If the last two years in politics have taught us anything, it's that predictions are hard to make. Pundits are really bad at foretelling the future. We tend to forget about the bad predictions and focus only on the good ones.

Luckily for you, GTM is not in the prediction business. We're in the forecasting business. Our analysts dabble in spreadsheets, not spread-betting.

In this week's edition of The Lead, we're compiling our latest forecasts from GTM Research for every major distributed resource: solar, wind, batteries, combined heat and power, advanced meters and microgrids. We're going to focus mostly on the U.S., but also provide some global context.

A brief aside: Sure, utility-scale solar and wind aren't necessarily "distributed." But they're more dispersed than conventional fossil fuel or nuclear power plants. So for the sake of categorization, let's call them distributed.

With the U.S. in flux politically, there are a range of unknowns. (Two years ago, did anyone think we'd be renegotiating the tax credits or facing a 30 percent tariff on solar modules?) Those factors have weakened demand a bit for solar and wind. But generally, the trend lines are still heading upward for distributed resources.

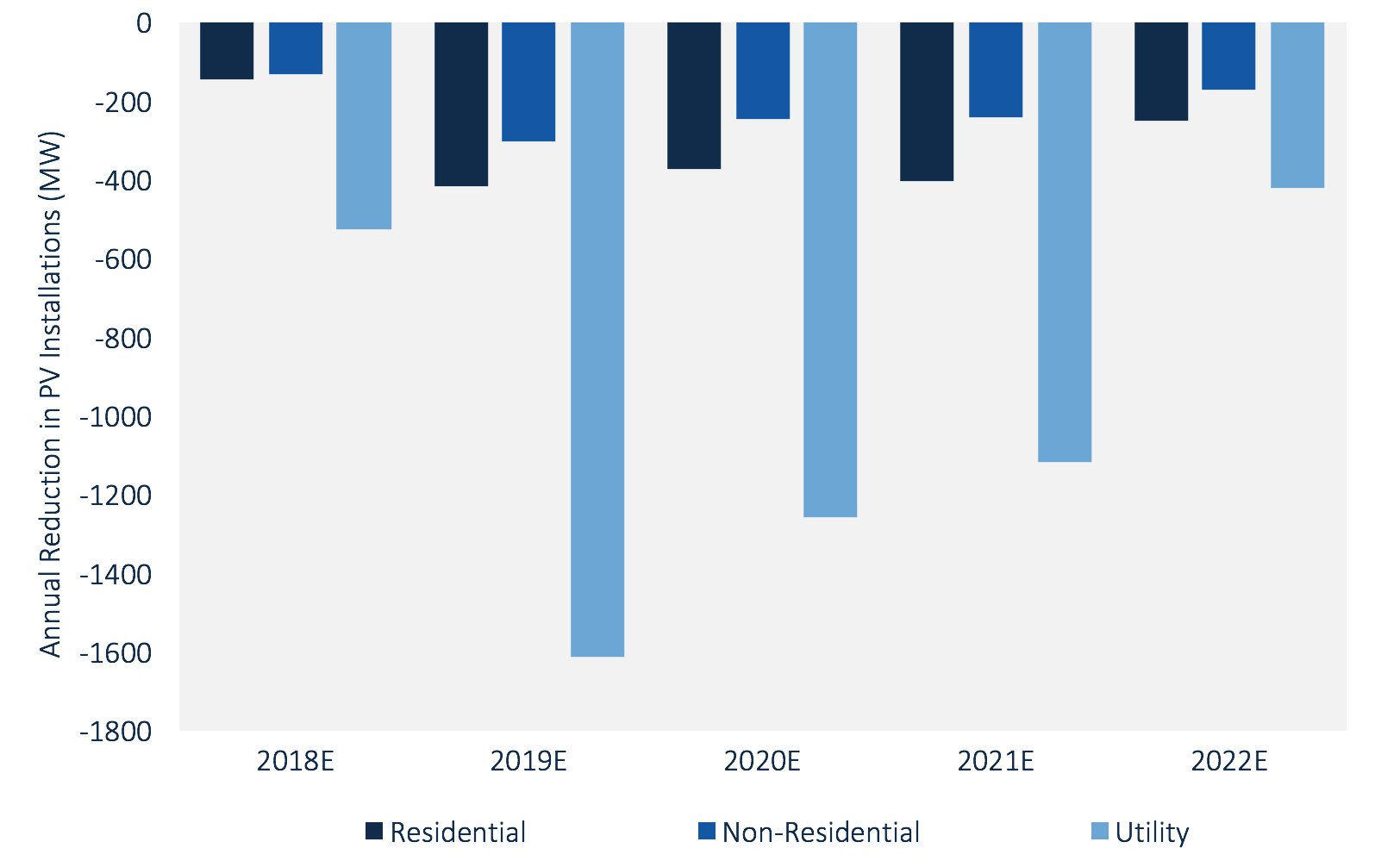

U.S. PV demand wavers after tariffs

America is set to lose out on 7.6 gigawatts of solar PV deployment between 2018 and 2022, due to Trump's newly announced solar tariff on imported cells and modules. At today's prices, the 30 percent tariffs roughly equate to a 10-cent per watt increase on modules in the first year of tariffs. By the fourth year, at a 15 percent tariff, the penalties will amount to 4 cents per watt.

On a megawatt basis, California will see a 1-gigawatt drop in installations over the next four years. Texas will miss out on 674 megawatts, and Florida will lose 513 megawatts.

It could have been much worse. No one knew what Trump would do. The tariff will have a "meaningful but not destructive impact" on solar, according to MJ Shiao, the head of Americas at GTM Research.

