Dominion Voltage Inc. (DVI) is already the country’s leader in deployments of smart-meter-enabled grid voltage control, with some 12 utility deployments putting its patented technology to work.

Now it has a jury verdict to protect the technology behind that market dominance -- and a plan to expand its scope of work to include smart inverters, behind-the-meter batteries and other grid-edge tools.

Earlier this month, the subsidiary of Virginia utility Dominion Resources announced its win in an 18-month legal battle accusing rival grid vendor Alstom Grid, now owned by General Electric, of infringing on its first patent, U.S. Patent No. 8,437,883. In simple terms, that patent describes a method of tapping certain smart meters as “dynamic bellwether sensors” to help utilities more accurately control how they keep grid voltages within required boundaries, from substations all the way down to end customers.

That’s a key feature of DVI’s deployments with 12 U.S. utilities, including Pacific Gas & Electric, Hawaiian Electric and Glendale Water & Power, and featuring smart meter partners including Silver Spring Networks, Elster and Landis+Gyr. That list puts DVI in the lead among a handful of companies using smart meters, also known as advanced metering infrastructure, to inform and fine-tune volt/VAR optimization (VVO) and conservation voltage reduction (CVR) schemes.

But according to the lawsuit, the Load and Volt/VAR Management module of Alstom’s e-terradistribution software, being used in a project with Duke Energy, used the same technical approach. With the jury verdict in its pocket, DVI plans to seek a permanent injunction against Alstom continuing to use it, DVI Executive Director Todd Headlee said in an interview this week.

Of course, there could be alternatives to shutting down Alstom’s project -- including Alstom paying DVI to keep using the technology. Specifically, the jury verdict in the case cited a “reasonable royalty” of $486,000 for Alstom’s patent infringement since August 2014.

While Headlee said that a permanent injunction was DVI’s primary goal, seeking payments instead “could be an option -- but first, we had to get a verdict to get them to stop.”

The same jury verdict in the U.S. District Court for the Eastern District of Pennsylvania upheld the validity of DVI’s patent against claims that it wasn’t a significant enough advance in technology to deserve protection. That finding was also backed up by the U.S. Patent and Trademark Office’s decision to deny Alstom’s challenge to the validity of the patent.

DVI’s patent describes a method for finding a handful of smart meters that can stand in as bellwethers for the voltages at key parts of the grid, and dynamically changing those bellwether meters to adjust to changing conditions, he said. That’s an improvement over centrally controlled VVO and CVR schemes, because it provides more visibility into the edges of the grid, where voltages tend to drop to their lowest levels as the distance from the substations increases.

Is this really an innovation deserving of patent protection? “That was a question that was brought up in the trial, as you can imagine,” Headlee said. “Those who are closer to what we do have a great appreciation for the complexities of how we accomplish this. […] The selection of bellwethers may be more complicated than one might imagine.”

For example, "Some utilities made the statement that they didn’t want one customer turning on a table saw or an arc welder in their garage, and having that one single event dictate how that circuit operated,” he said. “One small part of our methodology filters out that kind of thing, and only concentrates on the meters that are chronically low-voltage.”

Other companies using smart meters for voltage optimization that don't appear to conflict with DVI's patent, such asUtilidata, a company that’s providing CVR technology for utilities such as AEP and National Grid, or systems that use low-voltage alerts from individual smart meters to inform VVO systems.

Looking to the future

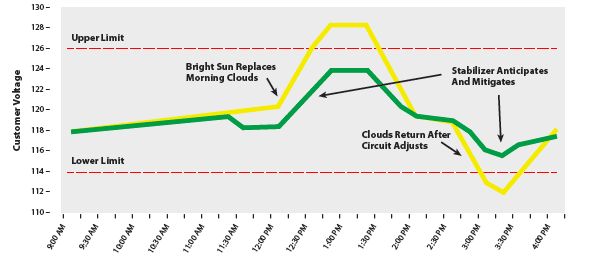

In the meantime, DVI is working on new applications of its technology, Headlee noted. In February, it announced its Edge Stabilizer product, which puts the same bellwether methodology to work to monitor over-voltages as well as under-voltages, he said. That’s of particular use in mitigating the problems that can arise on grid circuits that have high penetration of rooftop PV.

Pacific Gas & Electric is among the first utilities using that technology, he said, as part of a VVO pilot in Fresno, Calif. that’s also tapping smart inverters from Enphase and SolarCity. Hawaiian Electric, which has some of the most solar-impacted circuits in the country, is also planning on using DVI’s new technology as part of its broader plan to deploy smart meters across the island of Oahu.

In April, DVI was awarded a new patent that incorporates these distributed energy resources into its monitoring and control platform, he said. Smart inverters in particular can inject or absorb reactive power to lift or lower voltages that can be pushed out of normal range by rooftop PV, thus helping to mitigate the very grid-imbalance problems they may contribute to causing as part of a circuit’s set of rooftop PV systems.

This is a problem that relatively few utilities have to deal with today, but it could become a significant driver of investment in technologies like those on offer from DVI, Utilidata and other VVO platform providers, as well as distribution grid power electronics devices from companies like Gridco and Varentec.

“The VVO industry is going to be a multibillion-dollar industry,” Headlee said. “We’re one small part of it.” Even so, DVI sees “the opportunity to create a hundred-million-dollar company” on its patent-protected contributions to the effort.