In their 1963 recording “Little Saint Nick,” the Beach Boys correctly diagnosed that “Christmas comes this time each year.” The same could be said of Wood Mackenzie's Energy Storage Monitor for the year’s third quarter, typically published to coincide with the annual Energy Storage Summit at the start of December.

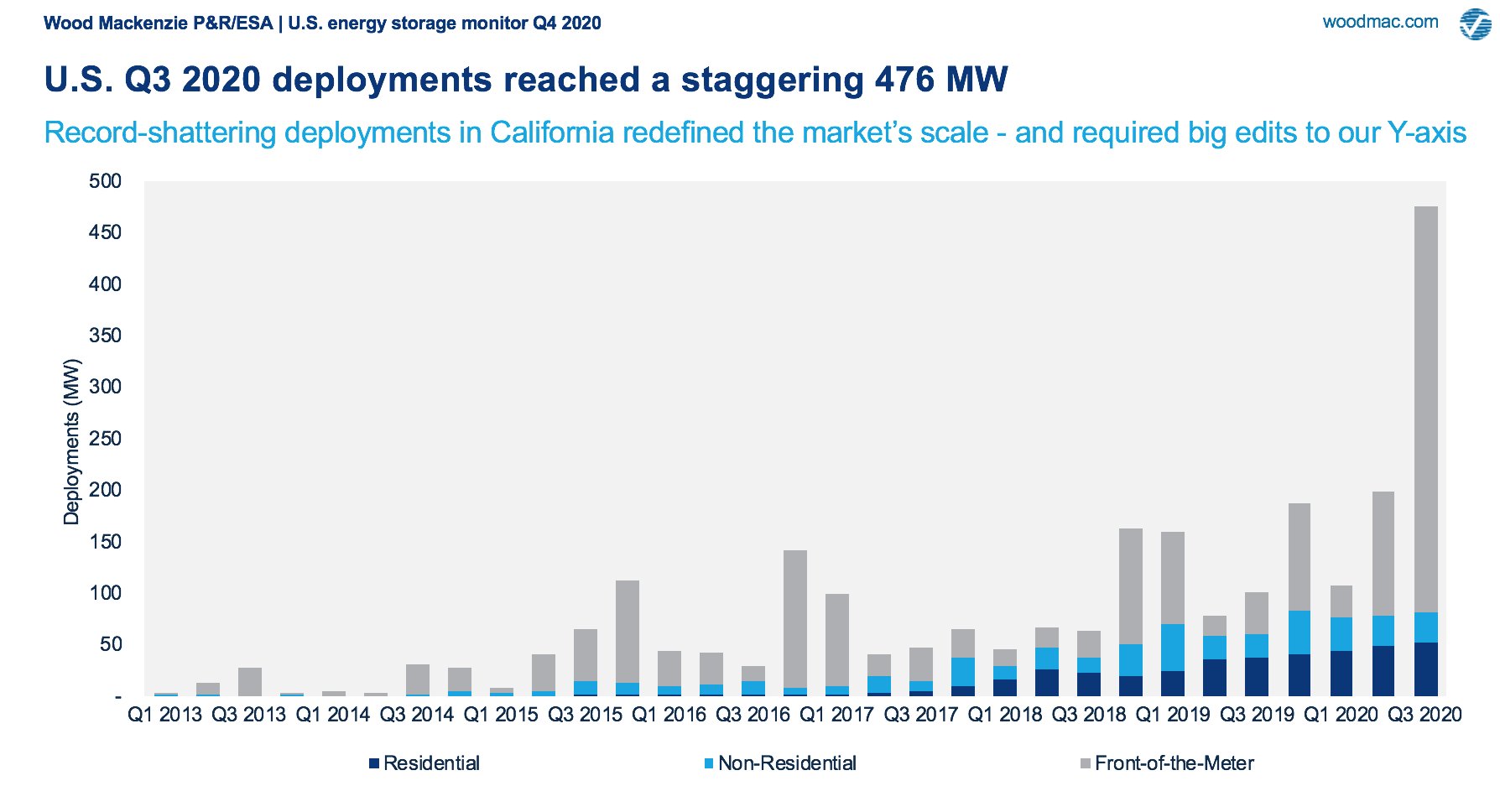

But never before has this periodic occurrence generated such excitement. The latest data drop, you may have seen, contained a remarkable 240 percent quarter-over-quarter surge in U.S. energy storage deployments, bringing the nationwide total to 476 megawatts installed.

