Net metering is one of the most widely adopted energy policies in the United States. Today, 42 states offer some form of net metering -- a billing mechanism that credits distributed solar owners for surplus electricity they add to the grid.

But while net metering is still the dominant compensation method for rooftop solar, a growing number of states are re-evaluating their net energy metering (NEM) policies and how to value the wider array of distributed energy resources (DERs) in the evolving electricity system.

Thirty-nine states took some form of solar policy action in the first quarter of 2016, according to the N.C. Clean Energy Technology Center’s latest edition of its 50 States of Solar report. Twenty-two states considered or enacted changes to net metering policies. Many of these states are looking at alternatives to retail-rate NEM, which compensates solar customers for energy exports at the retail electricity price.

New York state is currently leading one of the most comprehensive reviews of NEM seen to date. In late December 2015, the Public Service Commission opened a docket dedicated to determining the value of DERs (15-E-0751) as a part of the New York Reforming the Energy Vision (REV) proceeding (14-M-0101).

The proceeding is working toward an end goal that values DERs based on all of the benefits they provide, factoring in time and location. To get there, New York regulators are using the formula LMP+D, which represents the location-based marginal price of energy (LMP) and the value provided to the electric distribution system (D).

On April 18, a range of stakeholders filed proposals on alternatives to traditional retail-rate NEM as the state transitions to LMP+D. An interim solution is to be implemented by 2017.

On May 10, stakeholders held a technical conference to discuss four of the proposals -- including a landmark compromise deal put forward by a coalition of New York utilities and three major solar companies. This article examines that proposal in depth.

Separate interim proposals were filed that called for maintaining retail-rate net metering credits. Longer-term proposals were also filed on how to value distributed energy resources once LMP+D is in effect. These filings will be addressed in Part 2 of this series.

On May 25, administrative law judge Sean Mullany ruled that going forward, all active parties would engage in an “informal and collaborative process” to develop joint recommendations for the commission to act on before the end of 2016. June 10 is the deadline for the submission of public comments on the interim proposals. On June 14, the PSC will hold a conference to address issues related to the development of an interim methodology for valuing and compensating DER.

The Solar Progress Partnership

The Solar Progress Partnership (SPP) was formed in order to support solar development in New York state, while simultaneously addressing customer cost-sharing issues related to solar growth. The filing addresses compensation for both community solar and behind-the-meter or rooftop solar projects, with a slightly different solution for each.

The coalition of utilities and solar companies backing the proposal is made up of Central Hudson Gas & Electric, Consolidated Edison, New York State Electric & Gas, Niagara Mohawk Power, National Grid, Orange and Rockland Utilities, and Rochester Gas & Electric, as well as solar companies SolarCity, SunEdison and SunPower. The Advanced Energy Economy Institute (AEEI) played a central role in facilitating the deal.

“It's exciting to have true collaboration between the utilities and the solar companies, which has been tried many times before with varying degrees of success,” said Lisa Frantzis, senior vice president of strategy and corporate development at AEEI. “I think this is an example where we really succeeded.”

It took nearly four months to craft the agreement, from just before the 2015 holidays to moments before the filing deadline on April 18. The SPP proposal was submitted as part of the value-of-DER docket (15-E-0751), which asked stakeholders to come up with an interim successor to NEM in transitioning to LMP+D.

One of the proposal’s first recommendations is to build upon the existing formula with the introduction of “E” to account for benefits to society at large. Using LMP+D+E would create a visible cash flow for externalities that are not captured in current markets.

