Solar smart inverters are going to be a key grid edge technology. First, they’re going to enable rooftop solar PV systems to automatically stabilize their own collective disruptions to the grid. Then, they’re going to start communicating to utilities, giving them a much clearer view of what’s actually happening at the edges of the grid, as well as offering reactive power and ramping controls that could become a major resource.

That’s how California sees the future for smart inverters. Under the state’s Rule 21, since September of last year, Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric have required that all new solar systems come with inverters with “phase 1” smart inverter capabilities — seven specific autonomous functions, like not tripping off during minor voltage excursions and thus making them worse, and automatically adjusting power factor in case of emergencies.

Then, starting in February 2019, utilities will start requiring “phase 2” communications capabilities from all new solar systems, as well as certain “phase 3” advanced inverter capabilities, like giving utilities some control over how much reactive power they are injecting or absorbing.

But to tap these next-phase capabilities, California will have to solve a significant set of challenges — not just for utilities, but also for the third-party distributed energy resource providers seeking to aggregate smart inverters in the field.

On Wednesday, PG&E released an interim report (PDF) on its flagship smart grid pilot project — the Electric Program Investment Charge-funded 2.03A project — which highlights these challenges.

In simple terms, over the past two years, PG&E and its vendor partner have shown that smart inverters can indeed help stabilize local grid voltage through autonomous functions. But the report also revealed significant gaps in the communications technologies now available to link smart inverters to utilities, both in terms of their reliability and their security.

It also revealed that its vendor partner was only able to deliver a fraction of the solar-equipped customers it had hoped to bring to the project — a potential problem for a utility that’s being asked to rely on third-party promises of resources to be available in years to come.

Meanwhile, PG&E is still working on a second field deployment that will show if smart inverters can help stabilize a grid that’s facing significant voltage and reverse power flow problems from high solar penetration. It’s also in the midst of lab tests to see how smart inverters perform in “extreme grid conditions,” as well as analysis to determine how smart inverter capabilities could play a role in the state’s mandate for utilities to value DERs as part of their multi-billion dollar annual distribution grid investment plans.

Here's our breakdown of the key parts of PG&E’s report, including the projects it’s finished, those yet to come, and how this work is connected to a whole host of critical policies being developed in California.

Smart inverters will be a huge part of PG&E’s future grid — if it can fill in the gaps

Finding ways to incorporate smart inverters is a critical goal for the Northern California utility, which had more than 350,000 solar customers as of May, a number that is growing by about 5,000 per month. The utility forecasts that by 2020, smart inverters will control half of the PV interconnected to its grid, and that the number of smart inverter solar systems will climb to 1 million by 2025.

PG&E has identified a host of values that can come from the simplest automated functions available: anti-islanding; voltage and frequency disturbance ride-through and "soft-start" after an outage to help maintain grid safety; power quality and reliability; and the use of autonomous reactive (volt/VAR) and active (volt/watt) power output control to enable DERs to maintain grid voltage.

But it also identified key gaps that must be filled before utilities can achieve the full set of benefits that could come from fully networked smart inverters, from "new modeling capabilities to better characterize and forecast the operations of smart-inverter-equipped DERs," to better communication and software to optimize and dispatch DERs through the smart inverters themselves.

Results from ‘Location 1’: The good news

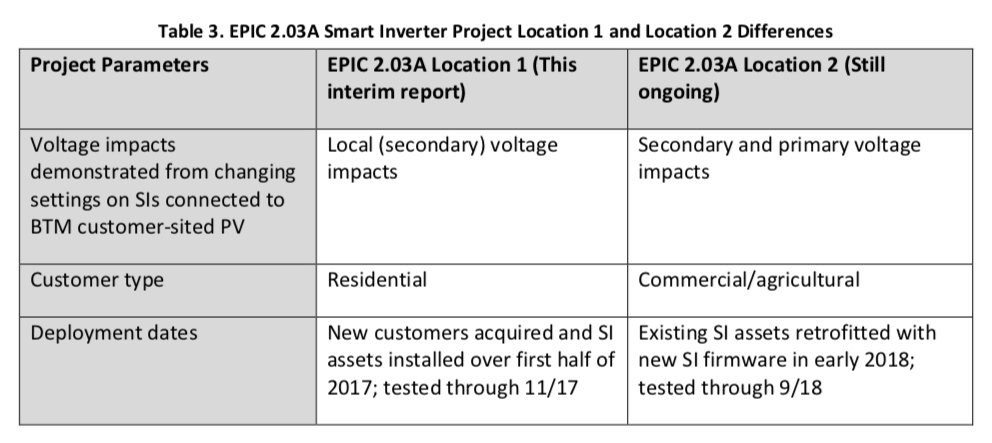

PG&E’s report this week covers the gamut of its smart inverter R&D work. Of the many tests it’s running, only one has been completed to date — a two-feeder, 15-PV-system test site referred to as “Location 1” throughout the report.

