This article kicks off a GTM Squared series on the leading U.S. energy storage asset owners. We reported on this topic back in 2017, but that feels like the Jurassic period given how much the sector has advanced since.

The entries are drawn from the Wood Mackenzie Energy Storage Project Database, cross-referenced with original reporting and other public sources. The series examines the leading owners of operational electrochemical energy storage installed in front of the meter. That leaves out batteries at homes and businesses; it also excludes mechanical storage, because that would turn into a roundup of who bought and held onto the most pumped hydro decades ago.

The goal is to understand the strategies, motivations and insights of the major early adopters of battery storage. After counting down the top five, we will examine how forthcoming projects will reshape the leaderboard in the next few years.

Duke Energy’s approach to energy storage has shifted from “watch and learn” to “build and use.”

The company’s regulated utilities spent years testing small batteries in a range of different applications. Now those lessons are informing battery proposals designed to show regulators a clear and calculable benefit. Duke has built or is building systems for distribution and transmission deferral, reliability and backup power, ancillary services, solar shifting, and more. And it’s doing so in states that have no particular policy driver to encourage this technology, such as North and South Carolina, Indiana and Florida.

“Our strategy was to start with smaller investments, get them up and running, and then we can bring some larger projects,” said Zachary Kuznar, managing director for CHP, microgrid and energy storage development on the regulated side.

North Carolina-based Duke Energy is one of the largest U.S. investor-owned utilities, serving electricity through its subsidiaries to nearly 8 million customers in the Southeast and Midwest U.S.

What Duke builds, it owns, and even its early projects launched it into the ranks of leading battery asset owners.

Surprisingly, the company’s biggest battery is one of its oldest: the 36-megawatt/24-megawatt-hour Notrees system at a wind farm in Texas that competitive arm Duke Energy Renewables completed in 2013. The Department of Energy covered half the cost of the $44 million technology demonstration project, and Duke had to replace the original lead acid batteries with lithium-ion. But the system is still delivering frequency regulation as Duke hones its battery bidding strategy.

All this studying is about to transition into an era of increasingly ambitious battery development for Duke.

North Carolina has the second-largest installed solar capacity of any state, generating value for shifting that generation. Duke’s corporate leadership committed to net-zero carbon emissions by 2050. Its plan leans heavily on natural gas, but there’s room for storage to move out of the niche roles supporting remote mountain towns and into a central duty for grid operations. The company says it will spend $600 million in the next five to 10 years to make that happen.

Coming up next: Bigger batteries

Duke’s early forays into storage development involved smaller systems installed on the distribution grid, Kuznar said. Now the company is entering a new phase.

“What we’re really looking at now is getting projects in our interconnection queue on the transmission side,” he said. These will be much larger, 20 megawatts or more, and will get into the business of serving peak power.

Duke has not announced any specific peaker plant batteries yet, of the sort being developed in California or Arizona — though most of the big battery peakers in the Western U.S. are still a few years away from completion.

The larger-format battery will probably make sense first in Florida as a solar-paired power plant, Kuznar said. Fellow regulated utility Florida Power & Light similarly found positive economics in the Sunshine State: It plans to build a 409-megawatt battery to shift solar production for peak power delivery.

Successful battery development in regulated states involves taking the time to explain the costs and benefits of the technology to regulatory staffs and ratepayer advocates. Duke has been building up its track record with smaller, targeted batteries for cases that clearly save money.

It airlifted a Fluidic zinc-air battery for a remote microgrid in the Great Smoky Mountains National Park because it was cheaper than maintaining miles of feeder line through the wilderness. An approved battery will enable islanding for the mountain town of Hot Springs, North Carolina, which otherwise depends on a 10-mile distribution feeder prone to outages. Projects like those are building up to the bigger asks.

“When you start spending hundreds of millions of dollars on these projects, they're going to want to make sure it's a good investment for ratepayers,” Kuznar said.

Another hurdle is the sheer crowdedness of interconnection queues. “One of the biggest holdups, not just in the Carolinas but in general, is the length of time for projects to get through the interconnection queue,” Kuznar said.

What is Duke building right now?

Duke recently finished two batteries that had to pause commissioning due to the arrival of the coronavirus pandemic. The Nabb battery in southern Indiana will provide reliability and bid into the Midcontinent Independent System Operator frequency regulation market. That and a 9-megawatt battery in Asheville are expected to wrap up commissioning in July, Kuznar said.

Also in Indiana, Duke is installing a 5-megawatt battery at Camp Atterbury, a National Guard training site. It will sit in front of the meter but is located on the base. During regular operations, the Camp Atterbury battery will serve in frequency regulation and solar firming roles, but it will switch to backup power for the base in event of a grid outage.

