U.S. utilities have spent the past half decade experimenting with different technologies and methodologies to aggregate distributed energy resources.

So how are these technologies being aggregated and integrated into virtual power plants?

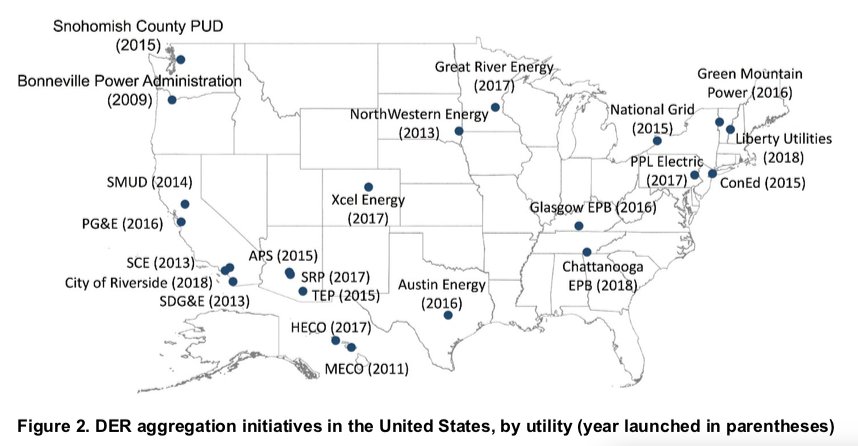

The Department of Energy’s National Renewable Energy Laboratory (NREL) has identified 23 virtual power plant projects across the country. Each project has a unique set of goals and mix of technologies designed to unlock new value streams for the customers and companies that are deploying them.

But how do these efforts compare to each other? To date, there has been little research on the “scope, performance, and lessons learned from utility-led DER aggregation projects,” according to a new report from NREL aimed at solving that problem. The 37-page report takes a close look at five specific DER aggregation projects to “compare lessons learned and identify common challenges and solutions that other utilities might consider when developing next-generation pilots and programs.”

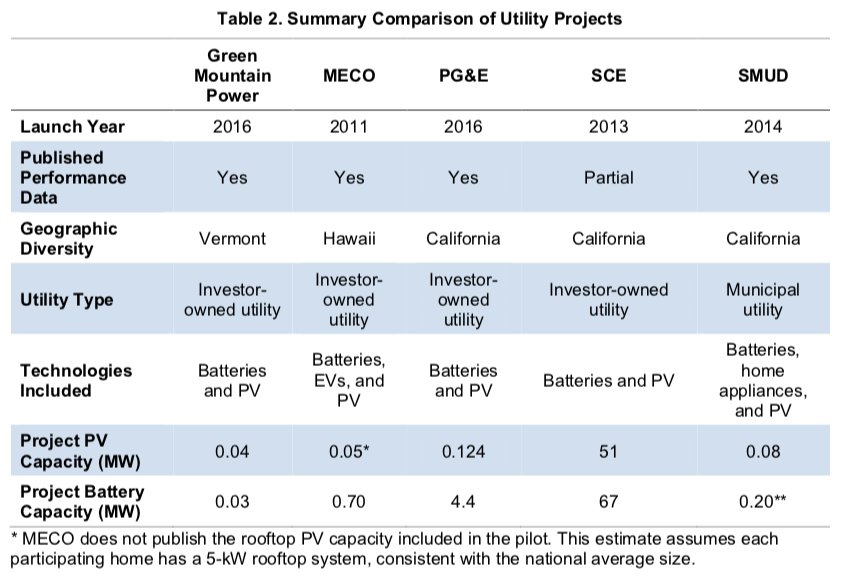

Three of the chosen projects are in California: Southern California Edison’s Preferred Resources Pilot, Pacific Gas & Electric’s San Jose EPIC DER demonstration projects, and the Sacramento Municipal Utility District’s 2500 R Midtown Project. The other two projects are Maui Electric’s JumpSmart Maui Project, and Vermont utility Green Mountain Power’s McKnight Lane Redevelopment Project.

