The Cape Wind project in Massachusetts was vital in starting the conversation on offshore wind in the United States, but 15 years after it was first proposed, the project is still mired in regulations and litigation. In Maine, regulators selected two offshore wind pilot projects to receive long-term contracts, but only one is advancing today. In New Jersey, the Atlantic City Wind Farm, a fully permitted 24-megawatt project, has stalled without approval to participate in the state’s offshore wind renewable energy credit program.

Needless to say, offshore wind has had a rough go of it in America so far -- despite significant technical potential.

It doesn’t have to be that way, though. A recent DOE-funded report, led by Massachusetts, New York and Rhode Island, examines the potential for policy action that could bring offshore wind to scale in the Northeast. Another new report by UC Berkeley examines policy options for offshore wind in California. This week’s State Bulletin dives into the offshore market.

A roadmap for expanding offshore wind in the Northeast

Massachusetts, New York and Rhode Island have joined forces to explore the potential for mutual action to develop offshore wind in the U.S. at the scale. The initiative, dubbed "A Roadmap for Multi-State Cooperation on Offshore Wind Development,” resulted in three analytical reports that were publicly released earlier this month.

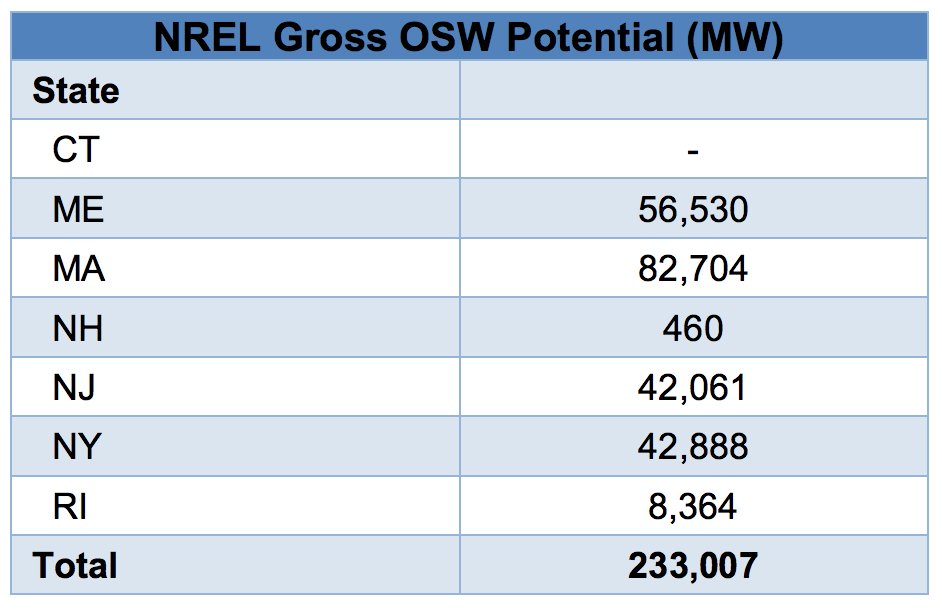

One of the reports, "Northeast Offshore Wind Regional Market Characterization," kicks off by highlighting the potential for offshore wind in the Northeast. These states “are well positioned to benefit from the deployment of offshore wind (OSW) as a resource that can stabilize volatile energy costs, create clean energy at a scale that can contribute to replacing the region’s retiring fossil-fueled and nuclear plants, diversifying the supply mix of a region heavily reliant on natural gas, meeting the region’s goals for reducing greenhouse gas emissions from the energy sector, and creating significant numbers of local clean energy jobs,” according to the report.

