The recent publication of EPA’s draft rule to limit carbon emissions from existing power plants follows a months-long drumbeat of One. Alarming. Climate. Headline. After. Another. Attention is being refocused on the future of low-carbon energy, in the U.S. and globally. There’s a lot at stake, and choosing energy resources wisely is key to keeping costs down.

Adding to the controversy, Charles Frank, a Brookings Institution nonresident fellow, recently published a paper called “The Net Benefits of Low and No-Carbon Electricity Technologies.” (One of us, Ron, is also a Brookings nonresident fellow.) Frank’s blog post, “Why the Best Path to a Low-Carbon Future is Not Wind or Solar Power,” summarizes his findings.

Frank’s paper may go largely unnoticed, as often happens. But since its intention is to inform policy and we find its conclusions to be incorrect -- and probably very expensive -- we wanted to respond.

So, what’s the problem, exactly?

Frank looks at five low-carbon technologies -- natural gas, nuclear, wind, solar PV and large-scale hydro -- and concludes (after some idiosyncratic analysis) that the best resources for a low-carbon future are natural gas, nuclear and hydropower. According to Frank, these technologies provide the best “bang for our buck” for lowering carbon emissions from electricity generation. Wind and solar power are resources that Frank seems to view as expensive, unpredictable and perhaps best left alone.

Unfortunately, Frank gets it exactly backwards. Wind and solar are essential resources that can reduce both the costs and risks of decarbonizing our electric system. As for natural gas, without sequestration of its carbon emissions, its role may be limited in the long run, as Energy Secretary Moniz has explained. Nuclear must obviously be deployed cautiously, if at all, due to cost, safety and security risks. Finally, new large-scale hydro is basically a non-starter in the developed world; as EIA states, “In the OECD nations, most of the hydroelectric resources that are both economical to develop and also meet environmental regulations have already been exploited.”

How do wind and solar help to lower electricity costs? Here’s Exhibit A (click to enlarge):

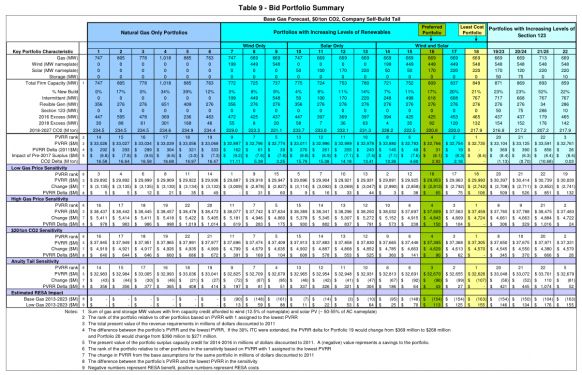

Sorry we don’t have a sexier graphic; this chart is available in more legible form on p. 40 of this document. (You can also view Ron’s recent presentation at the AWEA annual meeting to walk through this analysis.)

The chart is Xcel Energy subsidiary Public Service of Colorado’s analysis, published last fall, of different possible expansions to its energy portfolio. In a nutshell, Xcel found it was cheaper to add wind plus natural gas rather than natural gas alone. With added solar, the economics improved even more.

Rather than look at all 25 portfolios Xcel examined, let’s look at a handful that illustrate our point:

- Portfolio 1, the base case, would add about 750 megawatts of natural gas generation, resulting in a portfolio with a net-present-value cost of about $33 billion

- Portfolio 7 adds about 200 megawatts of wind power to the 750 megawatts of natural gas in Portfolio 1, and shows savings of $129 million

- Portfolio 16, the utility’s preferred portfolio, reduces natural gas to about 670 megawatts, bumps up wind to about 450 megawatts, and introduces 170 megawatts of solar, yielding savings of $261 million relative to the base case

- Portfolio 18, the utility’s least cost portfolio, ramps up wind and solar even further, resulting in savings of $292 million relative to the base case, with 16 million fewer tons of carbon emissions

How can this be? When the sun shines and the wind blows, the renewable resources displace natural gas plants. The fuel savings from idling the plants is greater than the cost of the renewables.

Notably, Xcel’s analysis doesn’t include a cost for carbon, nor does it consider the value of wind power as a hedge against natural gas prices. Either of these would strengthen the case for adding more renewables.

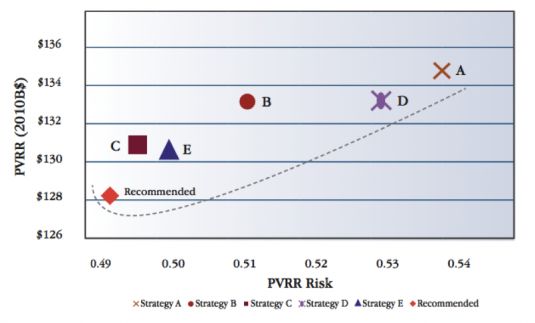

Here’s Exhibit B showing how renewables (and energy efficiency) lower electricity costs:

This chart shows Tennessee Valley Authority’s analysis of five different energy strategies as part of its 2011 Integrated Resource Plan. The two strategies most similar to Frank’s recommendation are Strategy B (mostly nukes and natural gas) and Strategy D (mostly nukes). As you can see, they’re also the two most expensive and risky strategies (after Strategy A, which would basically maintain the status quo and its many older coal plants). In the end, TVA chose a diversified portfolio, similar to Strategies C and E, with ramped-up contributions from renewables and efficiency.

Real-world experience affirms these analyses. Austin Energy recently signed a twenty-year solar PV contract at the surprising price of less than 5 cents per kilowatt-hour. Similarly, Xcel pointed out a year ago that it was getting utility-scale solar PV bids that were cost-competitive with natural gas-fired plants -- even without a carbon adder. AWEA recently announced that electricity prices actually fell in the top eleven wind power states between 2008 and 2013 while rising nearly 8 percent in the rest of the U.S.

Meanwhile, all five of the nuclear units currently under development in the U.S. have run into significant headwinds, while a sixth was recently abandoned after its price tag grew from $5 billion to $25 billion. Citi is hardly alone in predicting that construction challenges and high costs will lead to a decline in U.S. nuclear power.

While most analysts predict low natural gas prices in the U.S. for at least the next few years, the long-term pricing trend is upward, and important questions remain about fracking impacts. And, let’s not forget, natural gas combustion still produces about half the carbon emissions of coal -- not low enough to be included in the final fuel mix if we cut GHGs deeply by 2050, as scientists say we must.

Any robust low-carbon electricity strategy will employ the portfolio perspective and scenario analysis evident in our Xcel and TVA examples. It will also acknowledge energy efficiency as the cornerstone resource for reducing carbon emissions. And it will factor in the many ways that technology, climate trends and security concerns affect today’s power sector -- and tomorrow’s.

A transformation is moving through the electricity sector, of which low-carbon energy is only a part. If not handled carefully, it could be costly to utilities -- and to society. The burden is on utilities and policymakers to act. Discarding myths and letting facts and analysis guide decision-making will be essential to making wise choices as we transition to a cleaner, smarter, more resilient electricity system.

***

Ron Binz is the Principal of Denver-based Public Policy Consulting and former Chairman of the Colorado Public Utilities Commission. Dan Mullen is a writer and consultant based in Oakland, California, and former Senior Manager of Electric Power Programs at Ceres. Binz and Mullen joined Rich Sedano and Denise Furey in writing the report, Practicing Risk-Aware Electricity Regulation: What Every State Regulator Needs to Know, for which Binz was lead author.