The 2020s will be a new chapter for the wind industry, according to Wood Mackenzie research, as offshore wind’s share of the annual global wind market reaches 25 percent by 2028, up from 10 percent last year.

Onshore wind matured as an industry over the past 10 years. This maturation will continue in the new decade, as onshore wind increasingly competes with solar and suppliers undergo further consolidation.

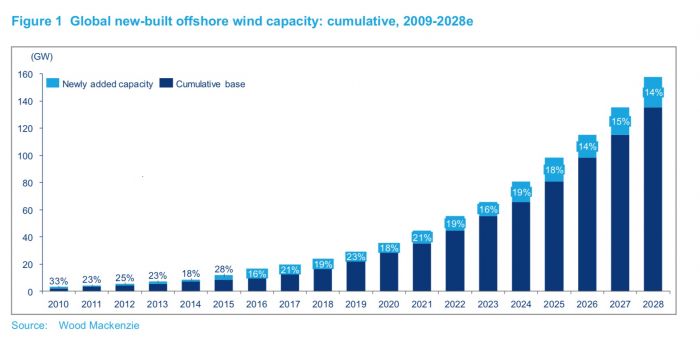

Meanwhile, WoodMac finds that installed offshore wind capacity is expected to grow 7x by 2028. More than 80 percent of the capacity expected to be installed between 2019-2025 has already been awarded.

Falling LCOE

While the levelized cost of energy (LCOE) for onshore wind will continue falling in the 2020s, none of the sector’s advances in turbine tower design, blade materials or controls will be true game-changers, according to Wood Mackenzie’s Dan Shreve.

Groundbreaking technology advancements now generally fall within the offshore wind sector as opposed to onshore.

LCOE had already dropped significantly for offshore wind in recent years as companies invested in purpose-built equipment and designs targeting offshore wind. That trend will continue in the 2020s as technology costs continue to fall.

Wood Mackenzie expects LCOE for offshore wind to decrease by half between 2019 and 2028, with Europe leading the way.

Offshore titans

In recent years, the big have only gotten bigger in offshore wind, as European developers have expanded their geographical reach and Chinese state-owned companies leveraged domestic growth.

European offshore wind players’ aggressive push to position themselves in emerging markets, combined with local players’ desire to bring in experienced counterparties, drove asset transactions in offshore wind to a stunning 100 gigawatts by the end of 2019. The trend will continue as emerging markets are tapped.

Looking ahead, global offshore wind capacity will hit nearly 160 gigawatts by 2028, up from 22 gigawatts at the end of 2018.

Floating wind

Most offshore wind growth in the coming decade is expected to be in areas suitable for bottom-fixed offshore wind. Floating wind is expected to constitute only a small fraction of the 2019-2028 offshore wind capacity.

However, floating offshore wind is gaining momentum. Up to 10 gigawatts of floating wind could be deployed across 10 markets by 2030 if new markets enter the offshore wind scene and countries form new regulatory frameworks.

More than 75 floating wind concepts have already been introduced, and experienced developers are starting to position themselves more aggressively in the floating industry by forging alliances and building up floating wind pipelines.

So far, the commercialization of floating wind has been hampered by a Catch-22, in which developers argue that capacity is needed to reduce the cost of floating wind, while governments argue that cost declines are needed for governments to allocate capacity to floating wind.

Policymakers need to work with the industry to develop a clear route to market if the floating wind industry is to become a true commercial success.

Regulatory frameworks and merchant risk

Policy is a source of uncertainty for the industry as a whole. Offshore wind pipelines are piling up across the globe as offshore wind targets expand, but thus far regulatory frameworks exist in only nine countries.

With a lack of commitment from governments, uncertainty remains concerning the pace and scope of the deployment of offshore wind. For offshore wind to go global and become a mainstream source of electricity, more governments need to offer a clear and stable route to market.

Merchant risk is also an area of concern as the market evolves. Developers will be increasingly exposed to fluctuations in wholesale electricity prices as the offshore wind industry transitions to merchant risk markets throughout the 2020s.

The risk from merchant price exposure will change the way offshore wind projects are financed. A better understanding of merchant risk exposure and captured prices for offshore wind is needed to capture the forecasted growth in merchant markets.

To successfully manage this, companies will need to absorb part of the merchant risk and find new ways to close funding gaps between senior debt and equity in financed projects.

***

A free WoodMac research insight outlines onshore and offshore wind trends to watch over the next decade. Download it here.