Image: NASA/Martin Stojanovski

Over the past year and a half, we’ve seen a slow-building controversy emerge over an obscure, yet critically important, set of rule changes at PJM Interconnection, the country’s biggest grid operator. It’s all about how to secure enough capacity to keep the lights on during times of peak electricity demand -- and whether the rules for doing so should be centered on the summer and winter seasons when those peaks occur, or on resources that can be available all year round.

It all started in late 2014, after the winter cold snap known as the “polar vortex” led to grid emergencies as power plants failed to deliver on their promised energy. In response, PJM created a new set of rules, known as Capacity Performance (CP for short), for its market to procure enough reliable grid resources to meet grid peaks in future years. The biggest change in the new CP rules was a shift from procuring capacity specifically for the summer and winter seasons, to requiring that all resources be available all year round, 24/7/365.

But renewable energy and demand response advocates see moving from seasonal to year-round capacity as a disaster. That’s because some of the greenest, and cheapest, resources to meet grid peaks -- demand response or solar power during hot summer afternoons, or wind power during windy, cold winter days -- won’t be able to participate on an equal footing with always-available competitors, namely, fossil-fuel-fired power plants.

That’s led advocates like the Natural Resources Defense Council to demand a return to seasonal capacity procurement in some form, and to fight the adoption of PJM’s new CP rules at the Federal Energy Regulatory Commission. Indeed, after its protest to PJM’s original application and a request asking FERC to reconsider its approval of the rules were both rejected, the NRDC joined the Sierra Club, the Union of Concerned Scientists, and Earthjustice last month to announce they’re initiating legal action that could lead to a lawsuit against FERC to stop PJM’s rule change.

Amidst this public relations battle, PJM officials and stakeholders including power plant operators and utilities, renewable energy developers, demand response aggregators, and consumer and environmental advocates, have been working on market constructs that could maintain the ability of seasonal resources to play in PJM’s Reliability Pricing Model (RPM) capacity market.

The forum for this work is called the Seasonal Capacity Resources Senior Task Force, and it has a tight deadline for coming up with an alternative proposal. By late 2016, PJM will need to either stick to its current plan to move to 100 percent CP for its May 2017 auction to procure capacity for the 2020-2021 delivery year, or present an alternative that a supermajority of stakeholders can agree on, according to Adam Keech, PJM’s executive director of market operations

And while multiple stakeholders have suggested plans that reintroduce season-specific procurements, PJM is holding the line on sticking with an annual performance requirement. “In general, finding better ways for seasonal resources to participate in the existing construct is preferable to redesigning Capacity Performance to be something less than annual. Moving to a less-than-annual capacity product would have significant implications, including potential shifts in cost allocation,” according to a PJM statement.

PJM’s proposal: A synthetic matchup of seasonal resources

That sums up the state of play in PJM’s capacity market so far, although those looking for more background details should reference this great high-level view provided by GTM Research analyst Elta Kolo. So what are some of the alternatives being considered?

In an August 1 meeting, the Seasonal Capacity Resources Senior Task Force entertained a new proposal from PJM -- a novel approach to aggregating separate bids from providers of summer and winter capacity resources, in ways that won’t require those parties to work together, or even know of each other’s existence, in order to bring their resources to market.

“What we’re trying to do is find some middle ground between recognizing we have seasonal assets that can provide value on a capacity basis, and maintaining that we want to be a market that produces persistent, predictable price signals that guide long-term investment,” Adam Keech, PJM’s executive director of market operations, said in an interview last week.

Aggregation has been allowed for some time in PJM, Keech noted. But “those rules in general required the aggregating entities to make a commercial agreement prior to the auction,” adding, “We got a lot of feedback that told us that wasn’t going to be plausible.” Indeed, in the previous two auctions that combined CP and old capacity rules, only one bid featuring an aggregation of this kind was submitted, and it didn’t clear.

