A 202 kilowatt-hour Fluidic Energy Storage System, coupled with a 30-kilowatt PV array, provides electricity to the village of Aidiru, about 100 homes, in the Papua Barat region of Indonesia. (Image credit: Fluidic Energy)

There are enough pages written about lithium-ion to give Tolstoy a run for his money, and here on Squared we've already dug deep into flow batteries. This time on Storage+, we're diving into a long-simmering alternative to both of these technologies: zinc-air batteries.

The fundamental technology has been kicking around for more than half a century in applications as ubiquitous as hearing aids. Only in the last decade, though, researchers have succeeded in making zinc-air batteries rechargeable and long-lived, and only one company has succeeded in commercializing it. Fluidic Energy, a Scottsdale-based startup spun out of research at Arizona State University, began deploying zinc-air systems in 2011 for cellphone tower backup in remote parts of Indonesia, Southeast Asia, Latin America and Africa.

That particular application may well raise eyebrows, as it has become a popular final plea for companies bargaining with the reaper for a few more months of run time. It happens to also be a revenue-generating way to try out a new technology in real-world settings and gain valuable data to hone the operations of the systems in the future.

If this experiment succeeds for Fluidic, flow battery makers will have to contend with a sturdy rival that promises low component costs, easy installation and maintenance, high energy density and few moving parts. Lithium-ion will have to catch up on a few other metrics too. Years down the road, zinc-air could even be in the running for a future electric car battery. Here's why this seldom-seen technology looks promising.

