A new model for calculating the value of distributed energy resources could lead to big changes in the biggest U.S. state's energy market.

This spring the California Public Utilities Commission approved changes (PDF) to its Avoided Cost Calculator. The ACC creates hourly values representing “marginal costs a utility would avoid in any given hour if a distributed energy resource avoided the provision of energy during that hour" — a key measurement of the value of distributed energy resources (DERs) to the state's electricity grid, calculated over a 30-year time horizon for each utility and climate zone in the state.

These values apply to both DERs that provide energy, such as solar panels or batteries, and those that reduce or shift energy demand, as with energy efficiency investments, demand response or time-shifting and grid-flexible loads. And the “costs” being displaced by new DERs include not only energy and grid capacity but also greenhouse gas emissions and grid investments.

The ACC was first created to guide how the California Public Utilities Commission (CPUC) and the state's utilities measured the impact of energy-efficiency programs. But with the proliferation of behind-the-meter energy resources, "there are some interesting possibilities for using it to value other types of resources," said Tom Beach, principal consultant at Crossborder Energy who worked with the Solar Energy Industries Association on the latest changes to the ACC.

While the ACC hasn’t yet been directly put to use in these ways, various CPUC proceedings are using it as a key input for measuring those values. Indeed, the CPUC's new ACC ruling makes clear that it's "moving toward a common valuation method with consistent inputs and assumptions across all uses of avoided-cost data."

The implications are potentially big: The outputs from this updated spreadsheet model could lead to changes in how utilities set up energy efficiency or demand-side management programs, calculate the value of net-metered solar power, or direct years-ahead investment planning for utility-scale renewable energy, energy storage and transmission investments.

Here several key ways that the ACC's changes break new ground in measuring the value of DERs in California's energy future.

1. "Duck curve" implications of replacing gas plants with batteries

California, like almost every other state in the country, used to assume that natural-gas-fired power plants were the default resource for the “marginal” energy being delivered to the grid. In a radical shift, the latest ACC replaces them with battery storage. "That’s huge as an assumption," said Matt Golden, CEO of energy analytics firm Recurve.

The change makes sense: California is shutting down gas plants, rather than building new gas ones, and its long-range generation forecast calls for gigawatts of battery storage, much of it linked to new solar, to provide future energy and capacity needs. But that changed assumption has lots of implications on what DERs will be worth.

The first big implication is for the duck curve. California's grid is marked by a deep midday drop in net load as solar floods onto the grid and a steep ramp-up in late afternoon and evening as solar resource fades away, which has led to increasing amounts of solar being curtailed in the state.

“Looking at the tranche of resources being added from now until 2030, if it’s primarily going to be solar-plus-storage that mitigates the duck curve,” Beech said, “you’re filling it up in the middle of the day and then discharging it during the peak.”

Because the ACC calculates DER values over a 30-year time span, this long-term change will yield much smoother values throughout the course of a typical day than the trough-and-peak values yielded by the duck curve.

