We're offering up this installment of The Solar Lead for free. Here, we'll discuss some of the most important stories and trends guiding the solar market. Only GTM Squared members will get access to future editions in web and newsletter format.

The first word: Don't panic over presidential politics

Since the world now seems to orbit around Donald Trump, the laws of physics dictate that we start with him. The White House is set to release a long-awaited executive order that will roll back many of Obama's climate regulations -- including the Clean Power Plan -- that many had hoped would spur additional growth for renewables.

While unraveling something as big and complicated as the Clean Power Plan will be difficult, it does signal Trump's willingness to completely abandon climate policy. That plan, which directed states to come up with ways to decarbonize the grid, would have opened up a dozen or so new markets for solar. So that's bad for solar, right? Well, not necessarily.

According to a draft of the executive order acquired by Bloomberg, it will actually single out renewables: "While the order will make clear that the target of the planned regulatory rollback should be on policies curbing the production of oil, natural gas, coal and nuclear energy, it also will say the U.S. is well served when affordable, reliable and clean electricity is produced from an array of sources, including solar, wind and hydropower."

Meanwhile, Elon Musk is reportedly collaborating with Jared Kushner's "innovation office," which is focused on making government more tech-savvy. According to the Washington Post, it will also assist in "developing 'transformative projects' under the banner of Trump’s $1 trillion infrastructure plan." One could imagine Musk, a solar and storage evangelist, getting in a word about those technologies. In fact, they already do play a limited role in Trump's draft infrastructure plan.

The net impact of all this activity is hard to determine. The Obama administration had long been working to make permitting renewables on public lands easier -- so it's not clear what kind of regulations the White House is referencing that could help solar. Plus, the CPP would have opened up a bunch of new markets -- and ending or freezing implementation definitely shuts out that incremental growth.