There are good reasons to suspect that it’s going to be hard for entities to band together to offer combined summer-winter resources, given that they’re otherwise competing against each other to win capacity bids, at price points they’d like to keep as secret as possible.

PJM’s new proposal seeks to do away with this issue right off the bat, with an auction-clearing algorithm that clears all annual CP sell offers, along with winter and summer-period offers, to “minimize bid-based cost of satisfying PJM and modeled [Locational Deliverability Area] reliability requirements,” according to its Aug. 1 proposal.

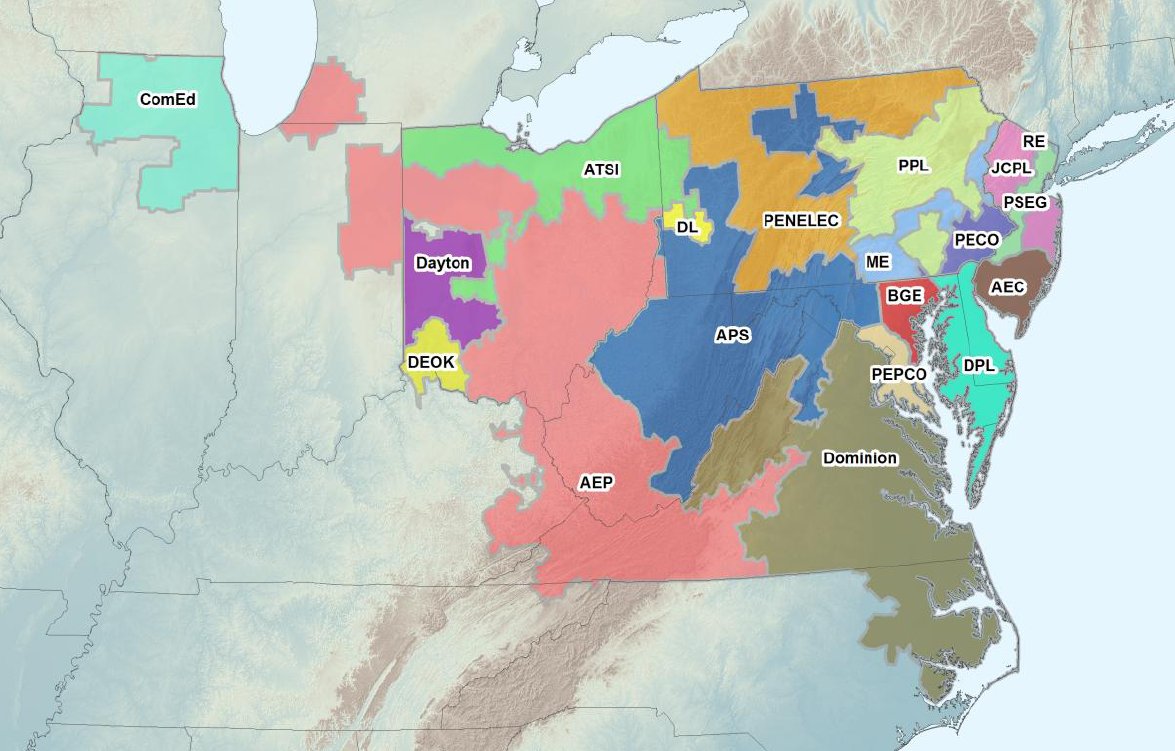

This brings up another issue -- where these resources are located. In PJM, these different regions are known as Locational Deliverability Areas (LDAs). At the highest level, they include three broad geographical areas, covering PJM’s Eastern Seaboard, the Chicago region, and a swath from Pennsylvania and Virginia to Ohio and Kentucky.

But they’re also broken into smaller regions within those big areas, corresponding to individual utility service territories, or areas where transmission congestion leads to a greater need for capacity resources, and thus potentially higher prices.