Gross Regional OSW Resource Potential Between 12 and 50 Nautical Miles From Shore

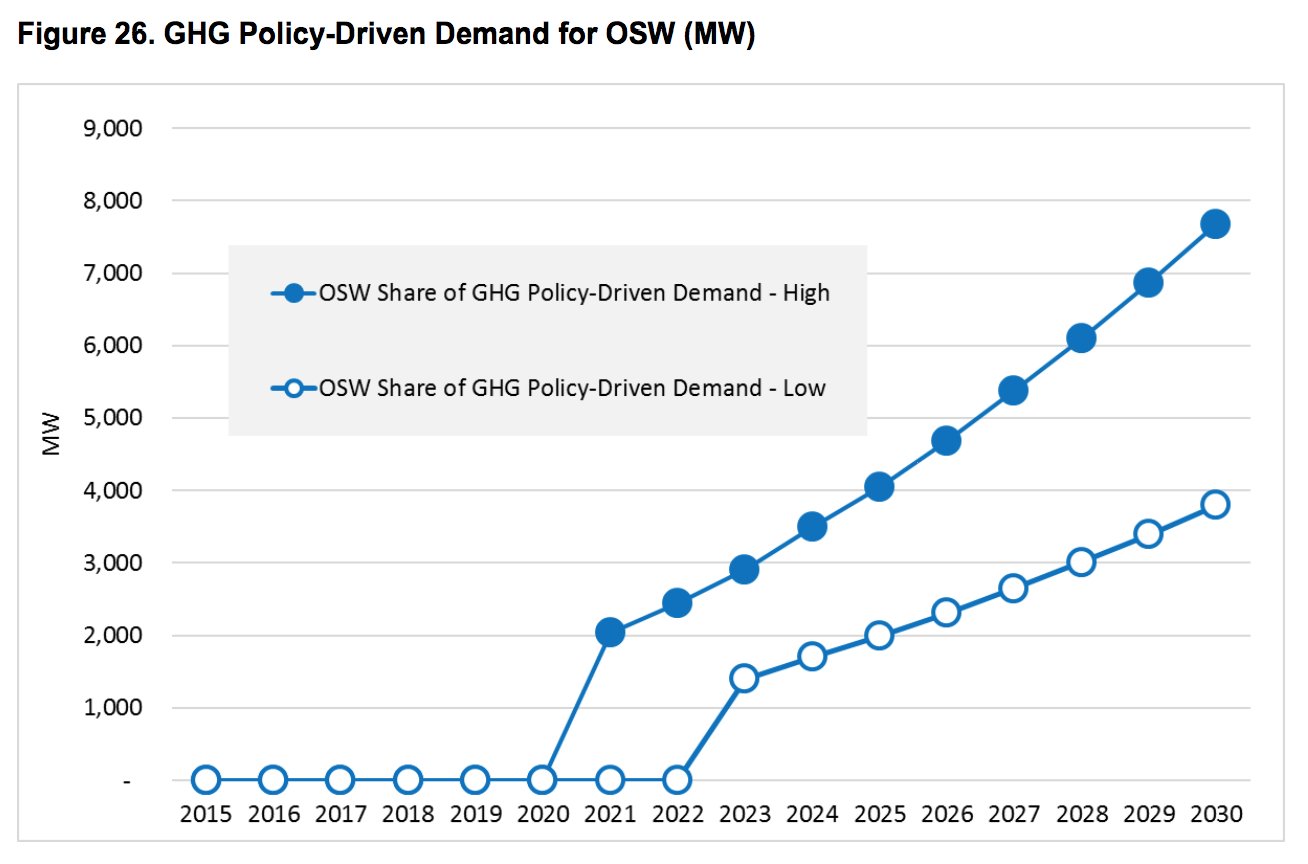

A number of factors play into offshore wind project deployments, including regional energy demand, load retirements, interconnection infrastructure, market design, project economics and the penetration potential of variable energy resources. How these factors interact will affect the Northeast’s regional deployment trajectory. In a low scenario, it could lead to 4,000 megawatts of OSW generation off of the Atlantic coast by 2030, the report found. In a high regional deployment scenario, it could lead to nearly 8,000 megawatts of OSW, which could power almost 4 million homes.

“These trajectories presume some degree of policy intervention,” the report states. “Due to the current relative and absolute costs of OSW and the critical importance of scale and market visibility in reducing costs of OSW over time, in the absence of any policy initiatives, even the low trajectory could be infeasible before 2030.”

