Electric vehicles have always been one of the utility industry’s favorite grid edge technologies. In a world with flat to declining demand for electrons, EVs are a huge new source of load growth. Investments in EV charging infrastructure could also become part of utilities’ capital budgets. And if EV charging can be properly managed, it could become a vital new asset for utilities to manage a rising tide of intermittent wind and solar power.

That’s led to a big push by utilities to support EV adoption and infrastructure — and to own it where they can. But EVs are also a technology largely outside of utility control.

This week saw three different reports on this utility EV challenge: one dealing with the nuts and bolts of Southern California Edison's first real-world EV charging infrastructure; one dealing with Hawaiian Electric Industry’s long-term plans to make EVs an integral part of the state’s 100 percent renewables future; and another from the Electric Power Research Institute on the critical role that EVs will eventually play for utilities across the country in a world with flat or declining load growth.

Southern California Edison and the nitty-gritty of getting EV infrastructure off the ground

California is leading the nation in utility EV infrastructure investment. Southern California Edison’s “Charge Ready” program is one of the biggest utility-managed, ratepayer-funded EV charging rollouts in the country. In 2016, the California Public Utilities Commission approved $22 million for SCE to deploy up to 1,500 Level 2 chargers at workplaces, stadiums, shopping malls, fleet refueling stations, and multifamily housing sites.

This first-stage rollout is meant to prove out the logistics and economics of a much broader Phase 2 deployment, which SCE expects to file with the California Public Utilities Commission within the next three months. SCE's Charge Ready Phase 1 Program Pilot Report (PDF), released this week, lays out its successes and challenges since the program’s May 2016 launch.

As of last month, SCE has deployed infrastructure to support 941 charging ports at 60 customer sites, including corporate and government EV fleet fueling stations, parking lots at workplaces, sports arenas and malls, and parking at multi-unit dwellings such as apartment buildings and condominiums.

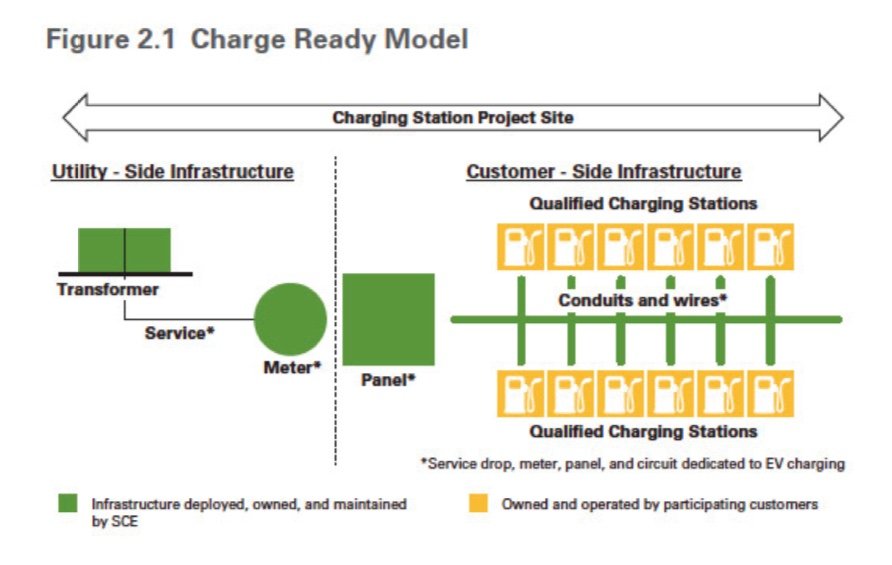

After years of barring California’s big investor-owned utilities from participating in the EV charging business, the CPUC changed its regulations in 2015 to allow them to invest in EV charging — up to a point. Utilities are allowed to own all the infrastructure up to the charger itself, but the end customer chooses which third-party charging system to use.

But SCE’s plans require these chargers to meet a lot of tests, from the simplest safety and interconnection requirements, to more advanced capabilities to serve as demand response and load-shifting assets — a critical future functionality for its pilot installations, as well as for its EV infrastructure as a whole.

To ease the upfront cost, SCE offered customers a rebate on the chargers themselves, in exchange for an agreement to keep them running for at least 10 years; pay for operating costs such as energy, maintenance, repairs and the EV network; and “participate in a Charge Ready DR Pilot and any future DR program.”

