The value of energy storage, supporters say, lies in its diversity. It can act like supply or demand, an unusual characteristic in the generation- vs.-consumption schema of the modern power grid. It can provide flexible capacity for utilities, reliability for critical facilities, dispatchability for intermittent wind and solar power, fast-responding power and energy for grid markets, or steady support for overstressed substations and grid circuits, depending on the need.

Sometimes it can do more than one of these things at once, or several of them that fit with its daily schedule and the limits of its chemistry and controls. The energy storage industry calls this “stacking” use cases, and it could allow well-designed systems to charge more money for their multiple capabilities, or earn more money with them once they’re up and running.

Someday, this kind of stacking will be a key factor, along with falling battery prices, in bringing storage cost-benefit equations in line with what they’re trying to replace, industry experts say. That list includes traditional grid upgrades and natural-gas power plants today. But it’s growing to include distributed solar, demand response, and competing storage projects in markets like those emerging in California, Texas and that of mid-Atlantic grid operator PJM.

We say someday, because very few storage projects are taking on this task today. Most tackle a single value proposition or revenue stream, whether from behind the curtain of a utility procurement or contract, or as a third-party provider in one of the few markets with the right mix of incentives, regulatory structures and commercial opportunities. That makes sense, given that the energy storage industry is just starting to move from pilot-scale to commercial applications.

“Honestly speaking, there are few revenue opportunities today,” according to GTM Research analyst and U.S. Energy Storage Monitor report author Ravi Manghani. Two markets -- California and PJM -- make up 88 percent of the country’s storage capacity, with nearly 300 megawatts deployed between them, although emerging opportunities in states including New York, Hawaii, Maryland, Oregon, Washington, Massachusetts, New Jersey and Minnesota, as well as grid operator markets in Texas and New England, could start to take more market share in years to come.

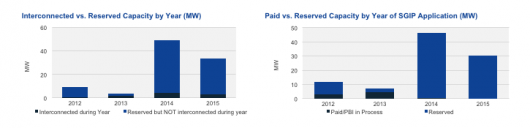

In California, most of that storage is either utility procurements made under the state’s 1.3-gigawatt-by-2020 mandate, or in buildings providing demand-charge reduction. That latter business case is central to behind-the-meter storage projects today, and bolstered by California’s lucrative Self-Generation Incentive Program (SGIP), which is set to expire by decade’s end.

PJM’s energy storage capacity, by contrast, is almost exclusively serving the grid operator’s frequency regulation market, which pays handsomely for fast-acting grid balancing. That condition has led to a boom in storage projects, with some 110 megawatts on-line, another 100 megawatts or so in backlog, and hundreds more under development -- a scale that could eventually exceed PJM’s need for the service.

A third business case, capacity or transmission and distribution (T&D) deferral for utilities, makes up the majority of the remaining storage deployed today, he said. That’s largely confined to utility-owned and -contracted storage, although states like California and New York are working on ways to open it to third-party players, for what could ultimately become a multi-billion-dollar market.

A few companies are starting to build projects around multiple value streams, Manghani said. AES Energy Storage is building a 100-megawatt lithium-ion project for Southern California Edison that’s meant to replace a gas-fired power plant with a more flexible and cost-effective solution, for example, and another project in Indiana combines frequency regulation revenues from the Midcontinent Independent System Operator (MISO) with capacity value for sister utility Indianapolis Power & Light.

On the distributed side of things, utilities like Southern California Edison and Consolidated Edison are moving into behind-the-meter batteries as grid assets, while startups like Stem and Green Charge Networks are bidding their capabilities into pilot grid markets and bundling utility capacity needs with demand-charge reduction.

“There are at least half a dozen other examples of storage projects under construction and development that are doing the same thing -- either as capacity or backup for time-shifting, or providing frequency regulation,” he said.