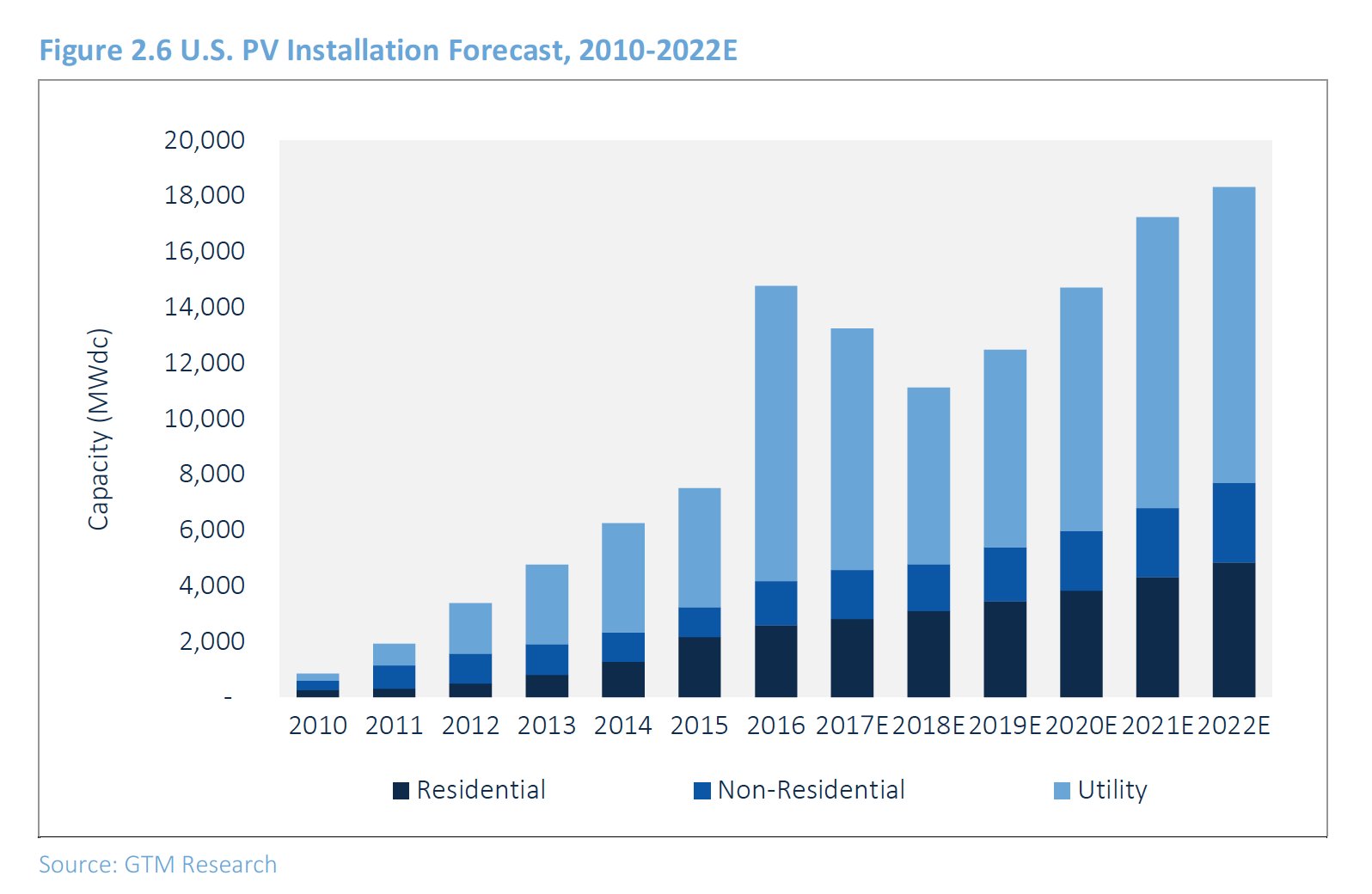

But here's the most important thing to remember: GTM Research has never factored the Clean Power Plan into its solar projections. So no matter how badly Trump and Pruitt try to beat up on the EPA, growth for solar is still going to look pretty good, driven by state policy and improving economics.

Getting rid of the federal Investment Tax Credit as part of tax reform is an entirely different question. But tax reform will be as hard as health care -- and we just saw how that turned out.

Data dive: Speaking of the states...

With or without the Clean Power Plan, solar jobs are growing rapidly. The Solar Foundation is out this week with some more juicy stats about solar's economic contribution to the U.S. According to the organization's latest tally, solar produced $154 billion in economic activity around the U.S. last year. Nearly half of U.S. states saw solar jobs grow by 50 percent or more.

Someone (Elon) needs to get those stats to Jared Kushner's innovation office.

There's a new interactive website that shows some of the most common jobs in each state, county and city. (Did you know that nearly half of all solar jobs in Minnesota are in sales and distribution? Must be all that community solar they're trying to market to consumers.)

