The tax reform bill, which went into effect at the beginning of last year, brought the potential for a big shakeup in utility spending.

When the bill passed, Moody’s Investors Service rated the changes credit negative for the sector. Under the new law, regulated utilities collect less money from customers. And while the lower corporate tax rate, now 21 percent rather than 35 percent, looked like a cash windfall, regulators in most states pushed for that money to flow to ratepayers. Regulated utilities also don’t qualify for the law’s 100 percent bonus depreciation, which allows an asset owner to deduct the costs of a project in the year it's built.

“Basically, utilities were getting, let’s say, free money through the depreciation. So, the utilities were incentivized to invest more,” said Christian Hermann, an associate analyst with Moody’s. “They spent the most that they could.”

But, Hermann added, because of tighter balance sheets and the loss of depreciation benefits, that incentive to invest is no longer as strong. Last January, Moody’s outlined a tight cash situation on top of “projected financial metrics that were already weak, or were expected to become weak” for many large, regulated utilities. In June, Moody’s published a negative outlook for the entire U.S. regulated utility sector for the first time.

Logic suggests all these factors would push utilities to spend less in order to preserve their bottom lines. However, recent research out from the credit rating agency suggests that utilities aren’t drawing down capital expenditures in the near term. In fact, emphasis on grid reliability and renewables means utility capital spending will stay relatively flat and “exceed historical levels” into 2020.

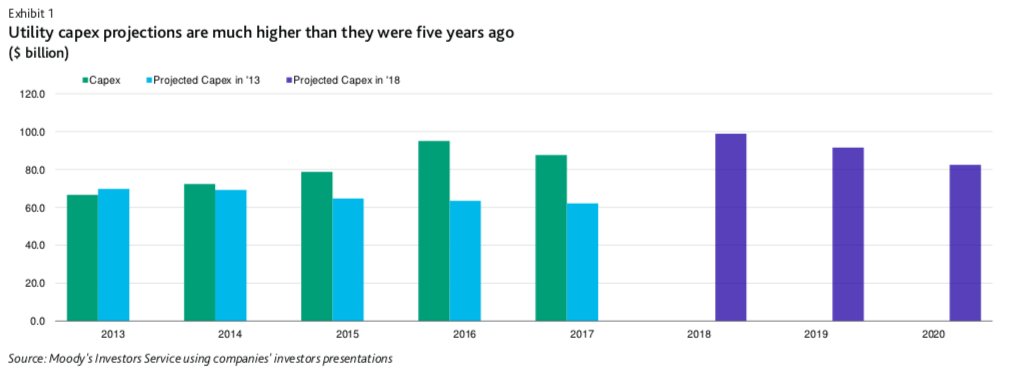

From 2014 to 2017, utility capital expenditures exceeded Moody’s projections. Looking ahead, Moody’s forecasts are much higher than they were in the past. Moody’s predicts that total expenditures from utility companies will peak in 2018, despite the tax changes, at about $100 billion. The decline through 2020, moving toward $80 billion, is relatively modest.

According to Hermann, transmission spending will be the focus going forward.

Spending here will likely peak in 2018 as well, declining to about $20.9 billion in the next couple years.

Transmission and renewables spending

Moody’s cites three main reasons for the increased transmission spend. Two are tied to renewables. While utilities need more transmission to reduce congestion, they’re also spending to better integrate new generation sources — particularly remotely located renewables — and to better connect distributed energy resources that add flexibility to the grid (they’ve also been rewarded by federal incentives for transmission spending).

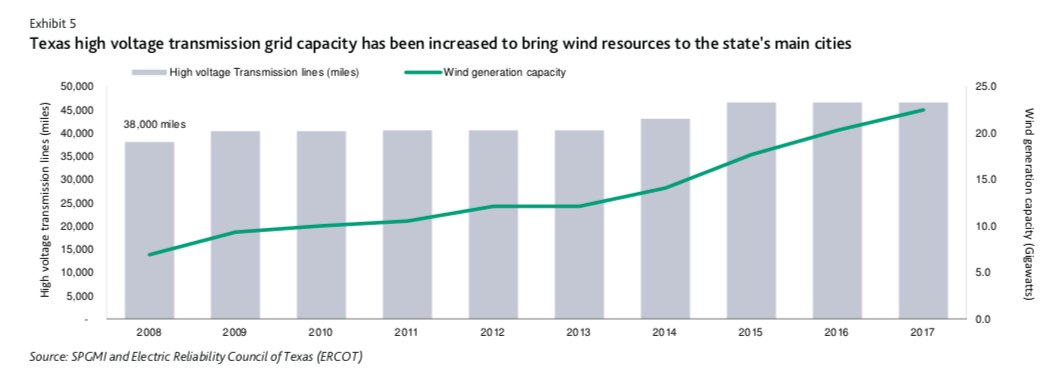

Transmission capacity in Texas, for instance, shows the correlation between the build-out of new transmission lines and the increase in the state’s wind generation.

High voltage transmission grew 22 percent between 2008 and 2017, as wind capacity increased 226 percent to its current 22.4 gigawatts.

