New York state is working its way through a precedent-setting docket on the valuation of distributed energy resources (DERs). The docket (15-E-0751) is a part of New York’s Reforming the Energy Vision proceeding (14-M-0101).

On April 18, a range of stakeholders filed proposals on alternatives to traditional retail-rate net energy metering (NEM) as the state transitions to a new valuation mechanism based on the formula of LMP+D -- where “LMP” represents the location-based marginal price of energy and “D” represents the value provided to the electric distribution system. The formula is intended to assign value to DERs based on all of the benefits they provide.

As the state works toward a more sustainable, long-term arrangement, the New York Public Service Commission called for stakeholders to submit interim alternatives to NEM to be implemented by 2017.

A landmark agreement between six New York utilities and three major solar companies received strong interest from regulators and other stakeholders. The Solar Progress Partnership proposal (outlined in Part 1) focused largely on net-metered community solar projects and how to create a pathway forward in light of a backlog of project applications. With respect to rooftop solar, the Solar Progress Partnership proposed to keep retail-rate net metering in place until 2020, and then begin a transition to LMP+D. The utility-solar plan also proposed adding another element (“E”) to represent the societal benefits associated with clean energy projects.

While the compromise deal is an achievement, it’s still a work in progress. The proposal offers a valuation mechanism, but does not propose specific values for DERs, leaving that work up to the Public Service Commission (PSC). Partnership members also failed to reach an agreement on how to transition rooftop solar compensation from retail-rate NEM to a long-term tariff post-2020. Outside stakeholders have taken issue with the proposal’s assumption that DER compensation would be lower than retail-rate NEM. Other proposals submitted on April 18 call for maintaining retail-rate NEM and the basic NEM mechanism for certain types of resources, such as rooftop solar, further into the future.

This article examines three separate fillings that address interim and longer-term solutions for valuing DERs from the Solar Electric Industries Association and Vote Solar (jump to section); the Environmental Defense Fund (jump to section); and the Advanced Energy Economy Institute in partnership with the Alliance for Clean Energy New York and the Northeast Clean Energy Council (jump to section).

On Friday, June 10, stakeholders submitted reply comments to proposals submitted on April 18. (Reply comments will be addressed in Part 3 of this series.) Over the coming weeks, stakeholders will participate in “an informal and collaborative process” to develop joint recommendations for the PSC to act on.

SEIA/Vote Solar

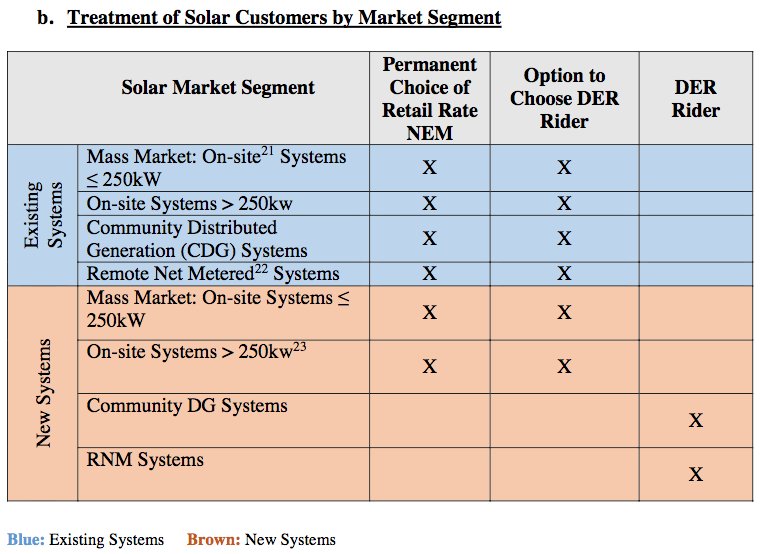

The Solar Electric Industries Association (SEIA) and Vote Solar filed a joint proposal on an interim mechanism for valuing DERs, which makes the case that the existing retail-rate NEM structure has significant value and that the process of transitioning to a new rate should be incremental.