NREL picked these five because they were focused on solar PV — one of the agency’s chief areas of research and development — and published DER performance data to work with. It also chose projects with significant differences in size, from Vermont utility Green Mountain Power’s 400-kilowatt McKnight Lane Redevelopment Project, to Southern California Edison’s 51-megawatt Preferred Resources Pilot. It also included a variety of technologies, including smart inverters, batteries, smart thermostats and electric vehicles.

This diversity of scale and scope “complicates comparison of DER performance and related grid value across the projects,” NREL noted. Still, each project demonstrated that DER aggregation can indeed provide some of the grid benefits that utilities were hoping to prove out, such as frequency response, load-shifting and voltage regulation.

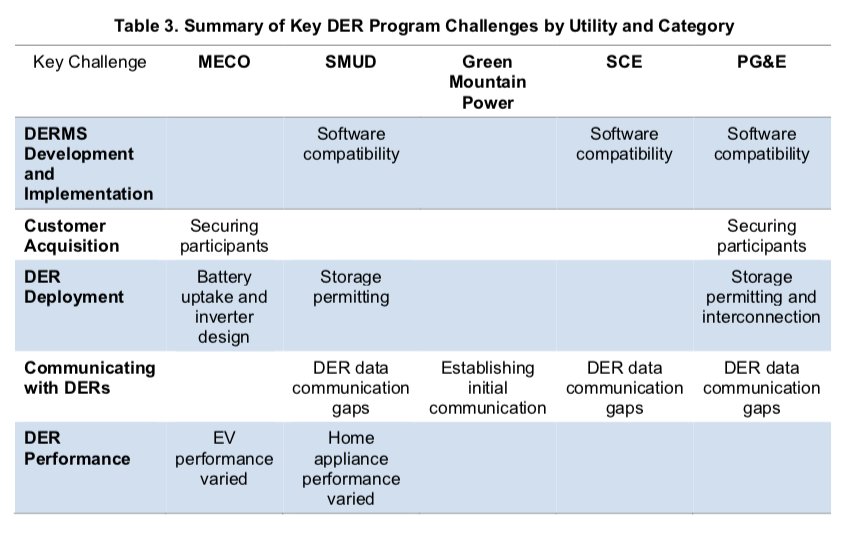

NREL’s five-project overview also identified common challenges faced by each utility, from getting enough customers on board to do the real-world tests in the first place, to getting first-time implementations of multiple technologies working together. NREL’s report provides useful context for how different utilities have encountered and reacted to challenges and what their experiences can teach those utilities still putting their pilot projects together.

Getting the customers — and the local authorities — on board

The first two common challenges identified in NREL’s report aren’t strictly within utility control, but still have an important effect on whether pilots can actually get started or complete their stated goals.

First is the customer-acquisition challenge — simply getting enough customers to sign up for the solar, batteries and other gear to be tested.

The second is making sure that the local “authorities having jurisdiction,” or “AHJs” — the city governments, fire departments, and other key agencies — are on board with the utility’s plans.

Customer recruitment has been a challenge for many of the projects. Maui Electric’s pilot with Hitachi, which launched in 2011, wasn’t able to get enough customers to sign up for solar paired with residential batteries to be able to test their efficacy in balancing electric vehicle charging and solar generation, despite boosting the incentives and outreach efforts partway through the project. The main problem was that Hawaii’s net metering structure at that time punished customers who stored solar energy on-site rather than feeding it back to the grid — a situation that’s since changed with the state’s new self-supply tariffs.

PG&E’s San Jose project, which launched in 2016, also had “unexpected customer-acquisition challenges, in part because the project needed to recruit non-PV customers because the original hardware configuration made retrofits difficult,” NREL noted.

Even projects like SCE’s Preferred Resources Pilot, which relied on contracts with DER providers rather than individual customer outreach, saw challenges in getting the mix of resources they were after. SCE’s first round of bidding for the PRP led to fewer PV bids and more energy storage bids than expected — quite possibly a reflection of the challenge solar aggregators would have had recruiting hundreds or thousands of homeowners to install solar.

Fire departments have stymied efforts to deploy behind-the-meter batteries in New York, and the projects reviewed by NREL reported some similar challenges for Sacramento Municipal Utility District’s 2500 R Street development and PG&E’s San Jose project, where city officials had to develop new expertise in permitting solar-battery projects that could have slowed the projects if they’d been on tighter timelines.

