California’s Demand Response Auction Mechanism pilot -- one of the country’s biggest experiments in pricing the value of distributed energy resources for utilities and the grid -- officially got underway this week. Monday was the deadline for companies to submit bids, stating their price per unit of whatever combination of rooftop solar, energy storage, and demand-side management they believe they can muster.

Now comes the hard part -- figuring out what it’s all worth. DRAM is named after the Renewable Auction Mechanism (RAM) used for years to procure renewable energy in California. But it doesn’t look much like its predecessor in structure, given that it’s meant to pay people to not use energy, rather than to generate it.

In fact, DRAM contains so many novel concepts, it’s hard to know where to start describing them. But certainly it's the opportunity to aggregate distributed energy resources (DERs) to compete with big generators and commercial-industrial DR portfolios that’s gotten the most attention.

For the first time, the state’s three big investor-owned utilities will be shopping for aggregated, distributed demand response at megawatt scale. The California Public Utilities Commission requires the state’s big investor-owned utilities to procure at least 22 megawatts of combined resources -- 10 megawatts apiece for Pacific Gas & Electric and Southern California Edison, and 2 megawatts for San Diego Gas & Electric -- from Monday’s bids (PDF) .

All bidders need to do is promise that starting next summer they’ll be able to provide at least 100 kilowatts of aggregated demand reduction, for up to four hours per day, that’s capable of responding to the dispatch signals of state grid operator CAISO. No project can be larger than 10 megawatts, given the limited scope of the pilot, and the utilities can’t spend more than their combined budgets of $5 million on resources, putting a ceiling on the potential size of the first round.

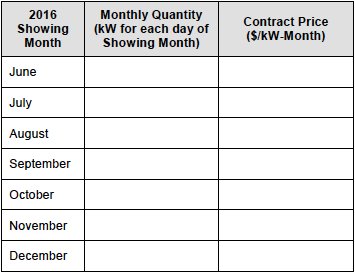

Just how bidders get there, and at what prices, is up to them. Each utility is simply requiring them to fill out a form, listing the months of June through December next year, how many kilowatts per day they’re able to give that month, and at what price per kilowatt-month they’re willing to make a deal.

The dollar figures being put into these boxes, however, are probably among the most closely-kept secrets in the business. That’s because they’re providing a crucial value, one almost entirely theoretical to date: the clearing price of different units of grid-edge-enabled DER capacity, based on where owners and aggregator-operators think they can make the most money, yet still beat the competition.

There’s never been a market for such a product, but the California Public Utilities Commission (CPUC) wants demand response to move in this direction. The DRAM pilot is part of a broader effort to shift from the siloed-off, utility-run program approach to demand-side energy management to a more open and inclusive system.

Plenty of distributed energy companies are interested in DRAM, according to Beth Reid, CEO of Olivine. The San Ramon, Calif.-based company is closely involved in the pilot as a scheduling coordinator, and from her conversations with companies interested in it, she’s expecting the number of bids to well exceed the 22-megawatt minimum.

“Now, I think the price points will be dramatically different,” she added. California’s utilities have gotten approval to forego their usual cost-effectiveness calculation for this round of DRAM bids, she said -- a nod to the lack of a historical record to point to and say, this kind of asset is worth this much, compared to what’s already out there.

“It’s not like this has been done exactly this way before,” Reid said. That’s caused a considerable amount of confusion among would-be bidders, primarily pertaining to what they can expect to earn from participation -- and what they’ll have to pay if they can’t perform to task.

The first channel to value: Resource adequacy

One of the biggest points of confusion is over DRAM’s bifurcated structure, Reid said. Winning bidders will earn their money through a bit of a Frankenstein combination of two key existing market mechanisms. “They’re two separate things, and they’re connected in the process, but people are getting confused.”

The first, and most important, revenue stream will come from capacity sold to utilities to meet their resource adequacy (RA) requirements, she said. Every year, the state’s big three utilities are required to procure a certain amount of RA to meet the next year’s projected peak loads. Those are typically hot summer afternoons when air-conditioning use spikes, but they also include the evening peaks when people come home from work.

