The second quarter of 2020 saw more than 17 gigawatts of wind turbine capacity ordered globally, worth an estimated $16 billion, according to the new Wood Mackenzie wind order analysis report focused on Q2.

Globally, Q2 2020 saw wind turbine orders decrease by 45 percent versus Q2 2019. This was partly due to the record-high number of orders placed in 2019 in advance of policy changes in the United States and China. Meanwhile, orders for the offshore sector in Europe gave the market a boost.

Which companies led the way in Q2?

Q2 wind turbine shipment numbers

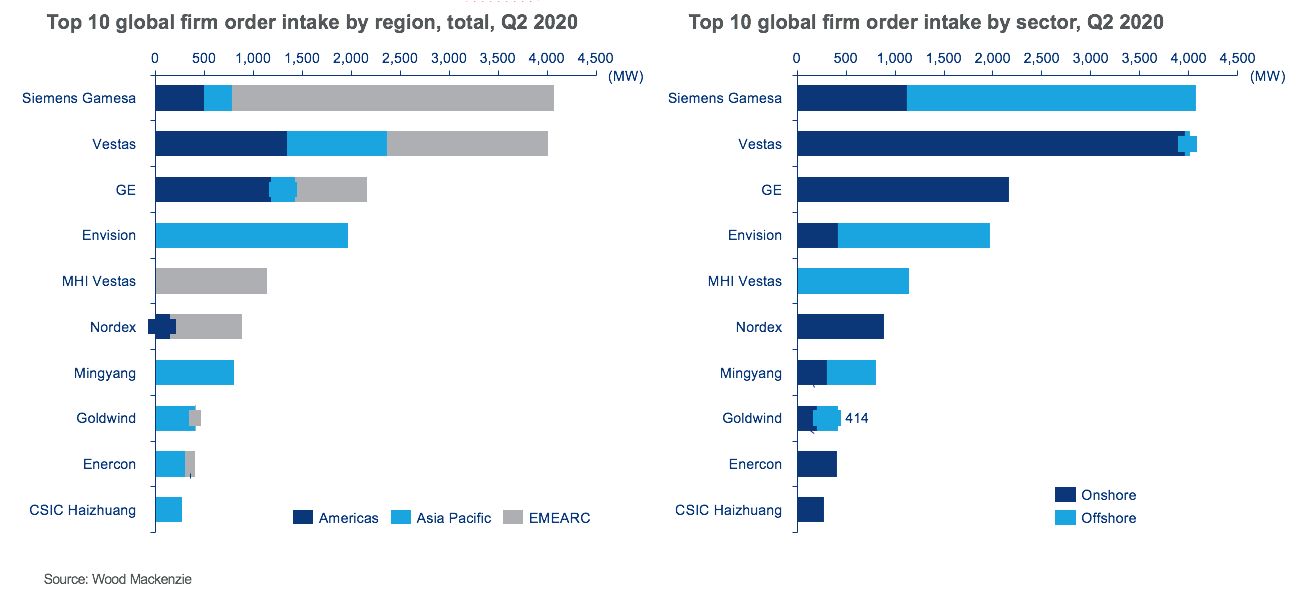

According to Wood Mackenzie, Siemens Gamesa Renewable Energy edged ahead of Vestas for announced wind turbine orders in Q2, for both onshore and offshore, reaching a total of 4.1 GW. SGRE’s offering of its new SG193-DD turbine helped set intake records for the quarter.

But although SGRE topped the list for overall global turbine orders, Vestas’ V150-4.2 turbine won out as the top onshore model for consecutive quarters after a particularly strong Q2 in Asia-Pacific (excluding China).

Onshore, developers continue to seek higher-rated models to make the most of sites with constraints, with SGRE, Vestas and Nordex capturing all demand in Q2 for onshore models rated 5 megawatts or higher.

In the offshore sector, Envision’s impressive haul in Q2 for its EN161-5.2 offshore model led to the company taking the top spot for Q2, coming in slightly ahead of SGRE. First orders for the model helped Envision crush its previous high in a quarter by a factor of three.

Chinese developers ordered more than 2 GW of offshore turbine capacity for the sixth consecutive quarter, with Envision capturing 66 percent of Q2 demand in China.

SGRE and MHI Vestas each landed more than a gigawatt worth of orders in Europe for new offshore turbine models rated over 10 MW. SGRE is the first manufacturer to hit 3 GW of firm offshore order intake in a quarter, contributing to its largest-ever quarterly volume in the Europe/Middle East region.

An offshore demand bump in Q2

Despite the 45 percent year-over-year decline, Q2 2020 wind turbine order intake still represented a solid haul and exceeded Q2 order intake for 2016, 2017 and 2018.

A wave of offshore demand in the second quarter of this year, coming from countries such as the U.K., the Netherlands and France, helped to lift overall turbine order capacity despite a drop in the U.S. and China.

Global offshore order intake accounted for 38 percent — or 6.5 gigawatts — of all Q2 orders, an increase of 40 percent year-over-year.

***

Wood Mackenzie's Q3 2020 Global Wind Turbine Order Analysis report presents an analysis of global and regional wind turbine order activity in the second quarter and first half of 2020.