This is the second in a GTM Squared series on the companies, technologies, applications, and opportunities in the U.S. building energy management system market.

The analysis, from industry expert Joseph Aamidor, dives deep to quantify the BEMS vendor landscape. The series answers key questions about the market, including:

- Which vendors have significant market share? Which are growing fastest?

- How much vendor turnover has there been in the market?

- What is the current penetration of BEMS within commercial buildings?

- Which building types offer growth opportunities?

Click here to read Part 1 and here to jump to Part 3..

Our previous article about the building energy management systems (BEMS) market highlighted the significant penetration that Energy Star holds among key building types: offices, retail, education, medical and lodging buildings. This is especially true among larger commercial buildings.

This article dives deeper into the vendor landscape. Using Energy Star data from the past six years, a number of trends emerge about the key vendors providing BEMS software capabilities.

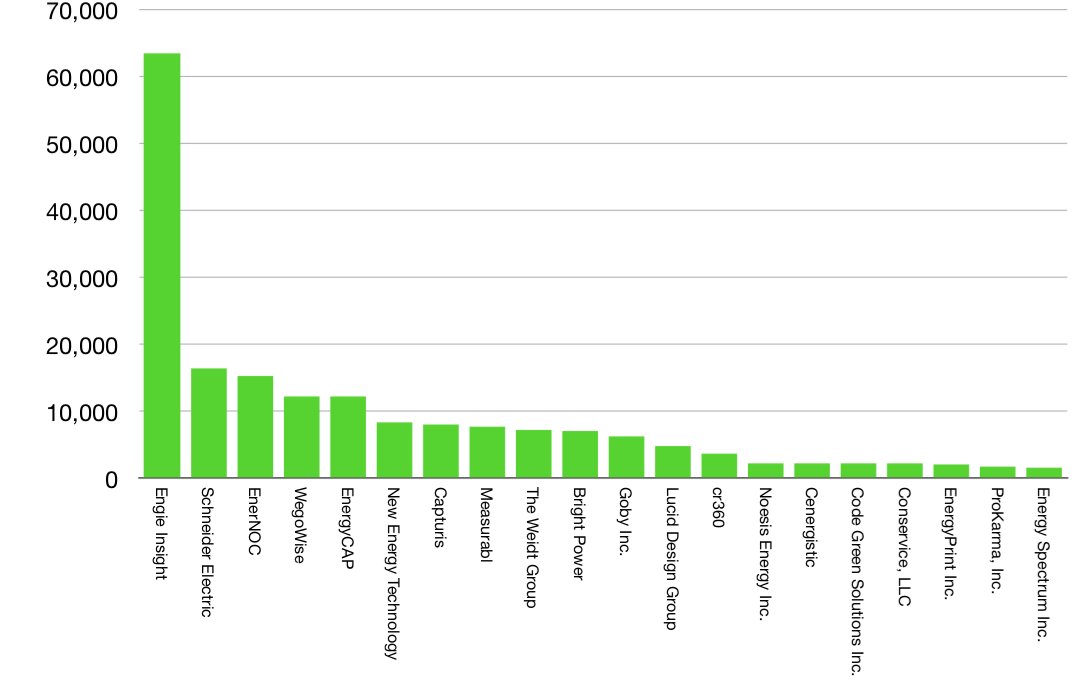

Energy Star: Top 20 Vendors, 2017

Source: Energy Star

Beyond the strong lead that Engie Insight (formerly known as Ecova) holds in total benchmarked buildings, a number of other vendors have significant and growing shares. Firms providing Energy Star capabilities come from different segments of the broad BEMS industry. Some of the vendors in leading positions are typically thought of as utility bill management, sustainability management or environment, health and safety (EHS) vendors. This includes firms like Measurabl, Goby, CR360 (formerly known as Credit360), Code Green and Capturis (formerly known as NISC), which along with Engie Insight, is a legacy utility bill payment service provider.

Vendors with a focus on interval data or deep building analysis are under-represented here. That said, smart building solutions that are more focused on interval data and deep building analysis are newer to the market. They typically do not market and brand themselves as core energy management products, either.