The benefits of zinc-air

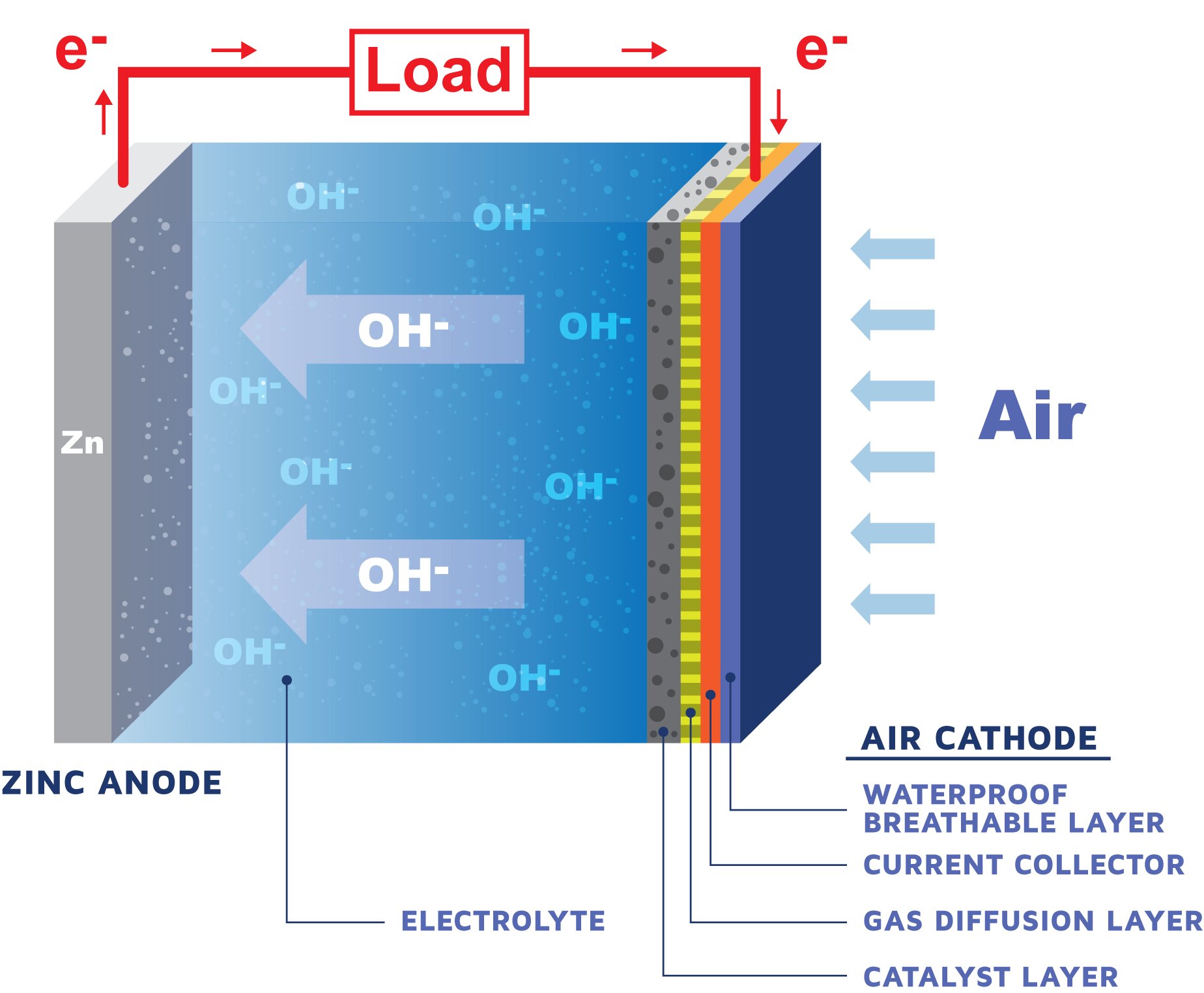

In a zinc-air battery, the electrons come from the air itself. Fresh air blown onto the device delivers oxygen through a waterproof but breathable layer, akin to Gore-Tex. The oxygen reacts at the cathode to form hydroxyl ions, which travel through an electrolyte to the zinc anode, where they form zincate ions. That process releases electrons that flow through the wires to the load.

If this doesn't make sense, it's time to break open that high school chemistry book you've been keeping for special occasions. (Image credit: Fluidic Energy)

The most prominent upside to this approach is cost: The materials come cheaper than really any other battery.

The raw materials for the zinc-air electrodes cost $1.2 per kilowatt-hour and can be purchased easily, no advanced mining of rare earth metals required. The cathode material is, well, air, which was trending even cheaper than zinc at the time of publication. The raw material required for Fluidic's zinc-air battery clocks in at about 17 times cheaper than a typical lithium-ion battery's raw active electrode materials, according to an internal analysis by the company. Fluidic even beats off-the-shelf alkaline batteries for raw electrode materials costs.

The design also decouples energy and power, allowing more customization based on the needs of the customer. To increase energy, said CTO Ramkumar Krishnan, Fluidic adds more zinc to the anode and electrolyte. To enhance power, the company expands the air cathode. This allows a high degree of customization in the ratio of power to energy, as opposed to many batteries where the two scale together.

In most batteries, the cathode takes up a good deal of space -- more than the anode, in fact. Zinc-air battery cathodes take up relatively little space, because the air itself is outside the structure. This leads to higher energy density, because zinc-air can provide more energy for the same amount of space as a conventional battery.

The chemically inert components and the structure of the battery minimize fire risk, as well.

"The moment you actually stop the air flow, you stop the reaction, which means there is no chance for thermal runaway," Krishnan said. "It's probably one of the safest chemistries that’s available on the market today."

Fluidic is already pulling off sales in the range of $350 to $550 per kilowatt-hour all in, including the weatherized outdoor cabinet, power electronics and other necessary components, said CEO Steve Scharnhorst. The cell and BMS alone cost around $250 per kilowatt-hour, and the company claims it's "well on our trajectory to be the leader and go below $100 per kilowatt-hour in the next 24 months," Krishnan added.

Zinc-air vs. lithium-ion

The prominent strengths of zinc-air seem strategically suited to excel in places where lithium-ion cannot.

The latter technology has dominated the budding energy storage market, to the tune of a 99 percent market share as of Q2 2016, according to GTM Research. It faces numerous structural limitations, though, which is why even the labs that developed the technology are racing to come up with something better.

Where zinc-air materials are cheap and easily accessible, lithium-ion chemistries need rare earth metals that are increasingly in tight demand, driving up system costs. The raw materials cost imposes a higher price floor for lithium-ion than zinc-air.

