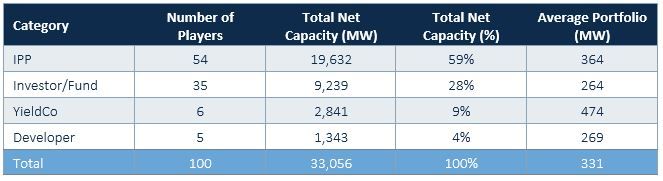

The top 100 owners of megawatt-scale PV plants globally -- outside of China -- accounted for more than 33 gigawatts of net installed capacity as of Q3 2016, according to the new report Megawatt-Scale PV O&M and Asset Management 2016-2021 released by GTM Research and SoliChamba Consulting.

Of the top players, 54 are independent power producers (IPPs), with a total of more than 19.6 gigawatts of net capacity. Financial investors and funds are the second-largest category, with 35 of the top 100 positions and 9.2 gigawatts of capacity. YieldCos and developers collectively represent just 11 of the top 100 owners with total net capacities of 2.8 gigawatts and 1.3 gigawatts, respectively.

FIGURE: Top 100 Owners -- Number of Players and Capacity by Category

Source: Megawatt-Scale PV O&M and Asset Management 2016-2021

The report identifies the top five owners of utility PV assets as: American IPPs BHE Renewables, NextEra Energy Resources and ConEdison Development; German IPP Enerparc; and British investor Octopus Investments. American firms are buoyed by a fast-growth U.S. market featuring large plant and portfolio sizes, while European firms operate in lower-growth environments and tend to manage portfolios of plants built over longer time periods.

Asset management: Quintas Energy takes the U.K. by storm

According to GTM Research and SoliChamba Consulting, the top 100 asset managers of megawatt-scale PV plants globally (outside of China) accounted for more than 42 gigawatts of managed capacity as of Q3 2016. While some owners, like most IPPs, self-perform asset management, many financial investors and funds hire a project developer or service provider to manage the assets.

IPPs represent a similar 50 percent share of the top 100 asset managers and a slightly larger capacity of 21.2 gigawatts. Investors/funds make for a smaller 19 percent share of the top asset managers because they often outsource this function to independent service providers (ISPs) and affiliated service providers (ASPs), which represent together 17 percent of the top 100 asset managers and 9.9 gigawatts of the managed capacity.

Spanish ISP Quintas Energy is now the largest PV asset manager globally (outside of China) after a spectacular 10x growth in 2016, when the firm took the U.K. market by storm by signing up several of the country’s top portfolio owners, and many smaller ones, as customers. Bankrupt developer SunEdison lands the No. 2 spot and remains the asset manager for a large portfolio of projects it originally developed. American IPPs NextEra Energy Resources and BHE Renewables rank No. 3 and No. 4, respectively, acting as the asset managers for plants they own (directly and/or via a YieldCo). Italian ASP WiseEnergy takes the No. 5 spot with a large footprint in its home market and in the U.K.

O&M: New leaders emerge as the market matures

The new report finds that the top 100 O&M providers for megawatt-scale PV plants globally (outside of China) accounted for more than 60 gigawatts of managed capacity as of Q3 2016. Unlike asset management, which remains tightly coupled with asset ownership and project development, O&M has grown into a market of its own in most countries around the world (although the phenomenon is only starting in Japan and India).

The top 100 O&M landscape is split between many categories of owners, without a single segment dominating the market. Developers manage the most capacity and large portfolios (1 gigawatt on average), although this picture is largely due to a trio of U.S. developers (First Solar, SunEdison and SunPower). Only three inverter manufacturers are in the top 100 O&M players (Schneider Electric, Ingeteam and SMA), but they manage the largest portfolios (1.7 gigawatts on average). Service providers (ISPs and ASPs combined) are the top category, with 29 firms managing a capacity of 17.4 gigawatts. Very few investors are active in the O&M space.

While First Solar remains the top O&M provider globally, American ASP SOLV shot up to the No. 2 spot (from No. 9 in the GTM/SoliChamba 2015 rankings), substantially growing its O&M portfolio capacity with both plants built by its EPC parent Swinerton Renewable Energy and with third-party projects. SunEdison dropped from No. 2 to No. 3 after seeing its O&M fleet shrink due to the firm’s bankruptcy and the associated loss of contracts with concerned owners, but remains one of the key players globally, with a very geographically diverse portfolio. Schneider Electric takes the No. 4 spot (and leads among inverter manufacturers) with strong growth and a geographically diverse fleet. SunPower dropped from No. 3 to No. 5 as its fleet growth was surpassed by other top players.

In a follow-up article, we will explore in more detail the global O&M competitive landscape and trends.

***

For detailed analysis of the top utility-scale PV owners, asset managers and O&M providers, as well as key trends, service levels and prices, market sizes and forecasts for all the key PV markets (Global, Europe, Germany, U.K., Italy, France, Spain, U.S., Canada, Chile, Mexico, Brazil, Japan, India) please refer to the new report Megawatt-Scale PV O&M and Asset Management 2016-2021: Services, Markets and Competitors.