Naturally, the headline numbers mask a wealth of stories and trends that are hard to capture in a quick news story. But that’s why we have GTM Squared. This week on Storage Plus, I’m digging into the underlying dynamics from this most dynamic of quarters to see where the action is and where things are lagging. The trend lines are up and to the right for the largest battery projects, but distributed storage has yet to prove its potential for massive growth. And any storage technologies besides lithium-ion batteries have even more to prove.

A tale of three segments

Like wealth in America, overall storage-sector growth was huge but unevenly distributed.

Playing out the metaphor a bit, the handful of biggest projects drove almost all the growth in capacity. The front-of-meter segment grew 3.3x on a megawatt basis and 4.75x on a megawatt-hour basis compared to the previous quarter. That’s triple the previous quarterly record for megawatts deployed and double the previous quarterly record for megawatt-hours deployed.

The residential storage segment grew too. In fact, it kept its consecutive string of record deployments going for the sixth time. But this was modest single-digit growth, just 7 percent on megawatts and 6 percent on megawatt-hours deployed. Maybe this is the middle class of the storage industry: Things are getting better, sure, but the heady growth narrative of bygone times has petered out into modest incremental improvement.

And then there’s nonresidential storage, a bit of a hodgepodge including commercial and industrial applications as well as batteries attached to distributed solar. The American Dream is not materializing for this hard-working storage segment. Nonresidential installations have declined for three quarters running. They’re still better off than they were in previous years, but whereas the other segments are doing fantastic, or pretty good, the nonresidential numbers are stuck in a rut.

Unlike the U.S. economy, there aren’t really moral implications to the distribution of wealth among energy storage installers. But breaking down the results by segment reveals that the theoretical benefits of distributed energy — consumer-driven, easier sales cycle, broader addressable market — have yet to become assets for the industry. Front-of-the-meter projects, on the other hand, benefit from a tremendous concentration of resources and a clear path to market via utility procurement. To get lots of batteries built and working for the American grid, it’s best to do it the old-fashioned way.

Kick the tires on residential growth

Six consecutive record quarters sounds impressive. If I grew by record amounts in each of the last six quarters, I’d definitely be taller than I am now. But it’s worth digging a little deeper into residential storage performance to see how things are really going.

For starters, the growth is steady but not earth-shattering, as noted above. There was a moment in late 2017 when we actually did see quarter-over-quarter doubling. We’re a long way from that exponential growth curve now. That was also a time when the industry had been doing a few hundred installations per quarter, and doing a few hundred more was eminently achievable.

But keep in mind that the growth is measured in capacity installed. If you look at the total number of projects, a different story emerges. The Energy Storage Monitor counts total behind-the-meter deployments together, although nonresidential drives so few projects that this metric effectively represents the breadth of residential installations. And that count has stayed flat at around 7,300 for each quarter this year.

That means that residential installers are moving more battery capacity but are not substantially growing the pool of customers they’re reaching from one quarter to the next. That’s not the kind of traction that would substantiate the vision of ubiquitous battery adoption told by bullish installers like Sunrun.

In fact, the residential solar industry, of which residential storage is largely a subcategory, is growing at literally double the rate of home battery deployment. According to Wood Mackenzie’s Solar Market Insight, home solar capacity installations dipped by 20 percent in the second quarter amid the worst of the coronavirus disruption. But installations increased by 14 percent in Q3, the same period in which the equivalent category for storage rose just 7 percent.

That means residential storage was more resilient in the face of stay-at-home orders and economic disruption than was solar overall. The impressive quarter for solar simply got it back to the level of deployment from Q3 2019: 738 megawatts. But residential storage installers have yet to prove they can scale up to reach thousands more customers from one quarter to the next, and that’s the kind of muscle that will be needed to make this product widespread. Or to meaningfully help Californians deal with utility power shutoffs next year.

Billion-dollar business, baby

The market value of U.S. grid storage jumped from $709 million in 2019 to nearly $1.5 billion in 2020. And that’s going to nearly triple next year.

The actual impact of this milestone may be a little abstract, like getting the blue checkmark on your Twitter account or joining the Century Club on Peloton. If we hadn’t collectively settled on a base-10 counting system, we wouldn’t even be talking about this.

Still, at a time when storage will be vying for a slice of COVID stimulus funding, it can only help to show that this is a serious sector, worthy of federal investment. Now it's officially a billion-dollar homegrown industry, and it’s growing fast. That sounds like a better place to stimulate the economy than paying off the debt of broke fracking companies.

It's a lithium-ion world

I spend a good bit of time scrutinizing the colorful field of companies and technologies vying to deliver long-duration energy storage. Just this week, I covered a report from California’s energy storage industry group that concluded the state will need 45 to 55 gigawatts of long-duration (in this case, five or more hours) storage to fulfill the 2045 clean grid goal.

