Yingli Green Energy Holding (NYSE: YGE) reported its fourth quarter and full year 2010 results this morning.

- Total net revenues for the quarter were $616.1 million. PV module shipments increased by 21.6% quarter over quarter, reaching a historical high at a gross profit of $202.7 million and gross margin of 32.9%.

- Total 2010 net revenues were 1,893.9 million at a gross margin of 33.2 percent

- Full year PV module shipments were 1,061.6 megawatts, beating guidance of 1020 megawatts to 1040 megawatts.

- Yingli will supply approximately 70 percent of the total amount of 272 megawatts in PV projects under the Golden Sun Program, sponsored by the Ministry of Finance of China. The majority of the shipments are scheduled to be delivered in the second half of 2011.

- 80 percent of Yingli's global sales were in Europe.

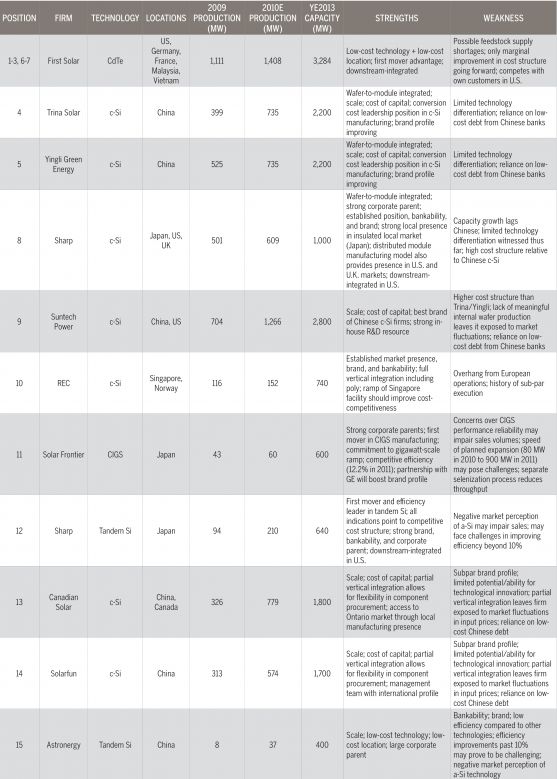

Yingli's manufacturing covers the full photovoltaic value chain, from polysilicon production through ingot casting and wafering, to PV cell production and module assembly, with a capacity of over one gigawatt per year. Two capacity expansion projects of 600 megawatts and 100 megawatts are under construction and are expected to begin production in the middle of 2011; they will increase Yingli's total nameplate capacity to 1.7 gigawatts in late 2011.

Yingli produces multi-crystalline products which have lower production costs than their mono-crystalline counterparts and the company is among the leaders in processing costs at $0.74 per watt in their previous quarter.

Yingli expects its PV module shipments to be in the range of 1,700 megawatts to 1,750 megawatts for fiscal year 2011, an increase of 60.1 percent to 64.8 percent compared to fiscal year 2010.

Aaron Chew of Hapoalim Securities writes, "As the challenging outlook for 2H10 and 2011 becomes more evident, we expect the stock to revisit its 52-week lows. We maintain our SELL rating and $9.00 price target." Lazard Capital rates it a BUY.

Currently the stock is up 5.3 percent to $13.53.