RA has traditionally come from generators, and hasn’t really been open to demand-side resources in the past, Reid said. One of DRAM’s goals is to “try to create a mechanism for the utilities, in the future, to get RA credit for demand response,” she said -- a goal that could apply to large-scale commercial and industrial projects, as well as distributed systems.

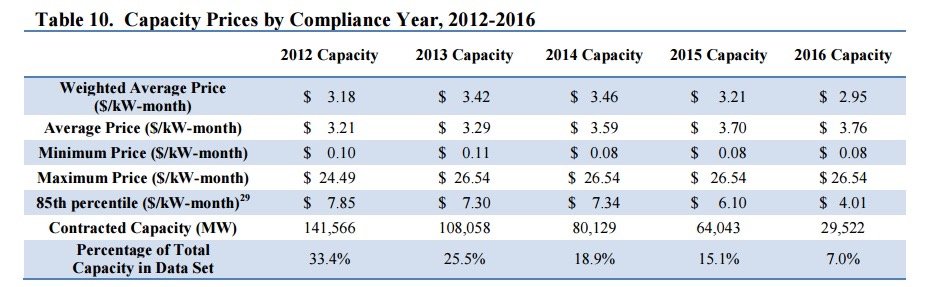

As for what price points DRAM bidders will be competing against, it's hard to predict -- but here are some historical capacity prices from a 2014 CPUC report (PDF) for context.

RA comes with some stringent requirements, however -- namely, the need to be available for four hours per day, up to three weekdays in a row, during the five-hour seasonal windows of 1 p.m. to 6 p.m. for April to October, and 4 p.m. to 9 p.m. for November to March. This is where that “price per kilowatt-month” figure demanded from DRAM bidders fits in, by the way. It’s for a kilowatt of energy reduction, available all month to meet those operating needs.

Four hours is a long duty cycle for lithium-ion batteries, EV chargers, or air conditioning, to name a few likely DRAM energy resources. But because this is system-wide RA, “You can do it anywhere within a utility's territory,” Reid said. It may be rare for a single DER asset to have available capacity for four hours at a time. But four of them might be able to contribute an hour apiece to meet the promised RA capacity when called upon -- and 400 of these systems in a utility’s service territory could meet the 100-kilowatt minimum.

California is home to DER providers with tens of thousands of customers, which could add up to a lot of potential spare capacity. Net-metered rooftop solar PV is eligible for DRAM, allowing solar-storage projects from the likes of Tesla and SolarCity to participate. So are behind-the-meter energy-storage systems using Self-Generation Incentive Program (SGIP) money, giving startups like Stem, Green Charge Networks and Advanced Microgrid Solutions an opportunity to bid their installed base into the program.

UPDATE: SolarCity reached out in November to tell us that, while net-metered customers can technically participate, "they will provide very little value in the DRAM due to the PDR requirements set by the CAISO." That's specifically "due to the coincidence of the RA availability window and solar" generation, which peaks around noon, and drops off in the afternoon, which is just when this program is asking for participants to deliver flexibility.

Direct load controls are definitely included, giving demand-response providers like EnerNOC and Comverge an opportunity to play. So are smart thermostats and other forms of home-energy controls. While much of the auction is likely to go to commercial and industrial customers, there’s a 20 percent carve-out for residential aggregations. Those have to be at least 90 percent homes -- the remaining 10 percent can consist of small and medium-size businesses. We’ve talked to startups that are bidding aggregations of electric-vehicle chargers and home-automation systems into the DRAM, and Reid said that she’s seen plenty of residential-specific concepts from would-be bidders.

Startup eMotorWerks, for example, has about 6,000 smart EV home-charging systems in California, CEO Val Miftakhov told me in an interview last week. Each one of those has the potential, from day to day, to defer charging for a certain period of time. Just how much capacity per charger might be available is “an educated assumption in our case,” he explained.

“We have the enrollment processes for our previous programs, and we know what kind of incentives will lure people to participate.” To ensure that it’s not promising more than it can deliver, the company is “building some flex room for ourselves in our bid,” according to Miftakhov.