The proposal argues in favor of keeping the retail-rate credit unchanged for both new and existing on-site solar systems above and below 250 kilowatts, with the option for these customers to switch to an interim “DER Rider” tariff if they choose. The Solar Parties claim this will give customers the opportunity to test out the rider rate without threatening market growth.

“We argue that behind-the-meter systems and mass residential systems should remain on NEM for the foreseeable future because there’s no evidence that that’s a problem, and lots of evidence that that’s a valuable tool for compensating customers,” said Sean Garren, Northeast regional manager for Vote Solar. “It’s also a valuable tool for educating and expanding the market, because customers understand their bill in terms of the retail rate.”

The Solar Parties argue that only new offsite projects (community solar and remote NEM projects) should be required to adopt the DER Rider. The proposal states this will “achieve the Commission’s goal of directing large net exporters to areas of highest value on the grid through establishment of accurate price signals, and will give both the market and regulators an opportunity to evaluate and adapt to the DER Rider.”

Rather than developing a distinct interim solution and a distinct end-state solution, the Solar Parties called on the Commission to view the proposed DER Rider as the start to incremental regulatory reform that will build in increasing granularity and more accurate price signals over time, with the ultimate goal of creating the robust DER market envisioned under REV.

The proposal lays out five main organizing principles for the development of a DER Rider: 1) transparency and inclusion; 2) right to self-consumption, or the right to reduce their demand for energy purchased from the grid through on-site generation; 3) proper value and compensation, factoring in value over the lifetime of a DER system; 4) simplicity, gradualism and predictability; and 5) grandfathering, such as existing rate classes are able to maintain their existing rate structure.

The ability to receive a credit for net monthly excess electricity remains central to the Solar Parties DER Rider proposal. “We believe people should be able to actually use their own solar systems and offset their retail-rate demand,” said Garren. “Reiterating that is an important part of any successor system.”

Going forward, the solar groups support building in increasing granularity for pricing and DER compensation, including locational factors. But the rider rate should also recognize the long-term benefits of DERs and factor in the full array of benefits, including values for reliability, water, land and others.

The proposal also calls for the distributed value of the DER Rider -- the “D” value -- to be evaluated every five years, and for whatever tariff a customer receives to remain in place for 25 years or more. This will ensure that projects can attract financing while capturing the potential changes in the value of long-term system benefits of DERs.

The Solar Parties call for PSC staff to submit a DER Rider proposal by the end of the year, even if it means approximating the value of certain benefits in the interim. While noting there should not be an assumption as to whether the full value of DERs is above or below retail rate NEM, the Solar Parties stated that the “Commission should ensure that in the near term the DER Rider rate does not fall significantly below the retail rate in order to support sustained market growth.”

“Currently, New York’s solar market is much smaller than many other states, including California, Hawaii, and Massachusetts, that have begun considering more advanced compensation mechanisms and market design for DERs,” according to the filing. “In fact, California’s recent decision to preserve retail-rate net metering almost entirely intact until 2019 despite significantly higher penetration of DERs than New York underscores the importance of moving incrementally.”

Garren said there are some good elements in the Solar Progress Partnership proposal, a joint filing by six utilities and three solar companies. The fact that several utilities signed on to an agreement that acknowledges a distribution system benefit from solar is an achievement in and of itself, he said. Many utilities make the case that distributed solar is a burden to all ratepayers, ignoring many of the benefits.

But while it establishes some common ground, the Solar Progress Partnership proposal is limited by the fact that it doesn’t offer any specific values for DER -- leaving that work up to the PSC. The phased-down approach outlined in the paper also implies that the long-term compensation for DER will be lower than the retail electricity rate, which Garren said runs counter to the findings of numerous studies around the country.

“I think the electric utilities, not shockingly, have done a lot of thinking and tried to roll out their proposal as a bit of a foregone conclusion [because it’s presented as] a détente between the solar industry and electric utilities. But in fact, that’s just their opening position,” said Garren. “We have a long and hopefully very deliberative process ahead of us to arrive at what the future [for DERs] looks like.”

