We’re now well into 2019. As U.S. solar developers dig out from the tariff anxiety of 2018 and look toward the future, they’re already confronting another big challenge: the declining federal Investment Tax Credit.

“The industry has, in my eyes, moved past the tariffs,” said Colin Smith, a senior solar analyst at Wood Mackenzie Power & Renewables. “Now the big strategy question will be the ITC step-down.”

This year is the last for the ITC’s full 30 percent value, before it declines to 26 percent in 2020 and down to 10 percent beyond 2022.

In recent months, uncertainty about how to confront the tax credit changes has started to give way to developer strategy. In this week’s column I’m digging into that dynamic, plus other themes and questions — like the rush on state-level policy and corporate and industrial procurement — currently occupying utility-scale solar.

The state of utility-scale solar

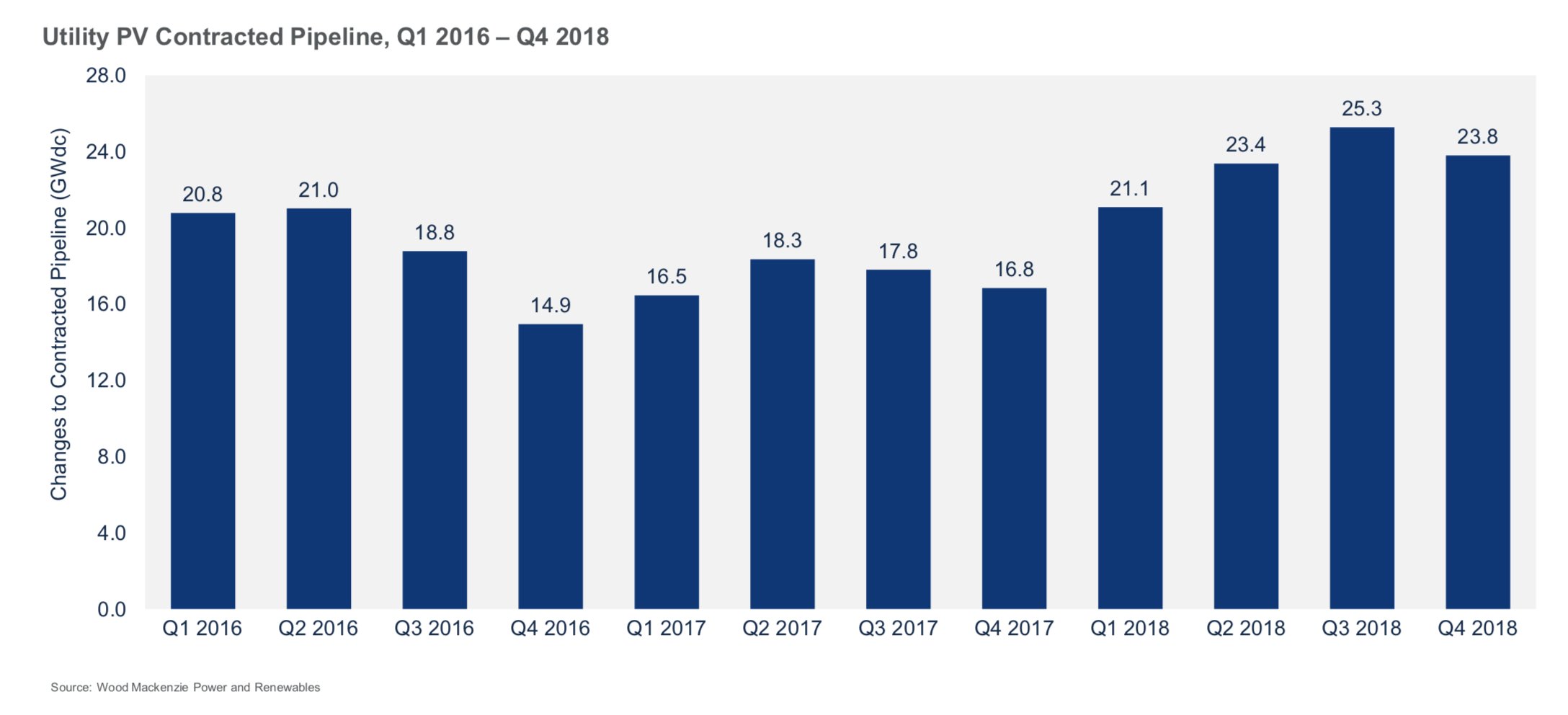

The U.S. utility-scale solar industry procured 13.2 gigawatts of new projects last year, according to the latest report on the sector from Wood Mackenzie Power & Renewables. The pipeline hit its highest level ever in Q3 2018, peaking at 25.3 gigawatts.

