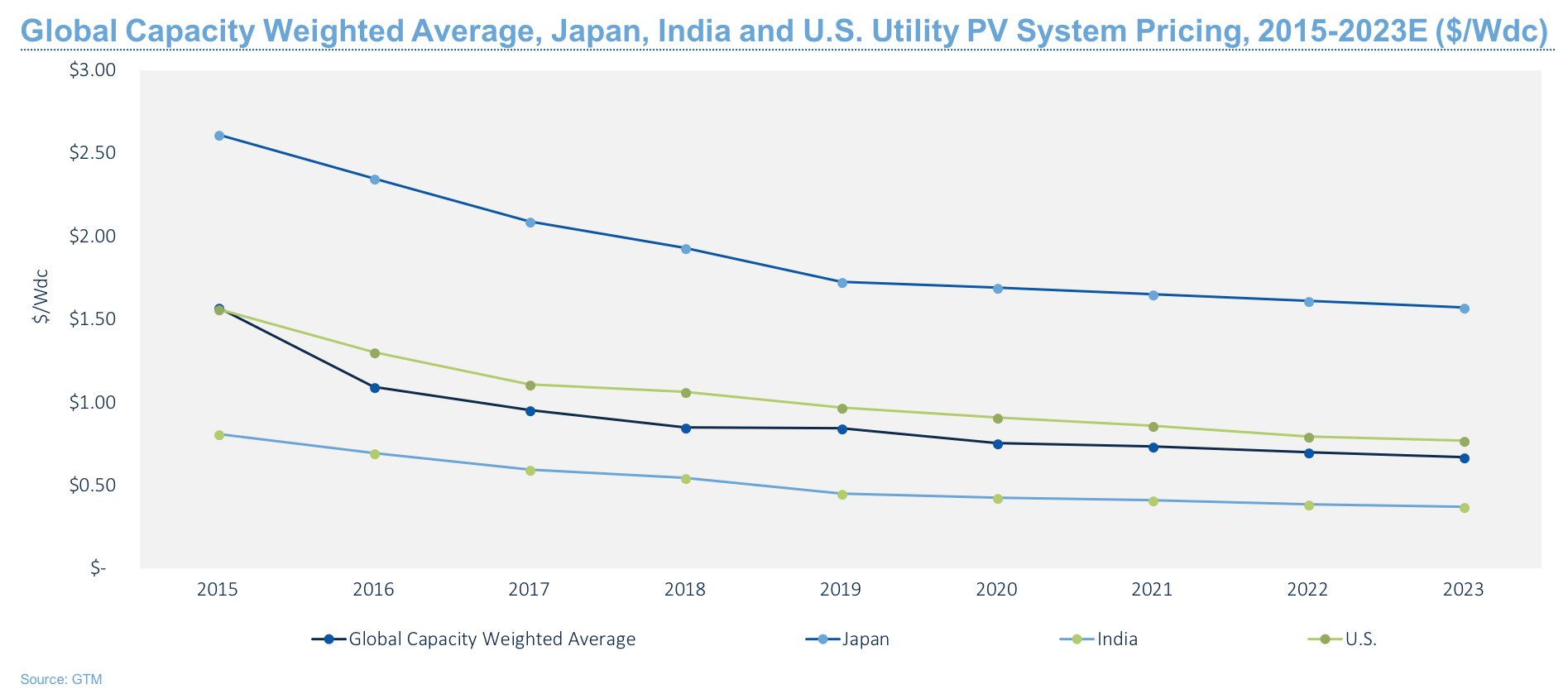

When the Department of Energy set its $1 per watt SunShot goal in 2011, it was a reach.

But deep price cuts and a rapidly maturing business meant the U.S. achieved its aim years earlier than expected. Though prices have since boomeranged back above the $1 mark, they’re set to dip again before the targeted 2020. Prices in countries across the globe have taken a similar nosedive.

According to two new reports from GTM Research, that trend is to continue.