“One of the big sticking points in the current aggregation rules we have is that it is required that those resources aggregate within an LDA,” Keech said. But that rule would preclude, say, wind farms in Illinois aggregating with summer demand response in Delaware, or even separate resources right across an LDA border from one another -- even though they might otherwise provide an aggregate resource that’s cheaper and more efficient than the alternatives.

To fix this, PJM has proposed allowing resources from different LDAs to be matched together. But that move “creates some side effects,” he said. For example, “If I’m a summer resource and you’re a winter resource, and we’re not in the same location -- I’m in New Jersey, and he’s in Chicago -- we have to pick some location where this pseudo-resource exists, both from a compensation perspective, and from a capacity-accounting perspective.” To solve this, “We will take the smallest LDA common to both of us, and that’s the location,” he said.

There’s another location-specific issue to be handled, however -- and this one gets to the heart of the conflict between PJM’s proposal and those coming from parties that want to keep seasonal capacity procurements intact. PJM’s proposal would require every megawatt of summer resource to be matched to an equal megawatt of winter resource, so that they come together to cover an entire year.

What happens if there’s more summer capacity on offer than winter capacity within an LDA? In that case, PJM proposes that the excess capacity from either season be moved up into competing against bids for the next-largest LDA, where they’ll be matched up with the capacity from the opposite season, Keech explained.

Summer-winter equivalence: A more perfect match -- or a costly mismatch?

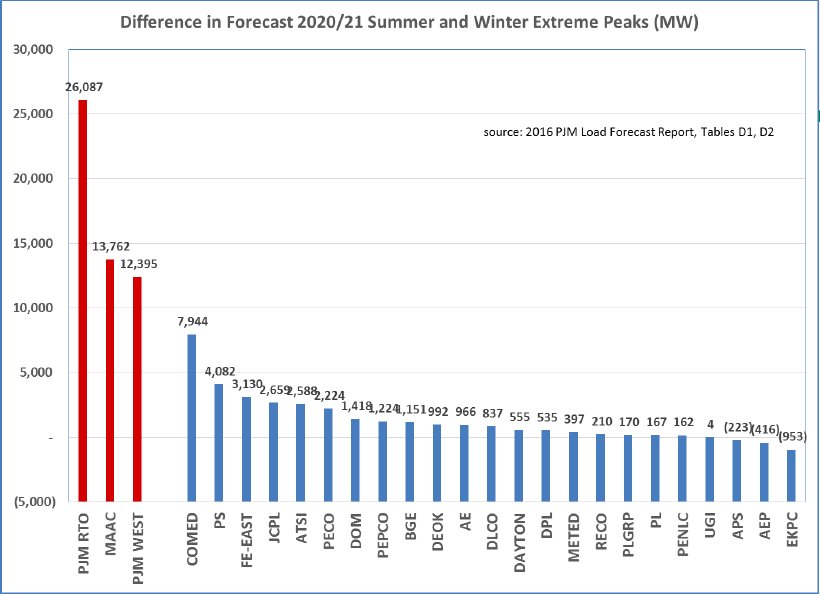

This brings us to the main objection coming from demand response, renewable energy and environmental groups. Because PJM has traditionally had a summer-peaking season, there has always been a greater amount of summer resources available than winter resources, they say. And because of that, requiring a one-for-one match will needlessly bar competitive summer-season resources from winning market share against more costly competing resources -- most likely fossil-fuel-fired power plants.

“The maximum number of aggregations you can have is limited by the smaller number, [and]...there are far smaller numbers in the winter than in the summer,” Katie Guerry, vice president of regulatory affairs for demand response aggregator EnerNOC, noted in an interview last month. Any rules that require strict matching will be limiting, in that “you’re going to leave those summer megawatts on the table. There just aren’t enough winter megawatts to match them up with."

NRDC attorney Jennifer Chen, who’s been writing about the opposition to PJM’s new rules for years now, highlighted the problems that environmental groups see with the new aggregation proposal.

