Hawaii is awash in distributed solar, and it's the only U.S. market where batteries to store that power are cost-effective on their own standing.

Consequently, Hawaii has invested heavily in grid hardware and software to manage the sharp sags and surges in voltage and current being pushed up its rooftop solar-laden distribution circuits, and to predict and react to its growing share of utility-scale solar and wind as it pushes toward a 100-percent-by-2045 renewable mandate.

Demand response will play a big part in Hawaii’s clean energy balancing act. State investor-owned utility Hawaiian Electric says it will rely on hundreds of megawatts of DR to help balance the more than 700 megawatts of solar and wind it’s expecting by 2021 under its Power Supply Improvement Plan.

HECO already has a host of curtailment strategies in place with big industrial and commercial users, and runs residential programs for emergency cutoff of air conditioning and water heating. On the more modern front, it’s been running a host of pilot projects using smart thermostats and water heaters, smart solar inverters, behind-the-meter batteries, electric-vehicle charging stations, and other distributed energy resources (DERs) to fill these demand-side needs.

For the next wave of demand response, it is planning a platform capable of serving each island’s grid at timescales from the day-ahead to the millisecond. What’s more, while HECO will maintain control over much of the apparatus, a fair portion will be contracted, aggregated and optimized on the utility’s behalf by approved third parties.

That’s more like a miniature version of what an independent system operator like PJM or CAISO does than the traditional definition of demand response. Implementation is a complicated matter, tied into HECO’s broader $205 million grid modernization plan, its ongoing smart meter deployment, and its separate, yet overlapping, investments in energy storage, both centralized and distributed.

Late last month, after more than two years and one revision, the Hawaii Public Utilities Commission finally approved the demand response tariff that will serve to bring this vision to life. While it still hasn’t revealed the companies shortlisted to serve as HECO’s partners in the market, it has given them a significant incentive to get customers signed, sealed and delivered by the end of 2018.

How it works

The purpose of the tariff, which HECO has been ordered to “begin immediate implementation thereof,” is to create the “economic and technical means by which customers can use their own equipment and behavior to have a role in the management of the electricity grid.” That includes an role for DERs of all description to “actively participate in the grid and its associated value chain.”

HECO’s new tariff structure -- and the rules, riders and rates that put it into effect -- are broken up into four programs. The first, and undoubtedly to be the largest, is its capacity program, which will be brought to life through time-of-use (TOU) rates, real-time pricing (RTP), critical peak incentives (CPI), and day-ahead load shifting -- four flavors of rates designed to reduce peak use.

HECO will also offer three ancillary services programs: a fast frequency response program to respond within milliseconds following a contingency event such as a generator tripping offline; a frequency reserve program that follows grid signals to adjust up or down to keep the grid stable; and a replacement reserve program to compensate customers who cut load to help it avoid firing up a fast-start generator.

These are fairly standard services that grid operators procure through markets today. But most grid operators haven’t opened their more technically challenging grid services to DERs in the way that HECO’s new plan envisions.

HECO’s rollout will start on Oahu, which will launch a fast frequency reserve and non-spinning auto response (i.e., frequency reserve) that’s immediately open to residential and small commercial customers, as well as larger commercial and industrial customers.

Larger customers on Oahu and Maui will also get a commercial peak incentive rate schedule, and residential customers on these and HECO’s remaining islands of Molokai and the Big Island will continue their interim residential TOU rates -- both meant to incentivize them to adjust power consumption or invest in DERs that can help it meet capacity needs.

By the end of 2018, all commercial customers of HECO on Oahu, Maui, Molokai and the Big Island will have access to day-ahead load shifting, while residential customers will continue to have access to an optional TOU tariff. But both of these capacity programs are expected to lead to real-time pricing, at least as an option for all classes of customers, by 2020.

Importantly, all of these services can be filled from the same customer agreement held between a company and its portfolio of clients, in keeping with a structure that puts third-party service providers in front. While the plan allows for direct contracting between HECO and customers, it defers the privilege for “at least a year in order to provide space for a third-party market to develop.”