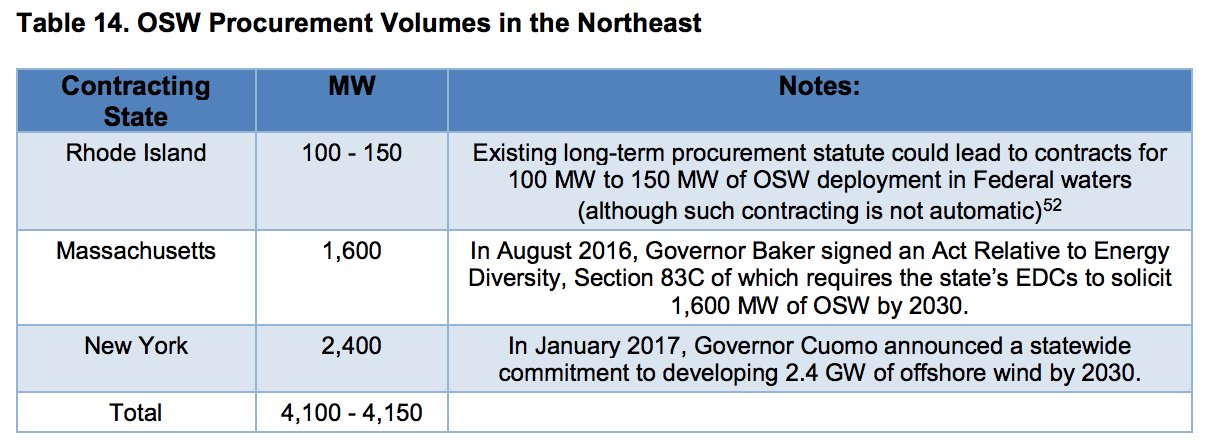

Until offshore wind can be deployed solely based on wholesale market revenues, dedicated policy supports will be necessary to drive demand for OSW projects and establish a market suitable for its development. The 168-page Market Characterization report breaks down current state and regional policies and plans regarding renewable energy and greenhouse gas reduction, as well as initiatives targeted at OSW. In this column, we review the policies being implemented in New York -- which has the most ambitious statewide commitment to OSW in the region, but will need to see policies implemented effectively in order to achieve it.

Until offshore wind can be deployed solely based on wholesale market revenues, dedicated policy supports will be necessary to drive demand for OSW projects and establish a market suitable for its development. The 168-page Market Characterization report breaks down current state and regional policies and plans regarding renewable energy and greenhouse gas reduction, as well as initiatives targeted at OSW. In this column, we review the policies being implemented in New York -- which has the most ambitious statewide commitment to OSW in the region, but will need to see policies implemented effectively in order to achieve it.

Offshore wind in New York

New York state has launched a number of OSW-related initiatives to help facilitate project deployment. Notably, in January 2017, Governor Andrew Cuomo announced a statewide commitment to developing 2.4 gigawatts of offshore wind by 2030 and directed NYSERDA to complete the State’s Offshore Wind Master Plan by the end of 2017.

In January, Cuomo also called on NYSERDA to ensure that the New York Wind Energy Area -- the lease for which was awarded to Statoil -- "is developed cost-effectively and responsibly to customers.”

That same month, the Long Island Power Authority selected Deepwater Wind’s 90-megawatt South Fork Wind Farm for a long-term PPA. The total cost for the 15-turbine project is estimated at $740 million, and it is expected to reach commercial operation by December 2022.

In October 2017, New York state announced that it submitted an area for consideration for OSW development to the Bureau of Ocean Energy Management, requesting that BOEM identify and lease at least four new wind energy areas off of New York’s Atlantic coast, each capable of accommodating at least 800 megawatts of OSW capacity.

New York’s Clean Energy Standard (CES), which requires that 50 percent of the state’s electricity come from low-carbon energy sources by 2030, is another policy measure that could drive OSW deployment. While the Public Service Commission did not create an explicit carve-out tier for offshore wind, it envisioned that OSW resources would be contributing to the CES targets, the report states. In its order, the PSC requested that staff identify appropriate mechanisms to achieve the "objective of maximizing the potential for offshore wind.” The New York State Offshore Wind Master Plan, which is expected to be released by the end of 2017, will include recommendations on what mechanisms the state should use for OSW procurement and offtake.