More and more, these smart building firms seek to supplement an existing building automation system (BAS). While the market for these newer products has attracted significant attention, investment and even M&A activity, it remains more opaque than energy management solutions that are represented in this Energy Star list. In many cases, these smart building firms appear to focus on the differentiated and harder-to-provide solutions, rather than the well-established, and mature requirements around Energy Star.

The range of vendors on this list, plus the absence of more recent smart building entrants, may be an indication that the market for energy management is separating into a few distinct feature sets. Many buildings have longstanding vendor relationships to procure utility bill management capabilities, which can be logically and easily coupled with benchmarking. But only a subset of these customers also purchase interval data and equipment analysis tools, which are still establishing themselves in the market. It is possible that basic energy management and benchmarking are nice-to-have offerings, routinely combined with other “must have” features like utility bill management, sustainability data tracking, or EHS solutions.

These open questions highlight the limits of Energy Star vendor data when estimating market shares. The source is a good indication of the market but is not a direct representation. For example, Energy Star does not provide benchmarks for most university buildings (other than dormitories) or many municipal buildings (other than courthouses). Some vendors that focus on municipal and institutional buildings are under-represented in these numbers.

EnergyCAP, a mature and well-known energy management solution, is one example. Steve Heinz, CEO of EnergyCAP, estimates that his company serves many as 10 times the number of buildings represented in the Energy Star list, driven by strong penetration in universities and municipalities. Heinz also notes that most of his company's customers do not just want an Energy Star score; instead, they are looking for a solution to manage energy data more strategically. EnergyCAP still works with many customers that are moving away from a homegrown solution or using spreadsheets.

Heinz makes a valid point on the addressable market for BEMS solutions. Energy Star has relatively strong penetration by square footage among the five main building types (about 45 percent of all square footage is in Energy Star). Additionally, among large offices, hospitals and lodging buildings, about half of all sites have an Energy Star score. But vendors still see an opportunity to sell to building owners/operators still using spreadsheets or simply not yet participating in Energy Star.

Matt Ellis, CEO of Measurabl, notes that using Energy Star to estimate the market for BEMS solutions may be a “moderately correlated proxy” but adds that “some large vendors place less emphasis on Energy Star for their solution set, but are nonetheless highly or even more engaged with a given building than the entity" that acquires that building’s Energy Star score.