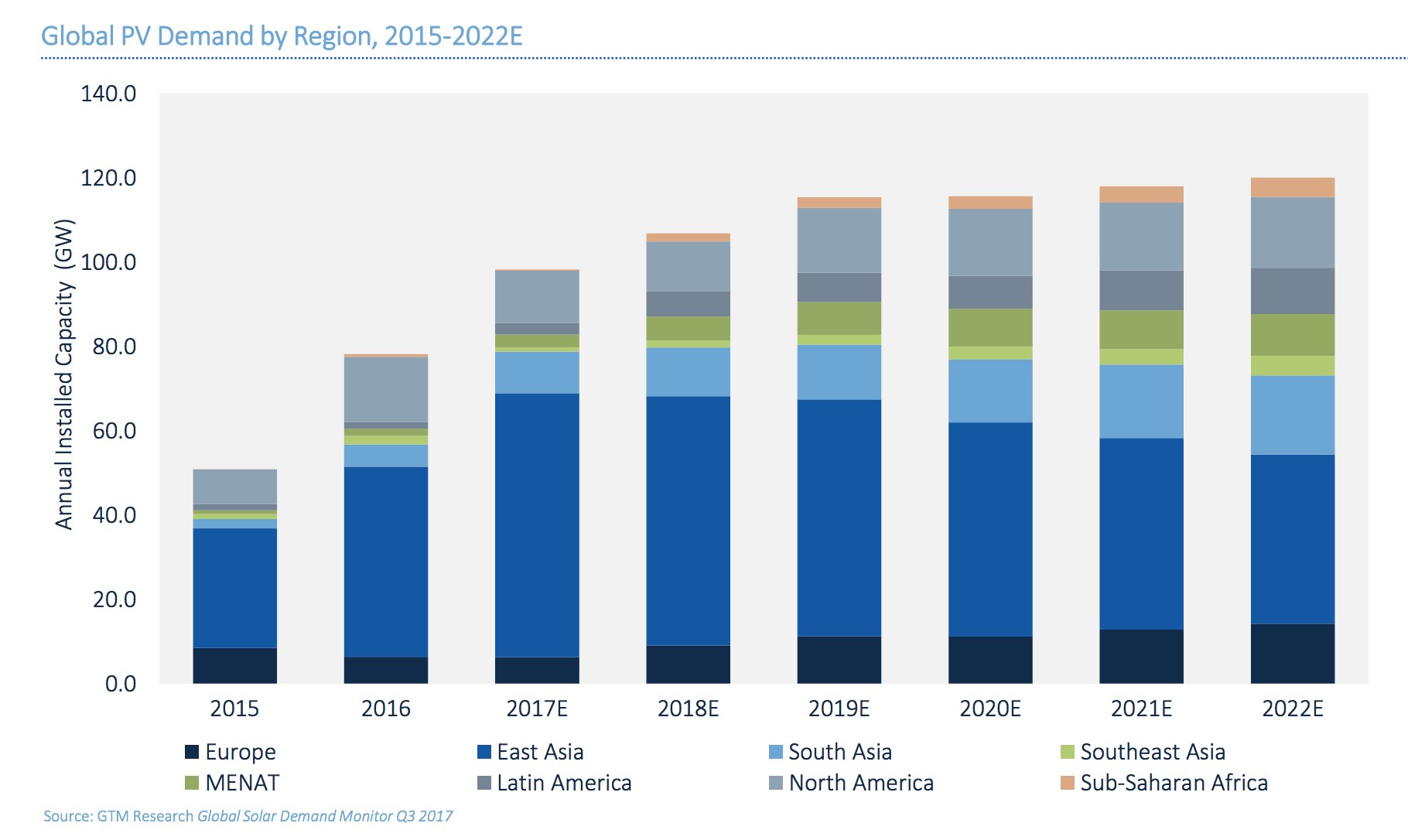

Yearly global solar installs are consistently over 100 gigawatts

As GTM Research Global Analyst Ben Attia pointed out on Twitter, cumulative worldwide installations will hit 500 gigawatts in 2018. From here on out, we're looking at a yearly market over 100 gigawatts -- with 120 gigawatts likely coming in 2022.

The 1-gigawatt club is growing as the global market diversifies. China, India, Japan and America are the four most important markets -- but their share of global installations will fall from 82 percent in 2017 to 72 percent in 2018 as Latin America surges and Western Europe sees a resurgence.

For a detailed outlook on the forces driving global solar deployment, read Mike Munsell's piece on the 10 things to watch out for this year.

