A week ago, California Attorney General Edmund Brown dashed off a worried letter to federal officials defending California’s PACE financing for home energy retrofits.

A week earlier, government lenders Fannie Mae and Freddie Mac released a vague lenders’ notice apparently critical of the innovative program. Brown worried that the notice could derail efforts to expand the Property Assessed Clean Energy financing to 28 million Californians by September.

Now the dispute is the subject of discussions in Washington, with efforts to remaking the energy profile of the nation’s homes hanging in the balance.

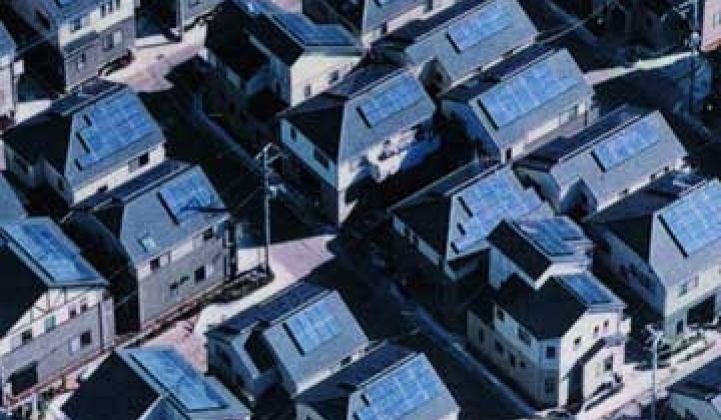

The low-interest PACE loans allow homeowners to borrow for home energy-efficiency improvements, including solar installation, and repay the loans over 20 years. The government raises the money by selling bonds. The repayments are added to property tax bills and the 20-year loans stay with homes when they are sold.

This final feature is what alarmed Fannie and Freddie. Would the liens keep the two lenders from underwriting mortgages for the properties, especially if the energy remodel didn’t translate into higher property values? Participating homes would have higher tax bills than other comparable properties. Wouldn’t they be at a disadvantage in the market place?

Apparently, the dispute is being hashed out among housing officials in Washington. Their decision, however, will have an impact beyond California, as states such as New York, Colorado and New Mexico are moving ahead with the program.

In California, PACE has already proved its popularity. In Sonoma County alone, 800 solar and other projects have soaked up $30 million in financing. Energy remodelers say that along with President Obama’s HOMESTAR energy retrofit initiative now moving through Congress, PACE should spark a boom in business. And it should cut energy use at homes and businesses -- which constitute about 40 percent of the nation’s demand.

Solar installers, however, are embroiled in an argument over PACE with retrofitters. Under most PACE regulations, it is not easy to finance solar installations, a provision that doesn't sit well with the solar industry. Some companies, such as SolarCity, are combining retrofitting and solar installation, but today the two industries largely inhabit parallel universes.

In his May 18 letter, Brown, who is running for governor, said Fannie’s and Freddie’s advice notices “caused confusion and concern among California PACE stakeholders [and may have] serious financial implications for participating local governments and the thousands of homeowners and small businesses currently participating in these programs.”

He said California has earmarked a substantial portion of $570 million in funds for PACE. The goal is to “support green manufacturing jobs and thousands of additional jobs associated with installation and maintenance of energy efficiency and renewable energy projects,” he said, calling for a withdrawal of the notice.