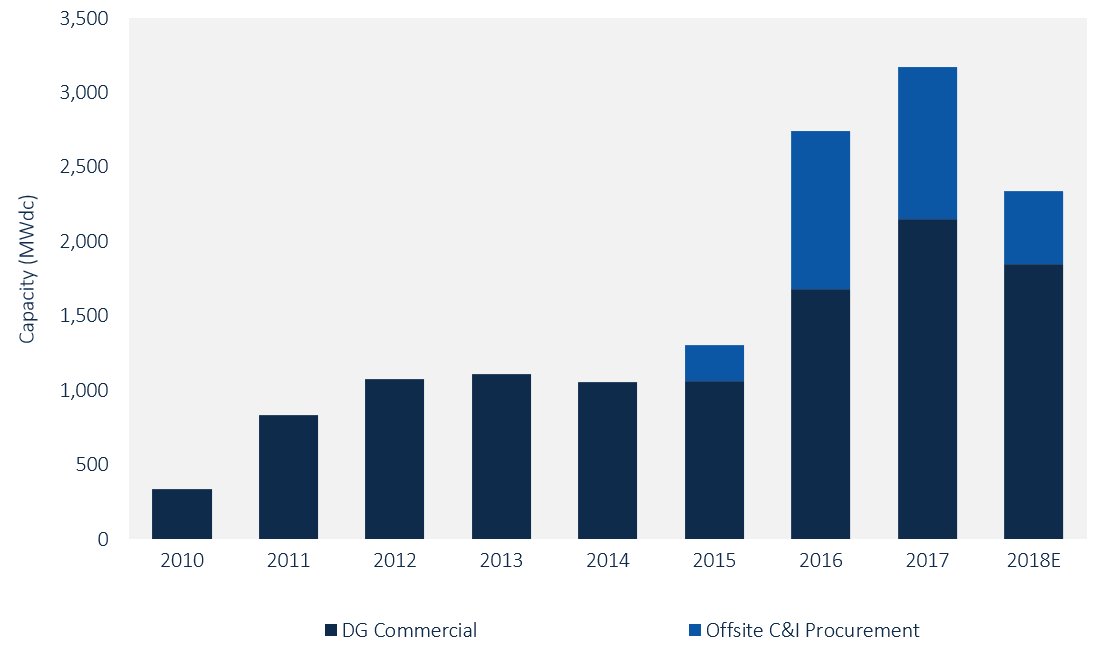

At Greentech Media, we’ve repeatedly covered the challenges confronting commercial clean energy projects, particularly solar, as well as the upswing in corporate solar purchasing.

While commercial solar projects can be fragmented and difficult to finance, corporations are increasingly dipping into solar. According to GTM Research, corporate solar installations exceeded 3 gigawatts in 2017 and the U.S. now has 11.6 gigawatts of projects — including offsite, distributed, front-of-the-meter and behind-the-meter — with corporate or commercial offtakers.

Annual U.S. Corporate Offsite and DG Solar Installations (MWdc)

Source: GTM Research U.S.Distributed Solar Service

Complications in the commercial solar space have compelled some companies, such as Tesla, to investigate the full ownership of projects from start to finish. Others have focused on virtual PPAs and offsite solar.

Whatever the route businesses choose, recent reports detailing corporate thoughts on clean energy procurement show the sector’s hurdles are not keeping companies from increasing their uptake in renewables. Instead, many are actively adjusting energy management priorities to consider clean energy.