All of these projects will have to contend with a regulatory environment that’s still figuring out how storage works and what it’s worth, and a financing outlook that still carries significant risk for would-be investors, compared to more mature industries like solar PV.

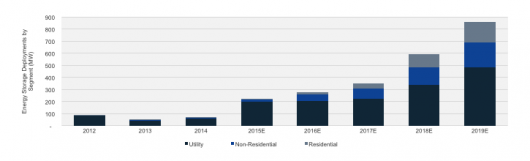

But as the industry grows to 10 times its current scale over the next five years, as GTM Research predicts for the U.S. market, the opportunities will start to open up -- including some that are still mostly theoretical today, like renewables integration and grid resiliency. Here are some glimpses at how that future may unfold.

Storage at the utility -- or independent power producer -- scale

AES Energy Storage is the heavyweight champion of energy storage, with 200-plus megawatts of lithium-ion battery systems under development around the world, about half of it in the United States. It’s also a leader in pushing batteries into new territory, like replacing gas-fired power plants for peak energy needs, as it’s aiming to do in Southern California.

In June it announced its latest project, a $25.5 million, 40-megawatt lithium-ion battery array for utility Indianapolis Power & Light. Both companies are owned by U.S. energy giant AES, and have convinced Indiana regulators that rate-basing the storage system will pay off for customers in the long run.

For IP&L, that starts with serving MISO’s frequency-regulation market for ongoing revenues, and relying on its capacity to stand in for a new power plant, more expensive peak energy purchases, or other options. “Call it peak energy,” Richard Benedict, the utility’s director of project development, said in a July interview. “Frequency regulation is the primary driver, and peak capacity and peak energy is second. They’re both important, but frequency regulation is really an around-the-clock thing. The peak energy is critical when you need it, but the hours are fewer.”

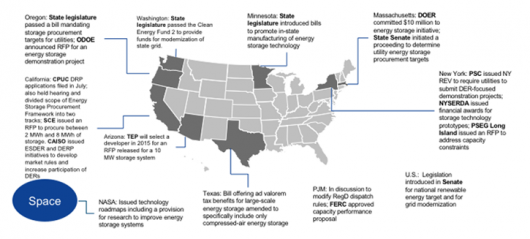

These are some of the key crossover characteristics that may help open more markets to large-scale, front-of-meter grid storage -- a term used to indicate that "utility-scale" energy storage isn't just being done by utilities anymore. Here's a chart from GTM Research's most recent Energy Storage Monitor report that highlights some key state-by-state developments on this front.

It makes sense to combine frequency regulation, which requires very fast response times but relatively shallow charge-discharge cycles, with capacity needs, which involve hours of storage for relatively predictable peaks. But to date, very few projects have taken it on, because most regulatory environments don’t really allow it, Manghani said.

That’s largely due to the structural barriers in grid markets run by the country’s regional transmission organizations (RTOs) and independent system operators (ISOs), he said. Utilities can procure storage for capacity and T&D deferral, but are often barred against bidding that storage into grid markets. At the same time, third-party-owned storage projects making money on frequency regulation and other ancillary services don’t yet have a wholesale capacity market to bid into, he said.

Last year, PJM launched work on a Capacity Performance product that would allow storage to compete against generation, demand response and energy efficiency, he noted. Although storage was exempted from some of the more challenging conditions, it’s “very likely that storage will not participate as a standalone in initial auctions, due to the longer-hour nature of capacity applications,” he said.

But for the time being, most of the opportunity for dual-use storage of this nature is occurring under the auspices of rate-based utility deployments, which brings pressure to ensure that customers are eventually paid back for the projects they’re bankrolling. In IP&L’s case, those benefits are partly to come from the battery’s role in helping it replace closing coal-fired power plants with cleaner alternatives, like overnight wind power or the city’s growing share of rooftop solar, Benedict said.

