We recently published the first article in a series on flow batteries as our initial Technology Squared column. We're looking to dive even deeper into the technology, finance and behavior of the energy sector than we do in our daily GTM news offerings. But I have to apologize: I dived too deep and came up with so much information that I really had to start again. So, this is flow batteries, Part 1, take two.

So, once again, we kick off our Squared coverage with the first in a two-part look at flow batteries and their application in grid-scale energy storage.

Part 1 covers:

- The need for long-duration storage

- What technology works in this application

- Flow battery technology, vanadium

- Flow battery vendors

Part 2 covers:

- Flow battery vendor profiles

- Lithium-ion as a competitor

- The future of flow batteries

The grid needs long-duration storage

If you were building an electrical grid from scratch (with no regard to physics or finance), then long-duration energy storage would be a requisite. It just makes sense -- store energy when its cheap and/or abundant, and discharge when the price is high and/or the energy is needed by the grid. Use it to load-shift, peak-shift and smooth; to replace fossil-fuel-fired peaker plants; as a UPS; and to integrate renewable resources on the grid.

Utilities have expressed interest in energy-storage systems with greater than six hours' worth of discharge to perform epic load-shaping over the course of the day. Long-duration energy-storage vendors have expressed their belief that there's an enormous commercial and industrial (C&I) storage market emerging as net energy metering (NEM) diminishes. Vendors claim that island nations, weak grids and microgrids are primed for long-duration energy storage. A portion of the mandated 1.3 gigawatts of grid-connected storage in California by 2020 will be long-duration.

Long-duration storage fits in with what utilities, independent system operators (ISOs), and regional transmission operators (RTOs) understand. “Most utilities seem to want much longer-duration storage systems, with 6 to 12 hours discharge, to do serious load-shaping over the day,” suggests a colleague at an energy think tank. “Their expectations are being driven in part by the performance of pumped hydro, which still constitutes the vast majority of grid-connected storage out there and is the most familiar form of storage for most utility operators. Pumped hydro is hard to build, but it works like a dream when you have it.”

The market for long-capacity storage could dwarf the market for shorter-duration grid services, where lithium-ion has led the way. About 30 gigawatts' worth of gas-fired peaker plants are added each year to keep up with increased global demand -- now a huge market that is increasingly addressable by energy storage.

Where is the technology to accomplish this?

- Flywheels are good for short-duration power applications.

- Lithium-ion batteries and most sealed battery chemistries have a sweet spot of a few hours. SolarCity has a PV project on Kauai coupled with a 13-megawatt/52-megawatt-hour lithium-ion battery bank. That’s four hours.

- Eos claims its zinc-air battery is optimized for four hours of continuous discharge.

- Sodium sulfur batteries from NGK perform with six hours of discharge and possess a long operational history.

- Compressed-air energy storage (CAES) can be employed in caverns, and pumped hydro is cheap but geographically challenged, while isothermal CAES in containers is still in development.

- Other proposed methods of long-duration storage by mechanical means (rail cars, mineshafts filled with water and weights, liquid air, underwater balloons, etc.) or chemical means (hydrogen, ammonia) are either uneconomical or mired in the artist's-rendering stage.

Does that leave flow batteries as the long-duration solution?

Advanced by NASA in the 1970s and by NEDO and UNSW in the 1980s, flow batteries circulate a liquid electrolyte through stacks of electrochemical cells and have long held the promise of 10-hour durations, tens of thousands of cycles, minimal degradation, and no limitations on depth of discharge. That potential has lured VC investment and R&D -- but so far, the investments have yielded very few commercial, competitive flow battery products.

Still, today's fleet of flow battery companies has developed some momentum in terms of capital, personnel and deployments in real-world applications. Firms are finally installing flow batteries that pencil out financially without incentives. There is even a flow battery firm claiming it will be the cheapest energy battery available (at $200 per kilowatt-hour) by 2018.

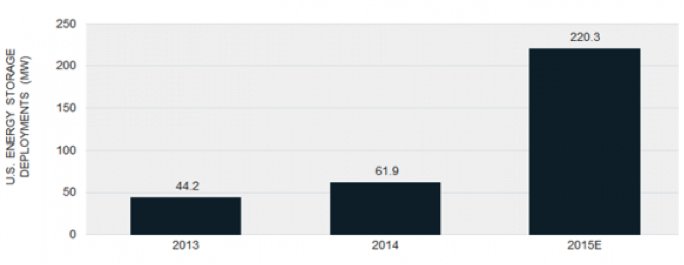

There are 76 flow battery projects big enough for the DOE to take note of, about half of which are operational, for a current grand total of about 20 megawatts, according to the DOE's energy storage database. Another 50 or 60 megawatts are listed as under construction or announced. GTM Research expects the U.S. to deploy 220.3 megawatts of energy storage in 2015 -- predominantly utility-scale and predominantly based on lithium-ion batteries. Only a few megawatts will come from flow batteries.