Meanwhile, Duke’s regulated business in Florida won approval for a portfolio of 50 megawatts of storage, provided they fall within a cost cap. The company has announced three of those:

-

Cape San Blas, 5.5 megawatts. Creeping load growth at this Gulf Coast community ran up against capacity for four or five days in the summer, Kuznar said. The battery option was cheaper than traditional substation upgrades to handle those few peaky days in the year.

-

Jennings, 5.5 megawatts. This project displaces more expensive distribution upgrades that would have been needed for reliability near the Florida-Georgia border.

-

Trenton, 11 megawatts. This one is another reliability play that is cheaper than conventional distribution upgrades.

These are not dramatic projects, as far as battery use cases go. They aren’t going to shut down coal plants or turn solar into a peak power source. But they show that Duke is incorporating batteries into the bread-and-butter work of keeping the wires running and finding it cost-effective relative to conventional alternatives.

Duke has won regulatory approval for battery projects in all of its regulated electric utility territories, clearing the way for more projects across the board.

Duke Energy Renewables: "We don't have to be the first mover"

Despite the proliferation of big U.S. battery project announcements, few developers have matched the size of the Notrees battery that Duke Energy Renewables built seven years ago. Neither, for that matter, has Duke Energy Renewables.

Chris Fallon, vice president at Duke Energy Renewables, describes the value of energy storage as more of a future-tense proposition. “I do believe that as battery technology improves and the chemistry improves, they will be able to add significant value to the grid,” he said in an interview.

Duke Energy Renewables owns and operates wind and solar farms across the U.S., typically selling the power through long-term contracts with utilities and corporations.

As Fallon sees it, the influx of renewables will lead to transmission congestion and curtailment, creating clearer value propositions for batteries. He expects to develop batteries alongside new and existing solar projects within the next five years.

Other developers are moving ahead already; during the next five years, annual U.S. storage deployments will grow sixfold, according to Wood Mackenzie's latest Energy Storage Monitor.

“I don't think we necessarily have to be the first mover,” Fallon said. “We want to invest in clean energy infrastructure, but we also like to have contracted revenues as much as possible. […] We’re less inclined to have heavily merchant or uncontracted revenue.”

Duke looked at some of the big California storage requests for proposals, Fallon said. But winning the capacity contract required bidding low and balancing it out with merchant wholesale market revenue. Duke’s early battery developments taught the company to be careful about banking on merchant market rules that are liable to change; the California opportunities didn’t meet the company’s standard for “clear line of sight to revenue.” Developers including Vistra Energy jumped in instead, willing to take that merchant risk.

The Notrees battery has been a “good asset” for the company, which views it as “tuition paid,” Fallon said. The company is still optimizing its bidding strategy as the environment shifts.

“The rules keep evolving as the nature of the grid changes,” he said. “And Texas is booming; [the state is] still putting on thousands of megawatts of new wind and solar assets.”

A closer look at Duke's net-zero plan for 2050

The stakes for Duke’s battery strategy amped up when the company committed last fall to net-zero carbon emissions by 2050 and featured batteries as a key pillar of that strategy. But the plan’s approach to peak power downplays energy storage in favor of other resources.

