It’s a new year. That means new projections for what the solar industry will look like in 2019.

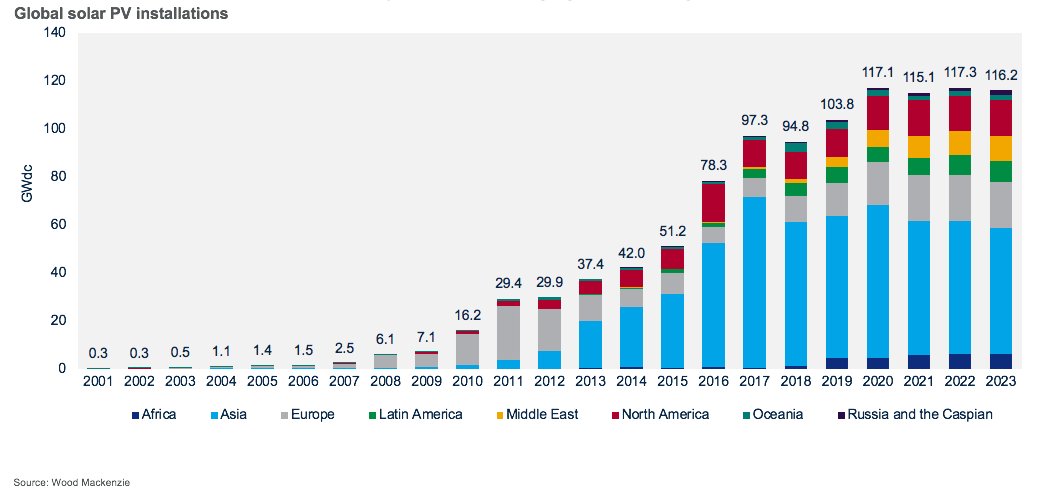

Last year was a weak one for solar. While research firms including Wood Mackenzie Power & Renewables found that the market reached new heights — Bloomberg New Energy Finance even calculated that the annual tally of projects exceeded 100 gigawatts for the first time ever — a pullback from China meant growth was much more moderate than in recent years.

In 2019, analysts expect the industry to once again add more capacity than in years prior. But this year is unlikely to mimic the shocking growth rates of a year like 2016. The solar industry is moving toward what is expected to be sustainable growth, rather than relying on drastic spurts of capacity additions.

“We’ll see less in the way of boom and bust in global markets as installations are spread more evenly,” said Tom Heggarty, a senior solar analyst with Wood Mackenzie Power & Renewables. “It should mean installations are a bit less spiky and there’s less uncertainty in the global market as a whole.”

Keep reading for a breakdown of the various projections for the year in solar, as well as the themes and trends shaping how much capacity is expected to come online.

100 gigawatts: Are we there yet?

In contrast to BNEF’s forecast, which put the industry at 109 gigawatts at the end of 2018, Wood Mackenzie Power & Renewables forecasts that the industry will top 100 gigawatts for the first time in 2019.

The disparity results from a difference in methodology for calculating total projects.

Projections for 2019 show an even wider spread.

WoodMac projects capacity additions of around 115 gigawatts added this year, an estimate it increased based on a stronger outlook in China and key growth outlooks in India, Vietnam and Spain.

BNEF is more bullish. The research firm presents high and low cases, for a range of 125 to 141 gigawatts added globally.

The International Energy Agency in its base case projects a cumulative 566 gigawatts of solar PV in 2019, an increase of just 85 gigawatts from the previous year. While IEA notes that "several policy uncertainties" remain in 2019, its accelerated case forecasts a cumulative 602 gigawatts.

Analysts at all three firms said a precipitous fall in capital costs, 12 percent in 2018 according to BNEF, would help drive further deployments.

“Basically, now solar is the cheapest source of bulk energy in many countries. A lot of projects are happening that would not have been feasible two years ago,” wrote BNEF head of solar Jenny Chase in an email. “The flattening of tech prices — not completely, but a bit — also reduces the incentive to wait for a cheaper time.”

In a research note about solar trends in 2019, WoodMac analysts Heggarty and Ben Attia state that in the next year, the market can expect more sub-$30 per megawatt-hour bids and possibly another record-low power-purchase agreement price.

That record could come as early as January, with Mexico expected to hold an auction this month. Overall, Heggarty said auctions throughout the year are likely to continue pushing prices lower as other markets step up to fill gaps left by losses in China.

“Elsewhere in the world, it’s a story of continued growth and emerging markets, and that’s really all fueled by competitive auctioning,” he said. “2019 is going to be a really strong year for auctions.”

And while 2018 brought huge cost declines, Heggarty said the market can expect to reap the rewards in 2019.

China and the markets growing to meet it

Last year, China drove much of the reduction in prices, with its pullback on feed-in-tariffs creating oversupply in the global market.

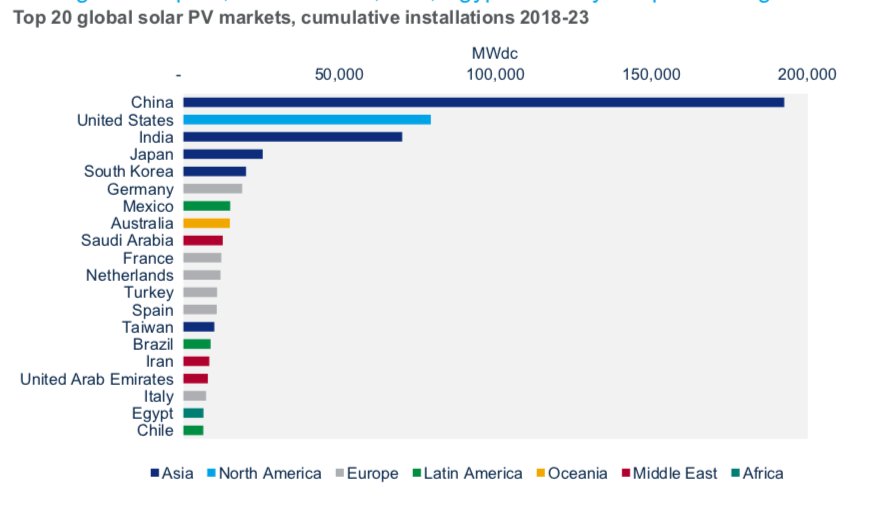

All the forecasts Greentech Media considered in this piece once again logged China as the biggest market in 2019. Despite the growth of emerging markets, analysts said China will continue to play a central role in global demand.