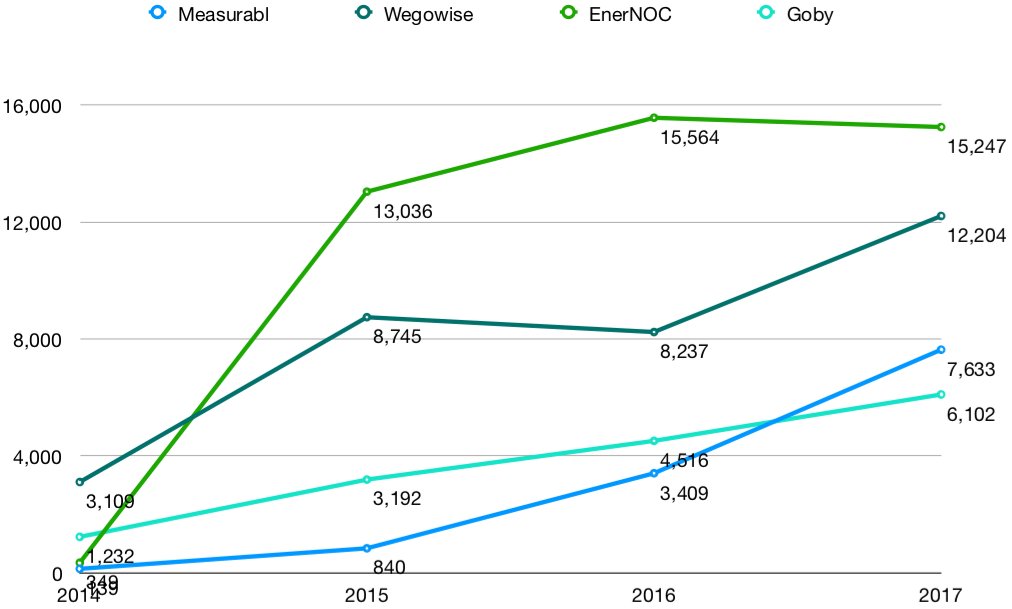

Companies Seeing Rapid Growth, 2014-2017

Source: Energy Star

There are a few firms in particular that are showing very fast growth in Energy Star benchmarks. Two of these firms, Measurabl and Goby, provide non-financial data management platforms that help with sustainability reporting protocols. This includes Energy Star, as well as the Global Real Estate Sustainability Benchmark (GRESB), among others. Local benchmarking regulations, which have been passed in a few dozen cities, likely have been responsible for some of this growth. These firms are “pure plays” in that they focus on offering easy-to-use and cost-effective tools for benchmarking and tracking building data. While many of their customers undoubtedly have existing relationships with other firms that may also provide Energy Star benchmarking, Measurabl and Goby have been able to grow rapidly within this focused offering.

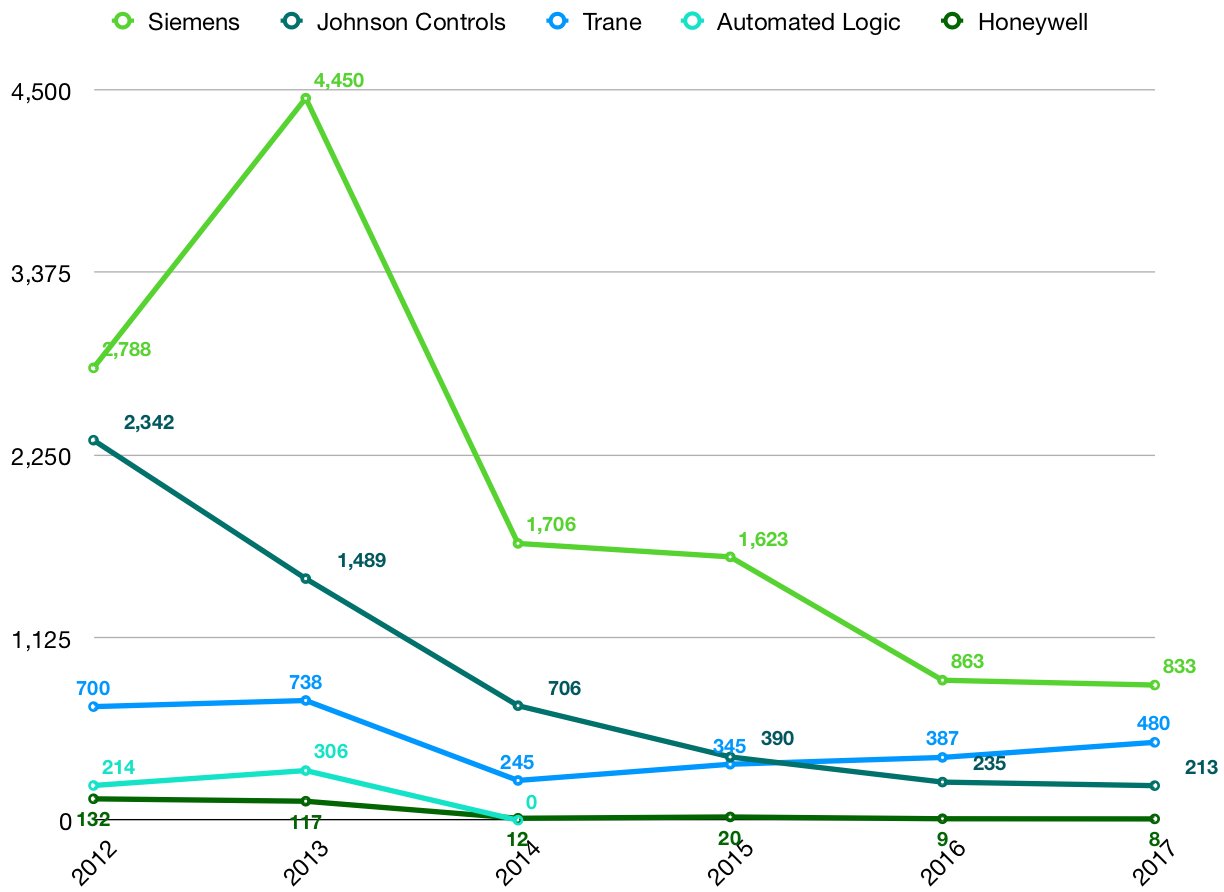

While some emerging software players have increased in market share with focused offerings, the well-known, established HVAC and control vendors have seen declines.