“We’re not worried about the installed base being there. We have some assumptions around what percent of that installed base we can activate,” he said. The beauty of this approach is that there’s almost no capital cost involved in putting that spare capacity to work.

“The resource itself is zero marginal cost, but there is cost in overhead, in operating it -- and there is incentive we have to share with the drivers to keep them motivated,” he said.

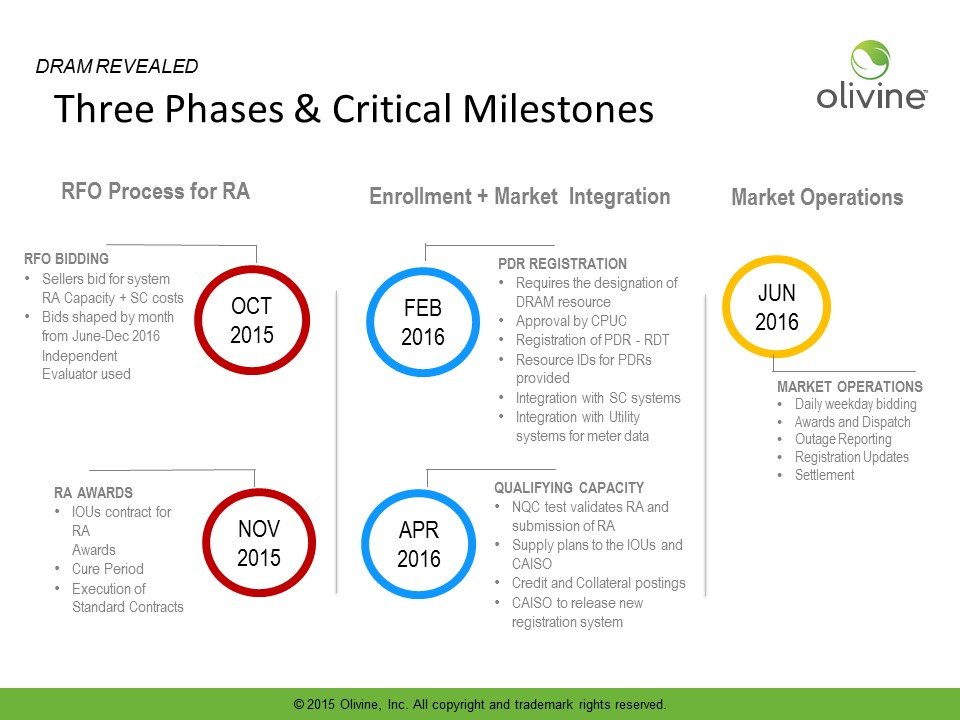

Utilities have until late November to select their winning bids, using a set of calculations that will include measures of a bidder’s experience and preparation for serving in California’s energy markets, as well as the price per kilowatt-month they’re promising.

But there’s no requirement that bidders show that they’ve already enrolled enough customers to provide the kilowatts they’ve pledged. As PG&E’s FAQ for DRAM participants (PDF) notes, “Offerors are not expected to have customers/service accounts/registrations under contract when the Offer is submitted.”

“The concept behind this is for the utility to be somewhat agnostic about how you provide it,” Reid said. “The idea is to let the third parties figure that out themselves.” To allow utilities more peace of mind in this process, the CPUC has given them a waiver from RA penalties for any failure of DRAM sellers to deliver -- at least for the next two years.

The second channel to value: Wholesale energy market participation

Where DRAM bids will have a chance to prove themselves is in the second phase of the pilot. “That’s what we’re calling the market integration phase,” Reid said, adding that “there’s actually quite a bit of effort” still underway to prepare utilities, CAISO and DRAM bidders for it.

That starts in February, when bidders will start registering their capacity for participation in the state’s Proxy Demand Resource (PDR) program. That’s the long-running demand-response program that has served as the first testing ground for DER participation, under pilot projects set up by PG&E over the past two years.

Those pilots -- 2014’s Intermittent Renewable Management Pilot Phase 2 and this year’s Supply Side Pilot -- have different rules than the RA portion of the DRAM. One of the biggest differences is that utilities aren’t actually paying DRAM providers for this portion of the program. Instead, the payments are coming directly from CAISO.