Energy and power are not decoupled, so to size a lithium-ion system to last for a day would require building (and paying for) far more power capacity than anyone actually needs.

Since lithium is more chemically reactive than zinc, thermal runaway, aka "catching fire," poses much more of a risk. That requires battery makers to meet stringent safety requirements for shipping the batteries, driving up overhead and adding time to an install. It also requires thermal controls onsite to keep the batteries in a safe temperature zone, again adding overhead.

That challenge compounds in adverse environments, like hot, humid, equatorial parts of the earth. For remote installations, it also means more stuff to trek in.

Inside the battery, each charge and discharge slightly degrades the lithium cells, so the battery systems' days are numbered from the moment they deploy.

The longer a system can cycle, the lower the levelized cost of energy. Zinc-air hasn't pulled away yet -- Fluidic offers five-year warranties for telecom backup and 10-year for remote microgrids, within the typical range for lithium-ion warranties. The company plans to extend the life as it reduces cost, Krishnan said, with a target of "well over 5,000 cycles."

One place where lithium-ion does benefit is the economics of scale. Companies are building so many of these batteries now that the prices have fallen precipitously and will continue to do so. Zinc-air may start cheaper, but as a niche product with relatively miniscule volume, it won't be able to ride the same wave of cost declines. It's hard to predict how much of a disadvantage that will be.

Zinc-air vs. the long duration field

Lithium-ion batteries currently rule the market for sub-4-hour energy storage. Beyond that, the fixed scaling of power to energy makes things prohibitively expensive.

Since the shorter-duration market is pretty saturated, with well-monied players already reaching lots of customers through established channels, the path of least resistance for zinc-air lies with long-duration applications. The initial deployments have indeed targeted the longer-duration market, where the technology can really shine.

That puts zinc-air into competition with a few developing models of lithium-ion alternatives, most notably flow batteries. The exact chemistries vary, although vanadium redox has a dominant presence (see Eric Wesoff's deep dive on this technology here and here).

Flow batteries similarly enjoy a lack of flammability (they're wet), cheaper materials and a decoupling of energy and power. They can increase power by enlarging the electrochemical cell, and increase energy by increasing the volume of the electrolyte tanks.

Flow batteries and zinc-air share a lot of advantages. The strongest point of distinction between them is a matter of simplicity. Zinc-air has few moving parts; flow systems require a network of pipes and pumps to move liquid around continuously. That creates more potential points of failure.

It also complicates the installation, as there are more intricate pieces to set up and monitor. That problem compounds in remote locations, where all the components might need to be carried in by hand. Fluidic's zinc-air batteries match the profile of a lead acid battery -- plug in the box and it's good to go. Some flow battery materials, like vanadium and bromine, create toxicity worries as well.

The current costs for flow batteries also run higher than what Fluidic has achieved at startup scale. Both technologies are quite young still, so it would be premature to judge them with finality. At this time, though, zinc-air appears capable of doing what flow batteries do, only better.

So who's using it?

With such good prospects on paper, one might wonder why this zinc-air stuff isn't conquering the world already. The best answer is that it's just really, really difficult to pull it off.

The basic premise has been in play for decades, used most prominently in hearing aids and train signals. The problem was, the cells couldn't recharge, so they would have to be discarded after use.

Then Fluidic appeared. The company spun out from ASU in 2006 to commercialize some early successes in the academic labs. The researchers picked up a $5 million grant from the recently formed ARPA-E in 2009 to improve the rechargeability and power density of the batteries, and got another $3 million in 2010 to adapt the product for low-cost grid-scale storage. Throughout the path to commercialization, they racked up 100 patents, and attracted nearly $200 million in investment from the likes of True North 2, Madrone Capital, Caterpillar and the International Finance Corporation.

Real-world deployments started in 2011. Now the company has installed 100,000 batteries totaling 50 megawatt-hours of storage throughout Indonesia, Southeast Asia, Latin America and Africa.