The pipeline dropped in Q4 as installations exceeded the amount of new projects developers had queued up. That’s not unusual for the end of the year, when analysts say 40 to 50 percent of yearly capacity additions often come online.

Now that developers have largely gotten a handle on their tariff anxiety, Smith said it’s not unlikely that the pipeline will grow again to meet demand from current market drivers like C&I procurement and newly increased state renewable portfolio standards.

Some impacts from tariffs are still hanging over the industry, though. A portion of projects announced in the first half of last year, according to Smith, were likely “legacy PPAs” — carry-overs of pre-tariff projects that waited for the Section 201 drama to get sorted before moving forward. Analysts said some engineering, procurement and construction companies admitted to putting more than 80 percent of their pipelines on hold until they could get clarity.

“We saw at least a portion of projects that would have announced 2019 completion dates that are now targeting 2020 and 2021 instead,” said Smith.

Those delays meant “lower-than-anticipated installations” in 2018 and the same trend likely in 2019.

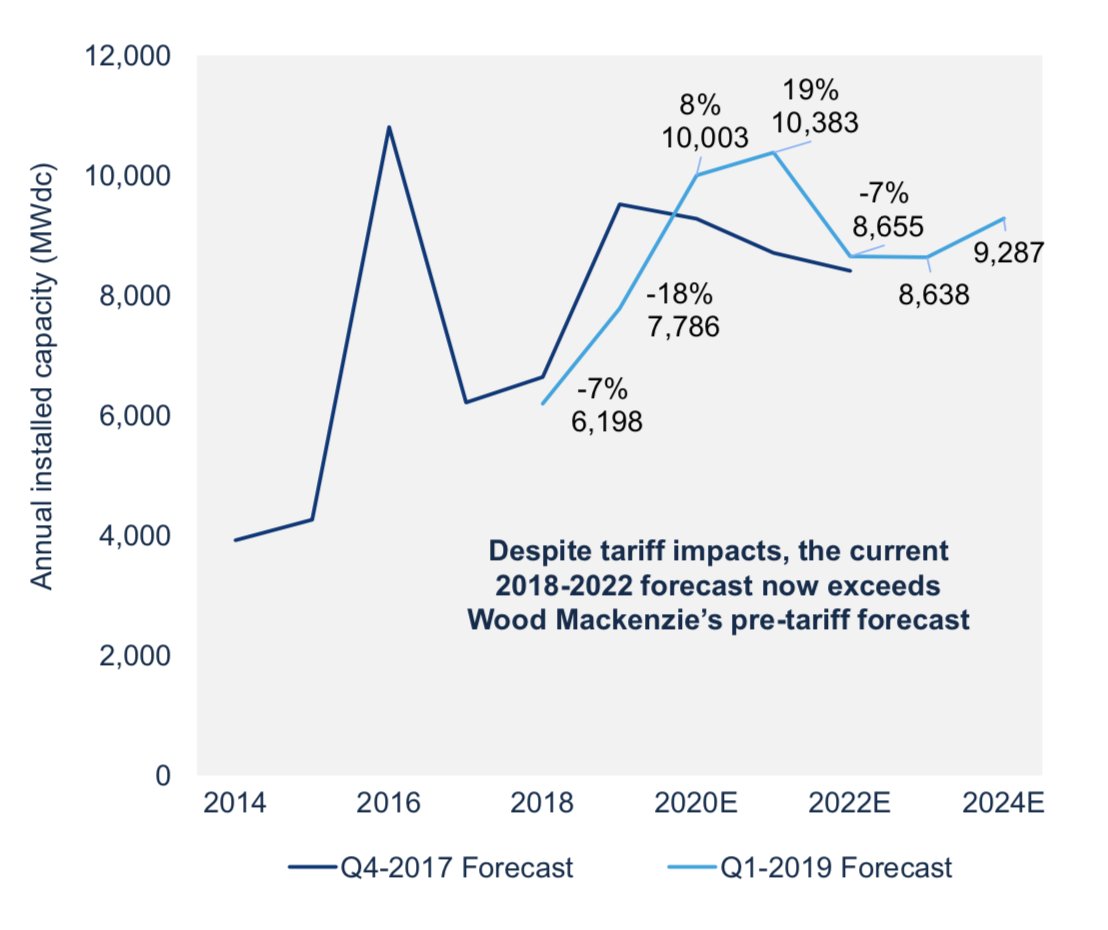

In the end, the uncertainty hurt more than the actual trade remedy. After the Trump administration announced a 30 percent step-down tariff on imported solar cells and modules in January 2018, developers were able to recalibrate.