Environmental Defense Fund

Similar to SEIA and Vote Solar, the Environmental Defense Fund (EDF) put forward an interim proposal that would keep retail-rate net metering in place for on-site DER projects until a long-term solution is approved. However, the environmental group added a twist by recommending that additional credits be offered to distributed solar customers in order to optimize where and when these resources are deployed.

“The interim solution is based on the idea that in the short term the underlying price structure is unlikely to become very much more nuanced,” said Elizabeth Stein, senior manager of New York clean energy law and policy for EDF. “So to try to incentivize not just plenty of rooftop solar, but the right rooftop solar, in the right place, configured in the most environmentally helpful way, [EDF] recommended adding certain credits on top of the existing netting against a regular retail rate to encourage the right kinds of behavior.”

To justify retaining retail-rate NEM, the report cites existing research from NYSERDA that finds any potential negative consequence of net metering is expected to be minimal at today’s low levels of DER penetration. The report also cites research that finds net energy metering as currently implemented provides a reasonable proxy for DER value. At the same time, New York currently lacks the advanced metering and communications technology needed to determine the precise benefits of DERs. For these reasons, EDF argues that retail-rate NEM serves as a fair compensation method, at least for the interim.

However, EDF also made three recommendations intended to enhance NEM in the short term, the first of which is to move NEM customers to time-variant pricing that is reflective of the actual costs of generating and delivering electricity.

Currently, NEM customers in Con Ed territory are discouraged from switching to time-of-use rates because credits for excess electricity can be used only to offset consumption in the same time period that the credits were produced. To remove the disincentive, EDF recommends “providing monetary bill credits (instead of kilowatt-hour credits) for the retail value of exports in each time period and allowing these credits to be used against grid consumption in any time period.” A well-designed time-variant price signal could encourage customers to make DER investments that are more socially beneficial.

The second modification is to offer customers a credit recognizing the value of west-facing solar panels, or other DERs that have been configured to be particularly beneficial during peak periods.

The third change is to offer a credit for DERs located in areas of the distribution system where constraints have been identified by the distribution utility. The credit should be based on the estimated value of avoided or deferred infrastructure investments. For the credit to work, utilities would have to identify locations where credits are warranted in their Distributed System Implementation Plan filings. Initial DSIP filings are due June 30.

Under the EDF proposal, on-site DER projects that do not qualify for credits would continue to receive the retail-rate NEM credit. Off-site DERs are treated differently, however. EDF recommends that community net-metered projects should transition to an LMP+D valuation more quickly.

“Net metering has been very successful. People understand it, solar is proliferating, and one would not want to see that slow down,” said Stein. “But, ultimately, one wants solar to be deployed even more strategically, when and where it has the greatest value.”

“In the long term, we want a rate structure [in which] the underlying pricing comes as close as possible to signaling where you want reductions in load from any source -- solar or otherwise,” she added.

EDF Full Value Proposal

In addition to proposing an interim successor to NEM, EDF offered comments on a full valuation methodology for DERs, which EDF economists presented on at a technical conference on May 10.

The filing calls for an electric service price structure that is fully unbundled and granular to reflect disparate values of different DERs and to provide price signals based on time and location. Ideally, these variations should be reflected in the full social cost of generation and transmission of a given unit of energy.

“To successfully achieve this, energy wholesale market prices would need to internalize the full external cost caused by greenhouse gases and other pollutants, and resources that do not participate in the wholesale market such as small DER that are located at customer premises, would also need to bear the full external cost of their pollution,” the proposal states. “On the delivery side of the retail customer’s bill, the rate structure should provide price signals that in turn reflect the relevant local peaks that drive distribution system costs, as well as location-and time-specific volumetric charges that reflect energy losses on the distribution system.”

EDF argues that price structure, combined with the basic premise of NEM -- netting on-site generation against consumption -- would ensure customers pay for the full cost of services they receive from the grid, while being compensated for the full value of services they provide to the grid.

Another central element of EDF’s long-term proposal is for the PSC to implement the LMP+D+E mechanism, where E refers to a resource’s emission reduction benefits.

