Yingli Solar (NTSE: YGE), founded in 1998, was listed on the New York Stock Exchange in 2007. Globally, it has sold over four gigawatts of modules. It saw a 13.7 percent jump in sales from Q1 to Q2 this year, sold more in 1H 2012 than any other panel maker and is on track for sales this year of over two gigawatts. Some analysts expect Yingli Solar to take world leadership away from perennial top dog but now-troubled Suntech (NYSE: STP) in 2012.

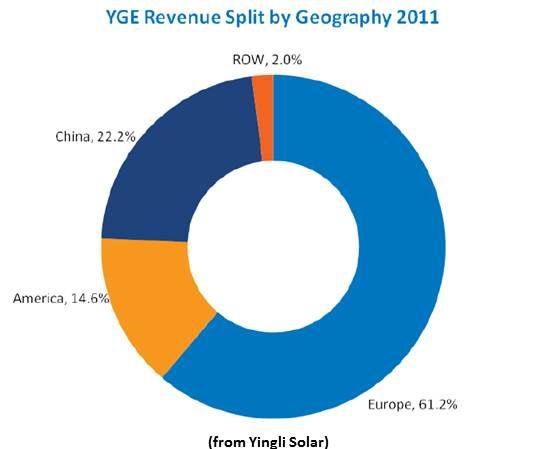

The Chinese company opened its Yingli Americas New York and San Francisco offices in 2009. The division has cumulative sales of 550 megawatts, including over 180 megawatts in 1H 2012. It had an approximately 15 percent U.S. market share in 2011 and is expected to match that this year. Business does not seem to have been inhibited by the recent Commerce Department-imposed tariff on inexpensive Chinese solar cell and module imports.

MEMC (NYSE: WFR) CEO Ahmad Chatila recently told GTM the tariff is having no appreciable impact except to shift business to Malaysia, Korea and Taiwan, and Yingli Americas Managing Director Robert Petrina confirmed Chatila’s point in describing his company.

“From its beginnings,” Petrina said, Yingli Solar “wanted to control its destiny by manufacturing its own ingots, wafers, cells, modules and providing an integrated product. It hasn’t really deviated from that except, due to the rules and regulations set up by the tariff investigation, we have to source cells from Taiwan to continue to be compliant.”

The company remains focused, Petrina said, “on innovating, moving up the efficiency curve quickly and trying to differentiate from other products.”

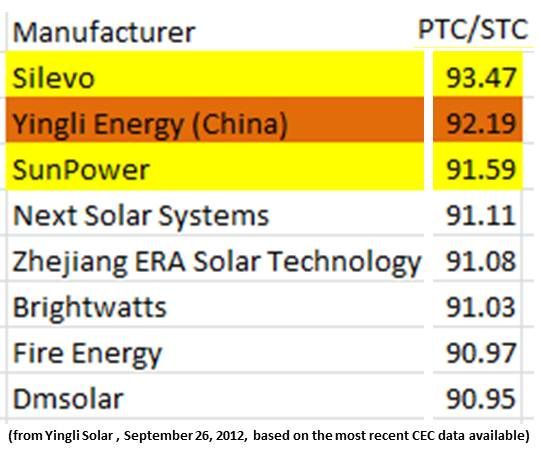

Petrina touted the Yingli Panda monocrystalline panel’s “19-plus percent average cell efficiency and 16.2 percent module efficiency.” He said the company’s roadmap predicts efficiencies in “the low twenties by 2014-15.” Those efficiencies put the Panda among the leaders of the top-selling modules, though not as efficient as SunPower (NASDAQ: SPWR) or Sanyo.

Based on the most recent numbers from the California Energy Commission (CEC) database, Yingli reported, its Panda YGE series has the highest PVUSA Test Condition (PTC) to Standard Test Condition (STC) ratio (92.19) of any monocrystalline PV panel. SunPower is second at 91.59, Yingli found.

“We also have a new panel for the utility market, the YGE-U 72 cell series,” added Marketing Head Helena Kimball. The new panel has 72 cells to the Panda’s 60 and is UL-certified to 1,000 volts, which, Yingli says, will reduce BOS costs, presumably by allowing longer strings.