“At the time of this report, there are 61 approved models offered by 12 SCE-qualified vendors,” SCE wrote. But this inclusive effort did not come without its share of challenges. “Some vendors left the marketplace post-purchase,” the report noted, leaving customers without maintenance and data. “Some EV [charging equipment] did not pass evaluation, for reasons such as failing to pass the momentary outage test, failing to stop the charge session even when charging has been completed, unknown charging interruptions, missing OpenADR 2.0b or UL certifications, ventilation and other safety issues.”

As for customer challenges, some were relatively trivial, and to be expected in a first-of-its-kind rollout. Many customers filled out their initial forms improperly, for example, and found SCE’s two-step process for obtaining easements too cumbersome. Many steps of the process took longer than anticipated, from completing easements, to getting chargers delivered and installed.

SCE singled out multi-unit dwellings as a particularly challenging environment. Unlike public parking lots, apartments and condos tend to have assigned parking, with few open spaces for EV chargers, and those often scattered in different areas, instead of all in one place, which makes for more expensive infrastructure and multiple service connections.

These high costs skewed the average cost per port for the pilot to $13,731, at an average of 14 ports per site — more than its projection of $11,195 per site, assuming an average of 26 ports per site. “Sites with the minimum number of ports are significantly more costly to deploy, especially if they require new transformers to serve the incremental EV load,” the utility noted.

These high prices are actually part of the rationale for CPUC to allow SCE and its fellow investor-owned utilities to invest in EV infrastructure. So is serving disadvantaged communities, which make up more than half of the sites in the program to date.

California Gov. Jerry Brown wants to see 5 million zero-emission vehicles on the state's roads by 2030, a goal that will require a massive build-out of charging infrastructure. The California Energy Commission projects that the state will need between 10,000 and 25,000 fast chargers, about 120,000 multi-family-unit chargers, and between 100,000 and 133,000 public and workplace parking chargers by 2025 to hit that goal.

SCE’s first foray into using its charger fleet as a grid asset begins this spring, with a demand response pilot that will run both a traditional load-shedding incentive program, and a load-shifting program that will add low, or even negative, pricing for times of day when solar is surging onto the grid — in essence, paying chargers to suck up excess capacity in the belly of California’s "duck curve."

The CPUC issued a proposed decision (PDF) late last month that would direct $589 million to next-stage EV charging investments. This includes $137 million for SDG&E to invest in residential EV charging, as well as a big focus on fleet vehicles for SCE’s $201 million Medium- and Heavy-Duty Infrastructure Program, and PG&E’s $207 million FleetReady program. Buses, trucks, airport cargo handling tractors, and other fleet vehicles are seen as a key early market for electrification, since they’re under centralized control and have relatively predictable daily schedules and range requirements, compared to the relative randomness of light-vehicle driving patterns.

A utility’s ability to influence mass-market EV charging is more subtle, involving rebates and incentives, tariff structures and rate schedules. All three California IOUs have myriad pilots underway to test and refine different approaches to this challenge, but SCE's Charge Ready rollout is the biggest, making its data of particular interest for utilities and regulators elsewhere.

HECO: A long-range view of EVs' value for a zero-carbon grid

Hawaii is not your typical energy market. The island state, which relies mostly on expensive imported oil for its power generation needs, has become a hotbed of rooftop solar, and one of the very few markets where going off-grid with solar and energy storage is economically feasible. Hawaii is also seeking to get 100 percent of its energy from renewables by 2045 — an admittedly long-range goal, but unique in the country for its all-in approach to renewables.

Last week, Hawaii Electric, the state’s main investor-owned utility, filed its "Electrification of Transportation Strategic Roadmap" (PDF) with the Hawaii Public Utilities Commission, laying out how “Hawaii’s aggressive renewable energy goals, high penetration of distributed generation, and diverse, isolated island grids make it imperative that we harness the flexibility in EV charging loads.”

Hawaii already has nearly 7,000 EVs registered, second only to California in per capita ownership. Expensive gasoline and lower range needs on islands make the state a good market for EVs. It also has 542 publicly available EV charging stations: 69 DC fast charger ports and 473 Level 2 ports. But of those publicly available chargers, about 8 percent were out of order as of April last year — a not-uncommon problem in a business with several prominent bankruptcies.