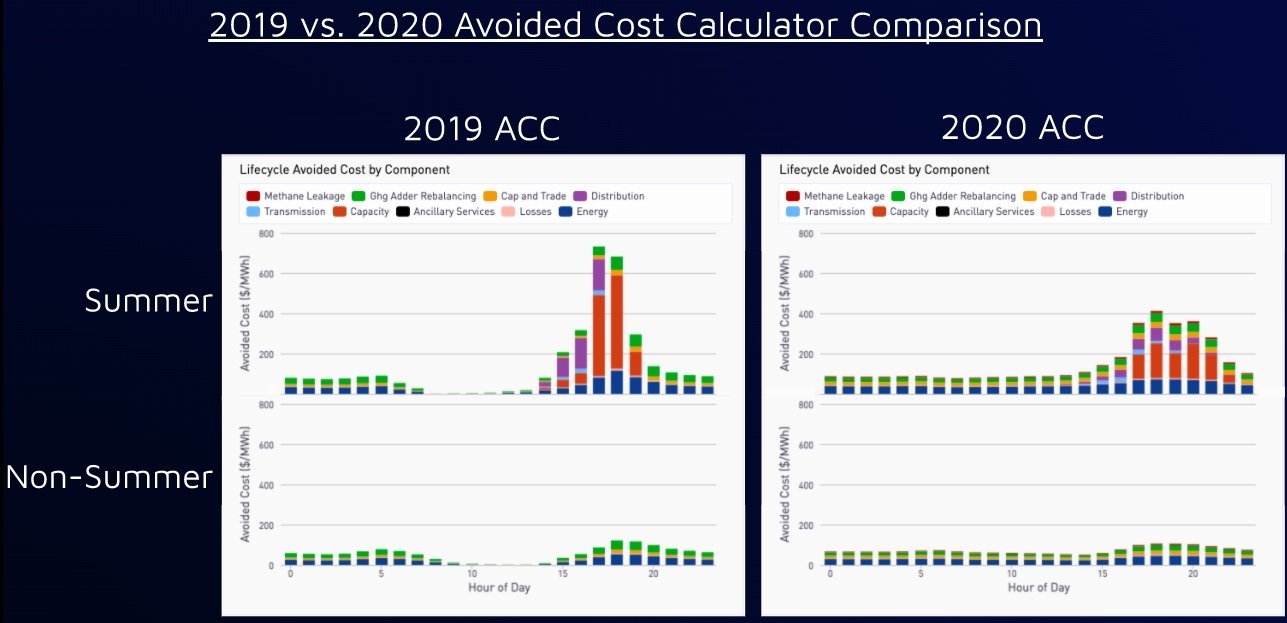

The chart below, developed by Recurve, compares old versus new ACC values for summer and non-summer months for utility Pacific Gas & Electric in a moderate climate zone. It shows how hour-by-hour DER values will be far less “peaky” in the late afternoons, and far more valuable during midday hours that used to carry little or no value, than they were under previous versions of the ACC.

2. Major adjustments in how demand-side resources are valued

The flattening duck curve “has very specific implications” for the relative value of different demand-side efforts, Golden said. Midday loads will become more valuable sources of load reduction, while those in late afternoon and evening reduction will be less valuable.

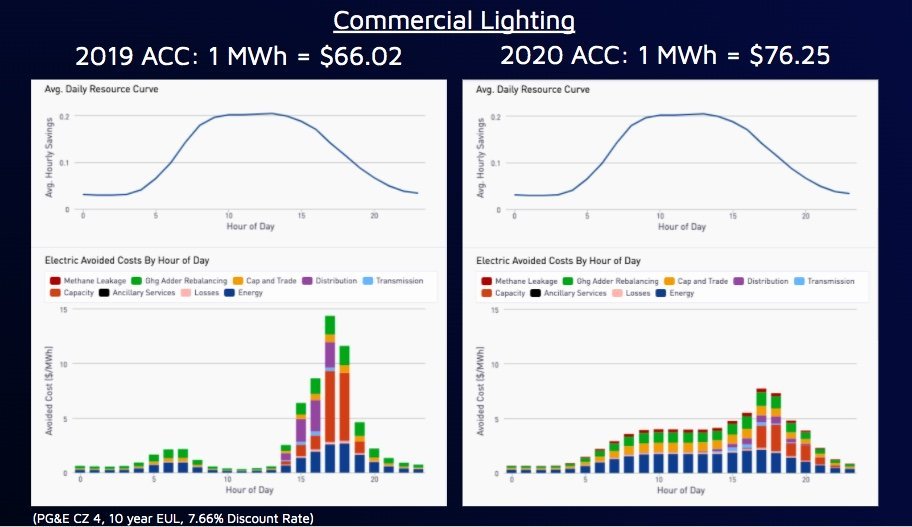

To illustrate this, Recurve analyzed two types of loads that fit these descriptions: commercial lighting and residential air conditioners. As a midday load, “commercial lighting just got a lot more valuable. You get less peak, but more hours during the midday.”