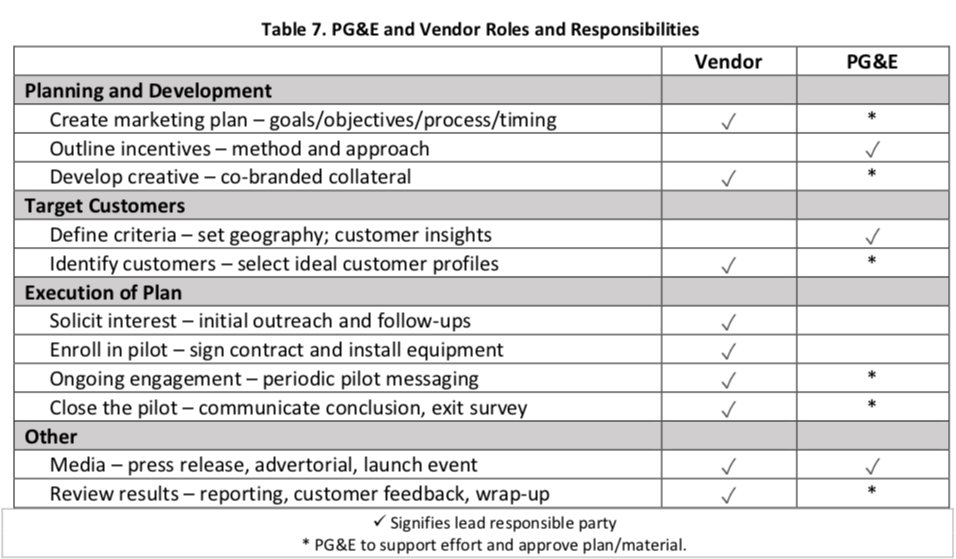

The report doesn’t name its partner on this project, referring to it only as the “vendor.” However, PG&E's Electric Program Investment Charge filings from 2016 (PDF) reveal that PG&E selected SolarCity (now Tesla) for its 2.03A project, “due to their large...residential market share and large amount of customers on impacted distribution circuits that is most relevant to test their technologies.”

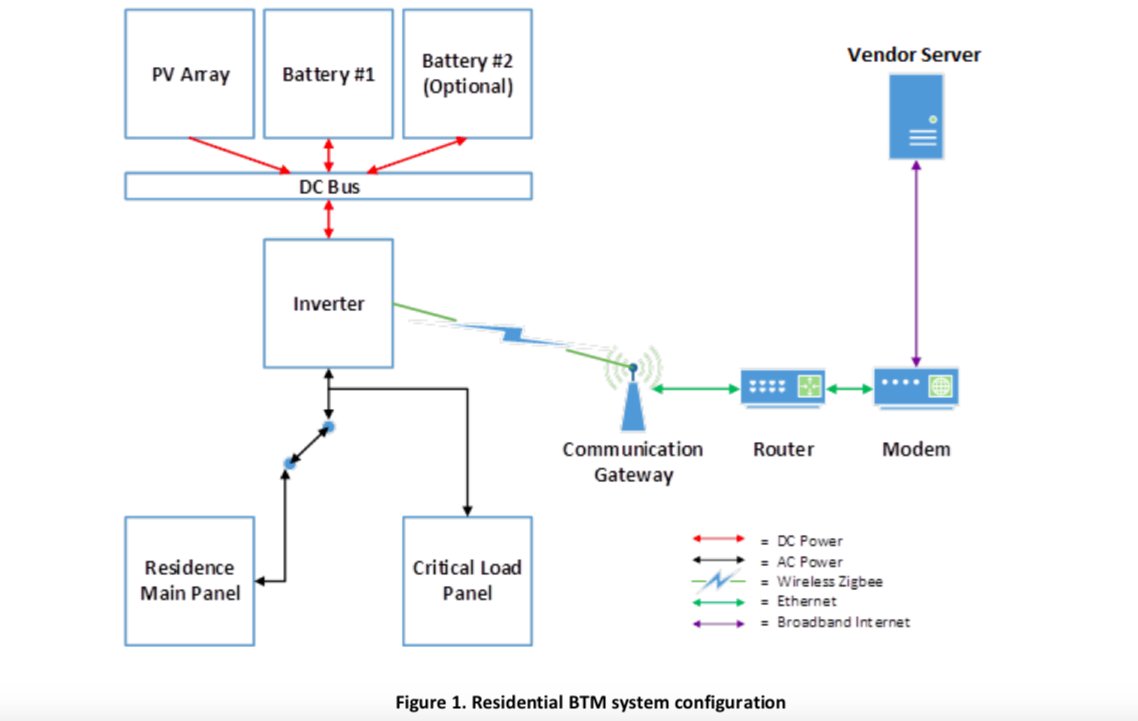

Here’s the schematic from PG&E’s report describing how each behind-the-meter system was set up.