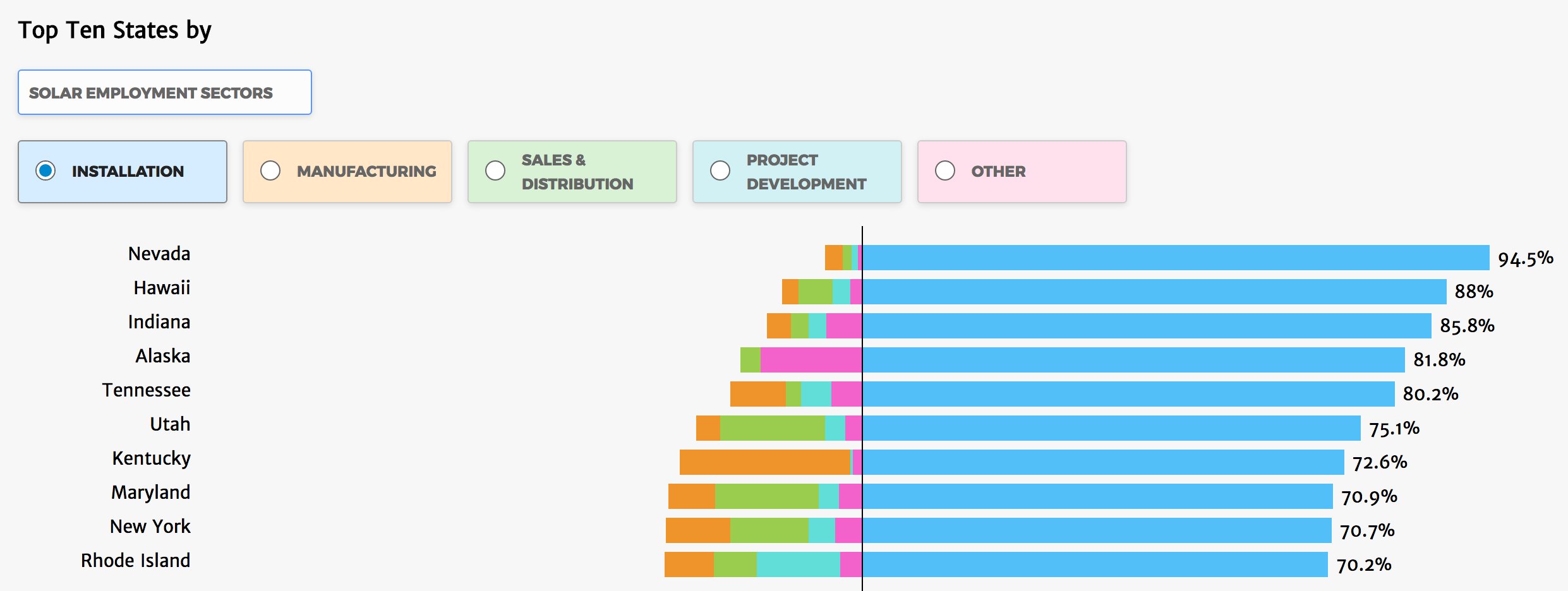

Installation jobs dominate in most states, of course. With 119,931 jobs, it's by far the biggest sector. Manufacturing follows with 30,282 jobs.

Source: Solar Foundation

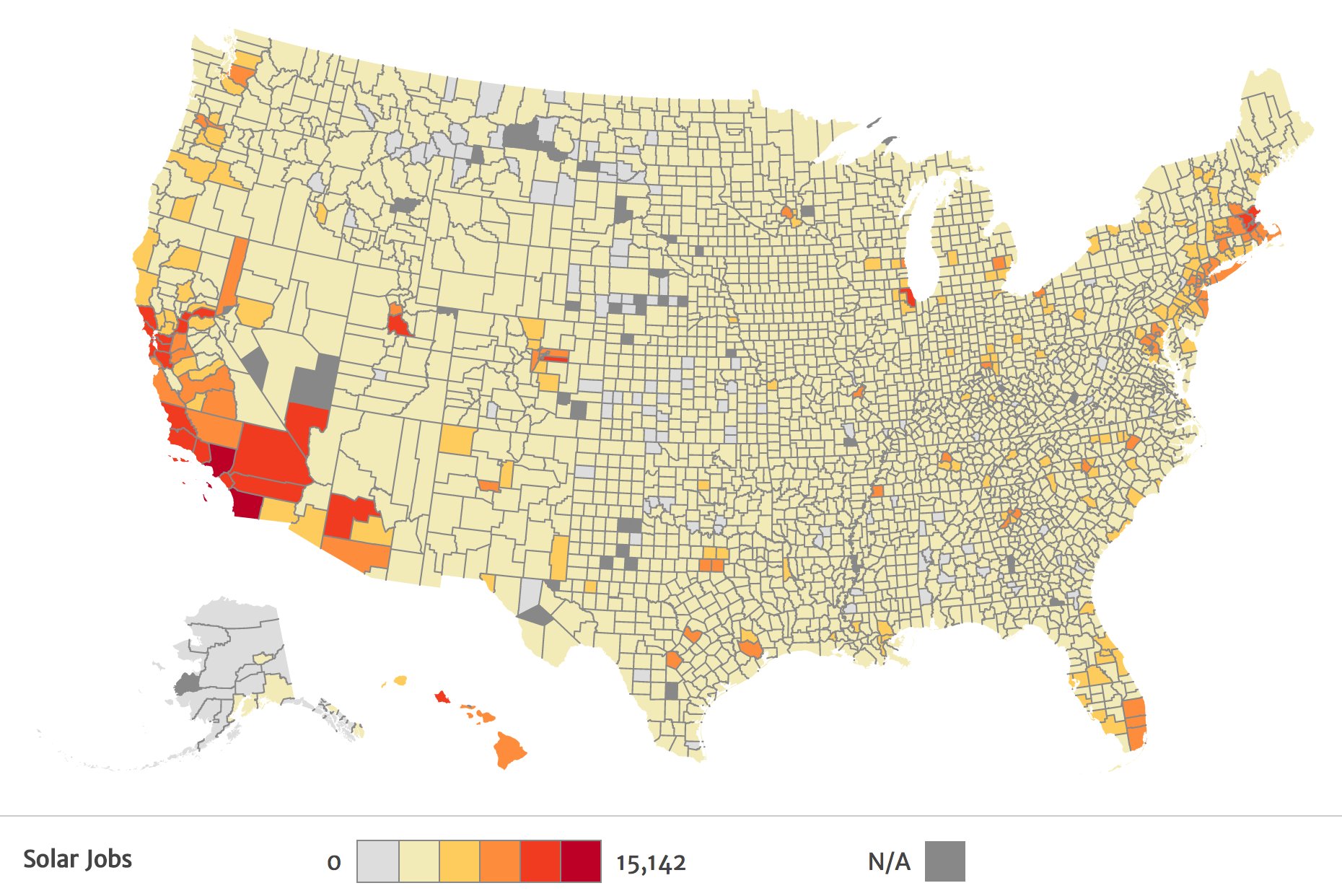

One of the most compelling maps shows solar jobs by county. Two things stand out.