Others have tried to make this work. A company called ReVolt Technologies won $2 million from ARPA-E in 2010 to work on rechargeable zinc-air batteries, but the project is now listed as "canceled." The company went bankrupt in 2012, The Portland Business Journal reported.

Another company, Eos Energy Storage, came closer to cracking zinc-air. The scientists there have not yet perfected the full zinc-air system, but along the way they made enough breakthroughs to create a different battery technology, which they call zinc hybrid cathode.

The details are still proprietary, but Eos Chief Scientist Steven Amendola said that it uses a more traditional cathode and an aqueous electrolyte, and "the battery itself is so simple that each cell is basically six parts." The spinoff from zinc-air research ended up beating the company's price goals, so it went to market with the new product instead. The zinc hybrid cathode now sells at $160 per kilowatt-hour for orders of 10 megawatts or larger, and $200 per kilowatt-hour below 10 megawatts.

Those are stunningly low numbers. They crush most lithium-ion pricing and even beat the effective unit cost of lead acid, the mature, incumbent competitor.

"Even if zinc-air never happens, we’ve got the winner I always thought we would," Amendola said. "The technology was never the first thing. I wouldn’t care if I could do it with horse manure if the price was right."

The ability to cut costs on that zinc battery without unlocking the full potential of zinc air points to the opportunities that await Fluidic once it gets up to scale. With the technology more or less in place, the company's fate now depends on its business strategy.

This cell tower is really backed up right now... in a good way. (Image credit: Fluidic)

The Fluidic business model

For a 350-person company that's raised $200 million and deployed 100,000 batteries, you don't hear Fluidic's name too often. That's largely by design.

The company wanted to stay out of the limelight while honing and scaling up the product, avoiding the scrutiny and outlandish expectations that can follow early media exposure. So, instead of courting U.S. tech blogs, Fluidic made entrees with the Indonesian government and started deploying its batteries far from Wall Street or Silicon Valley.

Working in remote equatorial areas, the company has gained ample experience shipping the product and gathered reams of operational data. Like a promising pitcher warming up on a farm team, Fluidic will be well practiced and cool under pressure when it finally makes a debut in the American big leagues.

More pressingly, Fluidic found in weak- or off-grid cell tower backup a market that valued the technology at its early-stage costs, without need for government subsidies, mandates or other market distortions.

"We’ve never had the intention of building a business around subsidies, and we don't today," Scharnhorst said. "That's why we're very patient in finding those applications that can pay for our technology today."

In these developing countries with unreliable grid performance, the zinc-air batteries go head-to-head with the diesel generators and lead-acid batteries that keep cell towers running through a blackout. Lead-acid batteries have short lifetimes and often fail in extreme heat, and diesel generators impose a significant fuel cost, not to mention the need to transport the fuel to hard-to-reach locales.

When a cell tower drops out of service, phone customers can simply switch to a different company's SIM card, so the telecom companies have a strong incentive to keep the towers on-line and avoid lost revenue. That all amounts to a more compelling value proposition than storage has in most of the U.S.

"The dollar per kilowatt-hour price is not really the big metric -- what they're selling is reliability," said Amendola, from Eos. "The product is not really the electricity, the product is cellphone service, which is worth a lot more money than just the electrons are worth."

Fluidic branched out from there to more robust solar-plus-storage offerings that power remote villages. Those batteries run for up to 72 hours, which Krishnan said achieves almost seamless power in the equatorial regions the company serves.

The preponderance of deployments going to Asia-Pacific markets prompted the company to erect an assembly plant in Bogor, Indonesia. The brains of the machine come together in Scottsdale and then ship to Bogor to be assembled into battery systems.

The company saves money shipping small electronics overseas rather than bulky whole systems, and saves money on labor and the plant itself.

Setting aside the cost of land, outfitting a comparable lithium-ion plant would cost $100 million, Scharnhorst said. A lead-acid factory would require $25 million to $50 million. Fluidic built a plant in Bogor capable of producing 100 megawatt-hours a year for $5 million in machinery, molds and building cost. Plummeting battery costs have upped the stakes for companies to cut expenses throughout the supply chain through moves such as this.

