Solaria is moving into the Chinese solar market.

Solaria President Suvi Sharma said Solaria's low-concentration photovoltaic (LCPV) technology along with the company’s significant experience in China are reasons to believe it can succeed.

It is difficult to do business in China as an outsider, Sky Solar COO Petra Leue said at the recent GTM Solar Summit. “It is difficult, but it is also possible,” Clean Energy Associates Founder/CEO Andy Klump replied to Leue, "as long as you partner with the right state-owned entity [SOE] or local company.” But, he added, “it takes years, and a long-term focus.”

In addition to Solaria’s experience in sourcing its supply chain in China, the company has completed a roughly 2-megawatt project in Qinghai province and is completing two more of comparable size in Inner Mongolia.

The first was built in partnership with CECEP Solar Technology, China's largest solar power plant investor and operator. The other two are being built in partnership with GD Solar, a subsidiary of China Guodian Corporation, and Huanghe Hydropower, a subsidiary of China Power Investment Corporation, two of China’s largest utilities.

All three have ties to SOEs.

Contrary to reports about the difficulties of making money in the China solar market, Solaria has earned margins on its China projects comparable to those from U.S. projects of a similar size, according to Sharma.

Just-announced plans call for Solaria to open a Shanghai regional office, headed up by Solaria China Business Development Director Zhao Defeng, in anticipation of building a China module manufacturing facility and starting the development process for 10-megawatt to 50-megawatt utility-scale projects.

“There are market forces [to contend with in China], and good companies do survive,” Azure International Managing Director Chris Raczkowski warned at the GTM Solar Summit, “but peeling back the layers, it is also the companies with very good relationships to the government that survive.”

Sharma acknowledged that wisdom. “If you are trying to source supply chain materials, you don’t need a local partner,” he said. “But if the goal is to either produce there on a large scale or sell into the market, it is a sufficiently unique place to do business that, to be successful, it is important to have as a strategic partner a company that is either a government-owned or -linked company, or has very strong ties, to help mobilize efforts there.”

Solaria will not try to sell directly into the China market. “Our partner there will sell the modules,” Sharma said.

He would not say if Solaria’s partners on the 2-megawatt installations are among the candidates for its manufacturing operation partner, but he did say Solaria’s negotiations are with players who “do both manufacturing and development” and focus on “more projects than manufacturing.” That describes all three companies.

Solaria has kept a competitive margin in the ongoing struggle for survival in the PV manufacturing landscape. Sharma noted two reasons the company can succeed in China.

First, the trend in China and around the world to deploy ground-mounted installations averaging around 20 megawatts suits the Solaria combination of single-axis trackers and competitively priced, frameless, thickly glassed modules in the 15 percent to 16 percent efficient range.

“A lot of big SOEs are looking at and adopting new technologies," Sharma said. “With our unique LCPV technology, we have really set ourselves apart in that category and found a lot of interest.”

Second, Solaria’s module is an advanced technology that uses the crystalline silicon materials China has an oversupply of and urgently wants to sell.

“Thin film and high concentration technologies don’t leverage the crystalline silicon infrastructure that exists in China,” Sharma said. “We use all the materials that a standard module does, so we fit right in to the supply chain there.”

Instead of coming in with a ‘this is better than what exists there today’ value proposition, Sharma said, Solaria is offering a ‘this makes what exists there today better’ value proposition.

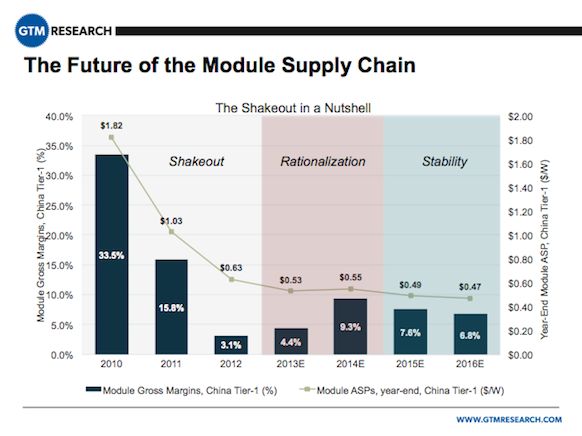

“The module pricing we have seen in China is the lowest in the world, and probably will remain so,” Sharma said.

It was as low as the $0.53 per watt to $0.55 per watt range, but pricing has been rising in the last couple of months and is now more like $0.60 per watt to $0.62 per watt, he added.

“From talking to companies on both the manufacturing side and the project side,” Sharma said, “we don’t see it going back down. It looks like it will stabilize in the 60s. Our projects will be profitable if prices are in the 60-plus cents per watt range.”