The map below displays the states where general rate cases are under consideration across the U.S. Scroll over an individual state to reveal which investor-owned utility (or utilities) are currently participating in a rate case in that state.

A rate case is a formal public process conducted by regulators to determine if a utility’s base rates are just and reasonable. During this process, regulators review and ultimately decide how much (if any) additional revenue a utility may raise through its rates, and how the utility’s existing rate structure and tariffs may be revised.

Through the rate-case process, dozens of U.S. utilities have proposed changes that would alter the economics of customer-sited distributed generation (DG), as well as energy efficiency and energy conservation. Such proposals include:

- Raising the monthly fixed charge for certain types of customers (often by more than 25 percent), while also reducing volumetric (i.e., per kilowatt-hour) charges

- Imposing a demand charge and/or other fees on DG customers, including PV customers

- Creating a separate customer class for DG customers

- Reducing the value of -- or eliminating -- net metering

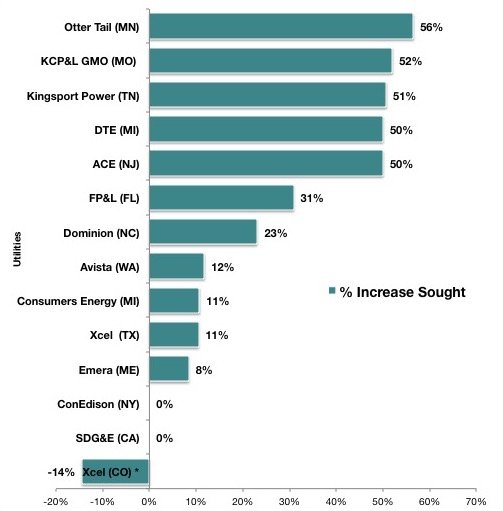

Fourteen utilities filed rate cases in Q1 2016. Of those utilities, 11 proposed raising their fixed charge for residential customers (Figure 1). Notably, five utilities proposed raising their fixed charge for residential by 50% or more. In Colorado, Xcel Energy actually proposed reducing its residential fixed charge and instead imposing a new five-tiered “grid use charge” that varies by a customer’s average monthly kilowatt-hour consumption. Most residential customers would pay an additional $7 to $14 per month as a result of this proposal.

FIGURE 1: Proposed Residential Fixed-Charge Increases

Source: EQ Research

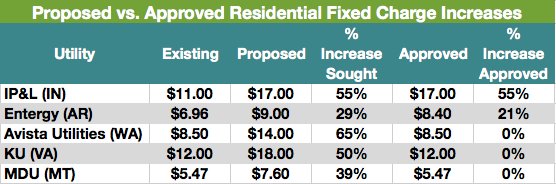

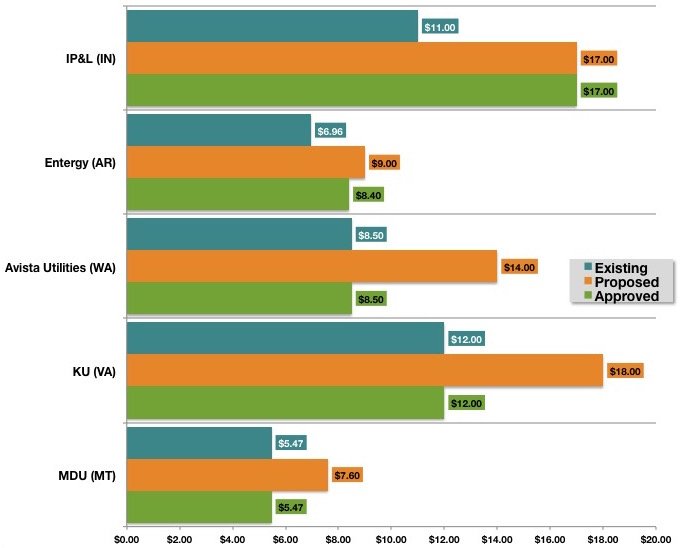

Of the five rate cases decided in Q1 2016, state regulators did not approve any increase in fixed charges for residential customers in three cases, thereby maintaining the existing charges for those utilities. However, Indiana regulators allowed IP&L to raise its charge by 55 percent, while the Arkansas Public Service Commission approved a 21 percent increase for Entergy (Figures 2 & 3). IP&L’s increase is the second-highest increase approved (by percentage) of all rate cases initiated since July 2014. Notably, in other rate cases, state regulators have rarely allowed increases greater than 25 percent, with around half of all rate cases resulting in no increase since July 2014.

FIGURE 2: Existing vs. Proposed vs. Approved Residential Fixed-Charge Increases, Q1 2016

Source: EQ Research

FIGURE 3: Existing vs. Proposed vs. Approved Residential Fixed-Charge Increases, Q1 2016

Source: EQ Research

***

In partnership with EQ Research, GTM Squared brings you a series of visualizations that map, graph and chart issues important to the clean energy industry across the U.S. These visualizations will be updated quarterly and serve as an up-to-date resource for Squared members.