“In a relatively short period of time, without what many would call any sort of major disruptive technology advancements, the industry has matured to these drastic cost reductions,” said GTM Research solar analyst Ben Gallagher.

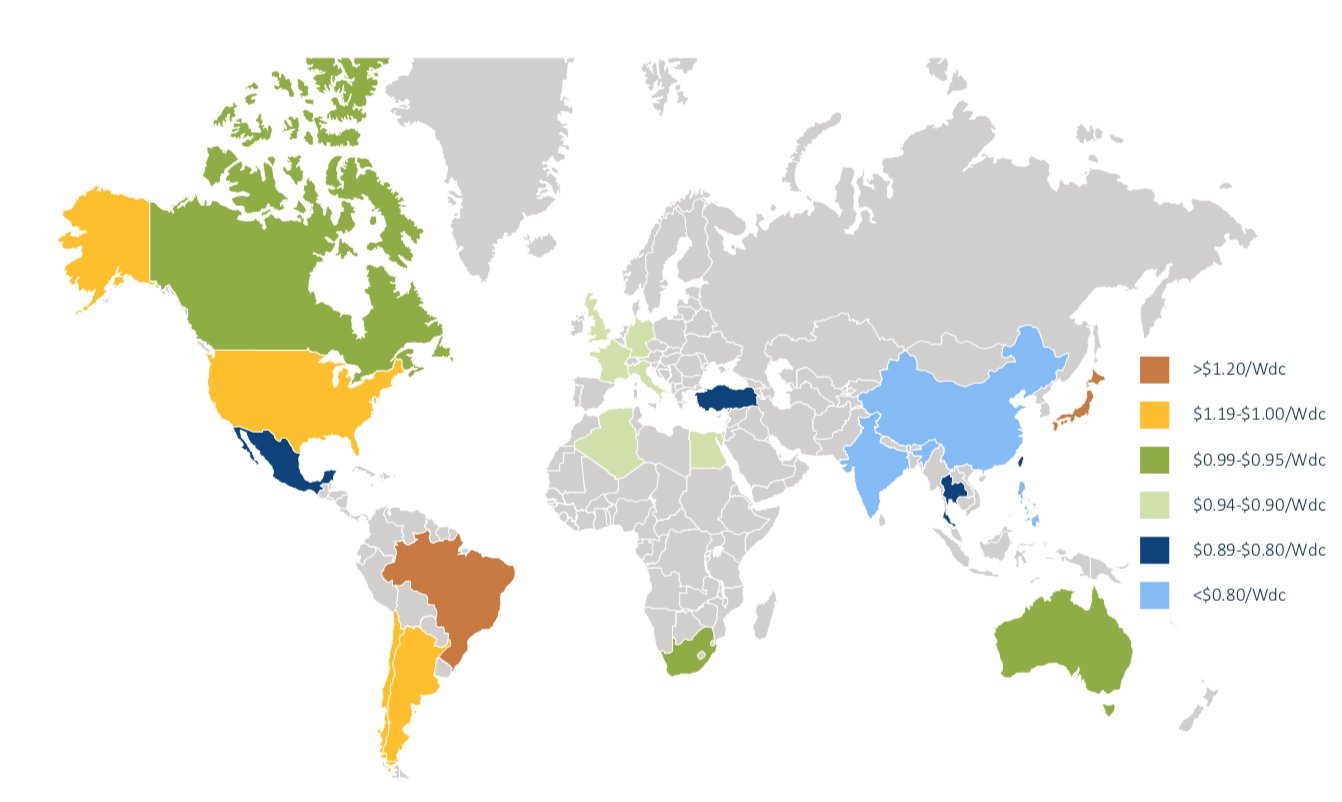

Global Average Utility PV System Pricing

Source: GTM Research

Now most major solar markets see an average utility PV price below the SunShot goal.

Gallagher attributes the continued tumble in overall costs to two main factors: dropping module prices and the gaining dominance of solar auctions. With those two pressures, prices remain on a downward trajectory looking into the next decade.