HECO hired energy consultancy E3 to forecast just what the natural growth in EVs will be in the islands. The results: 55 percent of personal LDVs (light-duty vehicles) are projected to be fully electric, requiring about 2,200 public charging ports on the island of Oahu alone.

HECO’s electric transportation plan is broken into 10 initiatives. Several are focused on outreach, education and alliance-building — getting the the all-important tourism industry involved, and reaching out to taxis, tour buses and ride-share vehicles working for Uber, Lyft or other “transportation network companies.”

Electrifying fleets is another major focus, including HECO’s own fleet, which has 200 EVs. Hawaii’s four counties have plans to convert their own fleets to EVs by 2035, starting with electric buses in Honolulu. Encouraging EV charging infrastructure at the workplace, in public parking lots, and at multi-unit dwellings each gets its own category.

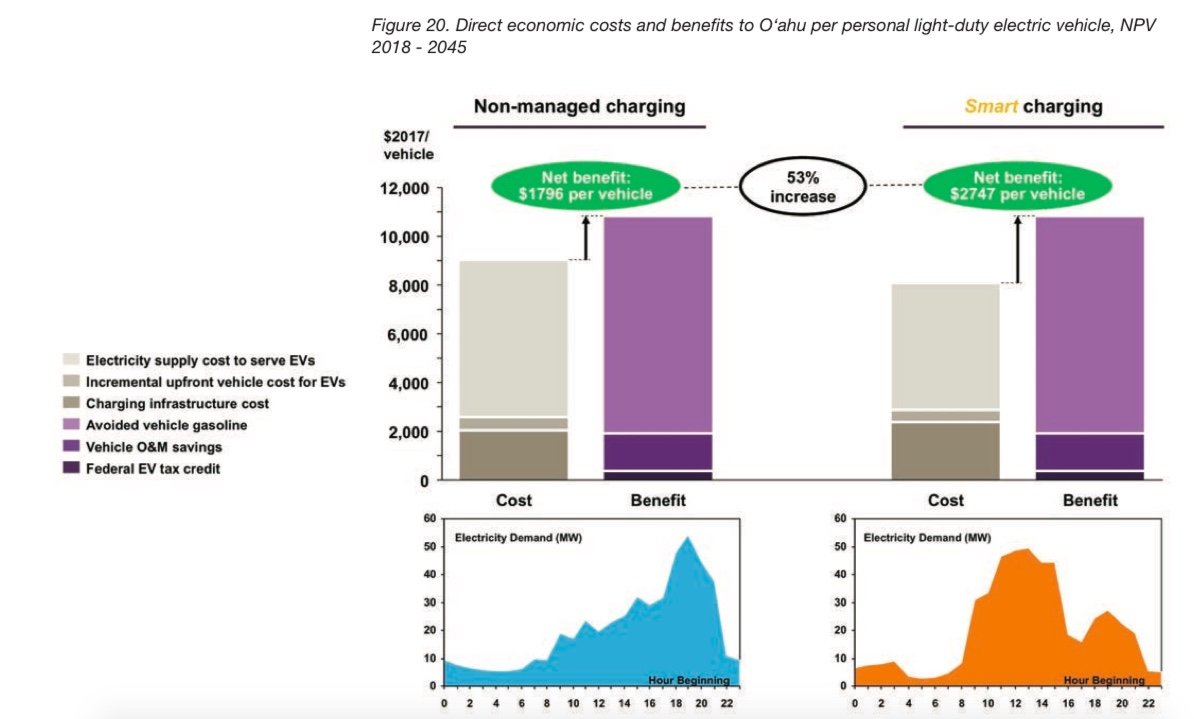

The effects of a nearly tenfold increase in EVs per capita will have a major impact on the load curves of each island’s power grid, of course. Managing and massaging these new curves will make a significant difference in the value the shift to EVs will provide the state’s residents, according to E3’s analysis.

EVs are expected to reach price parity with internal combustion engine vehicles by 2025, since they’re less expensive over their lifetimes due to reduced fuel and maintenance costs. E3 combined its multiple forecasts on EV costs and adoption rates with HECO system and planning data, and came up with a figure of $550 per EV in benefits to every utility customer over the next 27 years, or more than $311 million in potential benefits to the state, largely in fossil fuel never bought and burned.

But this value could be tripled if EV charging can be managed and controlled to shift charging times away from peak demand afternoons and into midday or nighttime hours, according to E3’s analysis.