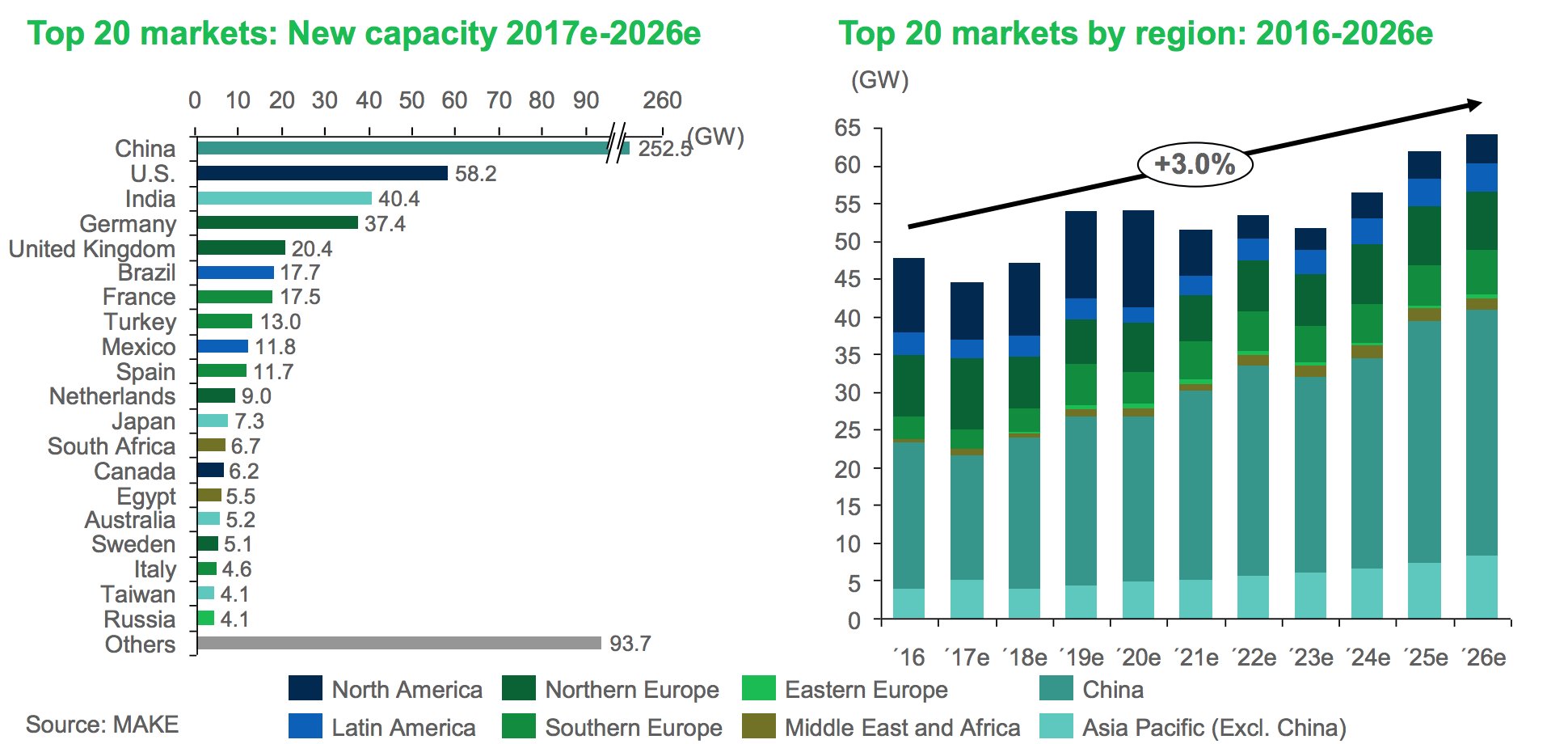

America's "soft" wind market brings a slight global downgrade for 2018

GTM's sister company, MAKE Consulting, puts out detailed quarterly forecasts on wind deployments, technology trends and supply chains.

The Q4 2017 forecast featured a 3 percent global downgrade in installations for 2018, as U.S. demand falls due to tax reform uncertainty and challenges signing short-term offtake agreements with utilities. By 2020 onward, however, the global forecast was increased by 4 gigawatts -- largely driven by a slight uptick in APAC demand and a strong expansion in offshore wind.

By 2026, the yearly global offshore wind market could be 12 gigawatts strong.