“When we look at pricing or system costs, going forward, basically in most markets the system prices are going to be far lower than anyone even imagined — even the most optimistic member of the industry,” he said.

By the end of 2023, the global average reaches $0.67 per watt according to GTM Research’s projection. The cost drop is so drastic that Gallagher said the price of a whole system in India in 2020 will be equivalent to the cost of purchasing just the panels for the same installation in 2015.

“That’s pretty gigantic,” he said.

Module prices and “near-term risk”

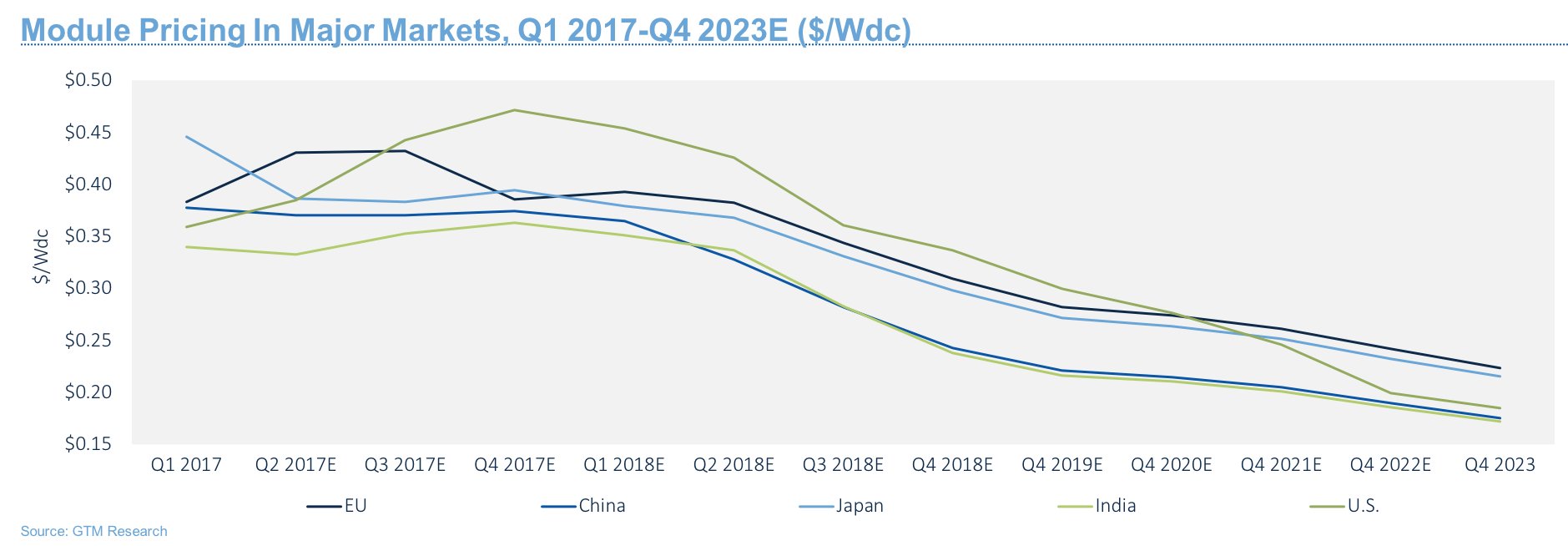

Module prices make up a large percentage of overall system cost, especially in utility-scale projects. Reducing costs there has the greatest capacity to drive further price declines.

Through 2023, GTM Research projects manufacturers will produce cheaper and cheaper modules. The lowest prices will emerge in India and China, two markets where module prices drop to about $0.17 per watt. Prices will be only slightly higher in the U.S. at $0.18 per watt.

A reduction in manufacturing costs will spur much of that downward trend. But GTM Research notes a larger market as well as political factors have also created “substantial near-term risk” to those projections, according to GTM Research.

Oversupply in the global market — partially driven by China’s recent change in solar policy — compelled GTM Research to revise down its forecast between 4 and 6 cents per watt, according to Gallagher.

