SolarCity’s announcement last month of its acquisition of high-efficiency PV module manufacturing startup Silevo evoked a combination of excitement and trepidation in this analyst. It isn’t often that PV manufacturing startups make headlines these days, much less for a major investment in a technology-oriented VC-funded firm by a leading downstream player. However, the last time we saw hoopla of this magnitude around a heavily funded American PV manufacturing startup, the firm in question imploded in spectacular fashion, sullying the reputation of all those within touching distance of it -- including its management, the Obama administration, the loan guarantee program, and solar itself.

I am speaking, of course, of Solyndra. Not since March 2009, when Solyndra announced that it had won a half-billion-dollar loan guarantee from the Department of Energy, have we seen so many lines of copy devoted to a solar manufacturing investment in the mainstream media (see here, here and here). In Silevo’s case, this was arguably due to the high-profile nature of the acquirer and its superhero-like chairman Elon Musk. Regardless of the reasons, the poisoned chalice has truly been passed on. Silevo is now the next great American PV manufacturing startup hope. With the spotlight, of course, will come heightened expectations and scrutiny. You can be sure that any delay, misstep, or layoff at Silevo will incite speculation.

Will the confluence of technical challenges, a weak value proposition, market fluctuations and heavily subsidized lower-cost competition claim yet another promising VC-funded, government-assisted American startup? To put it in more newsworthy terms: could Silevo be another Solyndra (or Abound, or SoloPower, or Evergreen, for that matter) in the making?

Both firms are (or, in Solyndra’s case, were) Fremont-based, venture-backed PV manufacturing startups. Both have developed and commercialized unique, highly proprietary PV technology that is ultimately designed to increase the energy output that can be obtained from rooftop solar installations. And both have been the beneficiaries of sizable government assistance (in Silevo’s case, through $225 million in planned infrastructure investments like manufacturing facilities, utilities and roads). But beyond these surface-level similarities are some very important differences -- differences that give us a lot more cause for optimism for Silevo than its ill-fated predecessor.

Business model and market strategy

Being acquired by SolarCity provides Silevo with a dedicated internal customer -- essentially, captive demand -- and allows it to circumvent bankability hurdles it would otherwise have encountered due to its nascent technology and startup status. As such, Silevo won’t even be competing directly with other module suppliers. Its technology will be one part of the overall value proposition for SolarCity’s leased systems. In Solyndra’s case, it had to compete with other module and system vendors in a crowded marketplace and often had to offer significant pricing discounts to drive market traction in view of its unfamiliar design.

Another point in SolarCity’s and Silevo’s favor is the inherent suitability of the technology in question -- high-efficiency PV -- for their target market, namely, residential rooftop solar. Solyndra, on the other hand, was always fighting the tide in its decision to focus on the commercial rooftop market with lower-efficiency thin film (the best efficiency Solyndra got to was somewhere in the range of 11 percent). Solyndra’s counter to this, of course, would be that even with lower power density (watts per foot), it could garner a superior energy harvest (kilowatt-hours per kilowatt) because of its 360-degree collection surface and CIGS absorber layer. This claim was hotly debated and analyzed throughout Solyndra’s time under the microscope. Higher kilowatts-per-hour is a much harder sell than simply more watts, as many now-extinct amorphous silicon firms could attest to.

Technology and cost structure

Silevo’s technology concept is evolutionary rather than revolutionary. Apart from a few steps in the cell processing stage, the manufacturing process flow and material requirements closely mirror those for established crystalline silicon technology. This allows Silevo to leverage the collective experience and economies of scale achieved by the c-Si industry over the last two decades. By contrast, the utter uniqueness of Solyndra’s cylindrical CIGS design -- no other PV firm had even attempted to commercialize such a technology concept before -- forced it to reinvent the wheel when it came to manufacturing equipment and materials specifications. That led to capital equipment and consumables costs that were significantly higher than the competition. Its decision to base its first large-scale facility in the California Bay Area, which is the very antithesis of a low-cost location, didn’t help matters either.

