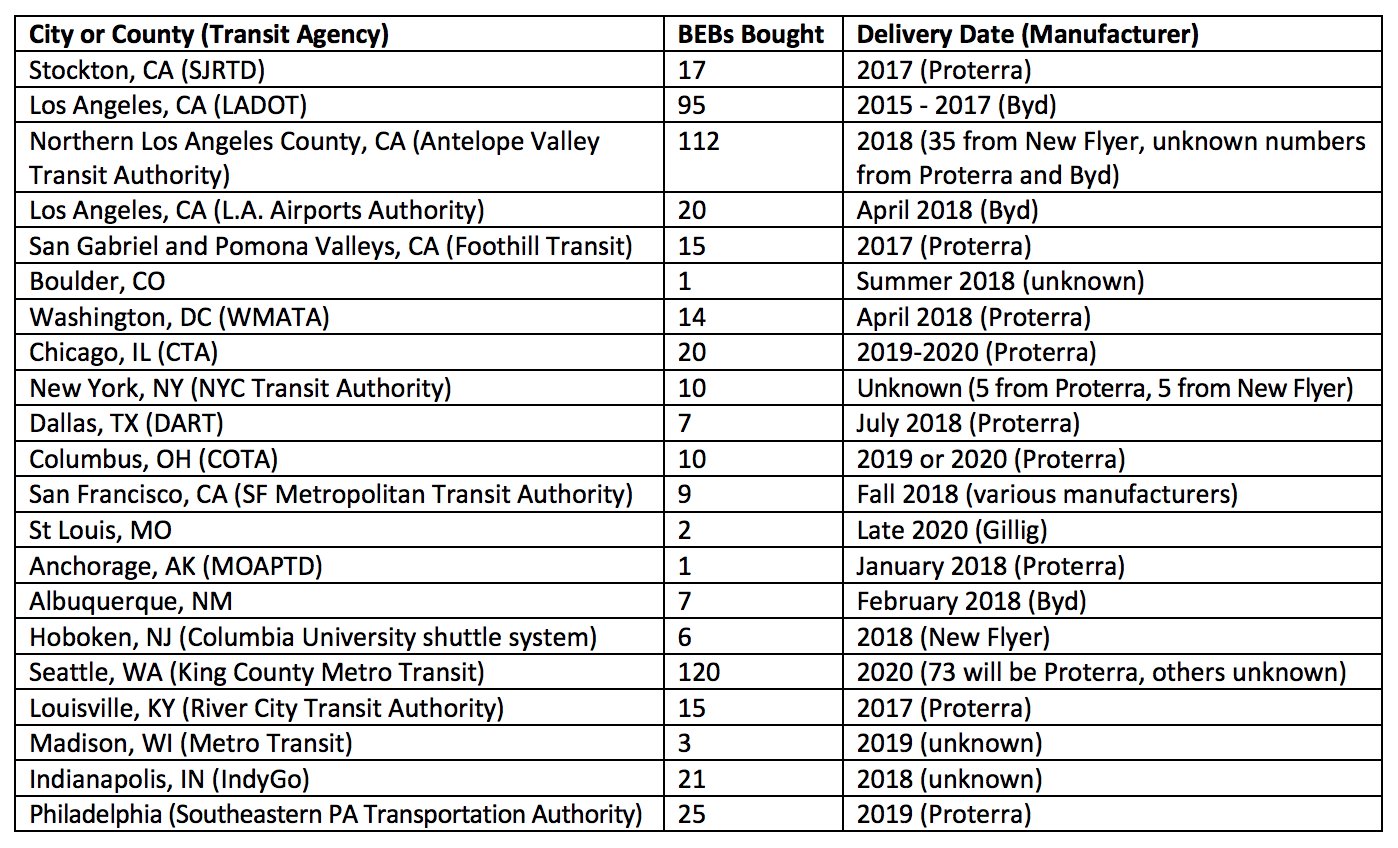

But cities and counties across the U.S. are beginning to drive up procurement numbers, with several operators committing to shift their entire fleets to battery electric buses by a certain date. These locations include Los Angeles County (by 2030), Seattle (King County, by 2040), San Francisco (by 2035) and New York (by 2040), according to the EESI report. Below is a list of cities and transit agencies that have already purchased electric buses or are planning to.

Virginia to invest $14 million in electric buses

Virginia Governor Ralph Northam announced last month he’s investing $14 million, or 15 percent, from the Volkswagen Environmental Mitigation Trust to fund the deployment of all-electric transit buses across the state. The announcement follows Northam’s August announcement that Virginia will apply its first tranche of VW funds (about $14 million) toward developing EV charging infrastructure, with an agreement signed with EVgo.

To support greater EV adoption, the Northam administration recommended “[exploring] legislative, administrative, and public-private opportunities to accelerate electrification and evaluate opportunities for local governments to aggregate purchasing,” as part of its 2018 Virginia Energy Plan.