According to Wednesday’s report, the test showed that smart inverters can indeed help with local secondary voltage through autonomous active or reactive power support. That’s good news, but largely to be expected. Most inverters have been technically capable of performing these kinds of phase 1 capabilities for years now. Hawaii has already worked with big solar inverter makers to retrofit their fleets to deal with solar-caused grid disruptions.

The tests also showed that “using a vendor-specific aggregation platform is possible” — a critical point for a system that’s built to support third-party-managed smart inverters, as well as those under direct utility control.

But PG&E attached several caveats to this finding. For this test at least, it had to “preload” many of the volt/VAR and volt/watt settings it dispatched through the vendor’s monitoring and control platform the day before the test occurred — not in real time, which “may be required for on-demand or active smart inverter use cases.”

The problems: Unreliable and insecure communications

While PG&E’s report did show some successes, it also revealed several problems related to expanding smart inverter capabilities beyond automated, preprogrammed responses.

The first relates to communications: the phase 2 capabilities meant to be supported by all new solar inverters in the state starting in early 2019. According to PG&E, “communication infrastructure performance must improve relative to what was observed in this project for use cases that require real-time active control at scale.”

That’s because PG&E found significant problems with SolarCity's use of “Wi-Fi internet in combination with ZigBee to communicate with the residential PV assets.” Here's PG&E's description of the communications pathway:

"The project utilized residential internet to communicate with the residential assets at Location 1. The commands were sent to the communication gateway, which were connected to the residential customer’s internet router by an Ethernet connection. The communication gateway stored the schedule and sent commands over the air to the inverter at the command execution time."

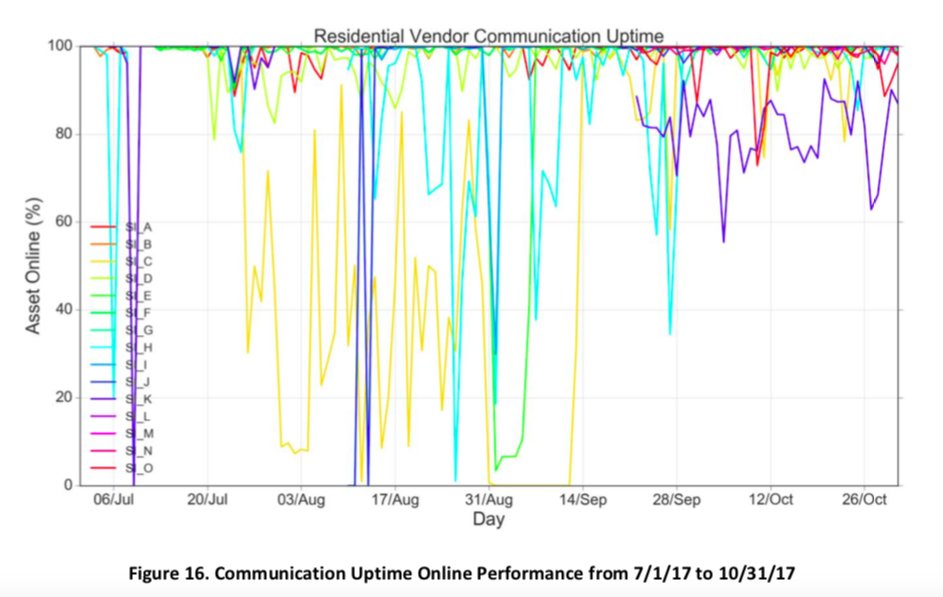

While that’s a low-cost solution, it wasn’t as reliable as PG&E had hoped. Communications uptime was greater than 99 percent only 5 percent of the time — the standard for many mission-critical utility communications systems — while the “probability of communication uptime being less than 95 percent was 15 percent,” a big margin of error in utility terms.

But to start using active or real-time control, PG&E believes it needs “more reliable and standardized communication performance.” Unfortunately, “as of this writing in July 2018, no such communication standards exist.” Nor do any national standards exist to ensure that [smart inverters] are implemented securely,” it noted. “Communication protocols for control and coordination are highly variable in the level of security offerings. Further exploration and testing is required to develop and validate cybersecurity requirements which safeguard against various threat scenarios intended to maliciously operate [smart inverters] outside of their expected manner.”

To be fair to solar vendors, PG&E also noted the need to develop many more capabilities internally before it can put securely and reliably networked smart inverters to use. “These new capabilities are currently being explored as part of PG&E’s distribution technology roadmap, which will seek to improve situational awareness and operational efficiency through implementation of an advanced distribution management system, additional SCADA enhancement and integration, advanced planning tools, and network upgrades.”

