There’s much to celebrate about the U.S. solar market’s performance in 2017. As I wrote in my previous State Bulletin, total U.S. PV capacity officially passed the 50-gigawatt milestone, community solar emerged as a strong new sector, and several states put themselves on the map as burgeoning home solar markets.

But there’s more to the residential solar story. The segment didn’t only see growth slow last year, it actually saw a market contraction for the first time since GTM Research started tracking the market, according to the U.S. Solar Market Insight 2017 Year in Review.

The Solar Energy Industries Association highlighted the fact that 25 of the 44 states tracked in the report saw year-over-year growth in annual residential PV installations last year. The increasing geographic diversity of states deploying solar is undoubtedly an encouraging sign, although it’s worth noting most of these emerging state markets are still at a very early stage, with less than 5 megawatts of residential solar capacity installed to date.

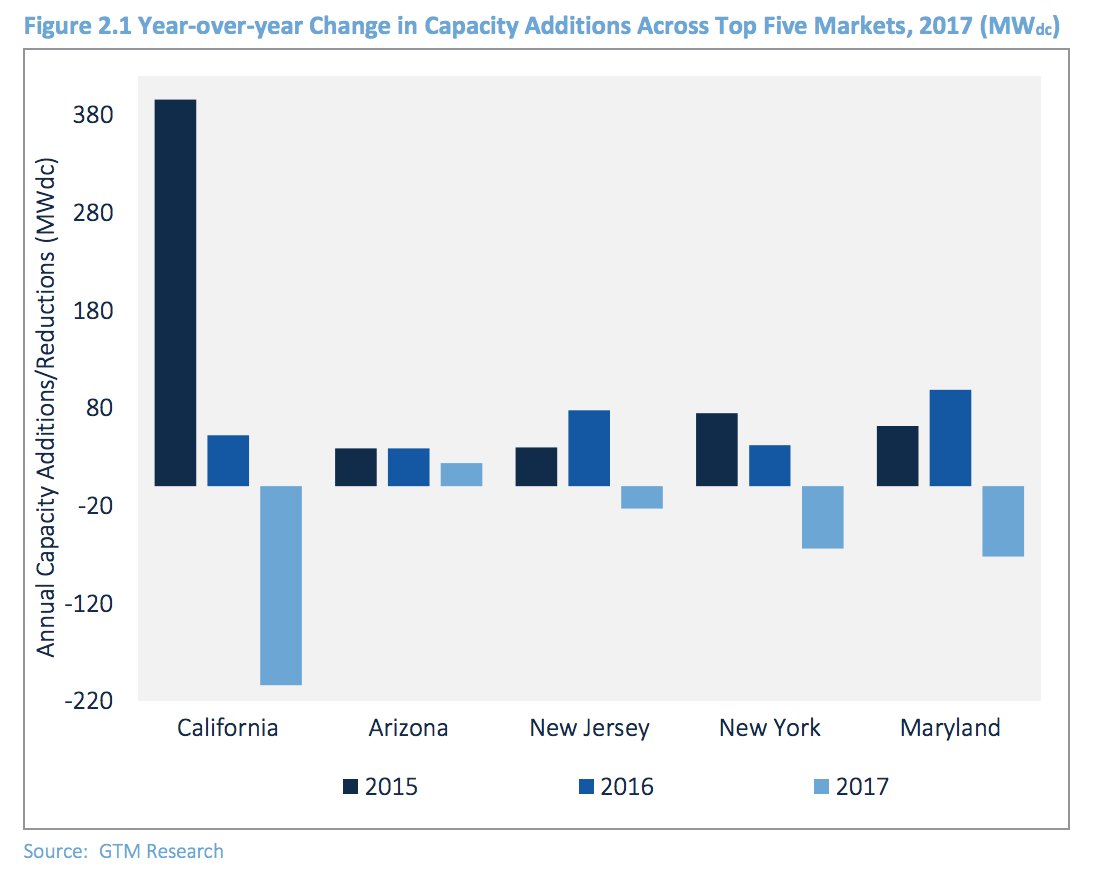

Another troubling factor is that among the top 10 state markets for residential solar in 2016, only two — Arizona and Utah — saw annual growth in 2017.

Policy is often pointed to as an impediment to solar market growth, especially in the residential space, where net metering continues to play a major role in making solar affordable. Some advanced solar states have started to reform their NEM policies. But, as I explain in this week’s column, these reforms can’t be blamed entirely for last year’s residential sector slowdown.

The impact of NEM 2.0 was "limited"

Let’s start with a look at California, which accounts for nearly 40 percent of the residential market. Because of its size, California’s slowdown accounted for half of the losses in megawatt terms last year relative to 2016.

California’s change of pace isn’t entirely new. The state’s slowdown was apparent back in first quarter of 2017, at which time the decline in new capacity additions could be blamed in part on an unusually rainy winter.