In addition, New York’s 2015 State Energy Plan lays out policy options that guide the state's Reforming the Energy Vision effort in order to advance its clean energy economy, and includes a series of studies focusing on OSW siting and cost reduction.

New York has several other policies and programs that support the development of large-scale renewables, including OSW. One of the most notable is the PSC’s $5 billion, 10-year Clean Energy Fund to “accelerate the growth of New York’s clean energy economy, address climate change, strengthen resiliency in the face of extreme weather and lower energy bills for New Yorkers.” The fund will allocate $2.7 billion to market development as well as $782 million to the NY Green Bank “to facilitate market investment and stimulate consumer demand for renewable energy resources, including onshore and offshore wind,” the report states. Under the Clean Energy Fund, NYSERDA will also undertake targeted pre-development initiatives including baseline environment and in-field resource assessments to reduce overall costs for OSW projects.

These policy interventions are critical to advancing the OSW market in the Northeast, the report concludes. States across the region will need to follow through on policy implementation and seek further regional collaboration in order to achieve greater OSW penetration. Failing that, even the report’s low trajectory of 4,000 megawatts may be unreachable by 2030.

Policies to kick-start a California offshore wind industry

The Northeast has a long way to go before it can be classified as a robust OSW market, but at least there are policies in place and projects underway. Meanwhile, on the opposite coast, the OSW discussion is just getting started.

