Photo: NASA

The slow march of distributed energy as a grid resource continues. This month, the Federal Energy Regulatory Commission approved plans from California’s grid operator to allow aggregations of rooftop solar, batteries, plug-in vehicles and other behind-the-meter distributed energy resources -- DERs, in industry parlance -- to participate in their wholesale energy markets.

That doesn’t mean that DERs are now bidding into grid markets, however. FERC’s approval is only the first step in the process. It’s going to take a whole new set of tariffs -- rules and mechanisms for grid market participation -- to allow lots of small-scale, independently controlled energy resources to join power plants, solar and wind farms and big commercial and industrial demand response as price-responsive, dispatchable grid resources.

Last June, grid operator CAISO submitted its first proposal to create a new class of market participant, known as a distributed energy resource provider, or DERP. That’s the broad-brush plan that received FERC approval earlier this month, and the final version contains most of the same core concepts laid out back then.

In simple terms, CAISO is looking for aggregations of at least 500 kilowatts of resource within a single sub-load aggregation point -- the regions that CAISO has broken the state’s grid into, based on transmission constraints. Aggregations will have to prove they’re able to follow the same dispatch signals that power plants do, and CAISO will be able to assess financial penalties to those that don’t.

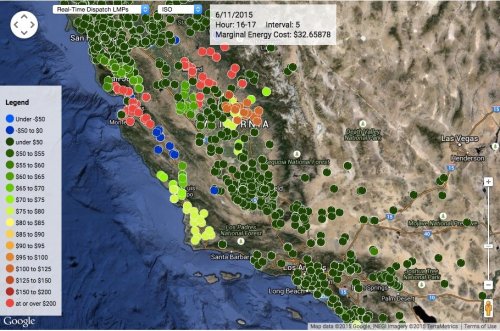

FIGURE: P-Nodes in the CAISO System

CAISO isn’t expecting its DER market participants to set up every solar-storage system or demand response-enabled building with the same real-time telemetry that now connects it to big power plants. Instead, it will ask participants to manage how they network and control their distributed assets, and create virtual connections to CAISO’s dispatch and control systems -- the rules of which are still being worked out.

At the same time, CAISO has formed the Energy Storage and Distributed Energy Resources, or ESDER, initiative, to work out the complexities of integrating DER aggregations into market rules built for power plants. It’s also split the ESDER initiative into two phases -- Phase 1, which deals specifically with a subset of energy storage and demand response issues, and Phase 2, which gets into more complicated issues.

The ground rules for distributed energy as grid market participant

Let’s start with ESDER Phase 1, which took on two key concepts. The first was how to make enhancements to CAISO’s rules for non-generating resources, or NGRs. That category includes demand response, which uses energy reduction to meet grid needs. But it also includes energy storage systems, since they don’t create their own energy.

This brings some new concepts into play, based on the unique operating characteristics of these two resources. For energy storage, it’s state of charge, or SOC -- how much energy each unit has stored and available for dispatch at any given time. For demand response, it’s the issue of baselines -- the methodology for figuring out how much energy the participants normally use, against which any reductions can be measured for compensation.

Earlier this year, CAISO submitted requests to FERC for tariff changes related to ESDER 1. These include several options for how participating energy storage can provide state-of-charge information, which is important for CAISO to predict how much stored energy is available at any given time. It also includes a range of options for how demand response providers can meter different combinations of load reduction and on-site generation -- important when multiple DERs are acting in concert.

At around the same time, CAISO kicked off its Phase 2 stakeholder discussions, which takes on additional tasks that couldn’t be fit into the timeframe for completing its first phase. As Tom Flynn. CAISO’s infrastructure policy development manager, noted in the phase’s opening stakeholder conference, “The development of all of those outcomes involves a lot of significant implementation work on the part of the ISO. […] We have to reserve enough staff resources to implement what we and stakeholders successfully developed last year.”

In May, CAISO published its ESDER 2 straw proposal, which lays out the key areas it’s working on. Here’s a quick breakdown:

- First, it’s considering two enhancements to better reflect the unique characteristics of the DERs it wants to bring into the market. The first is called “use limitations,” and will set rules for how to model the daily and annual duty cycle constraints that batteries need to hold, to avoid degrading their long-term performance. The second is called “dynamic ramping,” and will seek to model how energy storage’s capacity to both discharge and absorb power changes from moment to moment, depending on its current state of charge and other operating characteristics.

- Second, it’s taking on demand response enhancements that could unlock the ability for proxy demand resources (PDRs) to do more than they’ve done to date. It's aimed at allowing resources not only to reduce energy use to mitigate peaks in demand, but also to absorb excess energy -- something that could be useful at times when there’s more power being generated than is needed, as is increasingly happening in California during times of high wind and solar output. It's also aimed at creating alternative baselines to evaluate PDR performance, since traditional baseline methodologies aren’t accurate for all the new energy technology combinations now available to utility customers.

- Third, it’s seeking to clarify the distinction between wholesale charging energy and “station power” -- the energy used to actually run power plants, battery arrays and other grid resources. That’s an important economic issue, and lack of clarity there has complicated the economic modeling of storage’s value in grid markets.

Dealing with “multiple-use” DERs: A multi-party process

At the same time, CAISO’s ESDER Phase 2 work hasn’t put as much weight on what is bound to be a very important issue -- how to handle multiple-use DER aggregations. In CAISO’s world, that means a DER aggregation that’s not just playing in wholesale energy markets, but performing a valuable task for another party.