Beyond that, the partners are looking at multiple future value streams, AES Energy Storage President John Zahurancik said. “We’ll also do some reactive power, voltage support capabilities for grid reliability. And as MISO begins to look at things like dynamic ramp rate control,” or the fast-responding assets MISO is considering to help it manage its large and growing share of wind power, “they will have some resources they can look at.”

Independent energy storage developers are likely to look at these future revenue streams with a more jaundiced eye. “We’re really careful not to get ahead of where the technology curves and price curves might be in a year or two or three from now,” Spencer Hanes, director of transmission and portfolio optimization for Duke Energy, said. Duke owns the country’s biggest energy storage project, a 32-megawatt battery array at its Notrees wind farm unit in Texas, which was subsidized by Department of Energy stimulus funds. It’s doing a lot of work on grid-integrated distributed solar as well, under the auspices of its emerging technologies department.

But the U.S. energy giant has been moving slowly into commercial storage markets, with a 4-megawatt frequency regulation project at a retiring coal power plant in Ohio. “We’re aware of the costs for inverters, for batteries, for controls and energy management systems. We have a really good line of sight on what we can deliver projects for -- and we’re not going to bid projects where we’re going to lose money.”

Behind-the-meter storage: Utilities, customers and aggregators seek their balance point

So far we’ve been discussing the utility-scale side of the energy storage market -- the batteries that come in cargo containers. What about the batteries that fit in the basement or the closet? Opportunities for stacking revenue streams are lining up here as well -- with their own set of complications.

California is taking a lead on this front, with distributed storage bidding into experimental grid markets, providing utility capacity, and planning ahead for balancing the state’s increasing share of distributed solar power. But how these experiments may morph into broader commercial opportunities is still a work in progress.

“This is a very front-of-mind topic for companies like Stem, because we’re some of the first ones doing this,” Ted Ko, policy director for the behind-the-meter battery startup. Indeed, Stem was the only storage vendor to take part in last year’s pilot project with California utility Pacific Gas & Electric, which allowed customers to bid load reductions into CAISO’s energy market.

Stem is also searching out Los Angeles and Orange County customers to join in an 85-megawatt fleet for Southern California Edison, under a local capacity resource (LCR) procurement signed last year. Customers will get the benefit of Stem’s demand-charge reduction, while the utility will see a reduction in its peak energy needs -- and Stem will earn money for providing both functions.

So far, California’s big utilities have mainly been asking for utility-owned storage. But the state’s push to integrate distributed energy resources (DERs) with its grid plans could open up opportunities beyond utility contracts, as we’ve been covering over the past year or so.

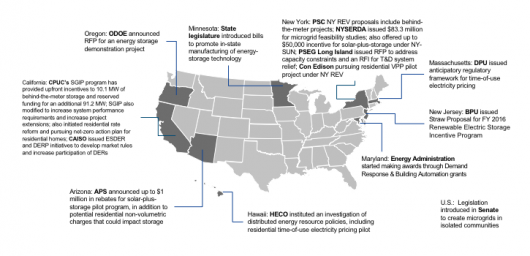

Other states like Hawaii, New York, Arizona and Maryland are starting to open behind-the-meter storage opportunities, mainly through pilot programs. Here's a breakdown of recent regulatory activity from GTM Research's Energy Storage Monitor report.

Distributed storage could have a significant “stacked” value, Manghani noted. “In an ideal world, all the utility benefits can be stacked with commercial benefits, to create a significant set of value streams,” he said. The challenge is in finding the right split between utilities that own and operate distribution grids, the customers served by them, and the independent players on the generation and energy market side of the equation, he said.

“If you are looking to stack up demand-charge reduction, or even a residential time-of-use case, with a grid service -- participation in ancillary services, or the utility relying on it for capacity -- to make it work, typically you’d want the economics to be at best 75-25,” he said. In other words, whichever party is paying for the asset will likely require at least three-quarters of the proceeds to justify the investment, leaving roughly one-quarter for the secondary actors involved.