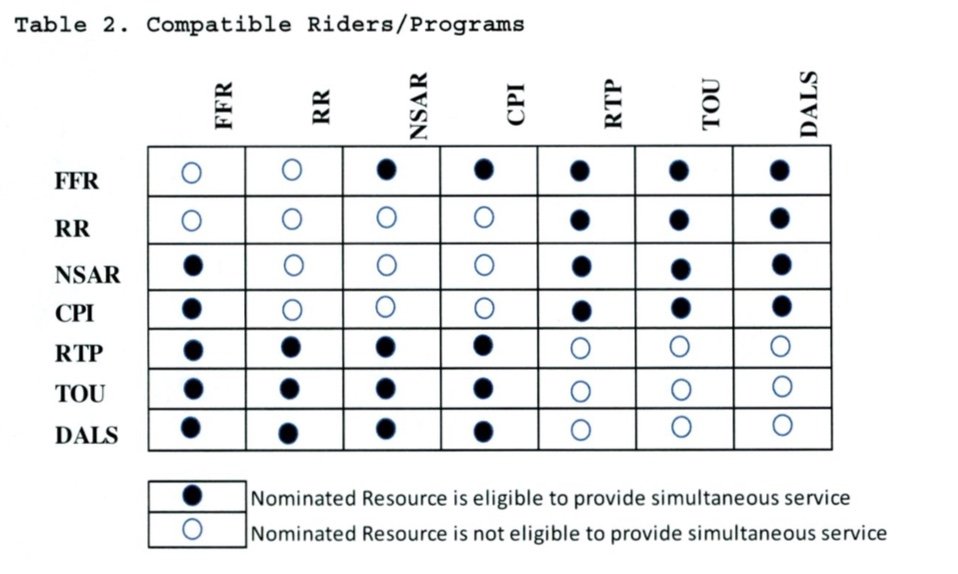

Not all of these services can be run simultaneously, of course. Regulating reserve is barred from participating in non-spinning reserve or commercial incentive pricing programs, and vice versa, and fast frequency response can’t double up with regulating reserve. Meanwhile, day-ahead load-shifting and TOU pricing will be replaced by real-time pricing by 2020.

Each service also comes with its own duty cycle that may restrict value stacking. Capacity grid services must run for four hours at a time, while regulating reserve will have a 30-minute minimum, but the hours in which these services may be called upon may coincide. Fast frequency response must run 24/7, and replacement reserves must be on 10-minute or 30-minute call by HECO’s energy management system.

But any third party should be able to negotiate a contract that calls for one or more of these services to be delivered from its portfolio of assets, under grid services purchase agreements (GSPAs) being created for the purpose. HECO released its first draft version of a pro forma GSPA in December.

While requests for proposals aren’t the same thing as an open market for services, the plan notes that “both HECO and third-party service providers have expressed interest in getting programs underway and improving over time, rather than delaying implementation to develop more format market structures.” But the reliance on RFPs does mean that price transparency is, for now, limited.

Who gets to compete?

The huge and overhanging question about all of this is: Which companies have been picked to compete in HECO’s new demand response sandbox?

“What is known is that these nine vendors have been shortlisted for the grid service RFP,” Elta Kolo, grid edge analyst at GTM Research, noted, referring to HECO’s 2015 request for proposals for companies to fill its demand-side grid services needs.”These contracts were initially expected to be issued to vendors in 2016 and to date have not been issued.”

It’s expected that at least some of the companies already heavily involved in Hawaii’s distributed energy pilot projects, such as Stem, Honeywell, Bidgely, Shifted Energy and others, might have a seat at the table. Last month’s plan includes guidance on migrating pilot program participants into the new programs, along with customers of HECO’s existing programs.

HECO’s agreement with the PUC calls for contracts to be executed “no later than June 2018, which should permit vendors to conduct customer acquisition in the third quarter of 2018,” she noted. “There is a clear urgency and large incentive to get these megawatts of DR contracted and operational by the end of 2018.”

To help push that process along, the PUC has allowed HECO and its chosen companies an incentive, in the form of a one-time 5 percent boost in the contract’s aggregate value, for “cost-effective megawatts acquired, enrolled and operational by December 31, 2018.”

The term "cost-effective" is important here, Kolo noted, given that it comes in the context of establishing more durable performance mechanisms for the program over time. But the PUC decided on the one-time tweak to the market as a “reasonable mechanism to reward the Companies for successfully launching the DR Portfolio.”

HECO is expected to keep the contracts coming, through “rolling RFPs for unfulfilled grid services” with terms that will shrink as their signing date approaches the 2020 deadline. As for how to pay for them, the plan calls for a combination of use of the existing demand-side management surcharge, through future rate cases, and through a newly created Demand Response Adjustment Clause to adjust between projected and actual costs across the previous two resources.

The state’s Consumer Advocate objected to such a fast implementation, noting that it would like more time to review the incentive levels themselves and whether they reflect a “reasonable pricing for the services that may be obtained.” It also expressed concern about the complexity of the cost-recovery mechanism set up by the plan.

As for the Distributed Energy Resources Council of Hawaii, representing the companies that would be playing in the new programs, it highlighted that a five-year contract is an “absolute minimum” term for balancing risks and benefits for such a new program. It also reiterated its concern that HECO should not come into the market too early.

Just how the first stages of the program roll out will have an important effect on how it's adjusted over time, the PUC noted. For example, while it's committed to third-party participation, it's also cognizant of the fact that long-term contracts may be more efficient than real-time pricing as a way to secure capacity. In that case, "if grid service targets are fulfilled from among the shortlisted vendors, new vendor entry may be effectively restricted for five years," it noted.