Major Building Services Firms, 2012-2017

Source: Energy Star

Joe Hirl, VP of energy services and controls at Trane and founder and former CEO of Agilis Energy (which Ingersoll Rand purchased earlier this year), notes that customers can “wrap their heads around Energy Star” more easily than other benchmarking analyses. But the energy use intensity of a building can be calculated outside of Energy Star, providing a similar level of usefulness. Moreover, Energy Star scores usually are based on 12 utility bill data points. To Trane, it is important to go deeper and understand the drivers of energy use and the realistic opportunities to reduce consumption. Hirl notes that even buildings with Energy Star scores over 75 may present significant efficiency opportunities. This sounds very much like a company looking to play in the smart buildings area, rather than just energy management.

Siemens echoed some of these comments, noting that controlling the environment in the building is a higher-value offering and has a more significant impact on overall performance. Like Trane, Siemens supports the benchmark and does offer utility bill management services that complement the Energy Star score process.

Ari Kobb, director of energy and sustainability solutions at Siemens, views the firm’s role as offering “a more meaningful benchmark” that is normalized for the building’s operation, focusing on control and automation of the critical systems, such as HVAC. Rick Rodriguez, senior director of energy solutions and performance at Siemens, also notes that there are increased expectations to provide device-level analysis of a building’s critical systems, solutions that are more aligned with a smart building offering.

That said, looking back at the numbers, there are a few legitimate reasons why these large building services firms may see declines in the number of buildings benchmarked in Energy Star:

- Many branches, which typically have a direct relationship with the building owners and operators, have significant autonomy from the corporate headquarters. They may prioritize other differentiated, mission-critical offerings. Many Trane branches are independent entities that hold a license for a given region (they are not owned by the corporate office). This autonomy enables them to decide what services to offer based on their local knowledge of the market and their customers.

- It also is likely that Energy Star benchmarking is not a significant profit driver for these firms, which have multibillion-dollar building and HVAC equipment and service businesses.

- With the growth that some small upstarts are seeing, building owners and operators could be pivoting to simple, independent and self-service options to acquire this score.

To this last point, it is clear that building owners and operators may work with multiple building and energy management vendors. While the vendors may have significant overlap across the full breadth of offerings, building owners/operators appear to use various elements of multiple offerings for specific differentiated purposes. This may be why most vendors interviewed for this series noted that the Energy Star number underrepresented their own installed bases. If a given building is working with multiple vendors but only getting an Energy Star score through one of them, the market for energy management solutions will be larger than what the Energy Star list represents.

Brian Glynn, SVP of product management at Mach Energy, which provides energy management solutions for large buildings, states that Energy Star is typically listed as a requirement for his firm's customers, but it's often the case that they are already are receiving a score for their buildings. Mach does provide Energy Star features, but Glynn finds it isn’t a core reason that building owners select the platform. This point also indicates that building owners may use multiple services to assist them in their energy and sustainability efforts.

Logan Soya, CEO of Aquicore, a startup energy management and asset operations platform that has recently begun supporting Energy Star, agrees that the market is complex, with many solutions. However, he sees that the level of maturity and adoption of monitoring solutions is significantly greater now than even five years ago. These broader adoption trends are also driving Energy Star. Soya notes that “Energy Star is widely adopted and interesting to the real estate landscape.” The 1-100 score makes it easy to understand performance. Those buildings with strong scores typically look to Aquicore to understand how to “do even more,” he added. With the forthcoming updates to the Energy Star scoring methodology, Soya notes that building owners and operators are even more interested in monitoring technologies, in case there is a decline in their scores.