Policy changes also influenced the market, but they didn’t necessarily trigger a slowdown. Over the course of the year, all three investor-owned utilities in the state transitioned to NEM 2.0, an interim policy measure that maintained net metering credits at the retail rate, but introduced time-of-use rates, interconnection fees and non-bypassable charges.

While that sounds like a lot of change, the impact on project economics has been modest. The one-time interconnection fee is somewhere between $130 and $145, and the non-bypassable charges, which go toward funding energy efficiency and low-income customer programs, add up to around 2-3 cents per kilowatt-hour — and only for the electricity solar customer purchase from the grid.

The switch to time-of-use (TOU) rates under NEM 2.0 has required some customer educating, but GTM Research analyst Austin Perea noted the move to TOU didn’t materially change project economics last year. In fact, the TOU rate structure was mostly to the customer’s benefit, he said, because the utilities compensated solar customers more during peak hours that were set during the middle of the day, when the sun is shining.

Based on discussions with solar installers and internal modeling exercises, the difference between NEM 1.0 and NEM 2.0 last year proved to be “limited,” said Perea. The move to the new rate pushed back the payback period for home solar customers roughly just three to six months.

California TOU rates are changing to later in the day, when the sun isn’t as strong, which makes residential solar less economically appealing. But the shift is also considered necessary to align customer incentives with the needs of the grid. By 2019, TOU rates will be mandatory for all California electricity customers, not just solar ones.

Still, when it comes to the price impact NEM 2.0 had on residential solar in California last year, by GTM’s calculations, it was minimal.

“There definitely is some limited impact on economics,” said Perea. “But it’s just not to the extent that I think it’s actually the primary mover behind why we’re seeing the downturn.”

In fact, the move to NEM 2.0 slightly boosted demand for residential solar in California, as some customers rushed to get in on the old rate. But the moderate demand pull-in around those transitions was not enough to mute the impact of other factors. Specifically: large firm pullback and customer-acquisition challenges.

Slowdown not specific to a company or state

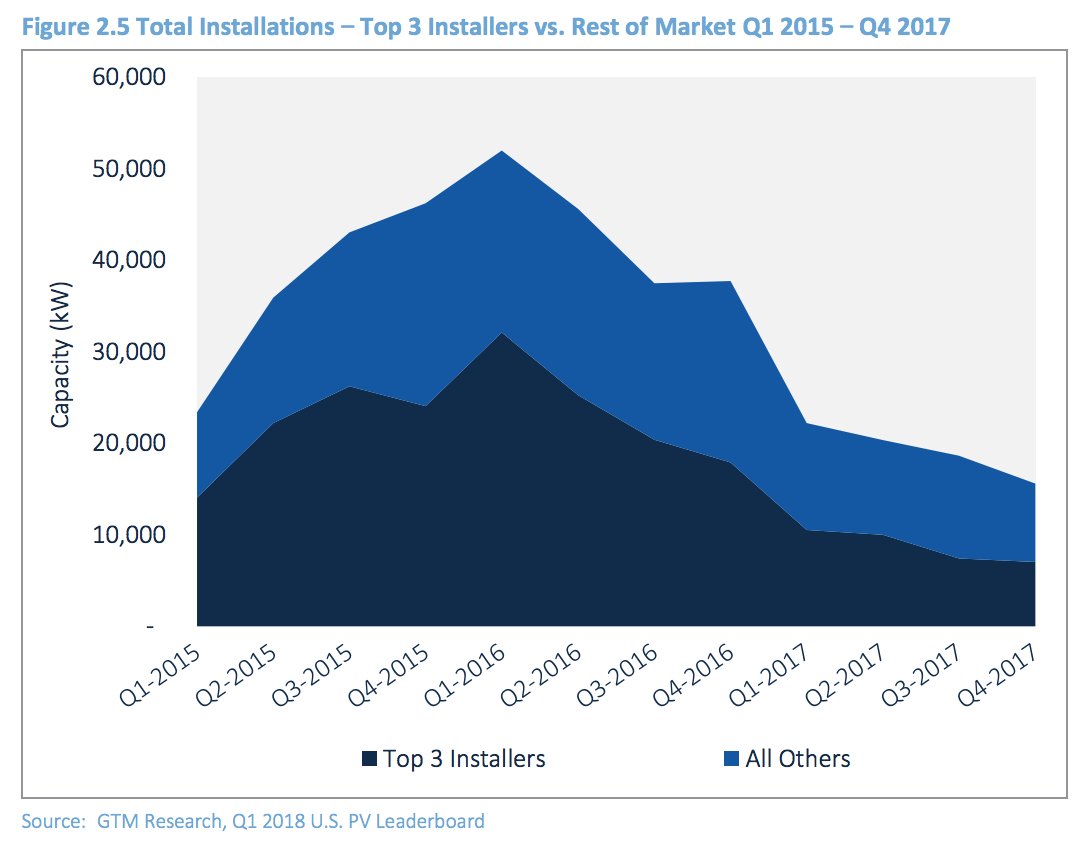

Over the course of the last year, national residential solar installers shifted their strategies away from third-party ownership. This trend was especially pronounced in California, which saw a record low third-party ownership rate of just 30 percent in Q4 2017.