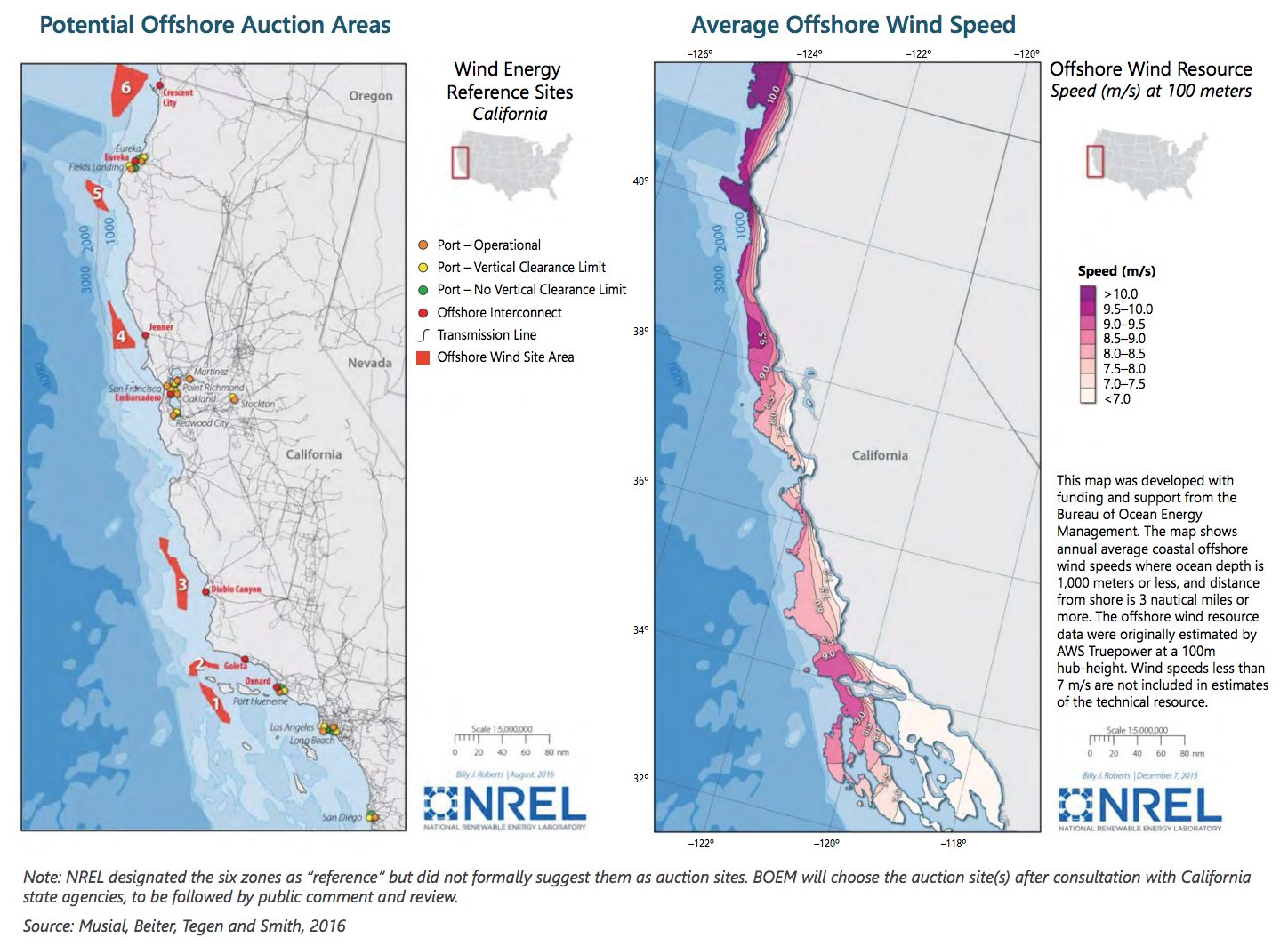

There are several challenges to kick-starting this market. For one thing, the ocean floor along California’s coast drops off quickly into deep waters, which means OSW turbines must be on floating platforms, rather than fixed to the ocean floor like off of the East Coast and much of Europe. The need for floating wind turbines creates complex manufacturing, logistics and maintenance issues. Separately, the U.S. military has emerged as an unexpected opponent to OSW in California, having blocked the state's first OSW auction after a year and a half of hearings and outreach.

So how can the state government help overcome these and other barriers? A new UC Berkeley report analyzes the policy actions necessary for offshore wind power to become an important component of California’s energy mix and an economic catalyst.

First and foremost, "state and federal governments need to send unambiguous signals to wind companies and investors that offshore wind can play a significant role in California’s energy markets," the report states. It goes on to lay out the following policy recommendations:

- 2017-2018 -- Air Resources Board: Inclusion of offshore wind as a potential supply of renewable energy in its Scoping Plan, which provides non-binding, strategic guidance about resource planning.

- 2017-2018 -- Public Utilities Commission: Guidance to utilities -- especially PG&E but also Community Choice providers -- to include offshore wind in their Integrated Resource Plans for 2030.

- 2018-2019 -- Bureau of Ocean Energy Management: Decision on size and scope of the initial project(s) -- most likely a relatively small pilot of 30-50 megawatts.

- 2018-2019 -- Legislature and/or Public Utilities Commission: Legislation and/or rulemaking authorizing utilities to purchase power from the initial offshore wind farm(s) with full cost recovery.

- 2019-2025+ -- State and local elected officials: Coordination with labor advocates and wind companies to encourage project labor agreements, community benefits agreements, and other measures to ensure favorable outcomes for workers and communities.

- 2021-2025+ -- Legislature and/or Public Utilities Commission: Legislation and/or rulemaking authorizing subsequent offshore wind projects and providing support to upgrade electric transmission capacity, port facilities, and rail connections.

To be sure the, the OSW potential in California is substantial. A 2016 NREL report concluded that a build-out of California’s six most likely OSW farm zones would have a total potential capacity of 16.2 gigawatts. This would be roughly equivalent to one-third of the state’s average summertime daily power consumption. For comparison, there were 20.7 gigawatts of renewable energy resources in the state as of June 2017.

Beyond adding to California's clean energy mix, OSW would have benefits for the grid. “Because generation from offshore wind would peak in the late afternoon and evening, it would be a helpful addition to the overall energy system," Karen Douglas, commissioner of the California Energy Commission and the lead state official on offshore wind planning efforts, is quoted as saying in the report.

To take advantage of this opportunity, however, an entirely new industry must being envisioned, "potentially involving major infrastructure requirements and long-term power resource planning," according to the report. "Success will depend on policy decisions and market signals that are only just now beginning to be evaluated by government and non-government stakeholders."