The filing states: “As the Commission noted in the BCA Framework Order, while the wholesale markets reflect the value of existing programs for controlling air emissions, they do not accommodate the full value of the external costs related to those emissions. Therefore, consideration of the full external damage costs requires an approach designed to address this undervaluation. Furthermore, different DERs have different emissions characteristics which are independent of the value of their benefits to the distribution system, and these benefits therefore need to be separately considered and valued in an E value that does vary depending on the characteristics of the DER technology.”

Calculating the clean energy benefits of DERs requires quantifying net avoided emissions and then monetizing the avoided emissions. The “E” component would first be calculated based on the avoided emissions of a kilowatt-hour of net load reduction, which would require separate metering. The performance of these resources would then compared to the environmental performance of marginal generators on the bulk power system.

The difference in greenhouse gas emissions would be valued at the actual Social Cost of Carbon developed by the EPA and other federal agencies, subtracting out any extension that is already incorporated in the price of bulk power, such as the Regional Greenhouse Gas Initiative (RGGI), to which New York state belongs.

“Our whole approach is primarily about recognizing that the DER value to the distribution system has a lot of parts, the value to the grid has a lot of parts, and that the environmental externalities are separate and need to be separately qualified and compensated,” said Stein.

“You do not want to be compensating something that was really not environmentally helpful the same way you’re compensating a solar resource, because…they are both DERs,” she said.