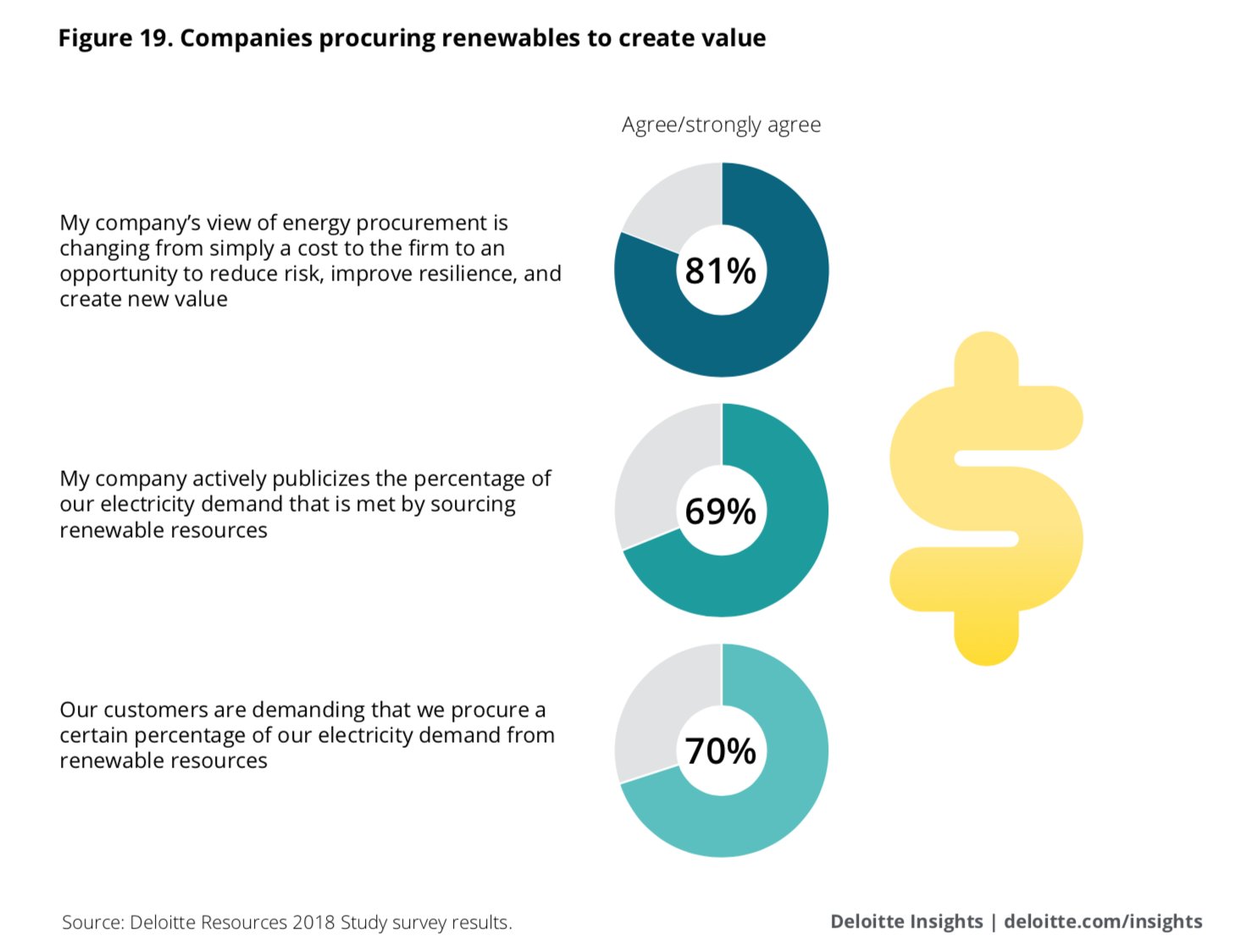

This shift in attention paid to clean energy acquisition is especially notable because, according to a report prepared by consulting firm Deloitte on business energy decisions, companies are no longer making these decisions solely on the basis of cost.

In a survey of 600 business leaders, more than eight in 10 said their energy procurement decisions are no longer dictated by just cost. Instead, companies are considering the creation of new value and added resilience.

While clean energy has become more affordable, general consciousness and interest in renewable energy has made companies begin thinking more about the value of their portfolios beyond securing the cheapest energy possible.

Consumers have compelled much of that consideration, with 70 percent of companies saying they felt pressure from customers to source energy renewably.