Niche or global?

The energy access market could easily keep Fluidic busy for years. The company acknowledged as much with its recently announced goal of bringing "affordable and reliable clean energy to 100 million people globally by 2025." The company has reached 3,825,000 so far.

This energy access market may not get as much coverage as residential, commercial and grid-scale storage in developed countries, but it should not be dismissed.

"It’s a multibillion-dollar market today and it’s serving billions of citizens of this globe," said Ravi Manghani, director of energy storage at GTM Research. "There is business as well as ethical significance to that segment."

That said, the most lucrative markets for energy storage remain in developed nations with generally reliable grids. They need storage to integrate large amounts of intermittent renewable energy, or to respond to surges in demand, or buffer the system against storms or terrorist attacks, or any number of other reasons. Pumped hydro has played a valuable role there as long duration storage, but new advanced batteries have yet to achieve that level of service.

It's tough for a startup to go head-to-head in these markets with corporate giants like LG Chem and Panasonic, which already produce at scale and can afford to sell below costs to maintain market share. Fluidic has expanded into markets that lithium-ion isn't trying to reach, and has grown and fine-tuned the product without fierce competition. The question now is, when do they jump into the fray?

First, there need to be more opportunities to get paid for long-duration service.

"The market today is mostly 4 hours or less and focused on frequency regulation and other things that, quite frankly, we're not going to get paid for the way we want to get paid," Scharnhorst said. "As the market evolves, we'll be ready to enter those markets when they're ripe to be entered."

That's on the horizon in the next 18 to 24 months, as costs come down and capabilities improve, Krishnan said. The juiciest potential applications: grid-scale peak shaving, transmission and distribution deferral, grid resilience in storm-battered places like New England and Florida, as well as solar self-consumption in Hawaii. Once costs come down, he'd like to expand to solar-plus-storage plants for capacity firming.

If the company beats $100 per kilowatt-hour for cells and BMS, it will outpace anything on the market today. Those other products on the market won't be sitting on the sidelines for the next two years, though.

Lithium-ion systems that went up for the Aliso Canyon procurement hit the range of $250 to $350 per kilowatt-hour for 4-hour storage hardware. It's not yet clear that those prices are sustainable for manufacturers, Manghani noted, but it's safe to say lithium prices are falling fast, and we're still in the early days of the industry's capacity expansion. It's possible that the big-scale lithium-ion makers could reach the neighborhood of $100 per kilowatt-hour in the next few years -- Tesla is already racing for that same finish line.

That would complicate the value proposition for Fluidic. Sure, lithium-ion has more risk of fire, more degradation over time and it requires oversizing the system to reach longer-duration energy capacity. But it's a technology customers know and want, and there are established companies providing it, meaning their warranties are likely to be honored. If it's cheap enough, customers could overlook the inelegance of an oversized lithium-ion system and just go with what they know.

Fluidic has staked a strong claim on the global energy access market. Its fate in the U.S. looks more ambiguous. It will take herculean might to topple lithium-ion from its throne, especially after it has reigned for a few more years. Zinc-air could give the incumbent a run for its money in select markets, like microgrids and powering critical infrastructure.

Long-term, zinc-air holds promise for better electric vehicle batteries, due to the added density that's possible when the cathode is air. (Incidentally, combustion engines save on space because they suck in air from the outside, too.) It's also intrinsically safer than lithium-air, Amendola said.

Fluidic decided to postpone the EV battery application because of the longer time to market, but it's on the agenda for post-2020, Krishnan noted. That will give battery-watchers something to look forward to in the new decade. Until then, at the very least, the battery ecosystem will benefit from an injection of fresh DNA and the technological offspring it engenders.

To learn more about this and other pressing storage industry developments, join Greentech Media for the U.S. Energy Storage Summit Dec. 7-8 in San Francisco. Now in its second year, the summit will bring together utilities, financiers, regulators, technology innovators and storage practitioners for two full days of data-intensive presentations, analyst-led panel sessions with industry leaders and extensive, high-level networking. Learn more here.