As with the Maui project, policy and technology developments since then may make future integration efforts far less onerous — “now that homes with PV systems can be more easily retrofitted with batteries due to hardware innovation, this challenge may be mitigated in other locations,” NREL noted. “Even so, utilities and other DER aggregation partners may wish to discuss battery storage deployment and permitting requirements with AHJs early in the process to address and resolve permitting issues.”

Getting the technologies right: Communications, integration and optimization at scale

The second set of common challenges were focused on technology integration — specifically, ensuring reliable communications between utilities, aggregators and DERs, and more accurately analyzing “technology mix, operation protocols, and consumer behavior” to ensure DER performance.

Communications problems were reported by all of the projects that NREL surveyed, except for Maui Electric’s project. Green Mountain Power’s McKnight project, which involved net zero-energy homes outfitted with solar, batteries, efficient heating and utility-to-DER controls, dealt with “challenges with establishing communication between the batteries and the DERMS, stemming in part from battery or inverter hardware issues,” which in some cases required replacing the equipment. Even when the batteries were deployed and communication systems tested, Green Mountain Power “still faced communication issues when calling on the batteries to respond,” requiring frequent visits back to the site to reestablish communications with the modems that controlled the batteries.

PG&E also faced challenges with coordinating the systems of the aggregators it was working with, Tesla’s SolarCity and Engie’s Green Charge Networks, with the different sets of communication standards it was using. Even when utilities were able to establish effective and consistent communications, as Southern California Edison's and Sacramento Municipal Utility District’s projects demonstrated, they still experienced some challenges with managing the data they received in response from DERs, the report noted.

NREL stated that one of the people it interviewed for the Sacramento Municipal Utility District (SMUD) project said that “communicating with specific third-party platforms was not the key challenge; rather, it was difficult to identify cost-effective pathways to manage integration and data exchange across the utility and third-party platforms.” While technology improvements may make this task simpler in the future, this interviewee opined that “open communication platforms will be hindered by third-party interests to protect proprietary information” — a factor that’s yet to be tested out at scale.

As for the challenge of getting the required performance out of DERs, NREL’s report primarily focused on the troubles that SMUD had with the smart thermostats and remote-control “modlets” that could turn off the appliances that were plugged into them. “Smart thermostat performance was inconsistent, and the cooling data were not fully available, prompting SMUD to call for additional analysis into the value of these resources” the report noted, while the modlets simply yielded too little demand response capacity for their cost.

Finally, the NREL report highlighted that “to scale DER aggregation programs, utilities likely need to develop a DERMS and find cost-effective pathways to integrate DERs with different communication protocols.” The five projects reviewed by NREL have different approaches and goals when it comes to developing a distributed energy resource managament system (DERMS) to control them all. Maui Electric’s project, which officially closed last year, ran on Hitachi’s Smart City Platform DERMS. Southern California Edison's and SMUD’s projects got underway before either utility had formalized any plans for systemwide DERMS, with SCE using a test DERMS but expecting to adopt a full DERMS in the years ahead. PG&E’s project was specifically aimed at testing General Electric’s DERMS platform, and Green Mountain Power used a DERMS platform developed by Virtual Peaker, a Kentucky-based startup.

The DERMS moniker can be used to describe demand response platforms that don’t have much integration to the grid, or advanced distribution management system capabilities that don’t have much connection to behind-the-meter DERs. But according to Wood Mackenzie Power & Renewables research, no utility has yet deployed a true “enterprise DERMS” platform that incorporates all levels of this integration challenge.

NREL notes that a DERMS “likely will be essential to scale aggregation programs given the need to develop situational awareness of DER performance, the ability to securely and reliably interact with those DERs, and optimally dispatch them to provide grid services autonomously.” While this is a significant challenge, NREL suggested that Green Mountain Power's and PG&E’s decisions to phase in DERMS functionality over time “may help mitigate some of these challenges” and “could serve as a model for other utilities.” That’s a commonsense suggestion, given that the technology involved is still very much in evolution, whether on the utility side or the DER aggregator side.