FIGURE: U.S. Energy Storage Deployments, 2013-2015E

Source: GTM Research's U.S. Energy Storage Monitor

Flow battery technology

A sealed battery has two, typically solid, electrodes embedded in an electrolyte. Charge flows through the electrolyte.

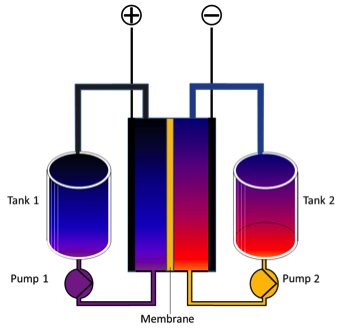

Compare that to a flow battery, which circulates a liquid electrolyte (with dissolved electroactive agents) through electrochemical cells that convert chemical energy to electricity. The electrolytes are stored externally in tanks. Power density is determined by the electrochemical cell’s area, while the volume of the tanks determines duration.

FIGURE: Redox Flow Battery Diagram

Source: Benboy00 via Wikimedia Commons

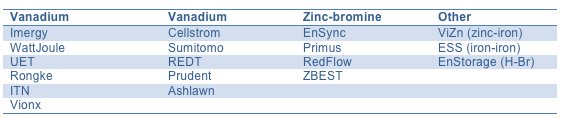

More than 20 flow battery chemistries, including zinc-bromine, zinc-cerium, magnesium-vanadium and vanadium-cerium, have been studied -- but the most researched and closest to commercialization is the vanadium redox flow battery (VRB).

FIGURE: Flow Battery Vendor by Electrolyte Technology

Flow batteries are categorized into the subgroups redox flow batteries and hybrid flow batteries.

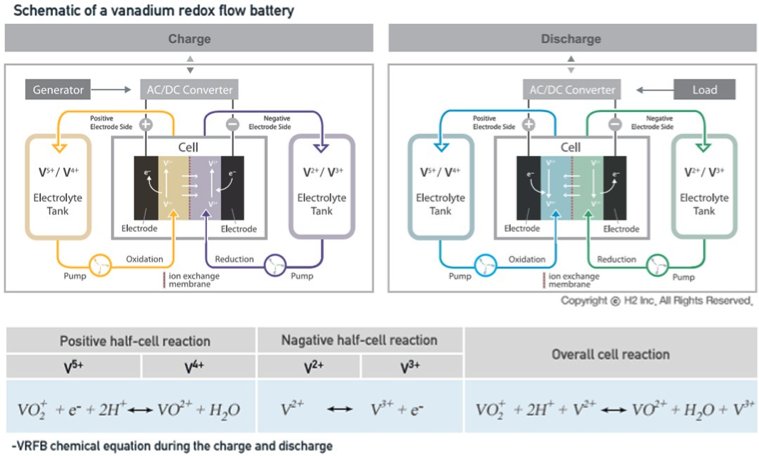

In redox flow batteries (RFBs), the negative electrolyte (also referred to as the anolyte) and positive electrolyte (the catholyte) both contain metal ions that stay dissolved in the fluid electrolyte during charging and discharging. The electrolytes flow through porous electrodes, isolated by a membrane that allows the electron transfer process, which is what this is all about. Vanadium redox flow batteries (VRBs) use the same metal ions in both electrolytes, so the electrodes and membrane are not cross-contaminated and cell capacity does not decrease with time. RFBs using ions of different metals such as Fe-Ti and Fe-Cr are subject to a degradation of the electrolytes and a loss in capacity.

The July 2013 DOE/EPRI Electricity Storage Handbook classifies vanadium redox, the most mature flow battery chemistry, as being in the "pre-commercial" stage. The report states, "The cell stack is probably the limited life component, with a useful life estimated at ~10 years; however, operational field data are not available to confirm these lifetimes. The tanks, plumbing, structure, power electronics, and controls have a longer useful life."

FIGURE: Vanadium Flow Battery Schematic

Source: H2

The DOE’s Pacific Northwest National Laboratory (PNNL) has developed a vanadium electrolyte that bears the promise of increasing energy storage capacity and operating temperatures. Imergy, WattJoule and UniEnergy have licensed the PNNL technology (although Imergy's current product is not utilizing the license). The PNNL electrolyte’s sulfate-chloride-based chemistry displays more stability than does the traditional sulfate-based chemistry.