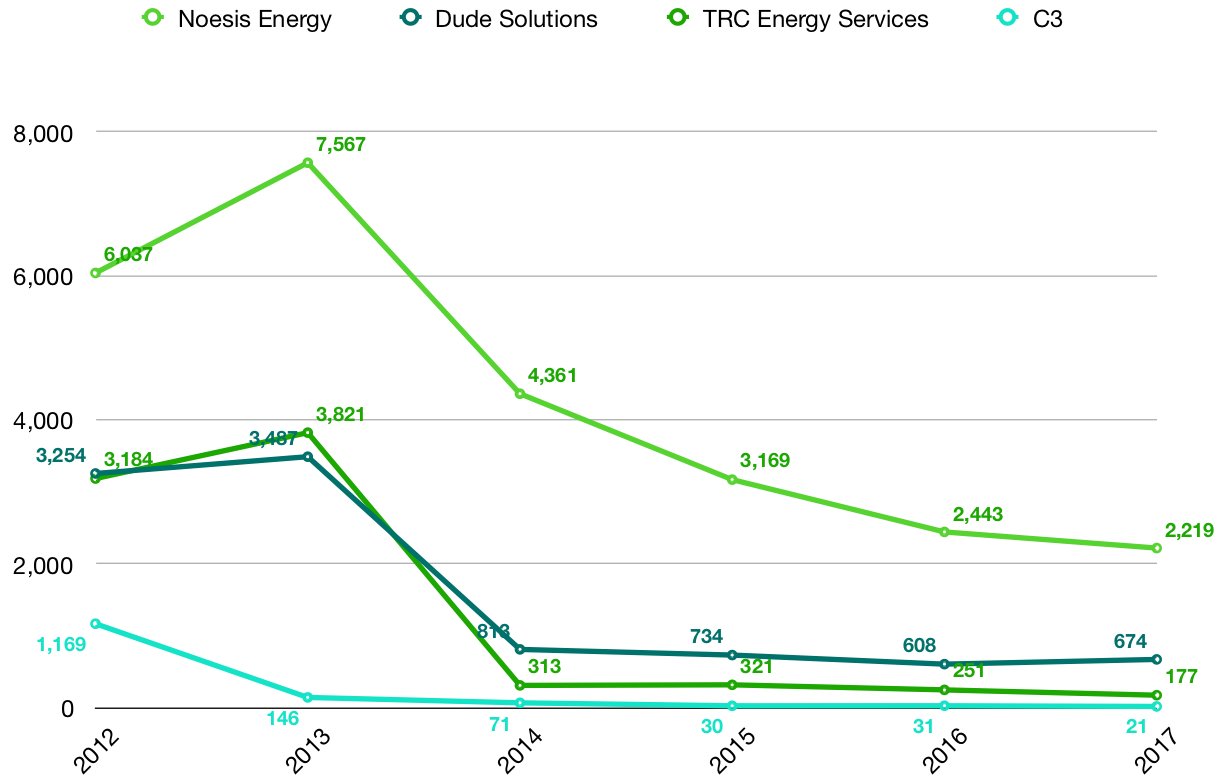

Other Firms With Benchmark Declines, 2012-2017

Source: Energy Star

Other firms have seen significant reductions, as well. Energy Star quantifies some other well-known trends and developments in the market. For example, C3, which started as an energy management solution, has pivoted to an internet-of-things platform. Dude Solutions, which owns Facility Dude and School Dude, has seen significant adoption of its work order management offerings, and may view energy management as non-core. Noesis, which gained significant traction in the early 2010s, has been acquired by LeaseQ and now is focused on building equipment financing. It’s likely that Energy Star benchmarking is no longer viewed as a core offering here, as well.

While many vendors view Energy Star benchmarks as a segment of their market penetration, rather than a direct representation, the trends observed in Energy Star do align with broader industry trends. Given that a variety of different types of software and services vendors provide this capability, some vendors see it as tangential to their core offering and not worth supporting in the future. Firms that stop benchmarking buildings may do so to focus on other core offerings, rather than making any decision based on their ability to acquire Energy Star benchmarks or grow the number of buildings they serve. Moreover, the rise of moderately priced and easy-to-use solutions like Measurabl may put margin pressure on other vendors and encourage them to partner for this service, rather than doing it themselves.

In the next article, the last in this series, we will take a deeper look at the competitive landscape and market opportunity for BEMS solutions, as well as identify the vendor strategies for penetrating each segment and quantify just how large these segments are.