For context, the state’s peak demand amid the record heat wave in August was around 45 gigawatts, so this would entail replicating all of that capacity purely from long-duration devices. A lofty goal to be sure, and one that the authors stressed means the state must act now to build a runway for procuring such assets because the current market rules aren’t doing the trick.

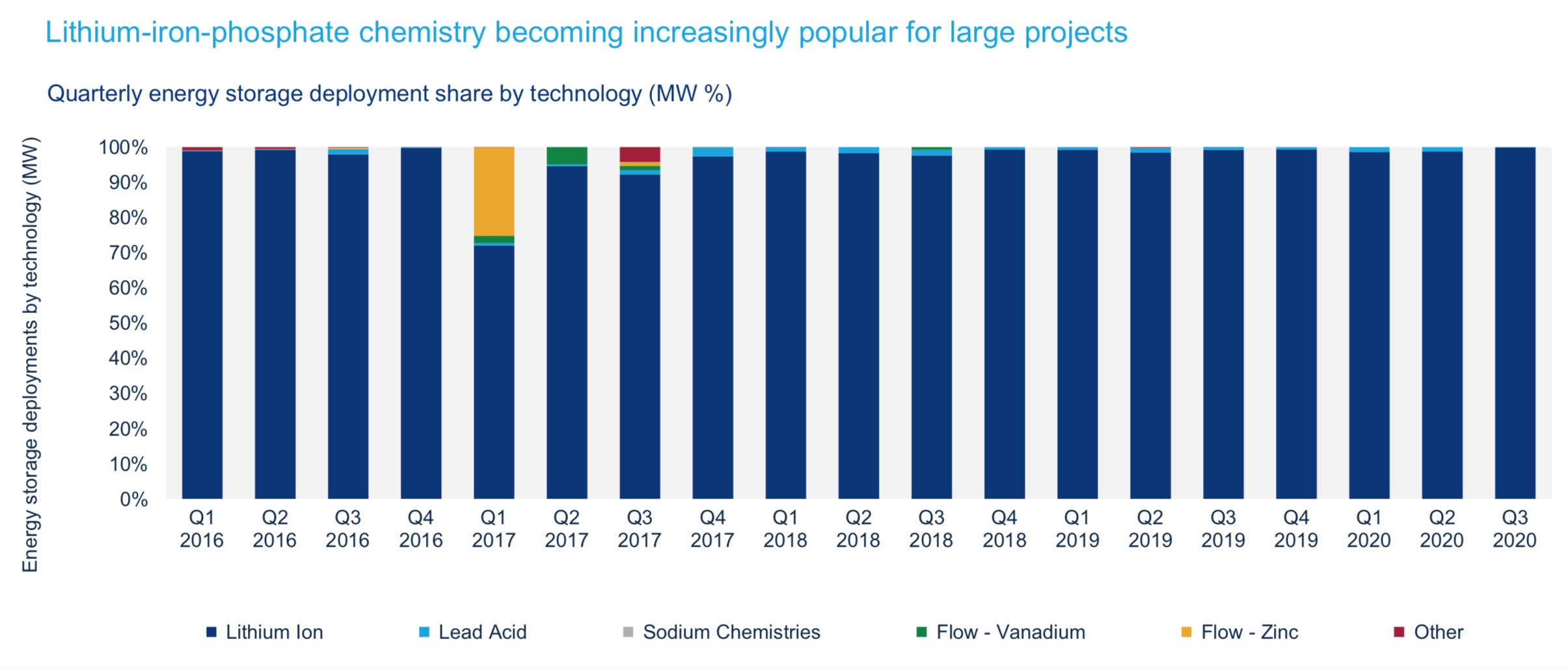

The ESM backs that up. California front-of-meter projects alone delivered 510 of the 764 megawatt-hours installed in these United State over the third quarter. As in the cultural realm, California represents the bulk of national activity here. The chart below presents a breakdown of the different storage technologies that made their mark.

Move over Michigan, Wisconsin and Pennsylvania; lithium-ion is the real blue wall. Its market share was close enough to 100 percent to round up to it. If there’s pent-up demand for long-duration storage, we sure aren’t seeing it in this data.

Of course, advocates for this sector would say that’s because current forms of compensation fail to assign value to longer-duration storage. California pays for capacity based on showing up for four hours. But as solar comes to dominate the state’s generation and gas plants shut down, the ability to guarantee power delivery through the dark hours of the night will become valuable indeed.

It would be a mistake to look at today’s numbers and conclude that since the market has spoken, we’ll never need anything besides lithium-ion. It’s safer to say that the market is uninterested in anything else, so if there is a verifiable need for other tools, they will need some extrinsic encouragement.