HECO, like California’s investor-owned utilities, has been mandated to support the growth of third-party EV charging infrastructure, not try to own it all. To achieve its goal of shaping charging to its needs, it plans to pursue time-of-use (TOU) and real-time rates, to encourage workplace charging during the midday hours when solar power is peaking, and to offer bulk price discounts for fleets, ride-share and transportation network vehicles and taxis to charge at midday as well, since business tends to be slower at that time anyway.

HECO is also encouraging aggregations of EV charging systems to bid into new demand response markets, from large-scale load shifting to real-time frequency regulation. The utility has multiple pilots underway testing how flexible charging can fit into its broader distributed energy and grid modernization plans, including the JUMPSmart Maui pilot project, the OATI Electric Vehicle DR Aggregation project, and two Hawaiian Electric pilot projects designed to better understand and manage the grid impacts of DC fast chargers.

EPRI analysis: EVs' centrality to the future electric utility business model

The utility-funded Electric Power Research Institute is focused on R&D that could help expand the use of electricity over the long haul. This year has seen the launch of a big new project at EPRI, its “U.S. National Electrification Assessment,” aimed at delving into the potential for shifting major sections of humanity’s energy consumption from fossil fuels to electricity.

Beyond cementing utility business models, “economy-wide electrification leads to a reduction in energy consumption, spurs steady growth in electric load, and reduces greenhouse gas emissions — even in scenarios with no assumed climate policy,” the report notes. And of all of EPRI’s potential new markets for electrification, transportation is by far the largest contributor to these gains.

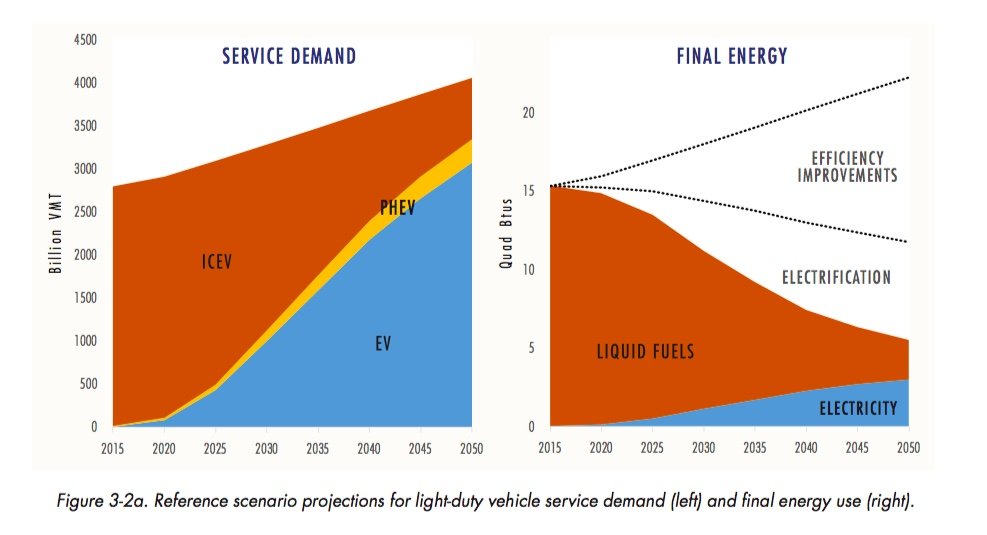

EPRI’s projections for EV penetration are based on a reference case in which EV costs reach parity with internal combustion engine vehicles by the mid 2020s. It projects that more than 70 percent of vehicle miles traveled by 2050 will be done with light-duty electric and plug-in hybrid electric vehicles. This would mean that EVs and plug-in hybrid EVs reach around 40 percent of new vehicle sales by 2030, and around 75 percent by 2050.

This shift will lead to a dramatic improvement in the energy efficiency of transportation, given the lower costs of transporting electricity to where it’s consumed, as well as the “tank-to-wheels” efficiency of electric compared to internal combustion drivetrains.

Electrification of transport may be essential stage to keeping utilities strong as the electricity sector shifts. Without efficient electrification, EPRI projects that electric loads will decline, driven by efficiency gains, requiring utilities to raise increasing amounts of capital investment from a stagnant revenue base.

With efficient electrification, the study projects cumulative load growth of 24 percent to 52 percent by 2050, or about 1.2 percent per year. “For electric companies, such slow but steady growth can moderate potential rate impacts of grid modernization investment.”