Ask a utility solar project developer or installer in the United States if they think string inverters should be used for a 50-megawatt PV project and they will tell you, “We aren’t sure yet, but we’re working hard to find out.”

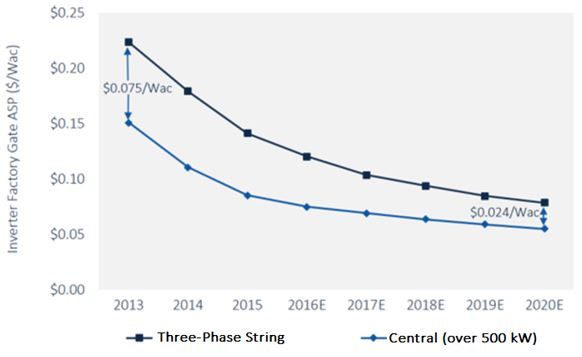

Three-phase string inverters have made giant leaps forward over the past several years. Prices have fallen rapidly relative to central inverters, and along with rapid shutdown and arc fault requirements, their use has become standard in larger projects. According to GTM Research's latest report, The Global PV Inverter and MLPE Landscape 2016, in the United States, three-phase string inverter use increased progressively over the last few years from 5 percent of all inverter shipments in 2012 to 11 percent in 2015. Over that time period, the threshold for which string inverters making clear financial sense has risen from about 500 kilowatts to around 5 megawatts today.

FIGURE: U.S. Inverter Factory-Gate Average Sale Prices, 2013-2020E ($/Wac)

Source: GTM Research report The Global PV Inverter and MLPE Landscape 2016

The market is now exploring the possibility of installing string inverters in mega-scale utility projects. The step up in application is reminiscent of the days when basketball stars jumped straight from high school to the NBA. The jury is out. Will we see the next Lebron James? Or will string inverters be the next Sebastian Telfair -- a player garnering lofty expectations who ekes out a steady career, but never quite reaches the big time?

China offers a window to the future

Three-phase string inverter growth in the United States has been foreshadowed by the emergence of their use in China. Huawei, now the world’s largest inverter vendor by annual volume shipped, has popularized the use of three-phase string inverters in utility projects in that market. According to our research, over 40 percent of installations in China in 2015 were installed with three-phase string inverters.

Huawei and Sungrow, the top two vendors in China and worldwide, are now targeting the U.S. market aggressively with three-phase string inverters (Sungrow offers central inverters in the U.S. as well), hoping to build on their success in their own country. However, growth in the U.S. has not been immediate. In spite of ultra-competitive pricing, it has been difficult to break through to conservative buyers who prize stability and proven technology.

FIGURE: U.S. PV Inverter Market Taxonomy, June 2016

Source: GTM Research report The Global PV Inverter and MLPE Landscape 2016

Will three-phase string inverters offer U.S. developers an advantage?

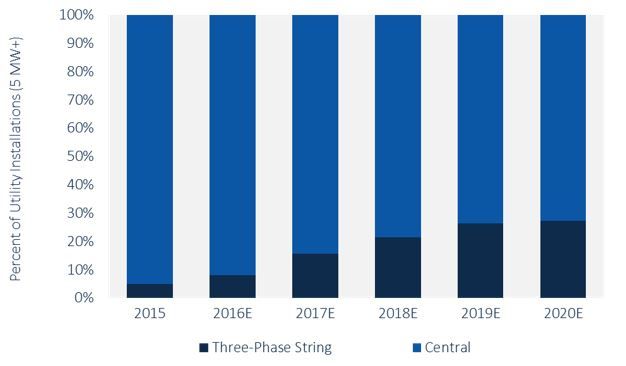

For all the fanfare of three-phase string inverters being used in utility projects, there is still very little adoption in the U.S. According to GTM Research’s report, only 5 percent of U.S. utility installations in 2015 were built with string inverters. For the most part, these installations have been projects under 20 megawatts with site-specific requirements that tilt the choice of inverter toward string technology, such as irregular block sizes or highly sloped land, for example.

For string inverter use to take off, the broader value proposition must be proven for large-scale projects. Price declines are a major driver; however, the upfront cost of the inverter is far from the only determining factor. Associated balance-of-systems, installation costs, system performance, and lifetime operations and maintenance needs are also taken into account.

Preliminary analysis and anecdotal submissions from leading EPCs suggests that for 20-megawatt and larger utility projects overall system pricing for string and central inverters are relatively close. Though the calculations are complicated and entail a number of assumptions, string inverters typically make up for some of the upfront premium of 2 cents to 4 cents per watt in their lifetime cost savings since they require less maintenance. Additionally, in the event of a failure, availability is minimally affected, and inverters can quickly be swapped out without the need of an electrician. However, the complexity of the calculations and the numerous project-specific factors such as slope, land shape, racking type, and interconnection requirements render rules of thumb for string versus central inverter use difficult to come by.

Further complicating the matter is the fact that different stakeholders are motivated by different metrics. EPC contractors that bid their services on an upfront basis are driven to reach the lowest possible price per watt. Conversely, developers and long-term project owners typically are more concerned with a project's lifetime costs and their effect on project returns. Inverter vendors, meanwhile, are driven by the desire to take a larger portion of project capital, and thus they see the slightly higher price of string inverters as a way to build revenue.

It is clear that the value proposition is improving and will result in string inverters being used in more utility projects. SMA continues to offer its 60-kilowatt product acquired from Danfoss in 2014. The product only has one maximum power point tracker and is designed specifically for large-scale installations. Tomorrow’s string inverters will be even better suited to utility projects. Sungrow discussed in a recent GTM webinar that its next-generation product will be 160 kilowatts, twice as powerful as its current highest offering, and will be suited for 1,500-volt installations.

What kind of adoption rates will three-phase string achieve?

As for whether string inverters might replace central inverters, the ultimate answer is no. Central inverter vendors continue to innovate and double down on their portfolios, and the technology remains an attractive solution. Ingeteam, the leading inverter vendor in Latin America, just announced the acquisition of Bonfiglioli’s solar inverter business -- all central inverters -- and as of July 2016, 12 central inverter vendors have introduced 1,500-volt products. Though string inverters will soon be offered at 1,500 volts, they will likely will not be available until 2017, so until then, central inverters will continue to have an advantage.

In the long term, one way to proxy the growth potential of three-phase string inverters is to look at the historical growth trend of module-level power electronics in the residential market. MLPE offer a similar value proposition of lower balance-of-system costs and greater lifetime performance, and today they account for nearly two-thirds of installations in the U.S. residential market. However, a sizeable portion of MLPE growth is due to the rapid shutdown requirements of the National Electrical Code. Code requirements play a much smaller role in the utility market, and thus, in the long term, we believe that string inverters will take a large but minority share of the utility-scale market.

FIGURE: U.S. Solar PV Installations by Inverter Type for Projects Over 5 MW, 2015-2020E

Source: GTM Research report The Global PV Inverter and MLPE Landscape 2016

Just as there is a place for single-phase string inverters in the residential market, there will be significant space for central inverters in the U.S. utility market. Overall, the share of string inverters will grow as their utility value proposition is proven and new products are introduced. However, we expect opportunity for all utility inverter types as the market prepares for long-term growth.

***

Scott Moskowitz is a GTM Research solar analyst covering PV systems and technologies. For more information on GTM's inverter research, contact Zack Munsell at [email protected].