Two huge challenges: Getting customers to sign up and solving the real-vs.-reactive power value conundrum

This week’s report also revealed another problem with relying on customer-owned DERs to provide grid values — sometimes, the customers won’t participate.

Originally, PG&E was targeting about 200 kilowatts of solar resource to hook up with smart inverters. But as PG&E noted in its report, “despite an incentive in the form of a $300 credit and a free residential energy storage device, vendors had a difficult time acquiring customers, delivering only 130 kW of [smart inverter] controllable PV capacity, but only 62.5 kW of testable capacity due to delays in deploying the technology in the field.”

What’s more, that testable capacity — only 15 systems in total — was only finally achieved 10 months after the target date.

One of the key barriers to getting customers to sign up, according to PG&E, is also one of the most critical issues that needs to be solved before smart inverters can become fully functional utility assets. “Because the vendor transferred ownership for most of these systems to third parties, the vendor had difficulties obtaining permission from third-party owners to curtail active power due to contractual obligations to maintain full PV production output,” the report noted.

This, of course, is the primary reason why solar industry and clean energy advocates are worried about smart inverters being used by utilities — every unit of reactive power used to stabilize grid voltage is a unit of real power revenue lost to the system’s owner. GTM Research grid edge analyst Daniel Munoz-Alvarez has identified this as the chief policy “bottleneck” for enabling advanced smart inverter capabilities. As we noted in coverage at this month’s Intersolar conference, it’s very much a subject of debate before the California Public Utilities Commission.

This failure to gather the targeted amount of resource led PG&E to declare that that “targeted customer acquisition and deployment of customer-sited DERs is a significant project execution risk for grid investment deferral, especially under short project timelines.” It recommended that “customer acquisition risks should be more heavily weighted to establish more realistic timelines and projected outcomes for BTM projects, particularly when targeted deployment of DERs is required for safe operation of the grid” — as might be required for DERs that are serving as part of a non-wires alternative PV + storage capacity project.

Location 2: A heftier solar penetration challenge and a "vendor-agnostic aggregation platform"

PG&E noted that the smart inverter-equipped solar resources at Location 1 represented less than 1 percent of peak feeder demand, on test feeders with “a moderate level of [behind-the-meter] PV penetration with no observed voltage/power quality issues or reverse flow.”

To learn more about how smart inverters can help in cases of high solar penetration, PG&E is working on a “Location 2” test that’s going to look a lot different than its first test with SolarCity. It’s in an agricultural area, with a lot of interconnected solar — enough to serve about 70 percent of the feeder’s peak demand, and capable of causing “prior voltage and capacity constraints as well as observed reverse power flow.”

PG&E is working with JKB Energy to test smart inverter capabilities on one of the commercial-scale solar installations on this feeder — a big one, enough to serve about 35 percent of peak feeder demand. That will give it a chance to test how a large-scale, smart-inverter-equipped solar system might support primary voltage as well as secondary voltage.

This second test will also do something PG&E failed to do in the first test: “Evaluate customer energy generation curtailment as a function of SI settings.”

The solution to this is simple — just set up one inverter at each test site that doesn’t run the volt/VAR or volt/watt curves being tested by the others, and use it as a baseline to see how much real power was lost to inverters performing their reactive power duties.

PG&E is also using this Location 2 site to evaluate a “vendor-agnostic aggregation platform,” as contrasted to the single-vendor approach it took in the first project. “Location 2’s configuration will use a vendor-agnostic utility aggregation platform and existing satellite communications infrastructure to relay information from each solar PV site to a cloud-based server, where it will then be processed and sent to PG&E. Ideally, such a system can communicate to a number of different [smart inverter] vendors and installers found within a utility’s territory.”

The challenge ahead: Finding the costs and benefits across the PG&E system

PG&E’s report also highlighted how smart inverter testing will play into its looming requirement to value DERs as part of distribution grid investment plans, as required under regulation. By modeling smart inverter functions on several representative distribution feeders, PG&E hopes to “drive greater understanding of” the costs and benefits of smart inverter deployment based on grid characteristics, and how DER penetration and siting affects these values over time.

Complicating this task is the fact that many of PG&E’s smart inverter test sites are also testing behind-the-meter batteries as a grid resource. That includes its 2016 project with SolarCity and Enphase to test a distributed energy resource management system in San Jose — a project that also encountered its challenges in customer acquisition and communications reliability.

This, in turn, will play into the technically challenging task of evaluating the “impact of PV and PV + storage, with and without" smart inverters and comparing their costs and benefits to traditional distribution grid upgrades.

But PG&E also warned that it, along with most other utilities, lacks monitoring and control capabilities, making it difficult to determine “whether the [non-wires alternative] and the market benefits outweigh the integration costs, including storage, communications and grid infrastructure upgrades, that may be required to capture all of the potential DER benefits.”