“That market has grown so rapidly,” Kimball said, “customers were demanding the new product. It might not seem like that big a deal, but the thing you have to recognize is that we can now custom-tailor modules for specific needs.”

The bankability of the company’s products have won it a place on the preferred supplier lists of large-scale installation funders in the third-party-finance space like SolarCity, Sunrun, and Sungevity, Kimball said.

“They only choose a select handful and they do evaluations of their suppliers on a fairly regular basis. You need to be up to snuff on your bankability, your quality and performance and your warranties. It is a very extensive process. For a Chinese manufacturer to come in and build those relationships, there was a lot of work done to overcome the stigmas.”

Yingli currently offers a warranty that covers performance for 25 years and product for ten years, based on a 0.7 percent annual degradation rate. But it is currently re-examining its warranty, Petrina acknowledged, because of SunPower’s recent industry-shaking move to a 25-year performance and product warranty based on a 0.4 percent degradation rate.

The Yingli products’ compatibility with other industry names is something Petrina and Kimball repeatedly noted.

Its panel-backing is DuPont’s industry-standard Tedlar, and Yingli “announced a substantial supply agreement with DuPont (NYSE: DD) earlier this year,” Petrina said, for other high quality materials. Yingli’s quality control processes match DuPont’s, Kimball added.

The YGE-U series was manufactured to be compatible, Kimball said, “with tracking systems like those from Array Technologies.”

The YGE series is compatible with Enphase (Nasdaq: ENPH) microinverters, Kimball said, and the company has explored power conversion options offered by Tigo and Ampt. The series was also designed, Kimball added, to be compatible with Zep Solar’s innovative grooved-frame concept which, both companies claim, reduces installation labor by 25 percent.

“That’s what the industry is demanding right now,” Kimball said, “better, faster, smarter.”

Yingli’s successful relationships with European developers, Petrina said, also validate its bankability, especially because many of those European developers are now being supplied by the Americas division as they move into the U.S. and Latin American markets.

Yingli has “been active in South America for the better part of the last year and a half,” Petrina said. “We are seeing ever-increasing demand in countries like Mexico, Chile, and Brazil.” The company recently opened an office in Sao Paulo.

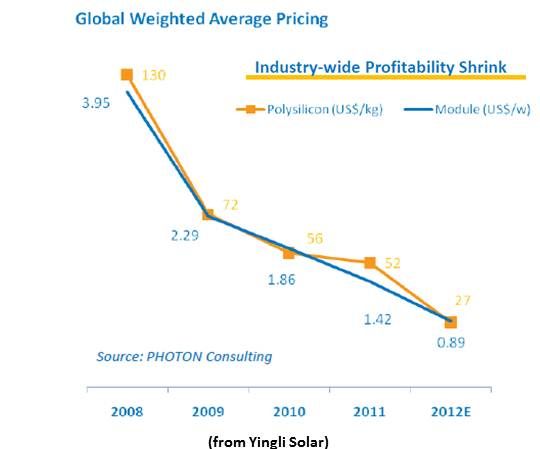

Emerging markets broadly, Petrina said, “are at the point that solar will grow at ever-increasing rates. The new economics that are trickling through are beginning to drive demand as people realize solar has become very competitive very quickly.” Europe remains a significant part of demand, Petrina said, but the U.S. is “poised to become Yingli’s second-largest market within the next two years.”

In the first segment of the Winning Solar Strategies series, SunPower showed how vertical integration and best technology allow a high-priced product to succeed. SunPower’s risk is that newer innovation can supersede its efficiency edge, which explains its recent foray into concentrating PV.

In the second segment, MEMC showed how global expanse and vertical integration can successfully be combined. The risk is being spread too thin, which explains the company’s cautious avoidance of anything too big and preference for balanced financing.

Here, Yingli shows how a respect for the market’s demand for better, faster, smarter can succeed as long as the company brings those three things, which is why Yingli is aggressively reaching out to industry partners.