While Texas is well-known for its wind resources, utilities across the country are increasingly dropping money into renewable portfolios. In the past several months, Greentech Media has covered large-scale renewables solicitations or carbon-free announcements from Virginia’s Dominion Energy, Hawaiian Electric and Minnesota-based Xcel Energy.

“Generally, utilities are trying to reduce their dependence on coal-fuel generation, so a lot of utilities are investing in renewable assets,” said Hermann.

“What [utilities] are investing in generation is usually a heavy focus on renewable resources,” he added.

Many utilities, at the same time, are still eyeing natural-gas resources and continuing to burn coal. Some argue that, even as utilities are changing, they aren’t doing so fast enough. Dominion, for instance, recently got a slap on the wrist from Virginia’s Corporation Commission, which questioned the utility’s calculation of future load. The commission said Dominion failed to show its integrated resource plan was “reasonable and in the public interest.”

Commenting on the Smart Electric Power Alliance’s 2018 Utility Survey, president Julia Hamm said in May the results of the study “reflect a pivotal moment in the U.S. energy transition, as utilities increasingly focus on solar and storage as distributed resources providing value to customers and the grid.”

The capital going toward linking that distributed generation with more transmission is perhaps even more noteworthy because of the controversies that have bogged down large-scale transmission projects in recent years. The $492 million Cardinal-Hickory Creek power line running from Wisconsin to Iowa, for instance, faces opposition over whether it’s needed to meet energy demand. The Northern Pass project, planned to carry electricity from Canadian hydropower to the Northeast, has also faced obstacles.

Moody’s analysis shows that more routine projects are going forward. According to Moody's, transmission investments have tripled since 2005, hitting $22 billion in 2017. The rating agency expects transmission spend to stay above an annual $20 billion into 2021.

Spending by utility

Breaking down the spending portfolio of several utilities, including American Electric Power Company, Duke Energy and Southern Power, Moody’s notes that transmission accounts for a great deal of their spending. Environmentally related projects and renewable generation also play important roles.

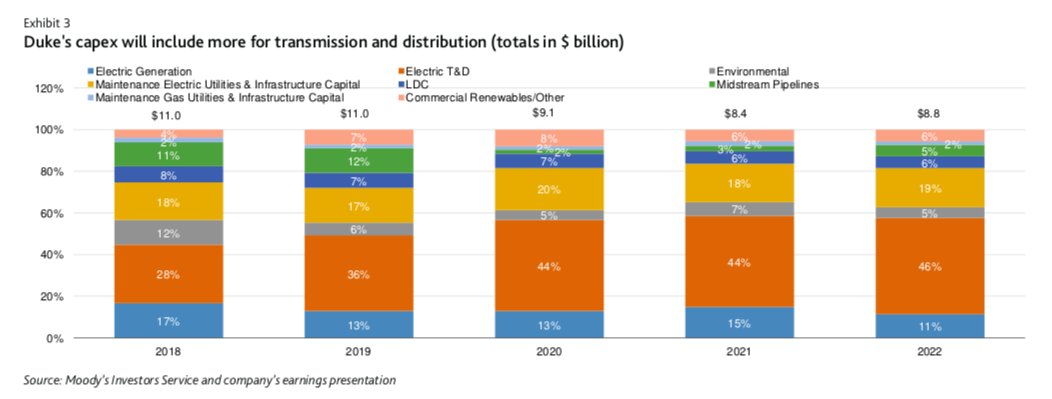

Taking a closer look at Duke’s planned spending, expenditures on transmission and distribution will increase through 2022. The proportion of the utility’s capital expenditures spent on T&D grows 10 percent from this year to 2022. Generation costs remain relatively flat, though money spent on commercial renewables is projected to grow into 2020.

It’s a similar story for AEP, which is spending 7 percent of its money on contracted renewables through 2023 and a full 50 percent on transmission (distribution will get another 25 percent of the utility’s money). Moody’s forecasts that Southern will spend 30 to 33 percent of its capital expenditures on transmission and distribution through 2021. Through 2023, Xcel will invest $3.5 billion total on renewables to replace thermal generation, with transmission spending reaching $4 billion in the same period.

Managing tax reform

Even as these companies are shelling out, though, they’re working to make up the difference left by the details of the new tax law. Previously, Moody’s forecasted that deferred taxes from customers, which have made up an average of 14 percent of a utility’s incoming funds, would fall to 8 percent in 2019.

Capital investments, Moody’s notes, will be largely met by debt. Utilities are also relying on state regulators. Public utility commissions and public service commissions in states such as Arkansas, Florida, Minnesota and Ohio have approved cost recovery mechanisms outside of rate cases. More states could follow suit.

“Most utilities are attempting to manage any negative financial implications stemming from tax reform through regulatory channels,” writes Moody’s.

As the new year begins, the spending levels of utilities may belie their precarious financial positions. In its analysis, Moody’s noted that the combination of less available money and the sector’s spending needs will make for more pressure on balance sheets. In a November release, Moody’s said it would keep its negative outlook for the sector into 2019. Developments since then, such as Pacific Gas & Electric’s flirtation with bankruptcy, haven’t helped to change that view.

“Several utility holding companies have taken defensive measures like equity issuance, asset sales and capex or dividend reductions to improve cash flow,” the firm said. “The majority, however, have not taken action to change their negative credit momentum.”