Latin America accounts for less than 5 percent of global solar demand, yet GTM Research analyst Adam James dedicates the majority of his time to keeping tabs on this nascent market. More strikingly, some of the largest international EPCs, developers, module suppliers, and debt financiers are setting up shop there. What do they know that others don't?

In a live presentation at Solar Power International's Industry Trends booth, Adam James drew on his research from the Latin America PV Playbook to provide a high-level overview of the burgeoning market and some granular detail on policies and trends shaping the most attractive Latin American markets.

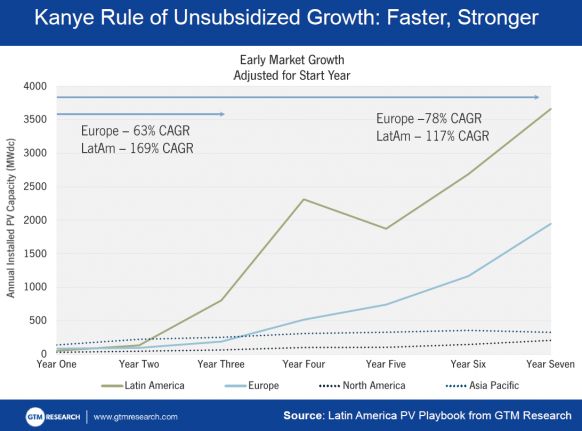

While still not much more than a blip on the radar of the global PV market, the Latin American market has grown faster than any other region before it in its first seven years of existence.

James cited three strategic reasons companies are beginning to invest in the growing Latin American region.

First, companies are entering the market to hedge risk and diversify downstream portfolios. In subsidized markets, a policy change can spell disaster for PV projects. Latin America as a whole is unsubsidized, so there is one less risk to doing business there.

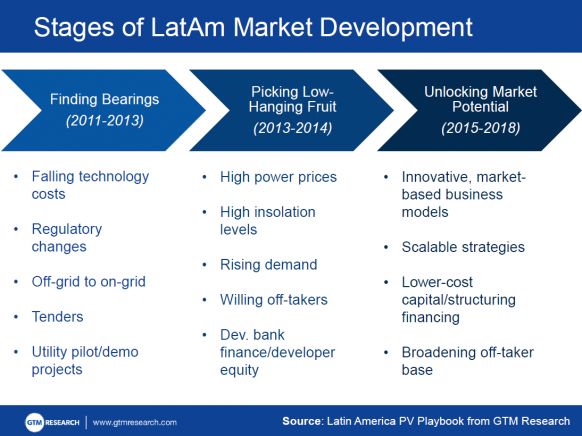

As system prices continue to fall, the prospect of unsubsidized markets becoming mainstream is not so far off. James described companies coming into the region in order to practice innovation and hone future business models in the unsubsidized market. What works in Latin America now will hopefully work in more countries when subsidies decrease or cease to exist altogether.

Finally, companies are looking toward future growth. With its high insolation and growing demand, Latin America's upside is on par with some of today's mature solar markets.

"What I think we can expect next year and beyond is really the unlocking of the potential of the market, with companies exploring more innovative and market-based strategies, such as the synthetic PPAs that are emerging in Chile, as well as more scalable strategies to get volume -- especially in distributed generation (DG) -- while capturing offtakers that have good credit," said James. "More low-cost capital will come into the market in the utility and DG segments, with the former getting more commercial financing as opposed to development bank capital."

GTM Research forecasts Latin America to install 805 megawatts of PV in 2014, and nearly tripling that to install 2.3 gigawatts in 2015.

***

For more information, download the latest key findings from the Q3 2014 Latin America PV Playbook.