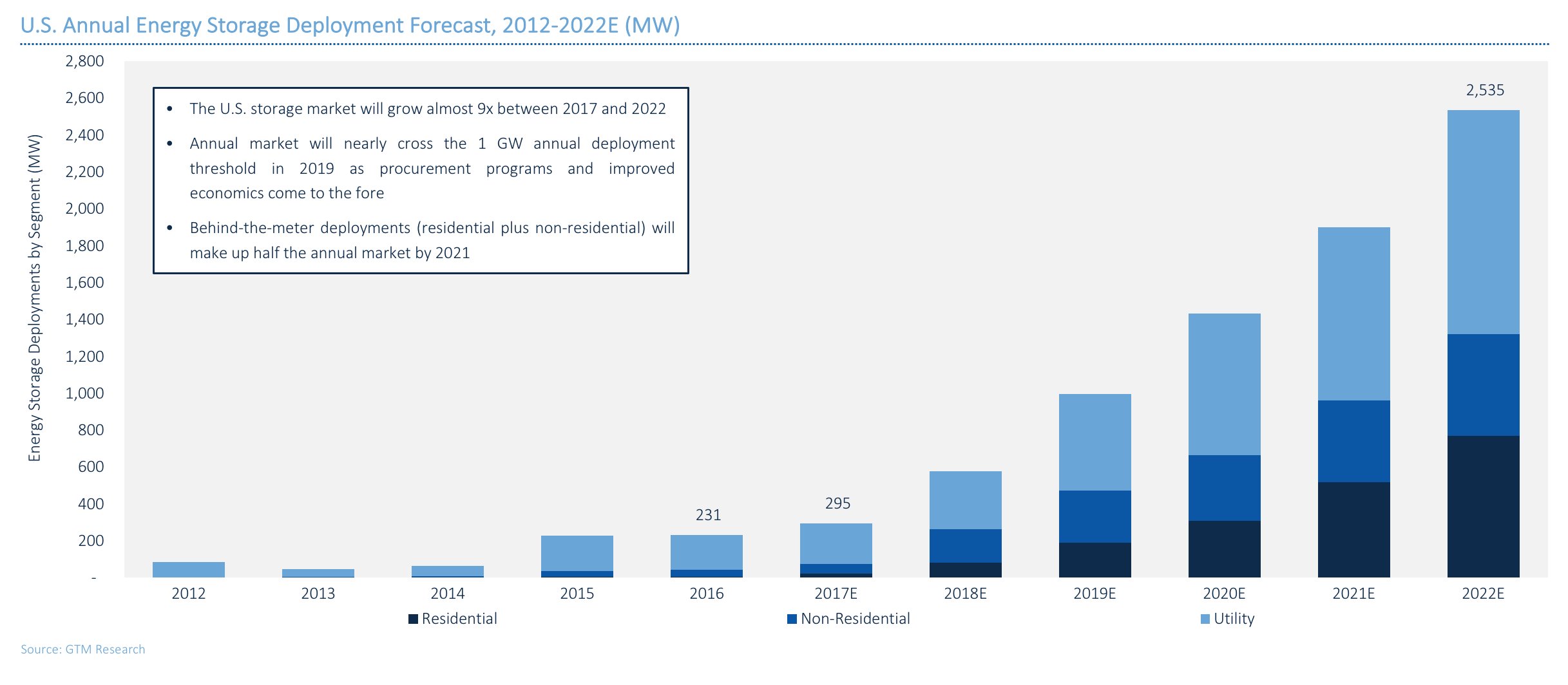

Annual U.S. energy storage deployments will pass 1 gigawatt next year

GTM Research doesn't yet have a global forecast for energy storage. That's on the way for later this year. In the meantime, let's look at U.S. demand, where we have granular numbers.

Between 2017 and 2022, the U.S. storage market will grow 9x in power terms and 12x in energy terms. This year, annual installs will pass 1 gigawatt-hour; by next year, they'll hit 1 gigawatt in capacity yearly. By 2022, the U.S. will likely install 6.7 gigawatt-hours of storage.

California currently has an "iron grip" on the storage market, according to the storage research team. The state accounts for 86 percent of non-residential storage capacity deployed. But states like Hawaii, Massachusetts, New York and Texas will certainly become far more influential as those markets mature.

Lithium-ion holds an iron grip as well. The technology accounts for more than 94 percent of storage deployments in the U.S.

