California is an unusual mix of progressive social engineering and capitalistic innovation. This mix has made California an undisputed leader in electric vehicles.

California’s progressivism on environmental issues -- and in particular on transportation issues -- has a very practical and pragmatic root cause. We’ve had terrible air pollution for years due to a combination of too many people and cars, sprawling cities, and, particularly in Southern California, a warm Mediterranean climate that promotes smog formation.

As a response to chronic air pollution in the 1960s, California passed its own air pollution control laws before Congress passed the federal Clean Air Act in 1970. As a legacy of California’s first-mover status, the state is still allowed under federal law to set its own unique fuel economy standards. But it must first obtain a waiver from the EPA.

Other states can then choose to adopt the California standard or the national standard. In the last couple of decades, the West Coast and New England states have generally adopted the California standard rather than the national standard.

The federal government under President Obama took the unusual step in 2010 of effectively making the latest California tailpipe emission standard, originally known as the Pavley Bill (AB 1493), the national standard. This culminated in a large negotiation completed in 2011 that included the major automakers and many other stakeholders. The final agreement received the automakers’ blessing. The new national fuel economy standard that resulted from this process is 35.5 miles per gallon (mpg) for the 2016 model year, up from 25 mpg in 2009, and 54.5 mpg by 2025.

There are many loopholes in these standards, however, and one compelling analysis concluded that the actual impact by 2025 will be 36 mpg to 42 mpg for light-duty vehicles rather than 54.5. This is still a major improvement, but it highlights the need to be vigilant about overly lax loopholes and to look past the headlines when examining policy.

What is not currently mirrored in federal law is California’s parallel vehicle technology law known as the Zero Emission Vehicle (ZEV) program, which has been delayed and transformed many times over the last 20 years. The ZEV program is today arguably the main driver for electric vehicles and fuel-cell vehicles in California and, by extension, to other markets in the U.S.

The trouble with mandates

I’ve observed or participated in the environmental law field since the mid-1990s, starting with an internship with the Clean Air Coalition in Santa Monica in 1994. I’ve noticed an interesting trend when it comes to government mandates: they’re very often set at a level that will likely be met by the market without any governmental mandate.

In other words, government policymakers often set the goal posts where the market is already heading. They then call this a mandate, provoke some artificial ire from the regulated industry at issue, call it a victory in appearing to be tough on polluters, and then laugh all the way to the next election or budget hearing. Everyone wins -- except the environment and the citizens made to suffer because of ineffective regulation.

For example, Obama’s much-praised and much-reviled EPA requirements for new power plants (stationary sources of emissions) will, according to the EPA’s own 2012 regulatory impact analysis, not do anything that the market isn’t already doing:

Energy market data and projections support the conclusion that, even in the absence of this rule, existing and anticipated economic conditions in the marketplace will lead electricity generators to choose technologies that meet the proposed standards. Therefore…EPA anticipates that the proposed [rule] will result in negligible CO2 emission changes, energy impacts, quantified benefits, costs, and economic impacts by 2020.

This was the case mainly because no coal plants were projected to be built through 2020, even without the rule.

I am happy to report, however, that California’s ZEV program is one of the few mandates that seems to be truly pushing the market rather than following it. In a state with chronic air pollution and, more recently, a major climate-change mitigation policy, this is a good thing. The mandate has received vigorous and sustained pushback from the automakers that have claimed over and over that they simply can’t meet it.

The California Air Resources Board, the agency that enforces the ZEV program, has listened to the automakers and adjusted the mandate a few times already. They may do so again in a future proceeding, but I hope they don’t.

Rather than further weakening the mandate, policymakers and stakeholders should think hard about what they can do with wise policy, working with automakers and other interested parties, to increase the sales of ZEVs to meet the mandate.