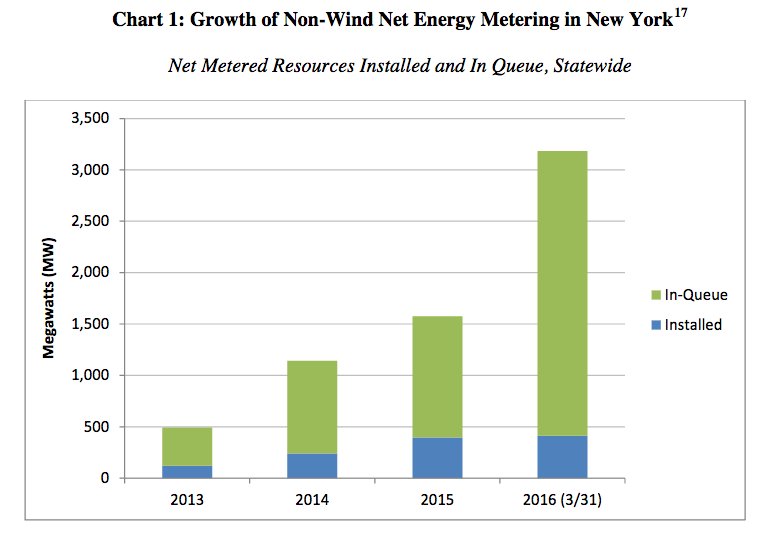

Utilities and solar companies were motivated to offer a joint solution as part of the broader REV discussion, and to address a backlog of community solar projects and the looming threat of a NEM cap. Applications for NEM-eligible resources more than doubled in the first quarter of 2016, with much of the development coming from New York’s community solar program.

The large number of community solar applications, particularly in Central Hudson and Orange Rockland territories, prompted utilities to effectively put the programs on hold and file a petition to reinstate a net-metering cap, which the solar industry feared would stall investment. With SPP’s community solar proposal, utilities withdrew their petition.

Community distributed generation

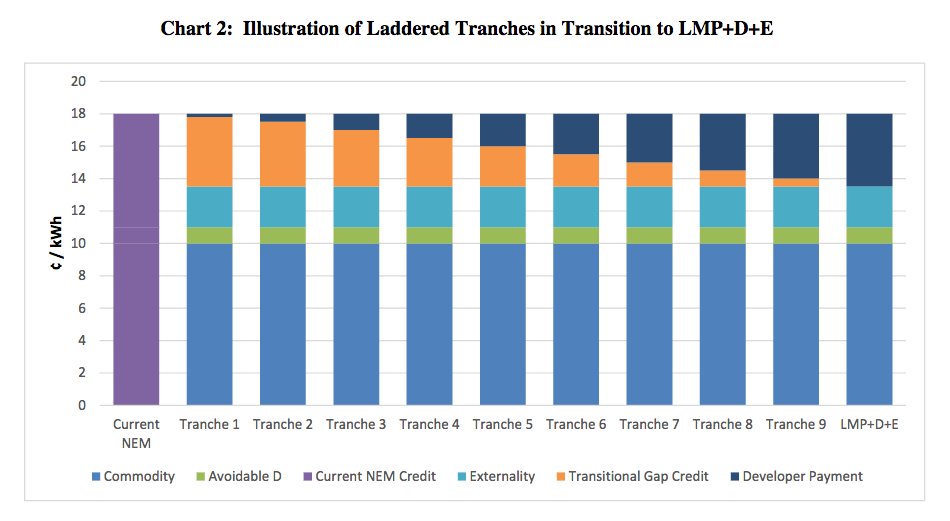

The Solar Progress Partnership proposed that stakeholders take a “laddering approach” to address community distributed generation. In the early years of the program, utilities would pay a “transitional gap credit” to cover the cost of a customer's energy exports credit. Solar projects that are installed where there’s greater value to the grid would get priority in the interconnection process; utilities will go through applications on a first-come, first-served basis.

As solar penetration increases and the industry moves through the tranches -- the proposal suggests 10 -- solar developers would begin to pay utilities for a portion of the customer credit. The gap credit would be steadily phased out until compensation reached the end goal of LMP+D+E. Prior to the implementation of LMP+D+E, NEM customers would continue to receive their designated NEM compensation for 15 to 25 years, which assures customers and financiers there won't be any sudden rate changes. Throughout the transition process, customers would continue to receive NEM credits at the full retail rate, while the entity that pays for the credit would change behind the scenes.

“Customers still get net metering, for all intents and purposes, under what they've already received and enjoyed. That simplicity is really important,” said Shaun Chapman, vice president of policy and electricity markets at SolarCity. “Then, on the back end, the utility and the developer will actually be working together to...transact for the grid costs of offering the community solar projects.”

The Solar Progress Partnership recommended a similar interim compensation structure for virtual net-metered projects.