Wood Mackenzie Utility-Scale Solar Forecast, Pre- and Post-Tariffs

Source: Wood Mackenzie Power & Renewables

Now, capacity forecasts from Wood Mackenzie Power & Renewables beat out pre-tariff expectations.

“Overall, demand has increased over pre-tariff levels,” said Smith.

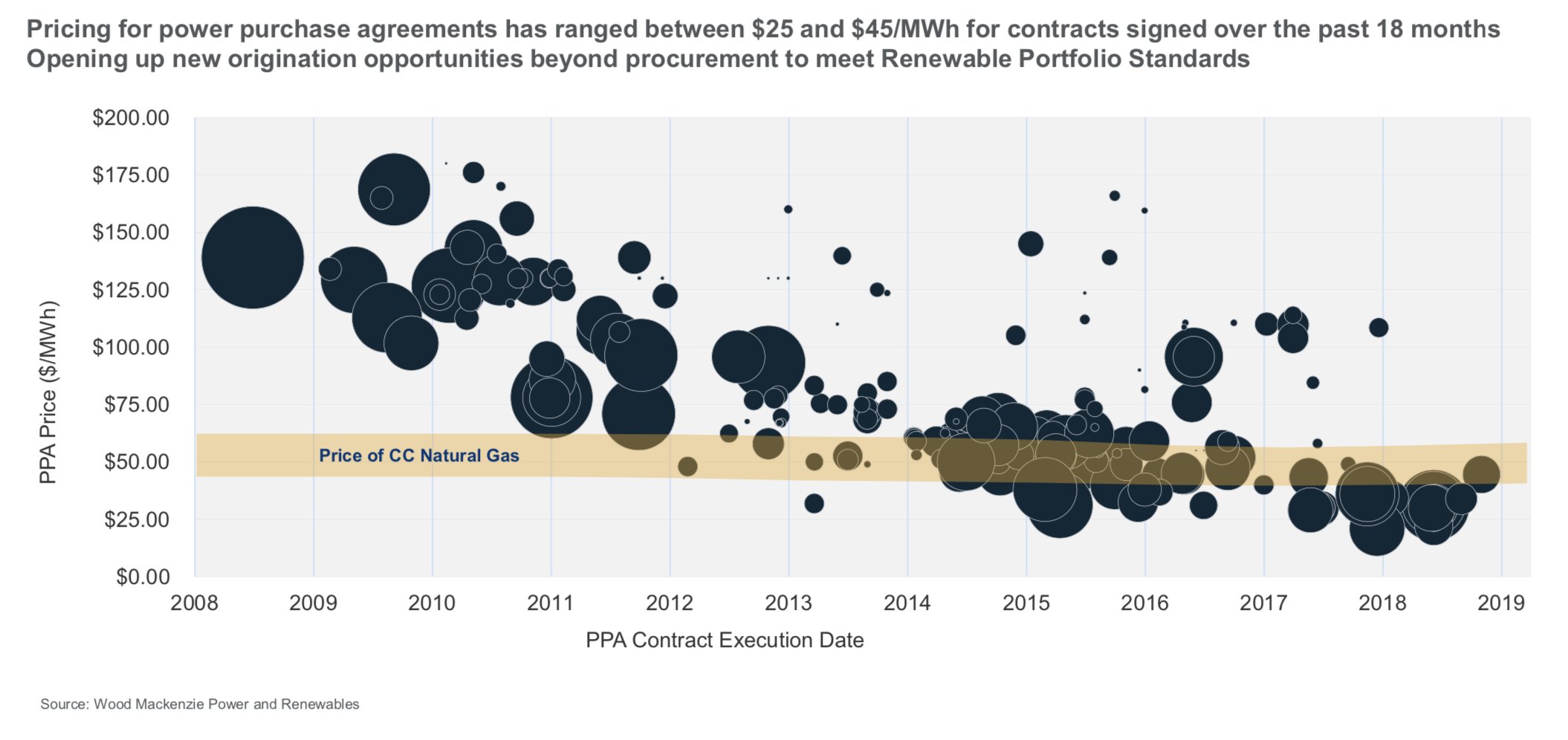

Utility-scale project demand has continued to grow largely because of its economic edge over other energy sources, and analysts say that edge is strengthening.