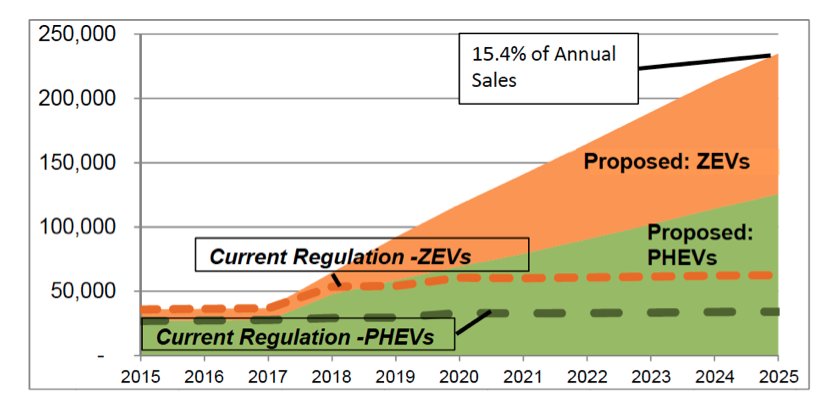

FIGURE: California's ZEV Program

Source: California Air Resources Board fact sheet

I’ve written previously about my doubts about fuel-cell vehicles (FCVs). My doubts have not dissipated, as sales figures and hydrogen fuel station installations remain anemic, even as EV sales grow respectably. Accordingly, I’m going to focus on EVs here rather than FCVs, because EVs may be on a growth curve, with a little more help, that is sufficiently robust to meet state mandates.

My client, the Green Power Institute, along with the National Asian American Coalition and other nonprofit entities, submitted a motion to the California Public Utilities Commission recently asking that the commission open a new track in the alternative-fueled vehicles proceeding (R.13-11-007) to focus exclusively on education and outreach. Our view is that the state and stakeholders have been insufficiently focused on education and outreach, which is probably the most important tool for increasing EV sales.

Education and outreach will not be a magic bullet, but until the state and stakeholders have massively ramped up their outreach efforts on EVs, we can’t know whether the public will respond well to such messages.

Nor can we deny that low gas prices are a major factor in the slump in the rate of sales. We can enjoy some justified optimism about a number of new affordable long-range EV models coming out in the next few years, lead by the Chevy Bolt, Tesla Model S and perhaps the 2050 Motors e-Go. GM recently confirmed that the Bolt is due in late 2016, so the new wave of EVs may be upon us sooner than we realized.

Can automakers meet the ZEV mandate?

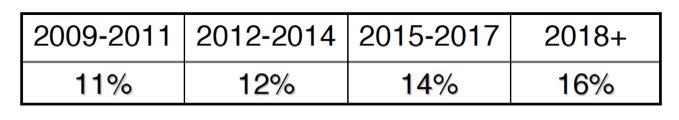

The current ZEV program requirements are shown in the table below. I described these rules in more detail in this piece from 2014. The percentage indicates what share of each automaker’s sales in that period must be ZEVs, which includes plug-in hybrids, pure-electric vehicles and full-cell vehicles. Each type of vehicle gets a credit multiplier.

Different types of cars receive different numbers of credits -- up to 9 credits per car are available for the 2015-2017 compliance period. The credits are calculated based on total sales and are used to offset the total requirement for each manufacturer. So if a manufacturer sells 100,000 vehicles in a given year, a 14 percent ZEV requirement means it has to earn 14,000 ZEV credits. These credits can come from selling true ZEVs or various types of partial ZEVs, or through purchasing credits from others. Tesla, for example, has sold a ton of credits to other automakers because all of its cars are fully electric.

FIGURE: Sales Requirements Under California's ZEV Program

Source: California Air Resources Board

All automakers met the 2012-2014 ZEV requirements, but many did so through purchasing credits from Tesla, Toyota and Nissan (Tesla accounted for about half of the credit market for 2014). We don’t have full data yet for 2015, but partial data suggests that 2015’s requirements will also be met. Future years are less certain, given that we actually saw a dip in EV sales in California in 2015, and that the ZEV requirements ramp up in each period. However, automakers have a large bank of ZEV credits remaining, as of September 2015.

Looking to the future, how can policymakers know how hard to push automakers on the ZEV mandate in the face of opposition or declining sales? We can’t know the future with any certainty, so policymakers can’t know exactly how hard to push the automakers. This is a mix of art and science.

We do know that automakers have historically been naysayers about every new requirement. And that’s not surprising. Their attorneys and CEOs are paid to be cautious and skeptical of new government intrusions. But we can also look to history and see, time and time again, that most government-mandated safety or environmental improvements made cars better without causing the automakers to go under.

The key question with respect to the ZEV program is whether customers will buy the required vehicles in the required quantities, and how much each manufacturer must do to promote such sales.

Automaker profits are up remarkably in recent years, after a well-publicized major downturn stemming from the Great Recession in 2008. Recent profits don’t justify a knee-jerk “push them harder” approach, but it does give some confidence that the companies subject to the ZEV mandate aren’t fragile and on the verge of bankruptcy as they were a number of years ago.