An "orderly step-down"

The SPP proposal is designed to provide stability and certainty for all parties moving forward. Utilities would have the financial resources they need to maintain a reliable grid, and solar companies would have an easier time securing customers and project financing.

Long-term contracts and simplicity for the customer help to secure financing, and so does working with utilities in good faith, said Chapman. Collaboratively addressing utilities’ technical concerns helps to ensure that solar companies have a willing partner that will deploy solar projects in a reasonable timeframe, “which is something that’s important to financiers,” he said.

The hope is to avoid a Minnesota-like situation where a high number of community solar applications caused the utility to slow the program rollout. Without adjustments, New York state could be headed in the same direction.

“What we were seeing more recently is that a lot of these [community solar] systems were in the queue, but the utilities weren't interconnecting them, because they were very concerned about the revenue shifting to other non-solar customers,” said AEEI's Frantzis. “I think this proposal creates an orderly step down in compensation to prevent a shock to the market, which we all agree is a better thing.”

But there are still a number of question marks with the Solar Progress Partnership proposal. Notably, the proposal establishes a transition structure, but does not propose what the values in each tranche should be. The SPP leaves the size and pricing terms of each tranche up to the Commission. Therefore, the PSC would have to have determined the value of LMP+D+E before instituting this interim NEM alternative.

Solar companies are banking on the fact that the transitional fee will be small and that the ultimate LMP+D value will be only slightly lower than retail-rate net metering. Developers will likely pass on the difference to customers in the form of a higher community solar cost, but still expect the economics to pencil out.

“I would not anticipate the solar developer payment be too high to warrant a market in the next year or two,” said Chapman of SolarCity. At the same time, solar project costs are expected to decline, which Chapman said should ensure “a bright and viable market over the coming years.”

SolarCity currently has more than 700 employees in New York state, and that number will increase significantly with the launch of SolarCity’s manufacturing facility in Buffalo.

On-site DER installations

The Solar Progress Partnership also sought to come up with a transitional solution for behind-the-meter solar. In this case, rooftop solar projects would continue to receive the full retail-rate NEM credit from utilities until January 1, 2020 -- unless accelerated solar deployment triggers an earlier transition, which would be determined by the PSC on a utility-specific basis. Starting in 2020, behind-the-meter DER systems would begin the transition to LMP+D+E.

Both utilities and solar companies agreed to this interim solution, but they did not agree on how behind-the-meter solar should be compensated after 2020. This element of the negotiation nearly derailed the entire agreement, but negotiating parties ultimately decided to offer two different solutions for the post-2020 timeframe, rather than scrap the deal.

Solar companies presented an option that would see bill credits for net exports of on-site NEM resources decline in blocks based on a certain amount of installed capacity. Compensation would decrease in 20 percent increments (LMP+D+E plus 80 percent the difference between the LMP+D+E and full retail bill credit, following by 60 percent, etc.) until compensation arrives at the LMP+D value.

Utilities proposed a shorter three-year ramp-down, as opposed to a usage-based approach. In the first year, NEM customers would be eligible to receive LMP+D+E plus 75 percent of any positive difference between full retail rate NEM and LMP+D+E. The following year, customers would receive 50 percent of the difference and 25 percent in the year after that. In year four, all installations would receive the LMP+D+E value.

In both cases, net metering credits for new solar installation owners would ramp down in phases, with credits locked in for 15 to 25 years at each step of the transition.

“I think most people acknowledge -- even in the solar industry -- that there eventually needs to be some transition to achieve these other end-state visions of where you want to go,” said Frantzis. “In New York, there’s a vision of LMP+D as a much more market-based mechanism. I think a lot of people have agreed on the vision, and there's a lot of alignment on the end state, but how you get there has always been the more difficult piece of it.”

The details of the Solar Progress Partnership proposal are still very much up for discussion, she added. At the same time, there’s a dynamic debate still to come on the values and methods of calculating the long-term LMP+D formula. Still, for many, the fact that two often-opposing sides were able to find common ground represents progress.

“The value to us and to all the utilities has really been that we were able to work with at least these three solar companies…to understand their needs, the needs of our customers, and how we can collectively move forward,” said Stuart Nachmias, vice president of regulatory affairs at Con Ed.