At the end of the day, one has to wonder whether cost-competitiveness was really front of mind for Solyndra over the course of its brief lifespan. Given that it had introduced a first-generation product with a radical design, the primary focus would (and probably should) have been on ensuring functionality, specified output, reliability and safety above all else. (To the company's credit, I have only heard good things about Solyndra systems from customers.) Undoubtedly, Solyndra would have planned significant cost reductions down the road from iterative learning gains and scale-up. But due to its unfortunate market timing, it had to pursue a rapidly declining cost target that eventually proved beyond its ability. Silevo, which is building a more familiar mousetrap, has been able to adopt a low-cost mentality right from the get-go. Indeed, data that the company shared with me last October from its first-generation 32-megawatt line pointed to a cost structure that was impressively low given the small scale of that plant. That bodes well for the competitiveness of the Buffalo facility.

Market timing

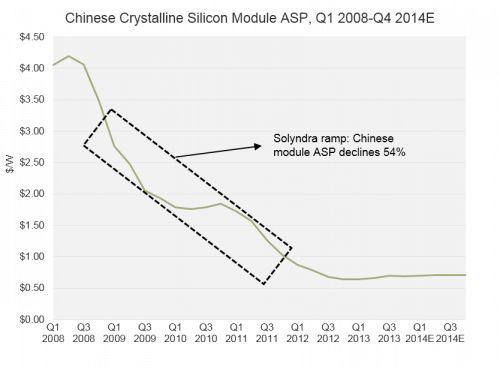

Solyndra’s business plan, as was the case with many other thin film aspirants, was conceived during the height of the polysilicon shortage during the period 2006 to 2008. By the time the firm started scaling up production in mid-2009, however, the polysilicon market had undergone a colossal correction, with spot prices having collapsed from highs of $500 per kilogram to less than $100. While polysilicon pricing stabilized and even increased over the course of 2010, it resumed its southward course in 2011.

The steep decline in silicon costs, coupled with widespread overcapacity in other PV value chain segments and the proliferation of low-cost, aggressively priced Chinese modules in the market, resulted in prices for crystalline silicon (c-Si) modules, the incumbent module technology, declining by 63 percent overall from 2008 to 2011. That undermined the competitiveness of silicon-free technology concepts such as Solyndra’s cylindrical variation on CIGS thin film. To maintain revenue and shipment growth, the firm was forced to constantly reduce selling prices for its systems to be in line with c-Si systems, causing it to bleed money over the course of its existence.

Silevo, on the other hand, will be scaling up production during a much more stable phase of the PV manufacturing business cycle. While the company was founded way back in 2007, it remained in stealth mode until 2011, and was wise (or lucky) enough not to scale up production or capacity during the protracted PV overcapacity period of 2011 to 2013. Since then, module pricing has stabilized greatly, and while GTM Research does expect pricing to resume a downward trajectory starting in 2015, we expect future price declines will be far more gradual than those seen in past years. Adding to that is the distinct possibility of further import duties on Chinese modules (preliminary anti-subsidy duties were imposed in June this year), raising the price of Chinese modules in the U.S. and enhancing the competitiveness of Silevo’s offering. In an alternate universe where Solyndra was ramping in 2014 instead of 2009, even that company’s prospects could have been very different.

Silevo is not a guaranteed success story. And it's unclear if the acquisition really even makes sense for SolarCity. But unlike with Solyndra, whose prospects we were skeptical of even during the best of times, there is legitimate cause for optimism in Silevo's case. While it’s far too early to anoint Silevo as a genuine contender for the module manufacturing crown, it at least has a fighting chance -- which, given the recent history of American PV manufacturing startups, is all one can ask for at this point.

***

Shyam Mehta is Lead Upstream Analyst at GTM Research, where he covers the global PV supply chain. For more information on GTM Research's coverage of the PV manufacturing sector, click here.