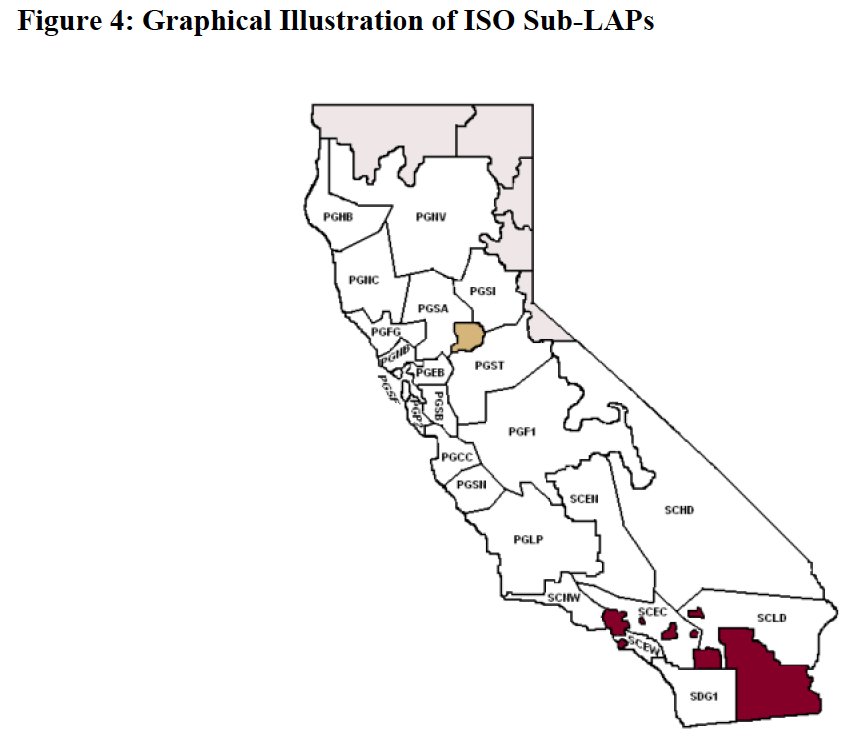

Another difference is that wholesale market payments will be based on the specific location of each unit of resource, not a system-wide calculation as with RA, she said. The DRAM pilot requires that bidders link each 100-kilowatt minimum aggregation to a specific, single sub-load aggregation point (sub-LAP) -- a term for the state’s grid regions, as laid out in the following map.

Within these regions, CAISO monitors hundreds of locational marginal price (LMP) nodes, which measure the shifting value of energy at specific interconnections and pinch points on the grid. These LMPs can fluctuate wildly over the course of a day. Some regions may see big spikes as demand outstrips supply, while others may experience negative pricing when there’s more wind and solar power being generated than needed.

For DRAM participants, these markets will create a second revenue-generating opportunity -- along with more risk than standard demand-response contracts, Reid noted. DRAM aggregations will have an opportunity -- and a “must-offer obligation” -- to bid into the day-ahead market at a price they believe will clear. If they then perform as promised, they’ll receive the clearing price for the kilowatt-hours they deliver. If they fail, they’ll have to “buy back” whatever portion of the bid they couldn’t provide.

By April, winning bidders are expected to make a showing that they’ve got the capacity they’ve promised. In June 2016, CAISO will start including DRAM resources in its day-ahead markets, settling the transactions, and making payments.

This is where the value of location-specific DERs could come into play. The value of distributed demand response depends on where it is -- namely, where it can replace expensive infrastructure upgrades by shaving peak load on stressed-out or hard-to-reach places. Solar alone can help a small portion of the state’s grid circuits defer peak capacity upgrades, according to a recent UC Berkeley study. Energy storage and flexible demand reduction could add to solar’s value, or serve as standalone substitutes to new wires, transformers and other grid gear.

California’s big utilities are in the midst of rewriting their distribution resource plans (DRPs) under CPUC mandate to include DERs as an alternative to traditional grid investment. The DRAM program isn’t specifically linked to the DRP proceeding, but it could help utilities get an understanding of just where the DERs are, and the prices at which they’re interested in providing a fundamental grid service.