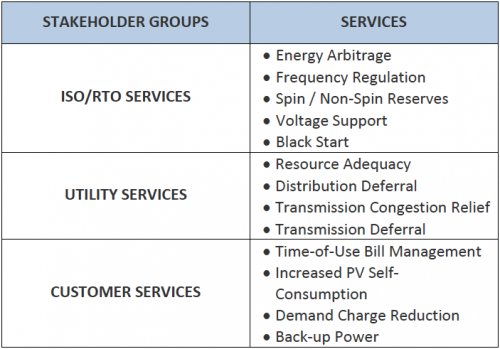

That could be a retail function -- reducing or shifting energy use to benefit a customer that’s seeking to reduce demand charges, manage time-of-use pricing, or other such benefits. Or it could be a distribution grid function -- serving to bolster a constrained portion of the low-voltage grid, or stand in for traditional grid investments. In ESDER 1, CAISO addressed these two general use cases, and noted several challenges they present, as shown in the following chart.

Take a DER aggregation that’s both serving a distribution utility to provide a grid service and bidding into CAISO market. In some cases, that resource may be getting CAISO dispatch signals that conflict with what it’s supposed to do for the distribution grid, putting it in the position of being penalized for not being able to serve both simultaneously.

At other times, however, it may be able to meet both parties’ obligation by taking the same action. That raises the potential for “double payment,” which could represent an unfair advantage in competing against other technologies providing grid market services.

This is one of the trickier issues facing CAISO, because it’s not the only party that’s involved in the discussion. Namely, the California Public Utilities Commission (CPUC) is in the midst of creating the structure for DERs to serve as distribution grid assets. Until that process is further along, CAISO can’t know with any certainty what the rules for DERs as distribution resources may be.

“The subject of multiple-use applications is receiving significant attention in Track 2 of the CPUC’s energy storage proceeding,” CAISO noted. That CPUC process has its own multi-stage process, with Track 2 “delving into many aspects of multiple-use applications including identification of use cases that provide multiple services and participate in the ISO market, and cost-recovery issues such as double payments, overlapping value streams, and redundant compensation.”

For these reasons, CAISO isn’t yet expanding on the multiple-use issues it first raised in ESDER Phase 1. And while that first phase did lay down some ground rules, it left out a big category of DERs that are being deployed in the state today -- those that have been contracted to fill utilities resource-adequacy requirements.

Resource adequacy is California’s version of what’s known in most other grid markets as capacity, or resources acquired today to ensure reliable energy in years to come. RA has traditionally been fulfilled through contracting for new or expanded power plants or broad energy-efficiency and demand-response procurements. But in the past few years, California’s utilities have begun to break ground on distributed energy for RA -- starting with Southern California Edison’s contracts for hundreds of megawatts of distributed batteries, solar and energy efficiency as part of its energy mix to make up for the loss of the San Onofre nuclear power plant.

But CAISO has so far limited itself to dealing with multiple-use issues for resources that aren’t providing RA, or can at least “set aside a portion of its installed capacity not providing RA capacity.” While it does intend to take up multiple-use issues for RA capacity resources, it hasn’t done so yet.

Defining the DERs that can, and can’t, play in CAISO aggregation

That’s important, because resource adequacy is expected to be an important driver for aggregating DERs -- and many of the other categories of DERs operating in California today won’t be permitted to participate in CAISO's new regime.

For example, participants in CAISO’s existing Proxy Demand Resource and Emergency Demand Response Resource programs won’t be eligible for DER aggregation. Those are the main demand response programs operating outside utilities today, and are served by the state’s utilities and mainline demand response providers like EnerNOC. These rules could change as California moves ahead on revamping its demand response rules to allow more distributed assets to take part, however.

Also barred from participating in DER aggregation are resources that are part of the state’s Demand Response Auction Mechanism (DRAM) pilot program, which is the first large-scale test of distributed assets for grid services in the state. That means that DRAM participants, like behind-the-meter battery providers Stem and Green Charge Networks, home automation platforms from OhmConnect and Alarm.com’s EnergyHub, and grid-responsive EV charging systems from eMotorWerks would have to create new aggregations beyond what they’ve done for the pilot program, if they want to play a part in CAISO’s new regime.

Finally, CAISO won’t accept resources that are taking part in retail-focused programs, namely, the state’s net metering program. Again, this makes sense, given that CAISO needs to make sure that resources aren’t getting paid two or more times for the same energy delivered.

All of these exemptions make for a tricky environment for would-be DER aggregators. Right now, these existing programs are the way for them to make money. But as CAISO’s new tariffs take shape, the market potential could become much more significant.

In all, these stakeholder discussions could go through the end of this year and the middle of next year until FERC takes decision on track 2 changes, said Ravi Manghani, director of energy storage at GTM Research. “In short, we're looking at summer of 2017 at the earliest for aggregated DERs to actually start participating in CAISO,” he said.

Still, FERC’s approval “is a big step, both practically and symbolically, in moving forward to a more distributed future in California wholesale market,” he said. Within six months, CAISO will be expected to submit an implementation report to FERC, including how many DER aggregations have requested participation, which could help reveal just how much appetite there is among DER players for tapping this unformed, yet potentially enormous, market opportunity for grid-responsive grid edge energy assets.