Trade protectionism and even brewing trade wars also remain a “tremendous unknown,” according to Gallagher. Depending on how the U.S. and other countries approach trade in the next years could have significant impacts on overall system costs and impact the industry at large.

In addition to the Trump administration’s Section 201 tariffs, for which the details on exclusions are still being sorted, India this month instituted a 25 percent import duty on Chinese and Malaysian cells.

In the U.S., 201 tariffs, plus increased use of single-axis trackers, have helped push average system price back above the Sunshot goal.

While those duties have more of an impact on utility-scale projects, the U.S. is also now the most expensive residential market in the world.

That’s largely because of still prohibitive customer-acquisition costs. Gallagher said costs to reach new buyers have either flatlined or risen in the last three years. That’s in comparison to markets like Europe and Australia, where higher electricity prices make the economic case a familiar one to customers.

“At present there is very little evidence to show that anyone has the correct strategy to acquire a customer better here in the U.S.,” he said. “It is a chronic problem.”

A tender market

A strategy to lower utility-scale prices is gaining ground around the world, though.

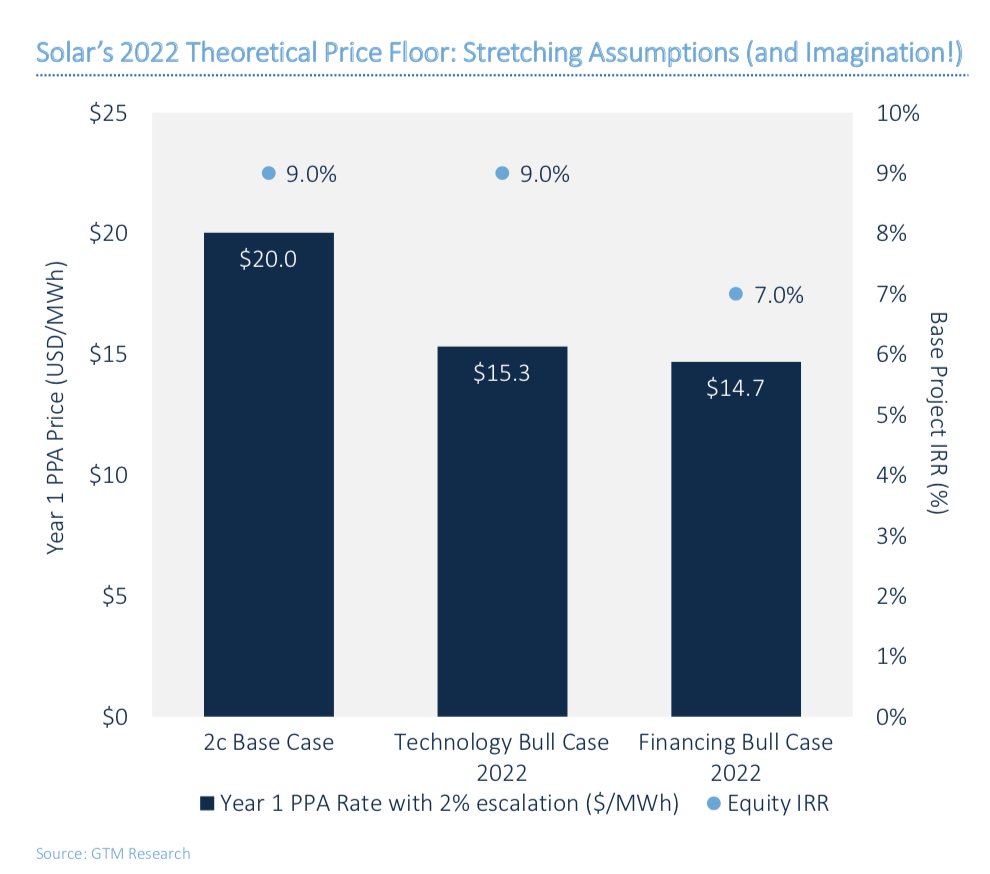

Auction programs have gained popularity and continue to push bid prices lower. In a recent report, GTM Research quantified the theoretical floor at $14.70 per megawatt-hour by 2022.

