It’s a question Marty Crotty, an American Wind Energy Association (AWEA) board member, asked at the recent AWEA conference on wind industry health and safety (H&S) and operations and maintenance (O&M).

Standing on a chair to change a light bulb, Crotty said, should be seen in the context of its potential costs.

Coal has been rocked by scandals about cost-cutting mining practices that have caused cave-ins and miner deaths. Oil industry executives have publicly bickered about which of their safety shortcuts were most responsible for driller deaths and ecological disaster.

Wind industry leaders like Crotty continue to remind developers that doing things the right way is ultimately the cheapest way.

“People in their everyday lives have a tendency to do things like put one foot on a chair, one on a table, or one on a rolling chair,” Crotty said. “If you do safety wrong, there will certainly be costs.”

Crotty also put numbers on the value of being “proactive” versus being “reactive” in O&M. An example is gearbox maintenance, the single most costly part of turbine operations.

Over the course of a year (8,760 hours), a 1.5-megawatt turbine with a 33 percent capacity factor generating $70 per megawatt-hour electricity earns $831.60 per day.

With shortsighted H&S or O&M practices, an otherwise predictable gearbox replacement could become an emergency. Instead of a scheduled two-day job, it would become an unscheduled three-week job.

Three weeks of downtime is a $17,463.60 production loss. Two days of downtime is $1,663.20. A scheduled crane rental would cost $100,000. Unscheduled, it would be $300,000. The total cost of a reactive gearbox replacement: $317,463.60; that of a proactive replacement would be $101,663.20. Savings from vigilance: $215,800.40.

Every opportunity to reduce costs and increase production is vital to a wind industry now locked in an urgent effort to stay competitive. The technology being tested by Crotty’s Catch the Wind is all about “optimizing the lowest cost per kilowatt-hour equation.”

Cheap natural gas is making it harder, many in the industry say, for developers to get power purchase agreements (PPAs). That will likely be a bigger concern, Crotty noted, if Congress fails to extend wind’s vital 2.2 cents per kilowatt-hour production tax credit (PTC). In response, Crotty said, an emerging trend is for developers who cannot get an attractive PPA to bet on wind’s viability in spot electricity markets.

These are called merchant projects. They constituted twenty-three percent of wind’s 2010 market. Without a PTC, and with investment and PPAs hard to find, more developers confident of wind’s ability to generate at low costs and inclined to believe the historic price volatility of natural gas will return wind to competitiveness are likely to make the bet.

“It’s all about your bet on the forward curve for gas,” Crotty said. “If your bet is that gas is going to go up, you may go merchant, and then ultimately sign a PPA when the price changes.”

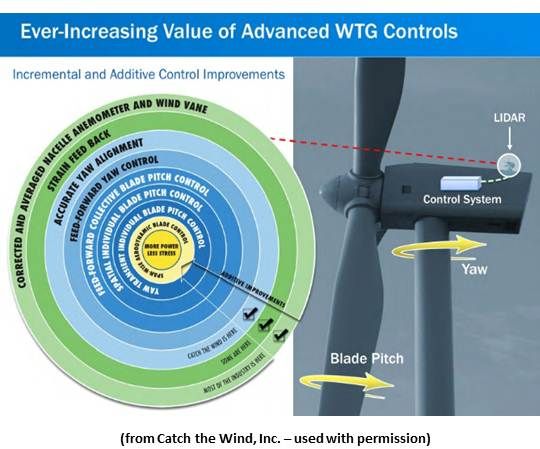

To help developers cut costs, Catch the Wind is testing a LIDAR device placed on the turbine nacelle. “It will replace the wind speed and wind direction device” [... and] rather than measuring the wind direction after it passes the turbine blades,” Crotty explained, it “measures the wind 150 to 200 meters out in front of the turbine.”

This feeds the turbine controller undistorted wind data long before the winds reach the turbine. “Initially, we’re changing yaw,” Crotty explained. “But we’re developing the device so you can integrate with the turbine controller and change blade pitch as well. First, we will be on collective blade pitch and then we’ll move to individual blade pitch.”

Translation: presently, the device responds to a wind direction change by turning the nacelle into the wind. That’s yaw. Next, it will tilt all the blades at once to optimize their bite of the wind and relieve stress from gusts. That’s collective pitch. Eventually, it will adjust each blade as it moves in and out of the wind, to get the best bite and give the least resistance as it turns, even when there is shear.

The devices are on about ten turbines, Crotty said, with over 100,000 hours of testing. Results have been impressive but have varied. “We’ve seen a fairly significant range of improvement in power production, from four percent to better than 20 percent, with better results when we optimized our controller. We would expect power improvements in the five percent to 10 percent range.”

The device has also shown a measurable reduction of stress on the drive train, which should, Crotty said, increase drive train life, further optimizing returns.

“The physical retrofit,” Crotty said, has so far proved “relatively easy.”

It’s too early to talk about the market price, but, Crotty said, returning to his theme, “The current pricing provides a more than acceptable return associated with the benefits of increased production and reduced wear and tear.”