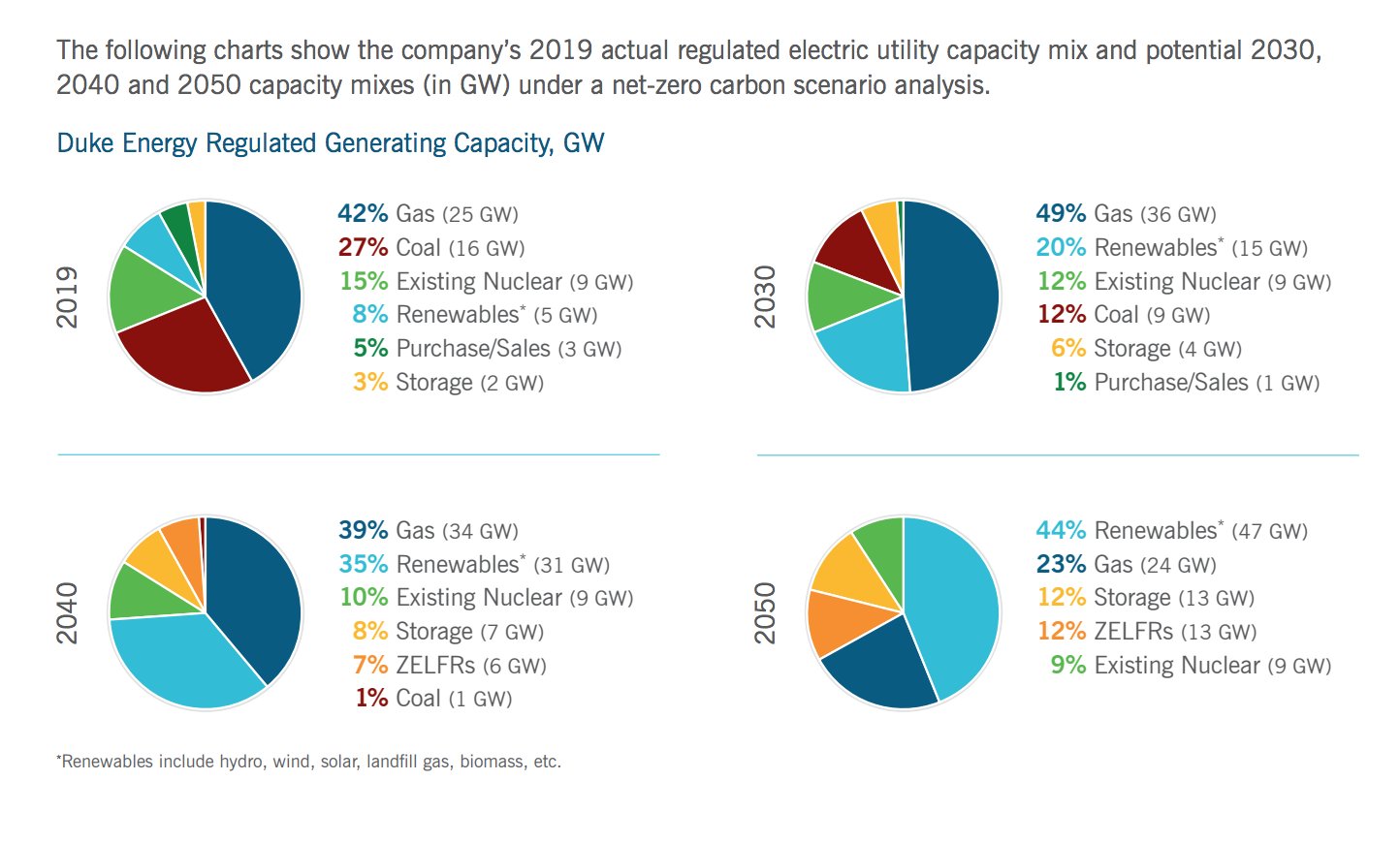

Duke’s strategy is to keep adding gas combustion turbines past 2030 while it shuts down coal plants; gas will still constitute 23 percent of capacity in 2050, though it will make up just 6 percent of megawatt-hour generation. Duke will also grow storage capacity from 2 gigawatts today (from a pumped hydro plant) to 13 gigawatts in 2050.

Duke's net-zero carbon strategy places equal weight on energy storage and a collection of commercially unproven technologies. (Image credit: Duke Energy)

Duke Energy dismisses the “no new gas” scenario pushed by some environmental groups, arguing that it would require storage investments by 2030 equivalent to 17 times the installed capacity on the grid today.

“We are not aware of any electric utility in the U.S. that has attempted to serve customers reliably at scale with such a high proportion of capacity from energy storage,” Duke's net-zero report notes.

Batteries vs. unknown future technologies

Kuznar took a more nuanced, operations-centric approach, noting that batteries are unlikely to ensure power through a multiday polar vortex but could be useful for replacing peakers that run four hours or less at a time.

“I don't believe that renewables-plus-batteries will be the answer to all of this, but it’ll be a piece of it,” he said.

Duke balances its planned 13 gigawatts of energy storage by 2050 with an equal amount of a new category called “zero-emitting load-following resources” or ZELFRs. The concern for seeing present-day market traction goes out the window for ZELFRs, none of which have achieved widespread commercial success. They include small modular nuclear reactors, carbon capture and storage, hydrogen and long-duration storage.

“We already know enough right now that we should be going whole hog into renewables-plus-storage,” said Daniel Tait of utility watchdog Energy and Policy Institute, which published a critique of Duke’s net-zero strategy. “We don't need to open up this Pandora's box of made-up technologies at this stage.”

If Duke holds out for the unproven technologies that may materialize in 20 years, Tait said, it could miss the opportunity to make easier, incremental investments in carbon-free peak resources that are already real, proven and competitive, including batteries and demand-side management tools.

“It’s going to be up to [regulatory] commissions to hold Duke accountable,” he said.

Utilities that try out a major battery tend to like it, and then they ramp up battery procurements dramatically. Duke has already called for several hundred megawatts based on a handful of smaller systems; it should be getting to its first large applications in the next couple of years. That process could instill more confidence in batteries for future sustainability planning.