“First, clean, cheap supply has seasonal attributes -- e.g., wind is strongest in the winter; solar, A/C cycling and other demand response are most available in the summer,” she said. “Second, electricity demand in PJM is highly seasonal as well. Winter peaks and capacity needs in most regions are far below summer needs -- summer capacity can be worth up to 40 times the reliability value of winter capacity. Procuring on an annual basis, as Capacity Performance does, limits reliable, clean, cheap resources while over-procuring capacity during off-peak seasons.”

To back up that assertion, Chen pointed to an analysis from James Wilson of Wilson Energy Economics, submitted to the Seasonal Capacity Resources Senior Task Force as part of a proposal to keep a seasonal component to its capacity rules. The analysis uses PJM forecasting data to show that, while certain LDAs within PJM have winter peaks larger than their summer peaks, the overall needs are heavily weighted toward summer capacity.

PJM’s Keech conceded that the organization has "definitely gotten feedback from people that there will be an abundance of summer [resources], and not enough winter [resources] to pair with it. I could see how people could come to that conclusion.”

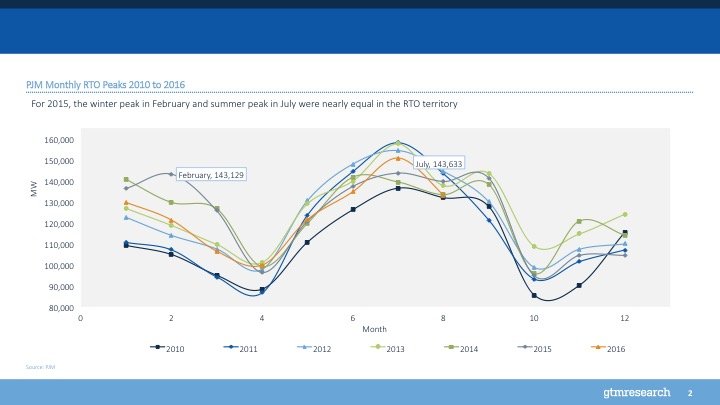

At the same time, recent experience shows that this assumption may require reconsideration, he said. “We’re coming off two, three years in a row where the summer and winter peak loads have been very close to each other in PJM,” he said. Indeed, PJM data from 2015 shows that the system-wide winter peak of 143,129 megawatts in February was nearly equal to the summer peak of 143,633 megawatts in July.

“I won’t tell you we’re not a summer-peaking system, because historically we have been,” he said. Notably, PJM reached a summer peak of nearly 152,000 megawatts last month, its highest in three years. At the same time, “The weather in the winter has been harsh enough for us to recognize that our winter-clearing capacity is as valuable as our summer-clearing capacity,” he said -- a point which gets back to the polar vortex issue that engendered PJM’s changes in the first place.

An uncertain outcome for demand response and green power

It’s hard to say how a shift to a full CP auction next year might affect the value of seasonal resources, given that there are several complicating factors beyond those we’ve already covered. One of them has to do with how demand response resources will be valued, particularly in the cold months, EnerNOC’s Guerry pointed out.

“Measurement and verification is a bit problem for demand response being able to convert to a CP annual commitment in the winter,” she said. That’s because right now, a demand response asset’s load reduction contribution to capacity is calculated against a value known as Peak Load Contribution, or PLC, which measures the five highest “coincident peaks” of a resource during the year -- peaks that almost always occur in summertime.

But winter resources measure their load drop against a consumer baseline measurement which Keech conceded is “not attractive to demand response providers, particularly industrial providers” -- and EnerNOC has a lot of industrial demand response. While PJM is working on an alternative winter measurement and verification schema, Guerry called them only a “modest improvement” from the previous methods.