First, solar jobs are nearly everywhere. But secondly, the county-level map below matches up perfectly with the Democrat-Republican split in the 2016 presidential election. In other words, there's still a correlation between more progressive counties and higher levels of solar jobs.

Of course, the solar industry would much rather talk about the dispersion of jobs around the country, not just on the coasts: “The solar industry is generating well-paying jobs everywhere," said Andrea Luecke, the executive director of the Solar Foundation, in the press release. (Go play around with the maps and statistics yourself here.)

Source: Solar Foundation

If you're keen on learning more about how to get a job in the fast-growing industry, this bonus conversation with MassCEC workforce expert Tamika Jacques provides some helpful advice on where to look. It's very Massachusetts-focused. You can either read the transcript or listen to the podcast. (The quick takeaway: You definitely don't need to get a master's degree to build a good career.)

Deals worth watching

Standard Solar: Quebec's largest natural gas distributor, Gaz Metro, is acquiring the East Coast C&I solar developer Standard Solar. Standard Solar is now calling itself an independent power producer, with the ability to finance projects internally and reach a whole new class of commercial customers. Gaz Metro bought the Vermont distribution utility Green Mountain Power in 2011.

Although Green Mountain Power has been supporting solar and storage for its customers, this is Gaz Metro's first direct play into distributed renewables. This is the sixth major acquisition by a utility or multinational corporation in the C&I energy management sector. The latest big play in solar was Mitsui's acquisition of SunEdison's C&I team. In just the last year alone, utilities or independent power producers invested $1 billion into distributed energy companies, according to a tally from GTM Research.

sPower: Last month, the global independent power giant AES said it is buying top-10 utility-scale solar developer sPower for $853 million in cash. AES had been trying to find a workable solar development business for a while. With pipelines depleted after the ITC-related rush in 2015, there's a growing hunger for large utility-scale solar portfolios -- and sPower has both.

Jigar Shah, who sits on the board of sPower, candidly explained the history of the company on a recent episode of The Energy Gang podcast, stating, "sPower really takes other people's broken deals and fixes them. That has been their MO. It hasn't been doing core, early-stage development, which has been really interesting. Their niche is actually expanding because there are so many early-stage developers who've run out of cash or run into problems with PPAs, interconnections, etc."

He continued, "When you think about big finance, the question becomes, is clean energy a place where TPG, Apollo, Carlyle, all of these big guys, can they actually use their model in clean energy? sPower is basically the first major proof point that the model works. That's why it's such a critical and important transaction."

(Squares can read the full transcript of the conversation.)

GE's Current: After slapping together a bunch of companies and calling it a "startup," GE realized its C&I business, Current, needed to get more focused. It recently restructured in order to focus more on lighting and analytics. It also kept the solar business -- and just announced a portfolio of 17 megawatts of completed commercial-scale projects. Will it become more of a traditional solar developer?

Must-reads in your ample spare time

NREL just issued a "greatest hits" of all its research on PV degradation testing. The resources include testing data from Chinese modules, an analysis of how degradation impacts LCOE, and an overview of methodologies on measuring PV module performance over time.

Nat Kreamer, the outgoing chairman of the board at the Solar Energy Industries Association, wrote a piece about his experience at the organization. SEIA is a complicated trade group, and Kreamer has had to corral a lot of competing interests. (He also got caught up in a public debate at GTM over whether to prioritize small installers over big manufacturers and developers.) This week, he offered up some lessons learned from that experience.

Bloomberg has an alarming piece about problems in India's off-grid solar market. Theft and disrepair are causing problems for villages that host a large number of solar systems. According to the story, hundreds of villages that were once considered electrified are now effectively without power: "Most of the equipment is either stolen or not working," said a project director at a state power retailer. Setting a 100-gigawatt solar target is ambitious -- but creating a functional market to help maintain that solar is equally important.