AEEI/ACE-NY/NCEC

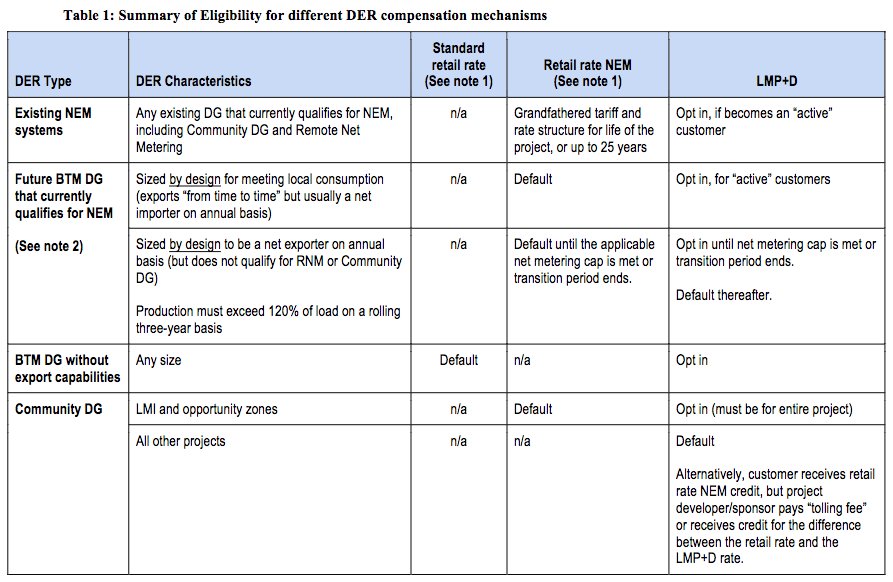

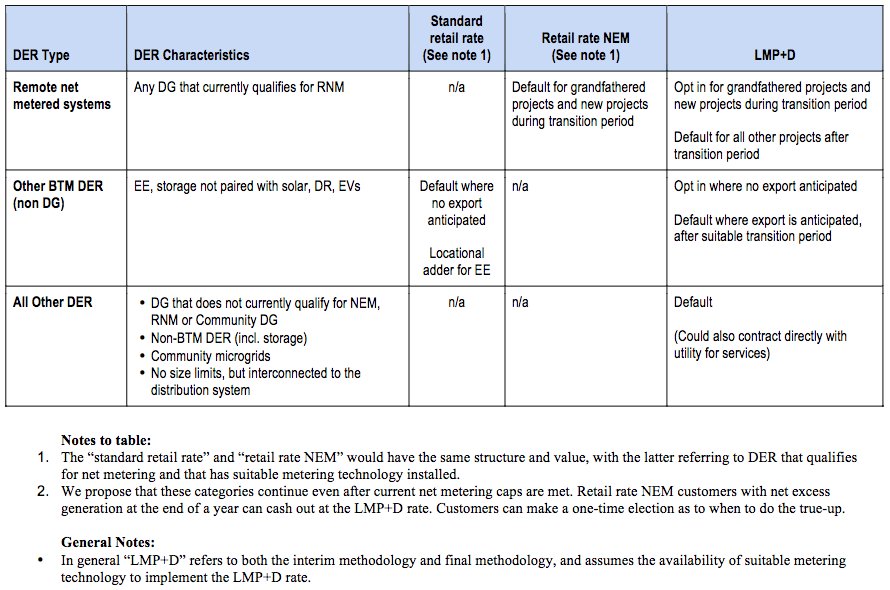

The Advanced Energy Economy Institute (AEEI) submitted a value of DERs proposal in the initial round of filings on April 18 in partnership with the Alliance for Clean Energy New York and the Northeast Clean Energy Council. Rather than focusing on an interim alternative to NEM, the joint filing focused on designing a longer-term LMP+D formula that could be implemented quickly and applied to all DERs.

The proposal centers on creating a location-specific hourly energy price. “The proposed LMP+D rate would be similar to a real-time rate in that it would incorporate hourly energy prices, but it would also allocate capacity, line-loss effects, and other costs as functions of hourly load and would reflect locational differences. It would also include all other benefits, such as environmental externalities,” according to the filing.

“All components of this ‘LMP+D rate’ would be converted into $/kWh charges,” AEEI explained in a recent blog post. “This includes converting wholesale capacity and distribution costs into $/kWh. The rate would apply to the customer’s entire bill -- the value paid for a kWh generated in a given hour would be equal to the rate charged for a kWh consumed in that hour. Similarly, a kWh saved would be worth the same as a kWh generated. Much like NEM, this would keep things relatively simple, once the prices were known. Interval meters would log hourly net consumption or production and bills would be calculated by applying the hourly rate. Customers would receive a bill or a credit, just like with traditional NEM. There would be no need for real-time communication -- just a monthly meter reading, albeit with more data to read.”

The proposed rate would also have shorter, sharper time-of-use peaks corresponding to the actual hours of highest pricing. This would enable customers with dispatchable DERs, like energy storage or fuel cells, to schedule their DERs based on a published price forecast. The rate would also apply to avoided consumption, so that customers are incentivized to precool their buildings ahead of the price increase, for instance. For customers with non-dispatchable DERs, like solar, there would be no benefit or penalty based on the time of production.

To ensure a smooth transition to the new rate, AEEI/ACE-NY/NCEC argued in favor of grandfathering in existing NEM customers under current rate structures. The proposal is also intended to be implemented gradually, in parallel with continued availability of retail rate NEM for eligible technologies up to the net metering caps. However, traditional NEM would remain the default option for DER customers whose systems are designed mainly for meeting local load. These are systems, such as rooftop solar, which generate no more than 120 percent of on-site consumption on an annual basis. The limitation is designed to discourage customers from oversizing their projects.

This proposal differs from the Solar Progress Partnership proposal, which calls for all behind-the-meter solar to continue receiving the retail-rate NEM credit until 2020, but to then begin ratcheting down. AEEI helped to facilitate the Solar Progress Partnership proposal -- the high-profile agreement between New York utilities and three solar companies. However, AEEI did not sign on to the agreement.

The AEEI/ACE-NY/NCEC proposed rate would be opt-in for most customers and become the default rate only for customers that are net exporters (those producing more than 120 percent of their annual usage), which includes remote net metering and community DER projects.

The notion of shifting to an hourly rate that’s time- and location-sensitive is fairly simple. However, the filing parties acknowledge it will be challenging to implement. Utilities will need to make cost data available to customers and DER providers. New tools and price forecasts will have to be developed. The plan also assumes utilities will make changes to their planning processes and make new investments in their networks to accommodate the growth of DERs.

But while reforming rate structures may be complicated, it’s also necessary, said Danny Waggoner, senior associate at AEEI.

“For a long time, there's just been so little movement to change the way we pay for the grid and interact with customers, despite all of the technology that has improved and is waiting to provide more value,” he said. “There's so much that needs to be done because it hasn't been addressed before.”