“Frankly, we at Con Edison had been watching what's happening around the country, and we said, 'There's got to be a better way,'” he added. “We had worked with the Advanced Energy Economy Institute previously, so we reached out to them and said, 'Could you help us facilitate some discussions with solar companies? We'd like to give it a try.'”

Potential drawbacks

While the Solar Progress Partnership represents a breakthrough in NEM negotiations, it’s not without issues. For one thing, only three solar companies signed onto the proposal, and one of them, SunEdison, is effectively no longer in operation. So the solar stakeholders in this case are hardly representative of the entire solar ecosystem in New York state. Also, some solar advocates and clean energy experts take issue with the premise that the LMP+D+E value is lower than the retail rate for electricity.

“My initial concern is the unwritten assumption that [the DER] value is less than retail,” Karl Rabago, executive director of the Pace Energy and Climate Center, at the Pace Law School. “There’s nothing in the model that addresses…that solar is worth more, which so many studies have found.”

Rabago also expressed concern over the credit ramp-down options for behind-the-meter solar starting in 2020. He believes both the solar industry’s proposed 20 percent decline and the utilities’ proposed 25 percent decline will be difficult for smaller solar companies to keep up with.

Smaller companies could also struggle to accommodate the tranche schedule laid out in the community solar proposal, he said. For one thing, the formula assumes that as solar companies start paying for an increasing amount of the export credit the industry will see measurable cost reductions to make up for it, which may not be the case for all installers. Rabago pointed out that the tranches also set up the possibility for queue gaming, where companies try to buy and sell prioritized positions to build out projects.

Managing the transition through 10 tranches is another concern, he said. Changing credit terms will be a challenge for small companies to manage logistically and financially. The community solar proposal also relies on being able to rank the sub-nodal distribution value in locations on the New York grid; however, utilities simply don’t have that kind of granular data yet.

“There is a lot of work for a relatively short period of time,” said Rabago. “It is proposed as a transition, but it's a transition that proposes a direction and magnitude that I'm not sure is 100% supported by market conditions.”

Rabago highlighted one other potential issue with the SPP proposal. Footnote 25 states that the portion of the “transitional gap credit” that utilities will cover in the earlier years of the community solar plan will be paid for by a non-bypassable surcharge mechanism on all customers, “because all customers benefit from societal benefits generated by an eligible project.” Arguably, the societal benefit of the surcharge is to serve as a policy tool in the broader NEM transition. But if there is some other benefit associated with an eligible DER project, Rabago questioned why it wasn’t factored into the underlying LMP+D+E equation.

“The real takeaway is that in spite of all our sophistication, in spite of all the progress we're making in REV, the utility joint proposal along with SolarCity, SunEdison and SunPower has not progressed past the…view that solar customers are being subsidized by everybody else,” said Rabago. “So I go all the way back to my first point, which is: Why the hell are you making assumptions about value and structure from this? You're getting yourself wrapped up in these inconsistencies. Wouldn't the first step be to just do some valuation?”

A solution for other states?

Rabago did give the SPP some credit, however.

“I will say, I’m happy people have the guts to put out ideas,” he said. “The commission has created an atmosphere in which people are willing to try out their ideas. That's pretty cool.”

The Solar Progress Partnership is one of the most high-profile proposals in the value of DER docket. Other parties are now assessing the plan and will have the ability to offer comments up until June 10.

The REV proceeding has offered a unique framework through which to address NEM issues and DER valuation. However, stakeholders believe the mechanics presented in the Solar Progress Partnership agreement are transferable to other states.

“I think a lot of these discussions are starting to surface, because -- one, the penetration levels of solar have increased, but also because I think there is a willingness to try to find some win-win solutions like we did in New York,” said Frantzis. “We're already engaged with other states to try to come up with other win-win solutions.”

Nevada, where recent changes to NEM policy effectively brought the rooftop solar industry to a halt, is often cited as the worst-case scenario. Solar companies left the state and people lost their jobs. Many consumers that were angry at the utility and policymakers are now looking at ways to go back and offer a more balanced solution. The New York model represents a productive alternative.

“We would like to replicate that collaborative process in as many states as possible,” said Jon Wellinghoff, SolarCity's newly appointed chief policy officer.