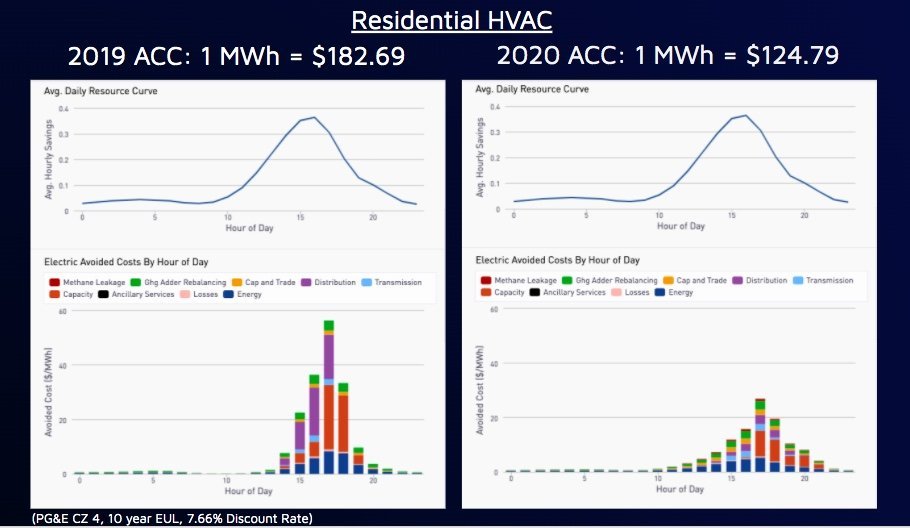

Residential AC, which is “very coincidental around the old summer peak, is less valuable now,” by contrast, as are other demand-response programs targeting those hours.

A 30-year average of future cost reduction benefits doesn’t change what utilities need to do this summer or next to manage peak loads. Still, given that California’s pay-for-performance efficiency rules are driving investment toward the most valuable resources, “the implication is that utilities are going to put more money toward commercial lighting, and less money toward residential HVAC, than they would otherwise,” said Adam Scheer, Recurve’s director of customer solutions.

3. Changing solar (and storage) values, from “NEM 3.0” to grid upgrades

California’s solar net metering regime underwent a big shift in 2016, adding time-of-use rates and new charges. But the next iteration of net metering, known as NEM 3.0, is expected to include even bigger changes, with the CPUC planning to incorporate an array of time- and location-specific measures that will alter the simple retail rates now earned by customer-owned solar.

The ACC, which is a systemwide calculation, isn’t designed to capture locational benefits, which are being developed in other CPUC proceedings. Still, “when you look at the costs and benefits of net metering, the [ACC] is a principal part of the benefits side,” Beach said. While the CPUC hasn’t said when it will begin its work on NEM 3.0, “they needed to get the Avoided Cost Calculator updated before they” get started on that process.

The new ACC will also inform how DERs are valued as part of investor-owned utility distribution and transmission grid investments under the CPUC's Integrated Distributed Energy Resources proceeding, said Carmen Best, Recurve's director of policy and emerging markets.

In that sense, the ACC could begin to serve a purpose similar to New York state’s Value of Distributed Energy Resources tariff, which is designed to deliver location- and time-based values for how DERs provide energy, reduce grid infrastructure costs and meet carbon-reduction goals.

"That could break down some of the silos that determine how we’re deploying these technologies," Best said, offering the potential to replace the relatively clunky, grid-project-centric approach now in place in California with "a market structure, a market design, that captures the value of the [ACC]."