“Utility-scale tenders have been proven to be an excellent way to reduce prices,” said Gallagher. “It forces everyone throughout the entire ecosystem, throughout the entire supply chain, to try to find ways to reduce costs.”

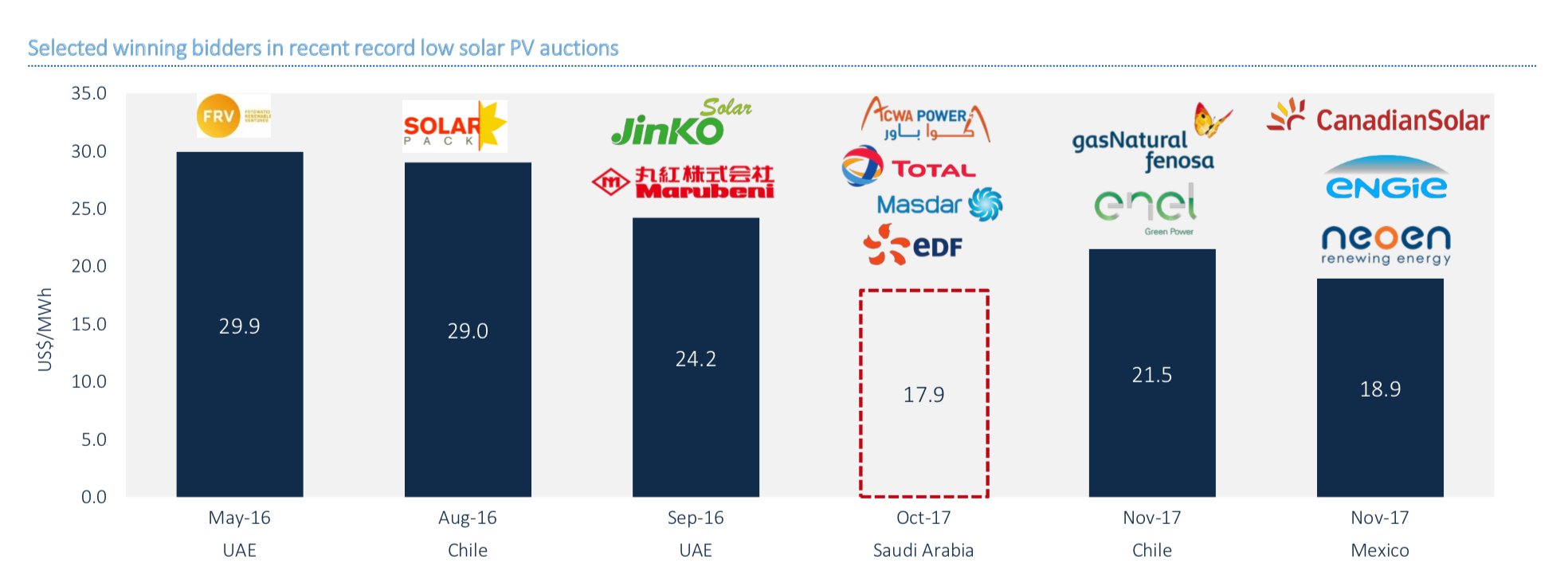

Recent record-breaking utility-scale bids — of which there have been seven in the past two years — hovered around $20 per megawatt-hour. Mexico hit a new low in November with a bid at $18.90 per megawatt-hour.

GTM Research Solar Analyst Ben Attia said by 2022 the global average for power-purchase agreements could fall to $40 per megawatt-hour from the current $60 per megawatt-hour.