Can California meet its broader ZEV goals?

Governor Brown signed Executive Order B-16-2012 in 2012, mandating a number of ambitious state goals that go beyond the ZEV mandate. The main goals in the executive order are as follows:

- The state must have sufficient ZEV infrastructure to support up to 1 million ZEVs by 2020. This includes charging infrastructure for EVs and fueling infrastructure for FCVs.

- The state must reach over 1.5 million ZEVs on the road by 2025.

- The state must reduce greenhouse gas emissions from the transportation sector by 80 percent from 1990 levels by 2050.

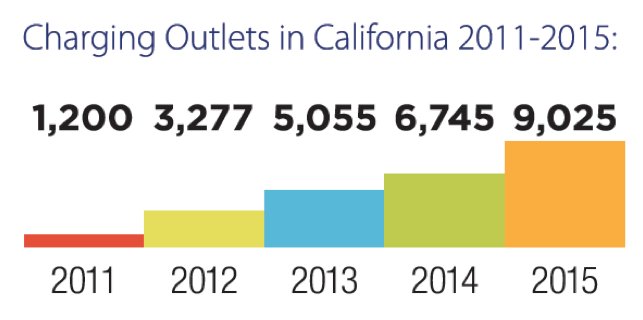

The 2020 goal may be met and will require a combination of public and private sector efforts. The EV charging infrastructure is developing fairly rapidly in California and around the country. There are about 9,000 charging stations already installed in California, up from about 3,000 in 2012, as a recent report from the group the Electric Vehicle Charging Association (EVCA) describes.

FIGURE: Growth in California EV-Charging Station Installations, 2011-2015

Source: EVCA State of the Charge report

NRG signed a major settlement with the governor in 2013, and a key part of that agreement entailed installing at least 200 DC fast charger stations and 10,000 Level 2 chargers at 1,000 locations around California.

Using public funding from ratepayers, the California investor-owned utilities have applied for approval to build out about 35,000 additional charging stations over the next few years. The Public Utilities Commission has, however, taken a phased approach to these major programs and has provisionally approved (in two pending decisions) much smaller pilot programs for Southern California Edison and San Diego Gas & Electric.

We can expect a similar decision on Pacific Gas & Electric’s proposal in the next few months. The net result of the CPUC decisions will be a strong boost to the EV-charging infrastructure market, but not at the scale that the utilities originally intended. Looking ahead, the market will be a robust mix of utility charging station ownership and third-party ownership.

Other companies, particularly ChargePoint, are rapidly installing charging stations without much public sector involvement. ChargePoint has over 25,000 charging stations installed and claims to have delivered more than 13 million charges to date. That’s impressive growth, and there’s no reason the growth rate won’t continue at the same or even a more rapid pace, particularly with the high-level support we’ve seen with the federal CAFE standards, the ZEV program, the recent Paris agreement on climate change and many other encouraging developments.

The sum total of these efforts suggests that California is on a trajectory to meeting the 2020 goal. The more difficult task will be to meet the 2025 goal of “over” 1.5 million ZEVs on the road. We are not currently on a trajectory to meet that goal, and this is why my client, the Green Power Institute, along with the National Asian American Coalition and its constituent groups, have submitted a motion to the CPUC asking that the commission rethink its strategy for meeting the 2025 goal.

Our view is that while a focus on charging-station infrastructure is laudable and necessary, we also need to place an equal or larger focus on education and outreach on EVs. A massive effort on education and outreach will inform Californians about the benefits and cost-effectiveness of the current crop of EVs and plug-in hybrids like the Chevy Volt, as well as models coming out soon. While the number of models of EVs has grown rapidly, awareness of these electric-vehicle options has not grown commensurately.

The 2050 goal is too far out to make any rational predictions, so I’ll let that one sit for a few years before examining it further.

In closing, California is on a powerful and positive trajectory in terms of EV development, infrastructure and sales. We are arguably leading the world in many ways -- though Norway, a less influential jurisdiction with a far smaller population, is far ahead in terms of EV sales per capita. There is much that needs to be done to ensure that these trajectories continue in the right direction in California, but these challenges are entirely surmountable.

Californians can rightly pat themselves on the back for exerting national and global leadership on EV policy development.

***

Tam Hunt is a lawyer and owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii, co-founder of Solar Trains LLC, and author of the new book, Solar: Why Our Energy Future Is So Bright.