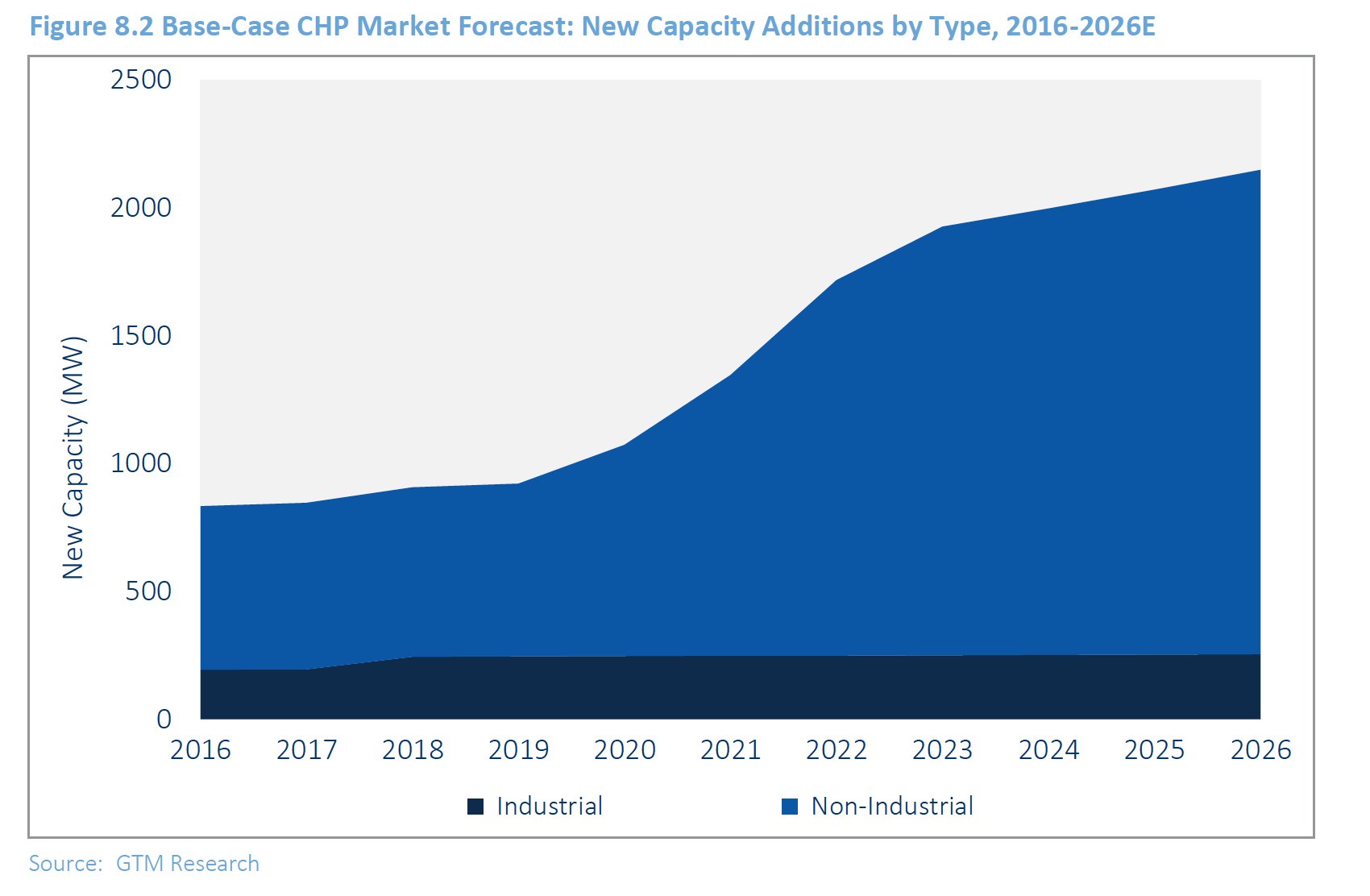

Combined heat and power will meet half its technical potential

The Department of Energy says that America's technical potential for combined heat and power is 240 gigawatts. According to a recent GTM Research forecast, the country could see cumulative CHP capacity hit 120 gigawatts within a decade in an upside scenario.

What would drive the market toward the upside? Utilities will be important drivers, assuming they emphasize localized resiliency and support non-wires alternatives to infrastructure development. With customers demanding more resiliency solutions and regulators pushing for non-wires alternatives, both of those trends will become more influential.

If gas prices stay low, which they likely will, the economic case gets more compelling after 2020, particularly for non-industrial customers. That is reflected in the forecast.