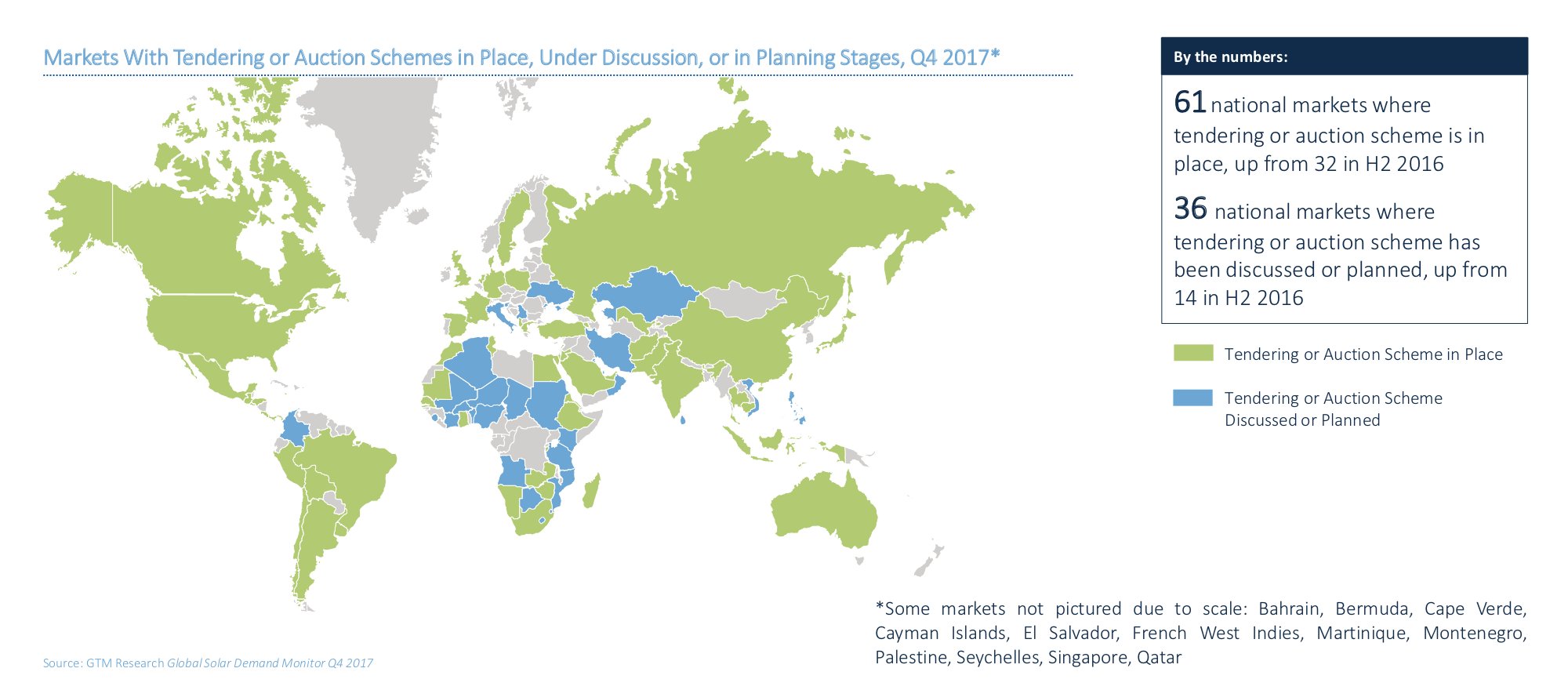

The number of national solar markets using tenders or auctions has ballooned in recent years, from 32 in the second half of 2016 to 61 currently. Such programs have been considered or planned in an additional 36 markets. Attia said nearly 100 countries are planning to or have already started transitioning to competitive procurement.

For developers, the increase in auctions has both widened the playing field and increased competition.

Recent record setting bids have come from large companies with “deep pockets and strong balance sheets,” including Total, EDF and Engie.

Attia notes more industrial companies specializing in areas like real estate and defense are also eyeing solar auctions as “greener pastures to deploy their capital” because projects represent a stable investment they can later offload to another investor. With more players looking to bid, prices will only sink lower.