Power-purchase agreement (PPA) prices over the last 18 months have generally come in well under the price of new-build combined-cycle natural gas. Notable examples include prices in Nevada from 8minutenergy at $23.76 per megawatt-hour and an Idaho Power deal with local developer Jackpot Holdings at $21.175 per megawatt-hour with a 1.5 percent annual increase.

The C&I influence

A significant sector taking advantage of those prices: commercial and industrial offtakers, as well as corporate procurement.

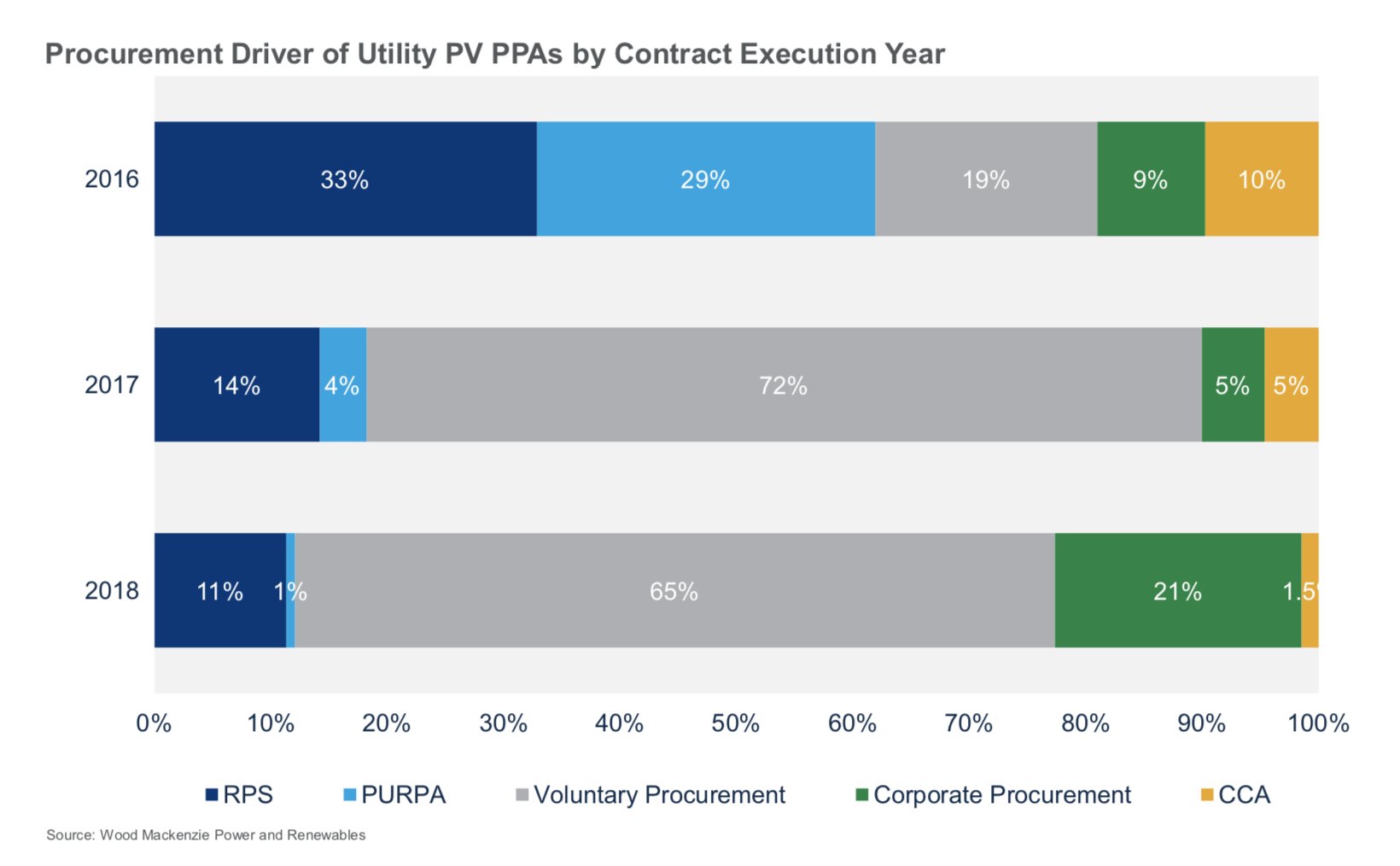

While voluntary procurement — which encompasses moves outside of any policy obligations — has dominated utility PPA contracts in the last couple of years, procurement by the C&I sector grew substantially in 2018.