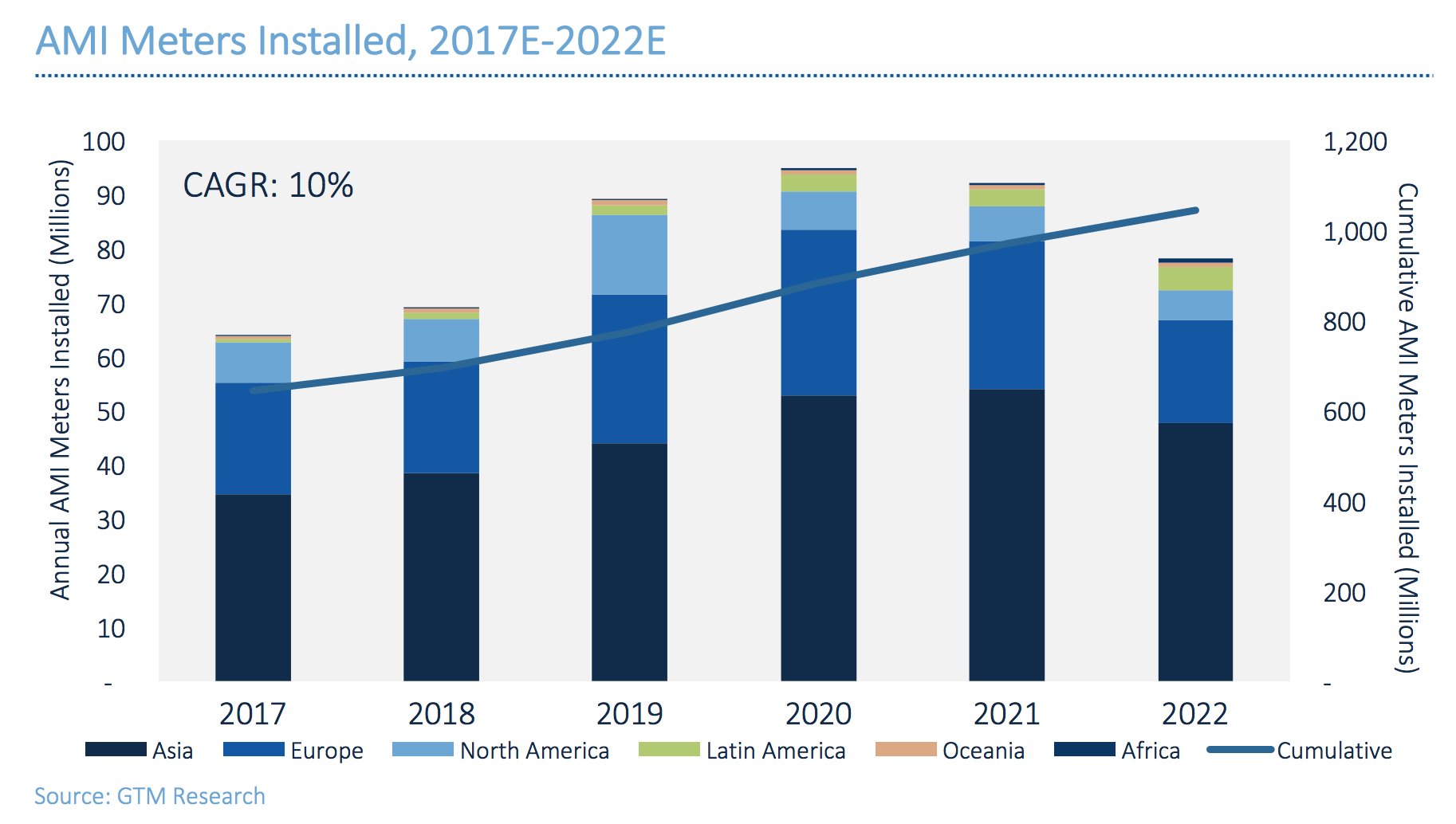

One million advanced meters coming by 2022

Between now and 2020, yearly installations of advanced meters will grow by 16 percent on average. By 2022, global AMI endpoints will hit the 1 billion mark, according to GTM Research forecasting.

China and Japan represent the biggest markets. Europe's share of the market increases through the end of the decade as countries work to meet region-wide targets for smart meters. After Europe's AMI deadline in 2020, the global market slows down a bit.

In the U.S., where more than half the country's households have smart meters, activity will pick back up through 2020 as roughly 10 large utilities execute new meter deployments.