But real-world storage valuations don’t always play out so cleanly. Take the example of Oncor, the Texas utility that last year unsuccessfully lobbied for changes to state law that would have allowed it to invest $5.2 billion in a distributed battery rollout. According to a study commissioned by Oncor and conducted by The Brattle Group, “approximately 30% to 40% of the total system-wide benefits of storage investments are associated with reliability, transmission, and distribution functions that are not reflected in wholesale market prices.” Meanwhile, independent power producers and retail energy providers challenged Oncor’s request, saying it was tantamount to it using a rate-based asset to steal their future storage business.

In California, state grid operator CAISO is formalizing rules for aggregating distributed storage under the form of a distributed energy resources provider (DERP). That could open up opportunities for third-party providers like Tesla and partners SolarCity and EnerNOC, which are now relying on SGIP grants to make projects pencil out. So could rules that require utilities to seek out existing distributed storage before procuring their own, as SolarCity has proposed to state regulators.

Of course, as Manghani noted, “if you’re being called upon to reduce demand charges, and at the same time you’re being called on to provide capacity, there could be some technical challenges.” That’s the kind of thing that Stem and other behind-the-meter storage vendors are aiming to solve with software and analytics.

The wide-open fields of resiliency, reliability and green power integration

So far, we’ve been discussing energy storage values in terms of the business models available today. But there’s a huge realm of potential business cases, such as time-of-use energy-shifting and backup power and resiliency, that are far more difficult to define or to build commercial projects around today, but may end up being important in years to come, Manghani noted.

Take backup power, a business case that relies on homeowners and businesses deciding that they’re willing to spend thousands, or tens of thousands, of dollars to keep the lights on during a power outage. Tesla’s Powerwall batteries, the heart of its residential energy storage push, are being sold as a backup system first, but with the promise that they’ll eventually be able to shift solar production and energy consumption in ways that will reduce bills and harness revenue mechanisms.

Similarly, most of the energy storage projects in New York, a state that’s put resiliency against future storms like Hurricane Sandy front and center in its grid plans, are meant to provide backup power first, while also tapping grid-services infrastructure revenues. Backup power can be of great value for industrial and commercial customers for whom downtime due to power outages can cost millions of dollars.

But for the typical home, GTM Research pegs the value of backup power at a relatively paltry $250 per year, meaning that cost-effective batteries will have to find other revenue streams. The rise of time-of-use rates, residential demand charges and distributed energy tariffs could provide the financial incentives to shift hour-by-hour energy consumption, although it’s hard to calculate the pathway to payback on those measures.

Then there’s the renewable integration business case, which requires a market with enough wind and solar power to be causing significant disruptions to the status quo. Hawaii was one of the first markets to call for energy storage for renewable integration, Manghani noted, with 60 to 200 megawatts of projects being sought by state utility HECO, and companies like SolarCity and Stem looking at off-grid and grid-integrated projects.

A similar trend is now being seen in California, where the concept of firm solar PPAs has gained traction, and there is interest in storage providing system-ramp support, he said. That’s drawn a long list of solar-storage partnerships into being, including Tesla and SolarCity, Sungevity and Sonnenbatterie, SunPower and Sunverge, Sunrun and Outback Power, SunEdison and Green Charge Networks, and Enphase and Eliiy, to name a few. Meanwhile, states from Arizona to Maryland are launching residential solar-storage pilot projects.

GTM Research predicts the U.S. solar-storage market will reach $1 billion by 2018, a fiftyfold increase from 2014, and more than $3 billion by 2020, with behind-the-meter storage making up most of the growth. But much of that growth will be predicated on existing values like demand-charge management, as well as mitigating the potential negative effects of changing solar net-metering regulations in states like California, Hawaii and Arizona.

Charting the future value of storage, calculated in terms of its integral role for a grid with a growing share of intermittent solar and wind resources, is a much more complex task -- but one that will be central to the industry's success over the long haul.