4. DERs as replacement for transmission investments

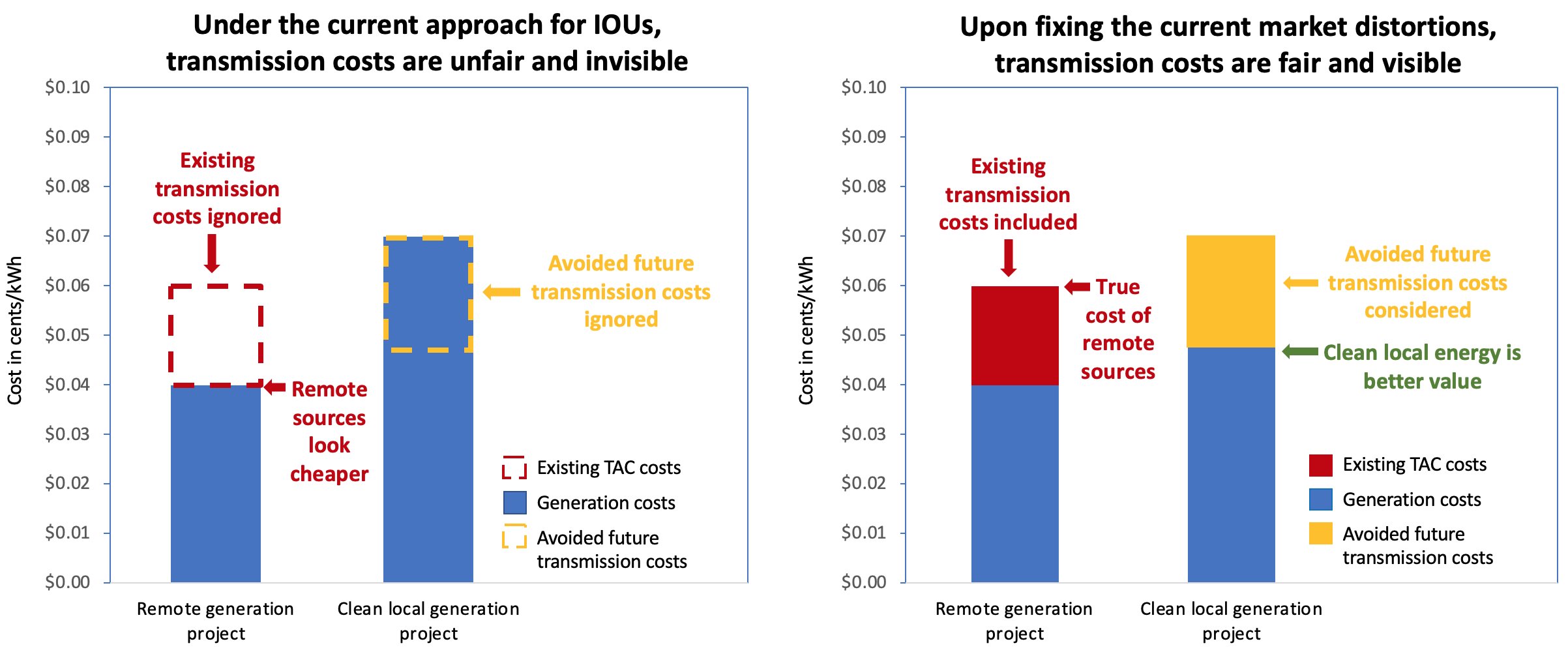

Among the notable changes to the revamped ACC is how it treats the value of DERs in reducing transmission costs. Energy that’s generated or saved locally reduces the need for new transmission, said Craig Lewis, executive director of the Clean Coalition. And, he added, “When transmission costs are incurred, they are socialized” in the form of a transmission access charge that appears on every utility bill, making any reductions in cost valuable to all customers.

Clean Coalition joined solar industry groups Vote Solar and the Solar Energy Industries Association in arguing for greater recognition of the value of DERs for easing transmission costs. The CPUC didn’t adopt Vote Solar/SEIA’s more aggressive proposal on how much new DERs can reduce the need for new transmission. But it did require Southern California Edison and San Diego Gas & Electric to start calculating that value, as PG&E already does, by applying a version of its calculation of DERs’ effect on reducing distribution grid upgrade costs to transmission as well.

While the ultimate effects of this change are still uncertain, proponents point out that state grid operator CAISO avoided $2.6 billion in transmission costs in 2018, largely because of reduced local area load forecasts due to rooftop solar and energy efficiency.

5. Demand-side resources on a par with supply-side in resource planning

The earliest iterations of ACC were developed in 2005, and they have traditionally been used to evaluate the value of utility energy efficiency, demand response and behind-the-meter solar programs. But the latest version lends itself well to integrating DERs into the integrated resource plans that guide utilities’ long-range energy mix, Crossborder Energy's Tom Beach said.

That’s because the new ACC is derived from what the CPUC calls the “No New DER Scenario” — a model of its 10-year carbon-reduction plan that presumes none of the forecasted growth in rooftop solar, batteries, efficiency improvements and other behind-the-meter investments over that time will come to pass.

In other words, “It’s the plan you would start with if you were assessing demand-side resource and supply-side resources on the same basis.”

That could allow the CPUC and utilities to build different DER scenarios back into future long-range energy plans in ways that weren’t possible before, Beach said. To be clear, the CPUC hasn’t started that work yet, and according to Beach, "It would be a really complicated endeavor.”

Still, he believes “it’s really taking a big step toward doing truly integrated resource planning that integrates both sides.”