Michigan’s VW settlement plan prioritizes buses

Michigan officials released the state’s “Volkswagen Settlement Beneficiary Mitigation Plan” this week, which will distribute $64.8 million over the next nine years to reduce pollution from the transportation sector. The first priority outlined in the plan is to clean up Michigan’s aging diesel school bus fleet.

The first phase directs nearly $13 million toward school bus upgrades, with up to $3 million designated for electric buses and charging stations. The plan favors EVs by covering up to 70 percent of the cost of a new electric bus and charging station, compared to 25 percent of a new diesel bus.

Michigan received a total of $64.8 million from the $2.8 billion Volkswagen settlement.

New utility programs

PG&E proposes a new commercial EV rate

Pacific Gas & Electric wants to make electric buses more affordable to operate. To do that, the utility has proposed a new subscription-based rate for commercial electric vehicle charging, as GTM covered this week.

The proposal, submitted to the California Public Utilities Commission on Monday, would allow customers to pay a flat monthly fee for their charging, similar to a cellphone data plan. The new plan comes with a tailored time-of-use rate that encourages charging to align with solar power generation. If approved, the plan would do away with the demand charges multi-family residences, businesses, transit stations and other commercial customers pay, which can become so onerous that they erode any savings the customer would see.

“We think [the new rate] should get the price down to equal or less than the cost of diesel so it’s competitive and…makes the business case for going electric positive for them,” Cal Silcox, clean transportation strategy manager at PG&E, told me.

San Diego pitches a V2G bus pilot

San Diego Gas & Electric filed a proposal with the CPUC Monday to deploy enough charging infrastructure to support 6,000 electric buses, trucks and other medium- and heavy-duty vehicles. The program also includes an electric school bus vehicle-to-grid pilot project that would charge up bus batteries when renewable energy is abundant and put it back on the grid when electricity is needed most.

NRDC writes that this proposal would modify SDG&E's original proposal (filed in January 2018) to align with the medium- and heavy-duty vehicle electrification programs the CPUC approved for California’s other large investor-owned utilities. PG&E and SCE’s programs have a combined budget of $592 million. If approved, SDG&E’s plan would have a budget of $107 million.

These utility programs come in addition to the $483 million funding plan for clean transportation investments, including gin zero-emission transit and school buses, announced by the California Air Resources Board in October. The funding comes predominantly from the state's cap-and-trade program.

A wave of utility bus investments outside of California

California utilities aren’t the only ones investing in electric buses. The NC Clean Energy Technology Center’s latest 50 States of Electric Vehicles report notes that Delmarva Power & Light in Delaware has proposed an incentive program for vehicle-to-grid-ready school buses, and PSE&G in New Jersey has proposed spending $45 million on electric school bus incentives and plans to test vehicle-to-grid technology.

Arizona Public Service has proposed a School Bus Electric Vehicle Pilot Program that would offer a limited number of free buses and charging infrastructure. And Pepco recently requested approval to deploy charging infrastructure along bus routes to serve electric commuter buses.

New electric bus options

FCEV buses come to market

Last week’s column highlighted the launch of Proterra’s new electric school bus, made in partnership with Daimler’s Thomas Built bus brand. The Saf-T-Liner eC2 features a 150-mile range and can be charged in about three hours using a 60-kilowatt charging system.

Plug-in buses aren’t the only kind of electric bus option out there, though. Some manufacturers and bus operators are focusing their attention on fuel cells, which convert hydrogen into electricity, instead of batteries. These EVs can offer significantly longer ranges and shorter refueling times.

Last month, Wrightbus debuted the world’s first fuel-cell-powered double-decker bus at Euro Bus Expo 2018, which comes with a 200-mile operating range and the option to add a 265-mile extended storage feature. The StreetDeck FCEV uses a Ballard FCVelocity fuel cell, a Siemens drivetrain and 48-kilowatt traction battery pack. Refueling the bus is said to take approximately seven minutes.

The problem in many places is finding a reliable source of hydrogen fuel. Sourcing hydrogen from natural gas is hard enough; sourcing hydrogen from carbon-free resources is even harder — and more expensive. The buses come with very high sticker prices too.

Still, manufacturers see an attractive market. Earlier this month, New Flyer announced it had ordered high-pressure hydrogen tanks from Norway’s Hexagon Composites, to be used on 25 of New Flyer’s Xcelsior hydrogen fuel cell transit buses. The new hydrogen tanks are specifically intended to store compressed zero-emission hydrogen gas.

“New Flyer is a zero-emission pioneer with over 50 years’ experience manufacturing electric transit buses. The adoption of fuel cell technology is a natural progression for us, and fuel cell-electric buses are an essential technology for driving the future of public transit in North America,” said Rod Neustaedter, vice president of supply management at New Flyer. “As communities increasingly adopt zero-emission, sustainable transportation, New Flyer will proudly support healthier cities with fuel cell-electric transit buses with hydrogen from Hexagon.”