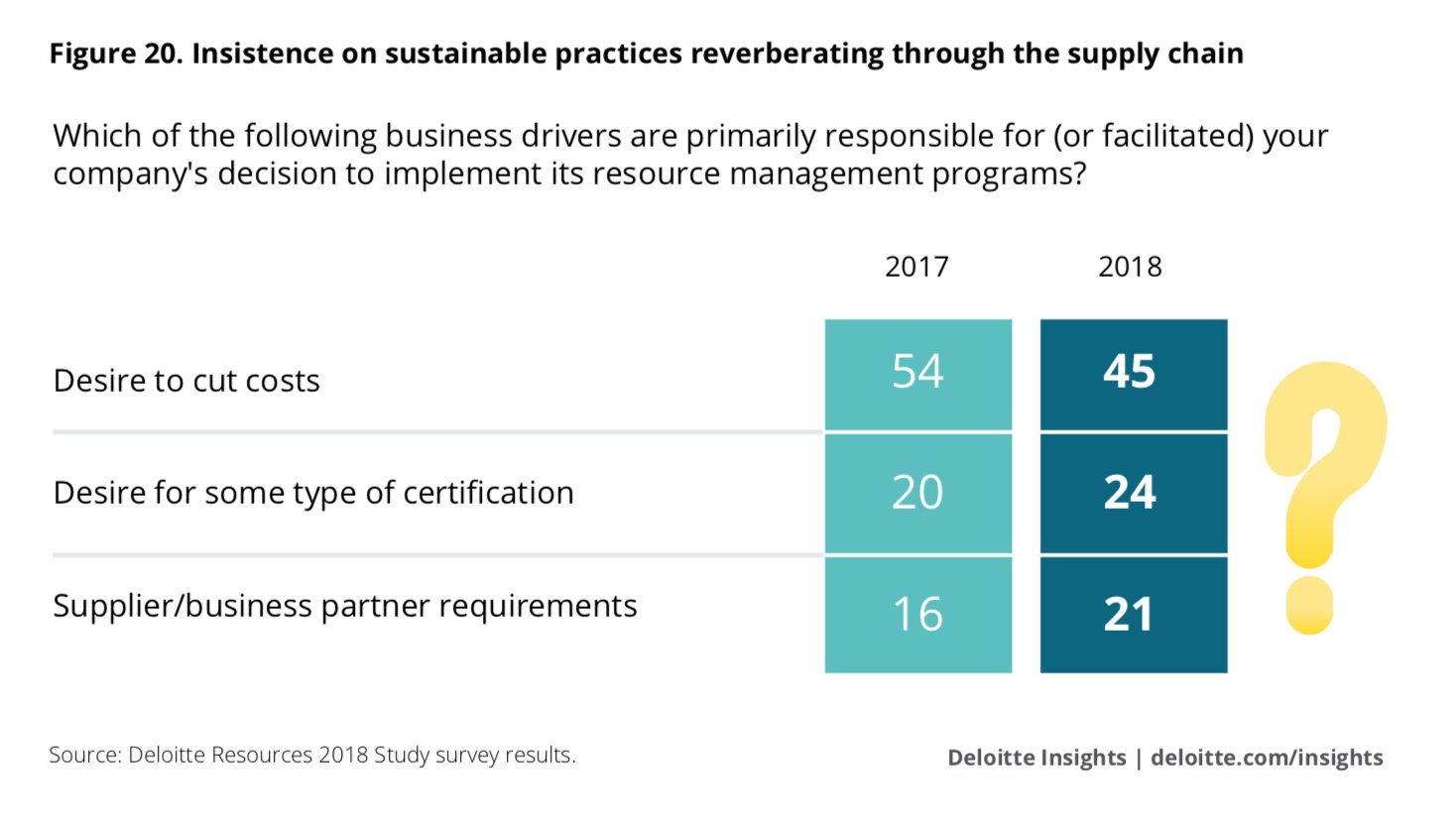

The percentage of companies citing “desire to cut costs” as being primarily responsible for their resource management fell by nine points over last year’s Deloitte survey. Deloitte notes that “this suggests that companies are responding to changing expectations about sustainability, which are permeating the broader business environment.”

That said, Deloitte still recognizes that cost-cutting remains the prime consideration of corporations. With a capitalistic focus on the bottom line, that’s unlikely to completely change even as other considerations such as the value of clean energy resources come into play.