Mexico is a prime example. GTM Research projects the country’s utility system prices will tumble to $0.56 by 2023 from $1.29 in 2015.

But as prices get lower and lower in Mexico and elsewhere, they present new challenges for the industry. Allegations of developers cutting-corners, such as purchasing sub-standard hardware, have swirled around some of Mexico’s super-low bids. Gallagher said those issues haunt the wider solar market.

“There’s been constantly a quality problem in the solar industry. There have been a lot of bad actors out there,” said Gallagher. “Going forward, there’s still going to be people that cut corners, there’s still going to be new players in the solar industry that don’t do the right due-diligence.”

Gallagher said working out those kinks is part of maturing a “relatively nascent technology.” But because problems with quality are more likely to impact the asset owner or the offtaker than a developer, he said financiers need to become savvier about products and project standards.

In eking out lower and lower prices, though, Attia said more onus will fall on the developer.

“It’s a much bigger leap to get from a 2-cent bid to a 1.5-cent bid for a developer,” Attia said.

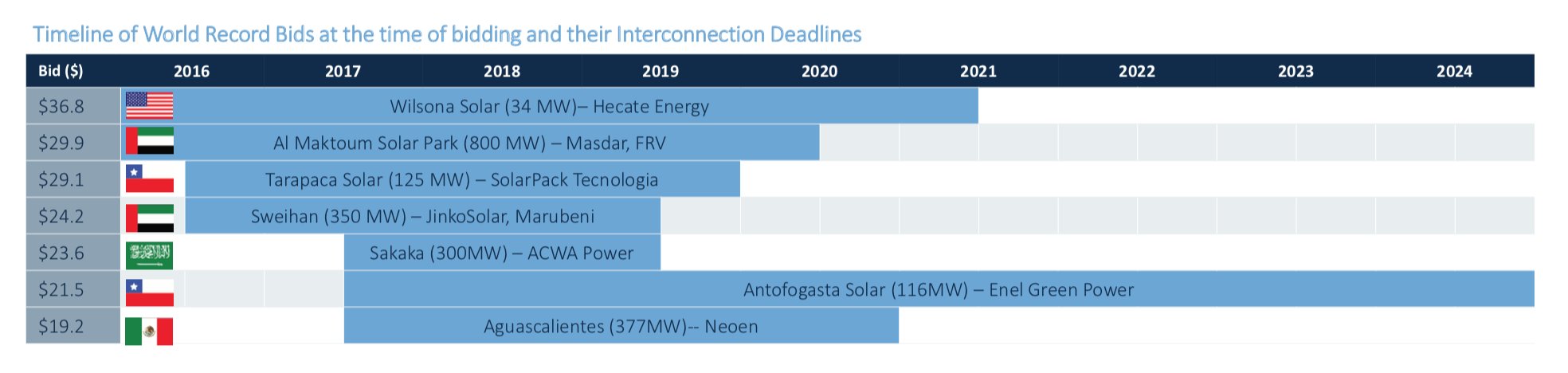

To cushion that risk, developers are using long lead times in their favor. Most projects tied to record-low auction bids appearing right now won’t come into service until at least 2020.

Source: GTM Research

Source: GTM Research

That allows for more aggressive pricing assumptions, as developers expect prices to continue to fall. But it also puts extremely aggressive projects at risk of cancellation.

“Banking on overly-aggressive assumptions on forward system pricing could mean many of these ultra-low-priced projects are not realized,” Attia writes. “Some ultra-low bids may be unviable if the true margins developers are earning remain razor-thin, or forward pricing assumptions turn out to be overly aggressive.”

Attia ties the future viability of those bids back to outside forces pressuring prices, including trade protectionism. Gallagher notes those forces could upend the dual pressure from module prices and tender schemes.

“Protectionism in Japan or India or in the U.S. or European Union, or any major market, could disrupt this forecast and have a variety of trickle-down effects throughout the industry,” said Gallagher.