To get there, however, “there are a number of meter data issues” to deal with, Reid said. DRAM bidders will need to set up systems for collecting the smart-meter data from each participating customer and providing it to Olivine for processing. The CPUC has agreed to cover some of the costs for DRAM participants to get set up in this manner, including scheduling coordinator costs.

That will make it easier for Olivine to do things like make sure DRAM participants aren’t enrolled in other demand-response programs, to avoid some participants getting paid twice for their day-to-day load reductions. They’ll also be confirming that participants are using a standard method to set a baseline for their typical consumption, to measure just how much reduction they’re delivering.

Olivine will also be taking DRAM participants’ revenue-quality meter data (RQMD) and turning it into settlement-quality meter data (SQMD) that is viable for CAISO compensation. The issue here is that CAISO doesn’t expect every meter from every DRAM participant to deliver real-time communication and control -- it’s allowing the bidders to manage that. But it will need verifiable data to pay them for what they’ve delivered at the end of the day.

As for how CAISO will calculate how well bidders performed, the DRAM pilot has set up a three-part test. First, bidders can use the results of a capacity demonstration test performed by their scheduling coordinator (i.e., Olivine). Second, they can use the average capacity they offered under their must-offer obligation. Or third, they can use the results of their performance in response to a CAISO dispatch instruction.

This trueing-up phase will also give utilities proof that bidders are meeting their RA requirements, by the way. As PG&E’s FAQ notes, “RA payments will be made on a month-by-month basis and are capped at the contracted capacity or the demonstrated capacity, whichever is less.” That will start to unfold in April, when DRAM bidders will have to make an “RA showing” to get themselves qualified for bidding in June, Reid said.

Finding the right price amid ongoing changes

In the midst of all this activity, the big question remains what prices we’ll see emerge from the DRAM process. The answer is complicated by the fact that the DRAM pilot doesn’t end with this week’s bids. Another auction, set for next spring, will open the opportunity to provide services for the 2017 season -- and that auction will be operating under different rules.

That’s because California’s RA program is undergoing changes aimed at making it easier to provide flexible capacity -- demand response that can be used to handle the peaks and troughs in grid supply that will come with increasing amounts of solar energy on the state’s grid. That’s the “duck curve” problem, when solar power feeds into the grid and reduces overall demand to lows at midday, then falls off in late afternoon and early evening, causing steep ramps in demand.

CAISO is working on new ways to bring flexible capacity on-line to deal with this. One of the biggest changes being contemplated is reducing the duration of flexible RA capacity from four hours to two hours -- a change that could be very valuable to DERs like lithium-ion batteries, which are most cost-effective when they’re not being asked to discharge too deeply every day. This effort will also build on CAISO’s work to create a class of grid market player, known as a distributed energy resource provider (DERP), a concept which is expected to launch next year.

“The challenge that people are faced with is that they will have to bid into the second auction, without having a full experience of performing in the first,” Olivine's Reid said. If utilities can’t procure their full 22-megawatt minimum in the first auction, they’ll be making up the difference in the second one -- and the terms of the second auction could allow bidders to offer lower prices, given the likelihood of reduced capacity durations and other changes that could lower participation costs.

“One of the other concerns I have is that people might -- in order to try to win a bid initially -- price themselves so low that it sets a tone that this is not a sustainable market,” Reid said. Olivine is providing DRAM participants access to its operations simulation software to allow them to game out different scenarios to determine which ones will offer them the best combination of bid pricing and return on investment.

But it’s going to be up to regulators to determine whether or not the DRAM approach has proven the value of distributed demand response -- and to do that, they need data. The CPUC is demanding the ability to “confidentially request from DRAM Sellers information relating to the DRAM agreement, the performance of the DRAM Sellers’ resource in the CAISO market, and any other information relating to an individual DRAM Seller’s participation in the DRAM program.”

That doesn't mean that the prices per kilowatt-month that bidders are proposing will be made public any time soon, however. That’s market-sensitive information, and the CPUC has pledged to protect it.