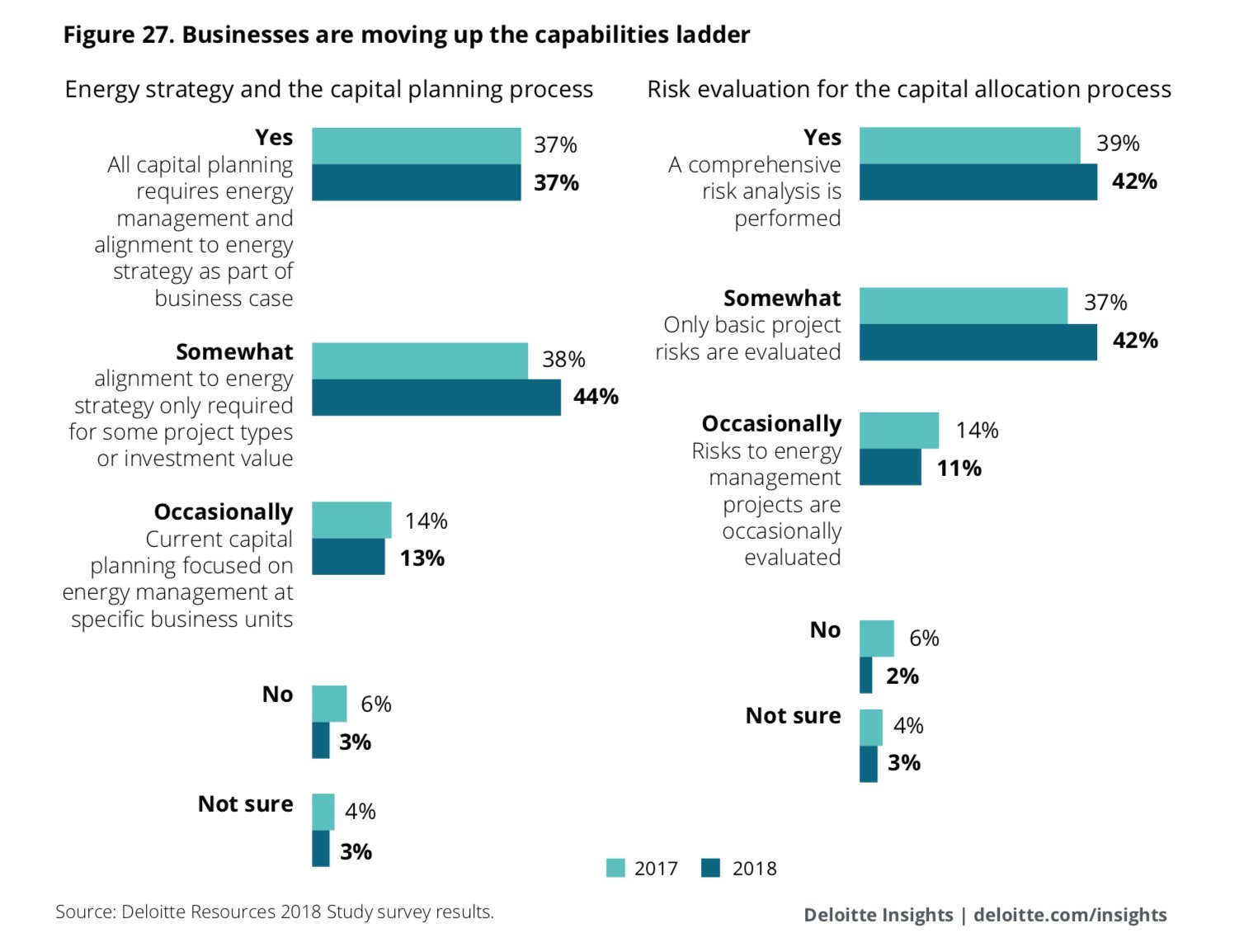

The number of companies growing their energy management, though, indicates to Deloitte that “companies are moving up the maturity curve” in how they think of diverse energy resources. While this year the percentage of companies that said they always consider energy management in business decisions remained the same, more companies said they somewhat consider it and fewer said they occasionally or never do.

“It seems the vast majority of companies have not only developed at least a basic level of capability in nearly every survey category, but they are extending the reach of their energy management efforts into more areas of business,” the authors wrote.