According to data from Bloomberg New Energy Finance, last year brought a record for global corporate renewables procurements (the Wood Mackenzie data referenced in this story only covers U.S. utility-scale solar procurements). Companies procured 13.4 gigawatts of renewables globally, with 9.1 gigawatts in the Americas region.

In March, groups including the Rocky Mountain Institute, First Solar and Walmart formally launched the Renewable Energy Buyers Alliance, which aims to increase corporate procurements to 60 gigawatts in the U.S. by 2025.

And although U.S. renewable portfolio standard policies were the main driver of utility-scale procurements in 2014 and 2015, RPS-driven solar contracts have fallen steadily since 2016 as voluntary procurement took the wheel. Last year RPS-driven procurement represented only 19 percent of the projects now in development.

“Utilities started turning more toward solar simply because it was the cheapest option, not because they had to,” said Smith.

That’s likely to change somewhat in 2019. In recent months, New Mexico, Nevada, Washington and Puerto Rico have enshrined policies that increase renewables or clean energy targets. While more utilities are doubling down on renewables efforts — Public Service Company of New Mexico and Xcel Energy both recently announced carbon-free targets — Smith puts the increased market potential at additional gigawatts per year.

Interestingly, as more states up their RPS targets, that could depress C&I deal growth in the long term. A company may be less willing to invest in potentially risky renewables deals if state policies are already pushing its energy provider toward more wind and solar.

Although it’s an interesting thought exercise, Smith said that dynamic is still a future possibility rather than a current reality.

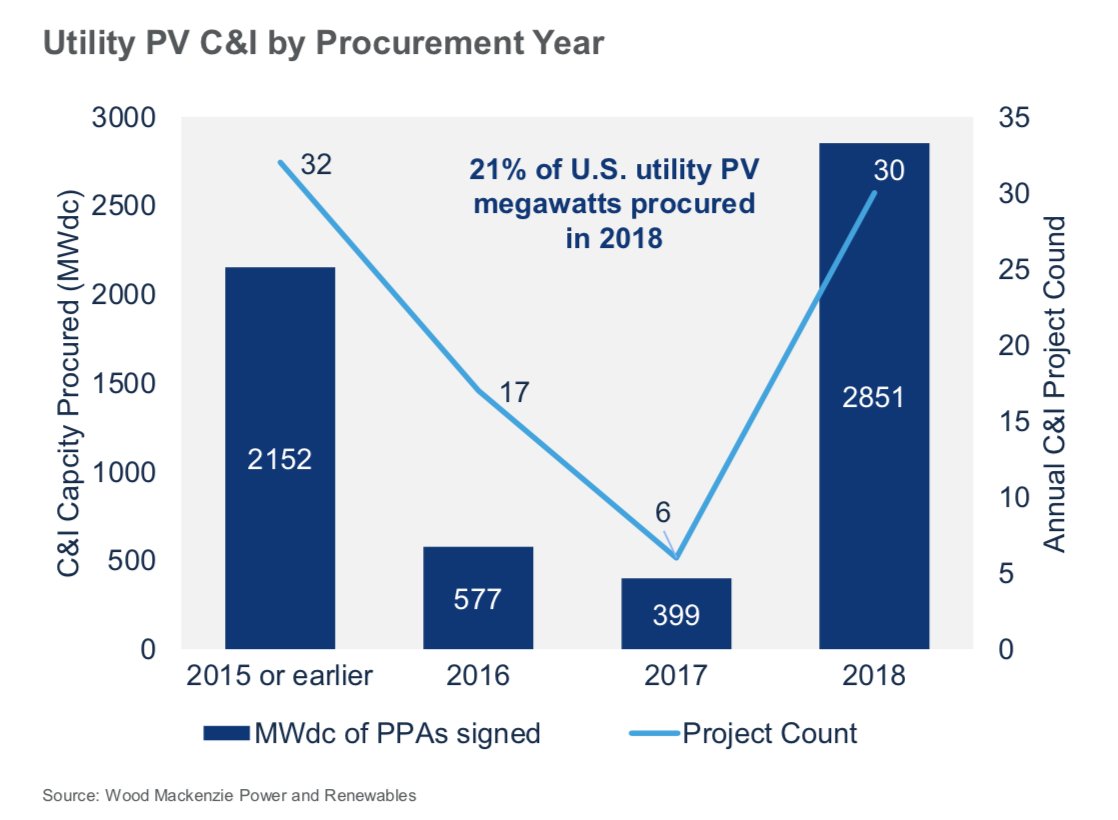

At present, data from Wood Mackenzie Power & Renewables shows that corporate utility solar procurement accounted for nearly 2.9 gigawatts of capacity in 2018. That’s 21 percent of total utility-scale PV procured in the last year. Comparatively, though, C&I capacity additions faltered last year with just 65 megawatts installed (they topped 1 gigawatt in 2016 and 2017).