BNEF forecasts China will add 34 to 44 gigawatts this year. WoodMac projects 45 gigawatts, but adds that there's a good deal of upside and downside risk there. And IEA once again presents the low-end view at 34 gigawatts.

Smaller markets are starting to mellow China’s influence, as the market there remains somewhat uncertain.

“That heady reliance on China for installation is starting to wane,” said Heggarty. “Which, generally, I think is good for the PV market globally.”

A recent note from BNEF notes the Chinese market is still in “disarray” and Chase said “there is no coherent government plan” to make up for the country’s move away from feed-in-tariffs.

A policy notice released this month offers some guidance on subsidy-free wind and solar projects. WoodMac analyst Rishab Shrestha said it “potentially cements the view that China’s solar market will return to stronger growth in 2019.”

Chase, however, argues there’s more clarity needed.

“We are really just guessing how much China will install in 2019,” wrote Chase. “We do, however, expect strong build in many, many smaller markets like Vietnam, the United Arab Emirates and Egypt. And, of course, some growth in Europe again as countries build capacity they tendered to meet 2020 targets.”

That growth outside of China means the market will remain “pretty stable,” according to Chase.

“The big swing is in China,” she said. “Most other markets look like they’re just getting on with it.”

It’s the same story from WoodMac. Heggarty noted that in China “installations will probably slow down somewhat from the real boom years where feed-in-tariffs were very much driving [installations].”

WoodMac’s Attia said, in addition to China, Europe, Saudi Arabia, India, Mexico and other emerging countries will be the markets to watch.

“We are seeing increasing diversification in the global market,” he said.

According to WoodMac, while four or five top countries used to control about 80 percent of demand, by 2023 that dynamic will shift significantly, with the top 20 markets accounting for 83 percent of demand.

Source: Wood Mackenzie Power & Renewables

WoodMac expects Saudi Arabia, Iran, Egypt and Italy to grow at the fastest pace.

“There’s no one big factor that offset the downturn in China but there’s a number of positive signs, or green shoots of markets cropping up around the world,” said Heggarty. “That’s really going to be a key feature of where we see the market over the next five years.”

The U.S. rise of renewables

Headed into 2019, the U.S. market is confronting the stepdown of the Investment Tax Credit, which after 2019 will drop from its 30 percent value. WoodMac projects the rush to finish projects before that deadline will mean a big year for the U.S., with the highest capacity additions since 2016.

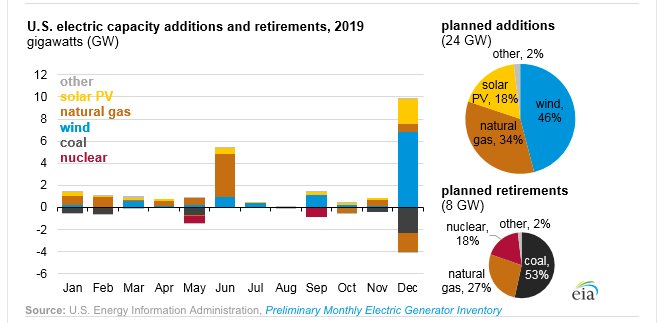

According to the Energy Information Administration, renewables will lead capacity additions in 2019. Though most will be wind, at 46 percent of total additions, solar makes up 18 percent of planned additions. That’s a total of 4.3 gigawatts of utility-scale and 3.9 gigawatts of small-scale solar.

WoodMac’s projection is quite a bit higher than the EIA's, at 11.5 gigawatts, while BNEF forecasts 10.5 to 14.1 gigawatts. IEA’s main case forecasts the U.S. will add 11 gigawatts of utility and distributed solar in 2019.

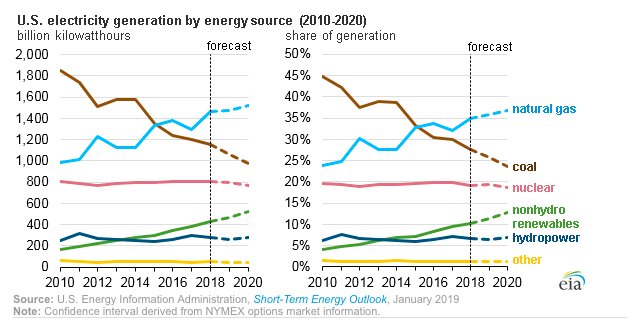

EIA’s forecasts show renewables accounting for 18 percent of electricity generation this year. EIA said non-hydroelectric renewables will be the fastest growing source of electricity generation in the U.S.

The electricity generated by utility-scale solar plants will increase 10 percent this year.

Though fossil fuels, especially natural gas, will continue to dominate electricity generation going forward, analysts say solar is becoming more and more of a threat to thermal resources.

“Solar is just becoming a lot more competitive in developed power markets,” said Heggarty. “2019 should be a pretty positive year.”