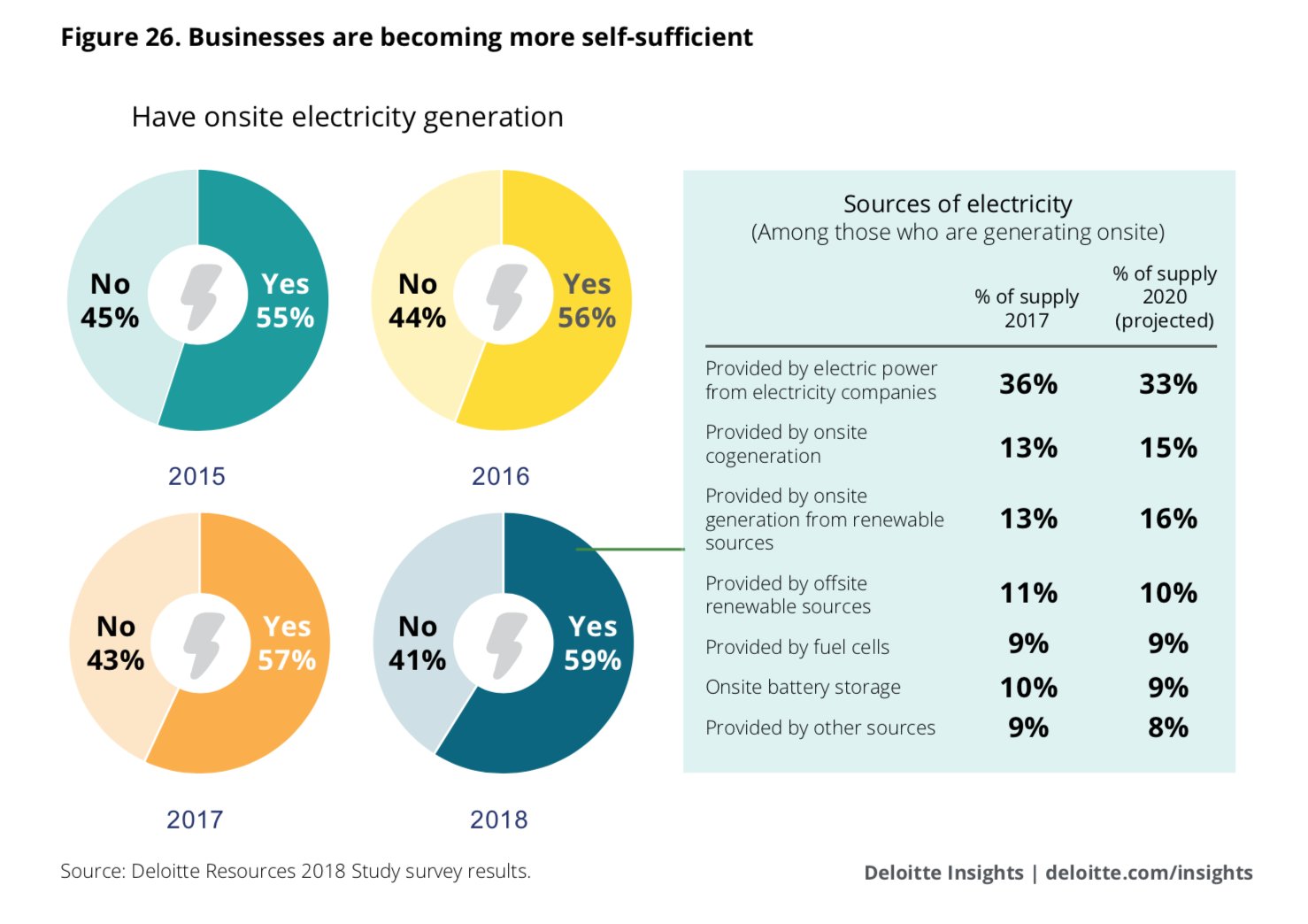

In addition to making decisions while considering energy management, companies have shown increasing interest in locating electricity generation on the site of their operations. The percentage of businesses with a self-sufficient energy source has increased steadily from 2015, rising 4 percent to 59 percent this year.

Of those companies supplying their own energy, more will choose renewable generation in the future and fewer will rely on power from electricity companies. Almost half of company respondents to the survey said they were working to procure more electricity from clean sources.

As more retailers and businesses get in the game, GTM Research forecasts that third-party ownership — which offers commercial offtakers more flexibility — will become increasingly popular. By 2021, GTM Research projects third-party ownership could account for 78 percent of commercial solar projects.

But analysts note that recent trends indicate commercial and industrial customers have moved toward more direct ownership — like in the Tesla example — and third-party ownership has dropped from 38 percent of projects in the last seven years to 27 percent in 2017.

Interestingly, while more companies seem to be coming around to solar, it may not be the case for more fledgling technologies like battery storage. Over 60 percent of the companies not working to procure clean-powered electricity told Deloitte they’d be more likely to do so if battery storage was included, indicating an understanding and familiarity with the technology. But in 2020 the percentage of supply using onsite battery storage is still set to decline marginally.