Another problem with PJM’s proposed aggregation rules is how it limits participating resources to contributing no more than their Capacity Injection Rights, Guerry said. “CIRs are what generation suppliers have to get -- you pay for them by way of upgrading the system to accommodate your megawatts,” she said. But wind power farms’ CIRs are typically set at a lower measure of megawatts, more typical of their average annual output, than the power they’re capable of producing at the peak of their capacity contribution during high-wind winter months.

But according to PJM's Keech, retaining CIRs is part of the bargain that aggregated resources have to take once they start mixing and matching with other resources outside their local LDAs. Because CIRs are calculated on very local grid upgrade needs, allowing a winter-season wind farm from one LDA to exceed its CIRs to match a summer resource in another LDA “becomes more problematic.” Limiting capacity contributions by CIR “may be seen by some as unequal treatment for wind resources. But it’s just equal treatment.”

To add more uncertainty to these questions, PJM has yet to fully implement its CP rules in a capacity auction. For the past two auctions, PJM has split up its requests, with 80 percent going to CP and the remaining 20 percent based on the old rules for its Base Residual Auction (BRA).

In its most recent May auction for 2019/2020 delivery, less than one-tenth of demand response, solar and wind cleared as CP, the NRDC pointed out. But it’s not clear whether that’s because those resources couldn’t meet the CP requirements, or if there wasn’t enough price difference between the old and new requirements to drive them to bid in as year-round assets.

At the same time, the May auction yielded prices of around $100 per megawatt-day for most of the region, compared to about $150 per megawatt-day in most regions for base capacity last year. Lower prices are good for the 61 million or so electricity customers in the territory PJM covers, but bad for the providers of capacity resources. Again, however, the lower prices were driven by a number of factors, including new natural-gas-fired power plants coming into play, that can’t necessarily be attributed to the CP changes in place.

Bracing for a shift

PJM’s capacity market is the main way for demand response to earn money, which makes the outcome of the Seasonal Capacity Resources Senior Task Force's various proposals a big deal for DR providers like EnerNOC, Comverge and other big players in the region. In a May interview, EnerNOC CEO Tim Healy downplayed the potential impact of a move to a 100 percent CP market in next year’s auction. But he did say that it would be a “customer education challenge” to prepare its customers for the new rules coming into play next year.

And EnerNOC’s commercial and industrial DR customers may be able to adjust to an annual performance requirement with more ease than those that rely on air-conditioning cycling, like many of the residential programs run by utilities and aggregators in the region. Those programs, which are tied to summer weather and power-usage patterns, could have a much bigger challenge working with whatever seasonal aggregation rules emerge from PJM’s process.

Wind and solar power developers are also eyeing the coming changes with concern as to how they’ll affect the share of revenues they can count on coming from capacity payments.

“It is true that the vast majority of our value comes through energy sales. However, I believe that capacity markets are increasingly important as a source of wind plant revenue,” Michael Goggin, senior research director at the American Wind Energy Association, said in an interview last month. “We were coming out of a period where almost all U.S. markets were long on capacity, and prices for capacity were really low. With the retirement of coal plants and other factors, we’re starting to see capacity prices coming up -- and energy prices are obviously low at the moment.”

The same goes for solar, as we noted in our initial coverage of the controversy. “Capacity revenues are very significant for utility-scale solar in PJM territory. For some of the large-scale projects we have, it’s actually worth more than the REC [renewable energy credit] values,” Brent Beerley, executive vice president at solar and wind power developer Community Energy, told us back then. “The PJM-proposed rules would effectively erase those revenue streams.”

During PJM’s Aug. 1 meeting, one participant suggested that PJM delay implementation of its CP rules for a year to allow more time to work on a set of compromise proposals. “That’s not something that PJM is supportive of,” Keech said. “But just because we don’t support it doesn’t mean stakeholders couldn’t bring it up."

In the meantime, the NRDC and its fellow environmental groups are keeping the option of legal action open, Chen said. “Once FERC issues its final order, there is a limited period during which FERC’s decision can be challenged in court,” she said.