Smith said that downturn may just be a “cyclical anomaly.”

“We’re going to see ebbs and wanes,” he said, adding that a rush to get projects online before the ITC was extended in 2015 could have played a role. Smith said that year and 2016 were when solar prices took enough of a nosedive to really begin competing with natural gas — piquing more interest just as businesses learned the tax credit incentives would continue.

Last year’s high levels of procurement show that C&I interest in renewables is only growing. And those deals are no longer concentrated among tech and data companies. That sector accounted for 56 percent of C&I deals in 2018 — for both solar and wind — but manufacturing and industrial companies procured 22 percent while the retail and service industry accounted for 8 percent of deals.

Coping with the step-down

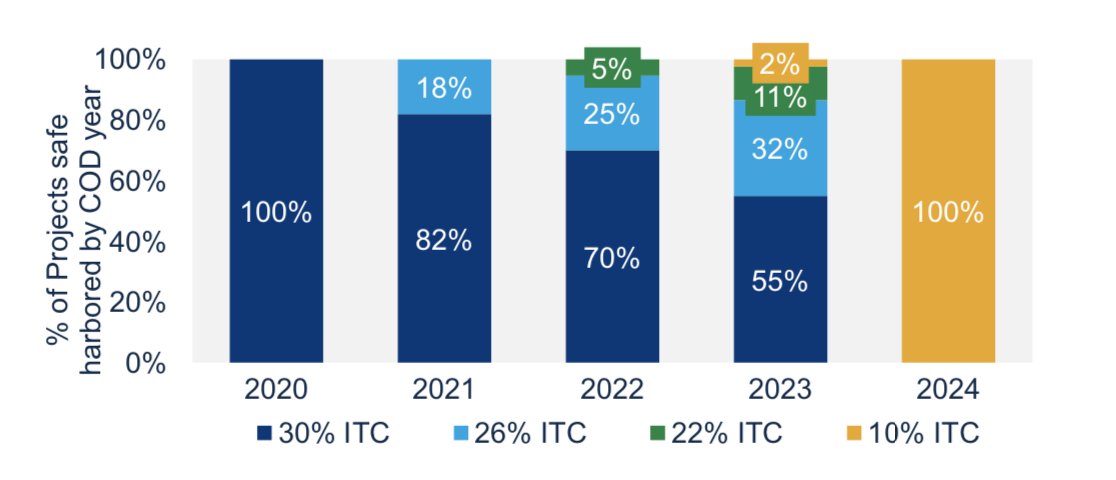

As the industry digs further into 2019, there are some challenges amid the opportunity. With the ITC set to fall from 30 percent in 2019 to 10 percent beyond 2022, developers are investigating how to qualify as many projects as possible for the higher incentives.

The same goes for the growing C&I sector, which will be under pressure to speed up procurement timelines.

“The ITC step-down is going to create a sense of urgency for C&I customers,” said Smith. “Across the board, generally speaking, we’re seeing increased interest, but C&I customers will view the step-down of the ITC as an impetus to act sooner rather than later because they’re going to get a better price.”

To receive the full value, developers must “commence construction” within 2019 by either starting significant construction work or investing 5 percent or more of the project’s total cost, otherwise known as “safe-harboring.”

According to Smith, strategies to qualify for the full value ITC have evolved over just the last few quarters across the utility-scale sector.

“Relatively risk-averse” as recently as Q3 2018, developers are now planning to safe-harbor as much as 100 percent of their qualified pipelines. Most, the analyst said, are looking to do so by procuring modules in advance.

Utility PV Developers Will Aim to Safe-Harbor 70% of 2020-2023 Projects to Secure the 30% ITC

Source: Wood Mackenzie Power & Renewables

Through 2023, Wood Mackenzie analysts expect over half of projects to use safe-harboring to take advantage of the 30 percent ITC value.

Even as the step-down arrives, though, Smith said analysts expect the utility-scale market to remain strong, in part because of the push from C&I offtakers and expanding state policies.

“We’re going to continue to see solar proliferate across the country even without the 30 percent ITC to bolster it,” he said.