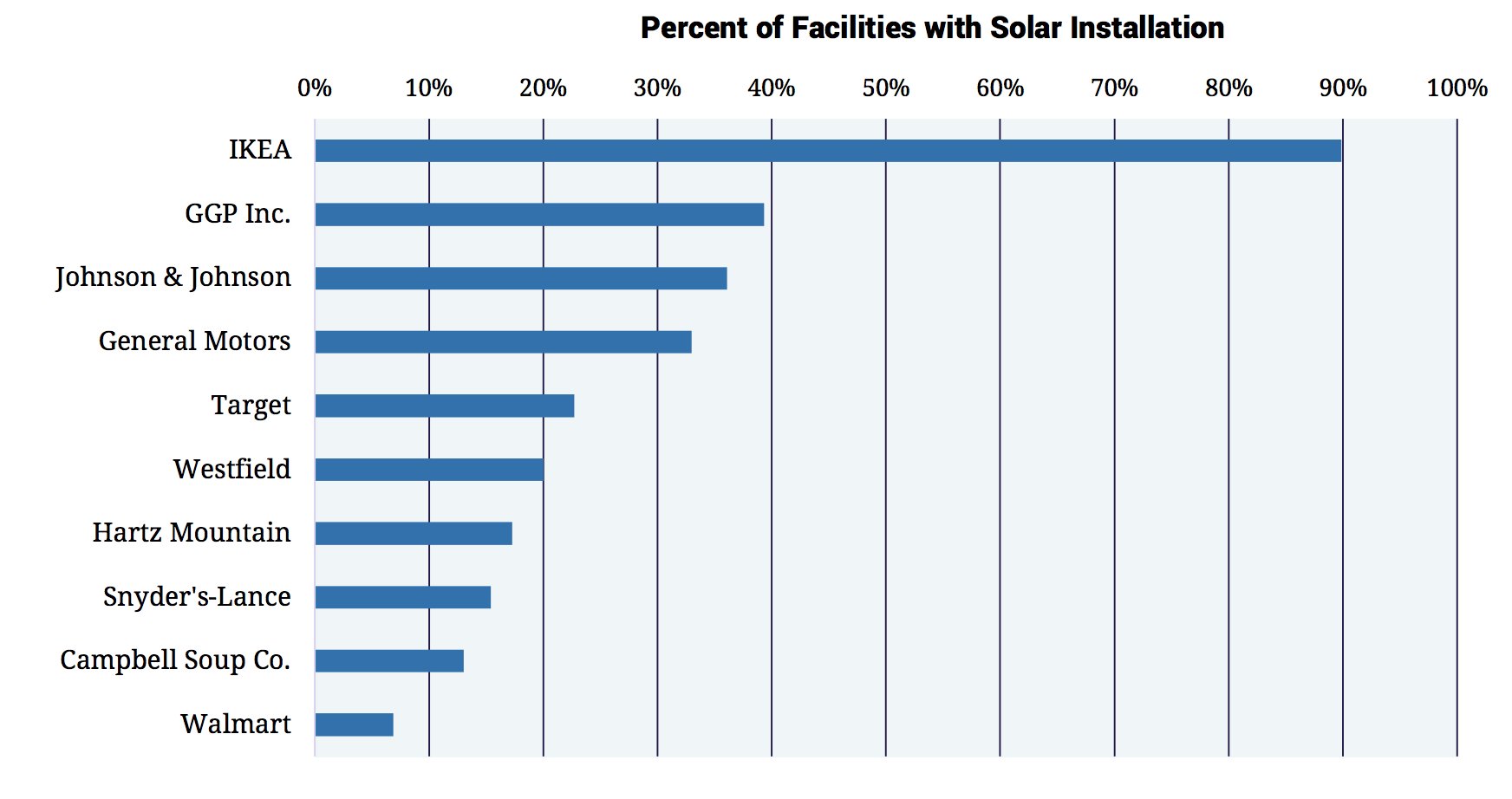

Deloitte's survey covered a wide swath of potential commercial and industrial customers, but among companies that are moving ahead with sustainability and renewable energy goals, several are leagues ahead of others.