Vanadium!

A rough cost breakdown for a flow battery has 40 to 50 percent going to the electrolyte and 30 percent to the cell stacks. The cost driver in the stack is typically the ion exchange membrane.

Vanadium, the dominant cost in that electrolyte, is a metal mined in Russia, China and South Africa, and used predominantly as a steel additive. The global market price is set by whatever the steel industry is willing to bear and currently runs about $9.00 per kilogram. The problem is that a flow battery needs a lot of purified vanadium.

Imergy has developed a process to use vanadium extracted from oil sludge or fly ash as its electrolyte. A small difference in purity comes with a big reduction in cost, according to Bill Watkins, Imergy’s CEO. “We basically take the contaminants, and we can mask it with our formulation. We don’t have to go to the commodity vanadium markets around steel -- we can create our own markets.” It lets Imergy cut its vanadium costs by a third, said Watkins, and ensure a supply of the metal. Imergy still has to prove this process at scale, however.

Imergy isn’t the only flow battery company looking for creative ways to reduce materials cost; Gildemeister/DMG Mori Seiki, the German-Japanese group that makes the CellCube VRB, and partner American Vanadium are looking to develop a low-cost vanadium source in Nevada.

Switching gears away from vanadium, in a hybrid flow battery (HFB), one of the active materials is stored within the electrochemical cell, while the other remains in the liquid electrolyte and is stored externally in a tank, an approach combining features of conventional secondary batteries and flow batteries. A typical example of the HFB is the Zn-Br2 system where zinc is deposited at the electrode during charging. Zn2+ goes back into solution during discharging. Hybrid flow battery companies include RedFlow and Primus. The July 2013 DOE/EPRI Electricity Storage Handbook classifies this technology as being in the "demonstration" stage.

Ron Van Dell, CEO of zinc-iron flow battery firm ViZn, points out that zinc-based flow batteries have had challenges in maintaining performance with repeated use due to the buildup of metals on the electrodes. Reaching ViZn’s claim of 20 years and 10,000 cycles of operating life has required solving “some fundamental challenges with a zinc-based metal liquid system,” he said. “It has to be able to manage the metal coming in and out of the solution as part of your charge and discharge, and that behavior has to be very reproducible, very robust, and still yield high performance.”

Other flow battery technologies being investigated in the labs include:

- The all-iron flow battery is a potentially low-cost system using common materials, aqueous electrolytes, and inexpensive separators.

- ARPA-E has funded an investigation of slurry electrodes for the all-iron battery.

- U.S. scientists have developed an alkaline flow battery that uses cheap, nontoxic organic molecules to store energy instead of "expensive and hazardous transition metal solutes." The team dissolved commercially available organic molecules in potassium hydroxide solutions and pumped them through a lab-scale flow cell.

- Lithium-ion: 24M, founded by A123 founder Yet-Ming Chiang, raised $12.5 million from Charles River Ventures and the DOE to develop a Li-ion flow battery using “concentrated nanoparticle suspensions of common Li-ion battery cathode materials such as LCO and LFP in an electrolyte to create an energy-dense liquid that can slowly flow over a membrane like the separators used in conventional Li-ion batteries; a similar suspension of an anode material like graphite or LTO flows over the membrane on the other side.” Although that flow battery technology failed, the company continues to win significant funding for its lithium-ion battery manufacturing technology effort.

- Vanadium flow battery research at the University of New South Wales is focused on "vanadium bromide solutions with up to two times greater energy density" and vanadium oxygen redox fuel cells with "potentially four times the energy density of the original VRB technology."

Market penetration and production volumes are just too small for any technological victor to be declared. There is no “best electrolyte” in flow batteries just yet.

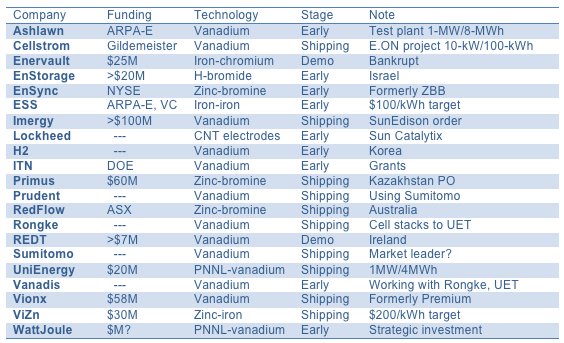

FIGURE: Flow Battery System Vendors

***

Click here to read Part 2.