This trend emerged in recent months as some of the largest national installers have sought to rejigger their product offerings to improve their cash positions. “The transition to a direct-ownership model is not an easy one, as companies must retrain their sales teams, which can be a multi-month process; this is affecting installers across the board,” the SMI report states. SolarCity in particular has become much less aggressive since being acquired by Tesla.

On top of that, national installers are the most exposed to customer acquisition challenges. According to Perea, low-cost sales channels (i.e., referrals) are difficult to replicate at scale. Nonetheless, national installers are working hard to bring customer acquisition costs down.

What’s surprising about the latest SMI report is that it revealed smaller installers are now starting to have difficulties in California, too. “Even small and medium-sized installers, which collectively have been gaining market share each quarter, saw smaller installation volumes in 2017 than in 2016,” it states. “This group includes large regional players, small local installers, and hundreds of electricians and builders who also install solar.”

The impacts of customer-acquisition challenges were not uniformly felt across the installer landscape, however. Medium-sized installers tended to perform the best in California last year. Furthermore, some of those companies sold only leases while others sold only loans. “The key to healthy growth in California and other major markets is much more a function of how installers are selling their products as opposed to the products themselves,” the report concludes.

How residential solar is sold going forward will be paramount, especially since this isn’t just a California problem. The Golden State had the first residential solar market to show signs of slowing in late 2016. In 2017, the trend spread to nearly all of the top 10 residential solar markets of the previous year.

Confronting market saturation

As prickly as it is to consider, rooftop solar could have a saturation issue. And if it does, it’s worth wrapping one’s head around in order to come up with effective solutions, especially since policies are only expected to get more complex in future.

Massachusetts — the sixth-largest residential solar market in the nation — offers another case study on this matter. Residential solar installations fell by 49 percent in the state between 2016 and 2017. Though several policy changes were underway last year, the lucrative SREC-II program was largely intact throughout 2017, the SMI report notes.

Larger installers account for a disproportionate share of the Massachusetts slowdown. But unlike in other state markets where small and medium-sized installers have partially offset slowed growth among national providers, growth in 2017 was hard to come by across residential installers in Massachusetts.

“From everything that we’re hearing, the pool of early-adopter customers is just growing increasingly thin, especially given the price point that residential solar currently is at,” said Perea. “Even though there are third-party party leasing options, and obviously the price of solar has come down significantly over past few years, that makes cash and loan sales a much more attractive savings proposition. But even with those things in mind, I think we’re passing the point, especially in major markets in California and the Northeast, where early adopters can be the primary customer demographic.”

The problem is that reaching mass-market consumers is a lot more difficult — and more expensive. Also, while the U.S. solar industry may need to grapple with some fundamental business marketing questions, many believe policy remains critical.

“It’s true that in both Massachusetts and California, the overlay of net metering hasn’t changed much…but net metering is only one of the three or four stools that prop up solar demand,” said Sachu Constantine, managing director of regulatory affairs for Vote Solar.

Lingering uncertainty around the future of the federal Investment Tax Credit impacted the U.S. residential solar market last year, he said. Proposed changes to state incentive programs also had an effect. The transition away from Massachusetts' SREC program, for instance, was hotly debated through 2017. The state’s new SMART incentive program was also contested last year, and the program design continues to raise concerns, although it hasn’t been implemented yet.

“It’s hard for even us to understand exactly how these transitions were going to happen, so you can imagine how a consumer thinks when they’re trying to understand how to go solar,” said Constantine.

Then there’s uncertainty at the federal level under the current administration, as well as at the local level as utilities seek to introduce rate changes, like demand charges and fixed charges, that hurt the economics for residential solar.

“Yes, there’s a slowdown, but there’s still a robust residential solar market,” Constantine said. “I think there’s still policy uncertainty and policy drag that we need to clear away before we can say this is the natural state or size of the market.”

The solar industry has done a really good job with net metering and rates up until now in order to appeal to single-family homeowners in moderate- and upper-income communities. But as a result, the industry hasn’t effectively addressed other segments of the market, including apartment dwellers, low-income families and people with unsuitable roofs, he said.

“I don’t know if we’re at a saturation point, but I know we need to enhance the value for a broader set of the community,” said Constantine.

“Regardless of your opinion on [saturation], we in the solar industry need to do a better job of reaching broader segments of the mass-market access to the solar economy; whether through shared solar options, or better financing options for low-income residents, or even improved green tariff offerings,” he said. “That’s the task that’s in front of us.”