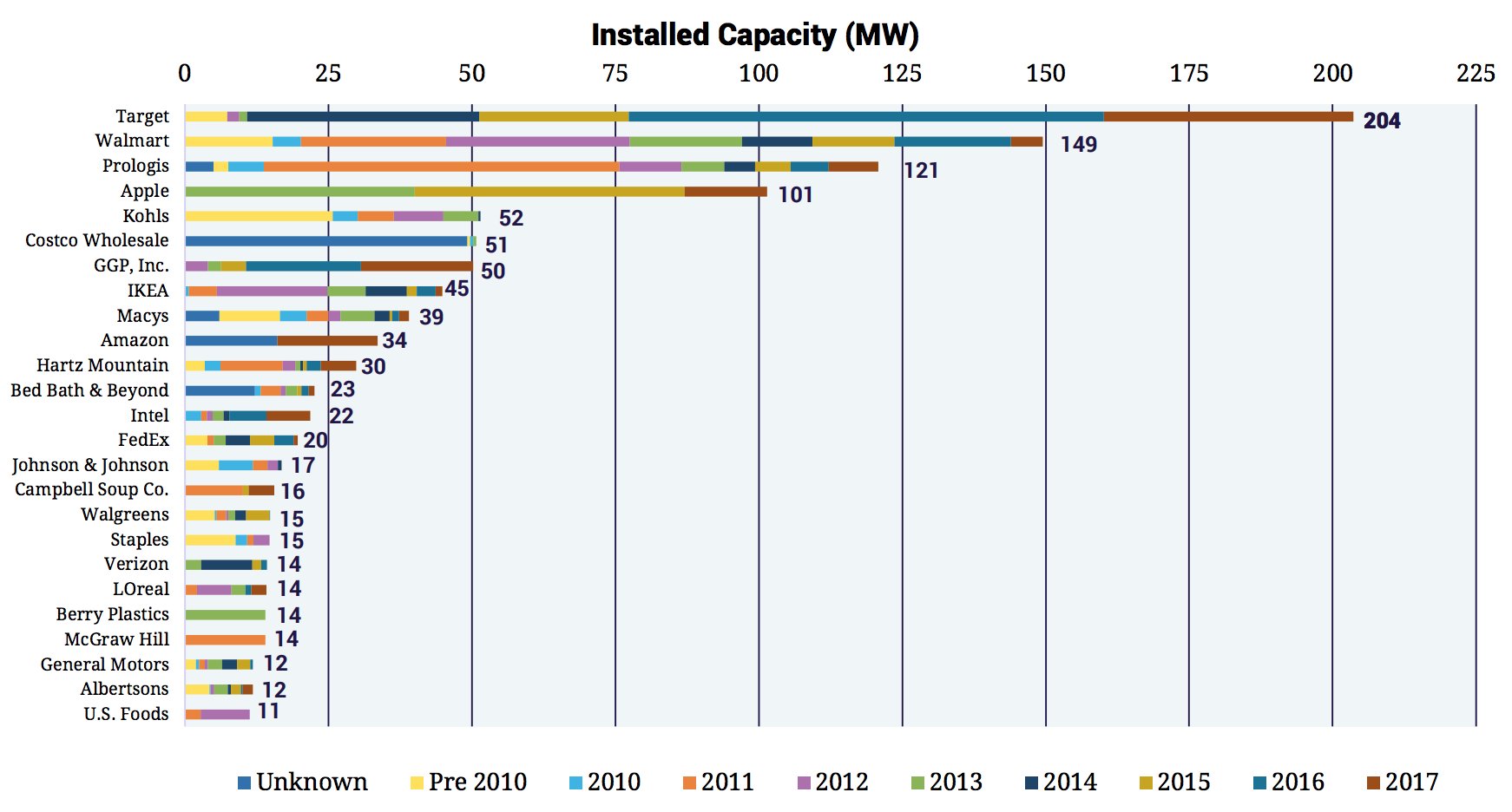

An analysis of the top corporate installers of on-site solar from the Solar Energy Industries Association gave Target the top spot for the second year in a row. But even among peers, such as Walmart and Apple, Target's installed capacity on-site far exceeds others. Walmart, Prologis and Apple are the only other companies that have installed more than 100 megawatts.

Source: Solar Energy Industries Association

Last year the company announced a goal to power 100 percent of its operations using renewable energy. Target’s total installed capacity now tops 200 megawatts located at 436 locations. In SEIA’s 2016 report, Target was reported to have installed 147.5 megawatts.

SEIA’s analysis showed 2017 as the third biggest year for installations by the companies they monitored, driven by falling costs as well as changes in state-based incentives, where subnational governments are working to fill in gaps left by a federal administration wary of clean energy.

The wide spread of companies noted in the report indicates that more businesses considering clean energy procurement and solar goals. But at the same time, project sizes are shrinking. Small-time installations from Albertsons and Walgreens are much more common than Target's ambitious position.