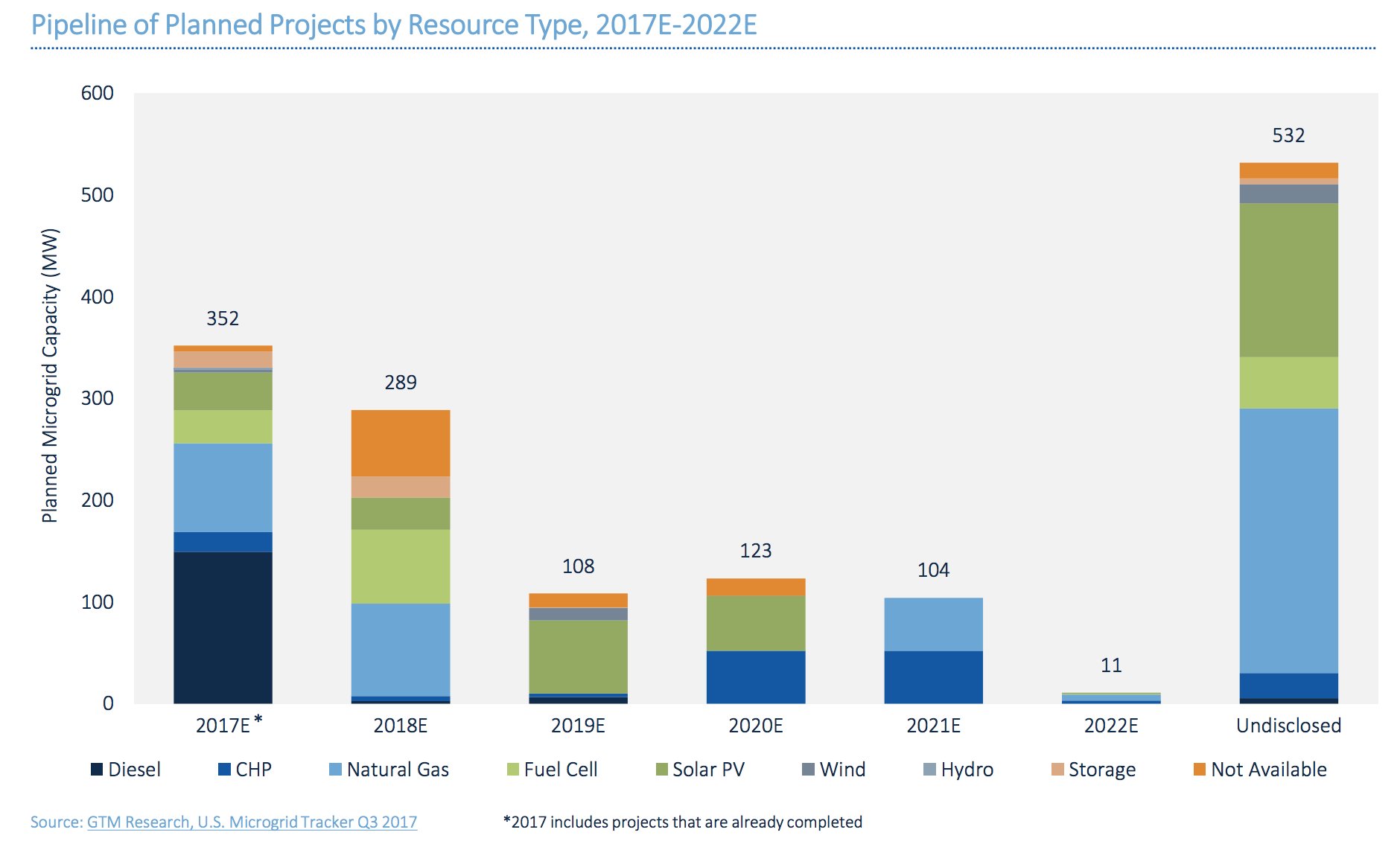

Microgrids are getting more renewables and batteries

By 2022, nearly one-quarter of America's 6.5 gigawatts of microgrids will feature renewables and battery storage. GTM Research's most recent forecast doesn't factor in the 30 percent tariffs imposed by Trump, so we still don't know if the microgrid landscape will shift as a result.

There are plenty of other positive trends shaping microgrids over the next five years. States are putting more money behind projects; utilities and regulators are getting series about non-wires alternatives; big money is finally coming into the sector; and developers are working to create out-of-the-box solutions that don't require as much customization.

From 2017 to 2022, total investments in U.S. microgrids will likely hit $12.5 billion.

Want the numbers behind these forecasts? We've got you covered at GTM Research.