Higher numbers of small installations, such as Extra Space Storage's projects approaching 100 installations, indicate quantity rather than capacity may be more attainable for companies with smaller building footprints. Still, the storage company recently announced it would add 6.7 megawatts at 58 sites throughout nine states in a partnership with developer Safari Energy.

In the announcement on the projects, Safari Energy's Senior Vice President of Facilities Tim Arthurs hit on values that Deloitte detailed as a trend. "We are pleased that through our solar initiative we have been able to be good corporate citizens, while also creating value for our shareholders," he said.

Source: Solar Energy Industries Association

Source: Solar Energy Industries Association

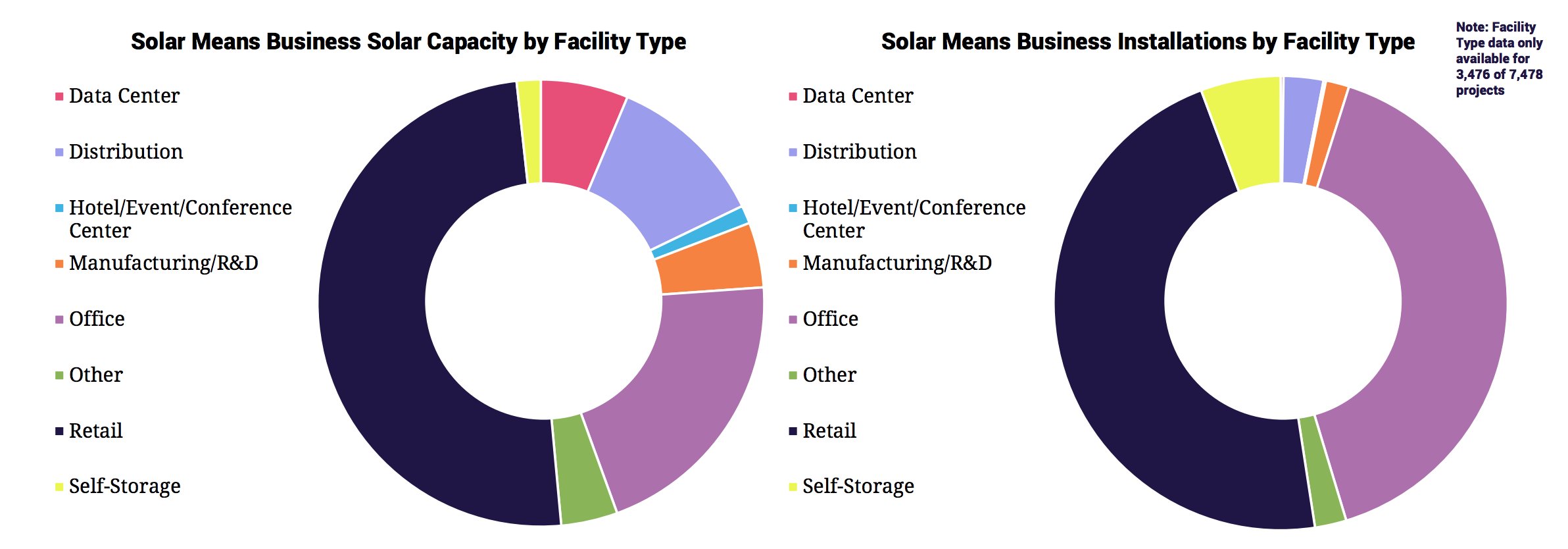

The types of facilities with solar installed underscores Ikea’s edge; retail still dominates the capacity category in the SEIA breakdown of facility installation by type (although it considers less than half of the facilities it includes in the rest of the analysis).

Source: Solar Energy Industries Association

Data centers account for a sizable chunk of capacity, too. And with more technology companies like Apple and Amazon growing their clean energy portfolios and goals, that’s likely to increase. Following the construction of its new 100 percent renewable-run headquarters, Apple announced in April that it had achieved its goal for all of its facilities to run on clean energy.

Despite promising trends — and flashy headlines like Apple's — the C&I space remains ripe for development, if corporations put the work in. As GTM Research senior solar analyst Michelle Davis noted in an April report, “commercial solar is still bogged down by high transaction costs, long development cycles, and lack of access to attractive financing.”

Though research shows corporate interest seems to be ballooning, currently less than 1 percent of U.S. business-owned facilities have gone solar. Even in leading solar states, such as California, the percentage of facilities using solar doesn’t exceed 3 percent.