Last month, GTM Research unveiled its new report, The Networked Grid 150: The End-to-End Smart Grid Vendor Ecosystem Profiles and Rankings. This article is the third in a series of perspectives on the topic from the report's author. To read the first perspective, click here; the second piece is here.

At the moment, the mantra in smart grid is 'Software, software, software.' Across the board, the biggest players are snapping up the most promising software vendors, at a clip we’ve not before witnessed in this industry.

While there have been notable purchases in the past, the acquisition of Ventyx by ABB for over $1 billion (to strengthen the latter's network management business) was one of the early “Holy cow!” moments. Next was Schneider Electric with its roughly $2 billion takeover of Telvent (soon after having purchased the distribution arm of Areva T&D for more than $1 billion). Meanwhile, GE announced that it was putting much more emphasis on software across the entire company, opening a new facility in northern California and investing as much as $1 billion on software development through 2015. Further, in Q4 2011, GE announced that it is now offering a software-as-a-service solution as part of its solution portfolio, something of a new twist for the industrial giant. GE, it could be argued, has actually been the quietest of the titans on the software-acquisition front. However, having said that, GE did have a nice pickup with Opal at the end of 2010.

Alstom snapped up a gem in Utility Integration Solutions (better known as UISOL) in an early 2011 acquisition. And Siemens, which already has serious grid software operations in place on the wholesale market side, and which in the summer of 2011 invested over $25 million in Tendril, pulled out its smart grid wallet again when it bought eMeter outright in the final days of 2011 for a rumored $200 million.

Not that software has been the only area of interest of late. Cisco Networks acquired wireless mesh networking player ArchRock in Q3 2010, but software does seem to be the missing piece that many electric utility vendors, especially the legacy players, are sorely in need of. Itron, for example, snapped up Asais, a French-based energy management and analytics company, at the end of 2010.

Smart Grid's 'Big Fish'

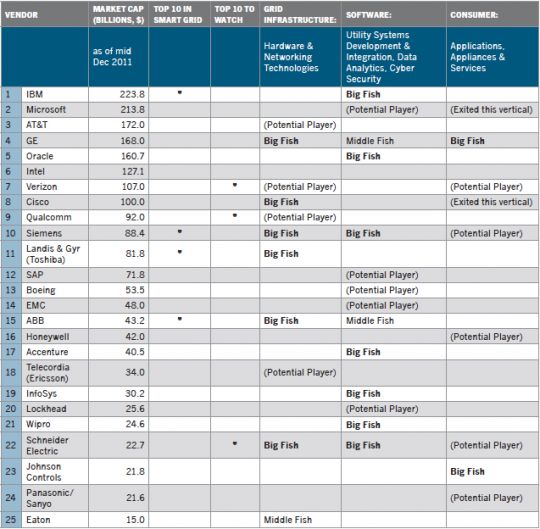

Based on market capitalization and market position, the following list represents the 25 largest companies in smart grid. While not all of these vendors are fully active in the smart grid space (Microsoft, Intel, AT&T), and while others currently exhibit merely the potential to be a leading player (such as Panasonic/Sanyo), we have denoted the companies that are currently active in the market with the nickname 'Big Fish.'

The term is fitting, as a smart grid feeding frenzy has been underway for the past 24 months and currently shows no signs of letting up. While the Big Fish noted in the following chart are actively leading this market today, due to their buying power, each of the companies listed could decide to quickly increase its smart grid offerings and join the ranks of smart grid's Big Fish, just as Toshiba did in March 2011 with the acquisition of Landis+Gyr for $2.3 billion. This move was surprising, not only because it seemed to come out of left field, but also because the rumors were contending that Toshiba substantially outbid the competition, to the tune of several hundred million dollars. If that is true, it certainly speaks to the buying power of the large caps.

FIGURE: GTM Research's Big Fish of Smart Grid

Source: The Networked Grid 150 (GTM Research)

To avoid confusion, we separated the market into three sub-verticals: hardware, software, and energy services. While our research breaks down smart grid into more detailed submarkets, this trichotomy allows for a quick understanding of where the Big Fish are presently active, as well as which area each of these titans are likely to approach.

For further clarity, we would like to distinguish between the significance of being labeled a Big Fish and being included on our list of Top 10 Vendor List. As mentioned previously, the companies in the GTM Top 10 all have the following characteristics:

- Best-of-industry technologies

- Utility-scale contracts with the largest utility-actors on the global stage

- Influence that extends beyond their particular domain expertise

- Excellent brand recognition in the smart grid

- Astute product marketing

- Integrated solutions that maximize utility investment, and

- An understanding of the changing needs of utilities, as well as the ability to anticipate these needs

Meanwhile, the criteria to be called a Big Fish are rather simple:

- Being active and influential in the smart grid market (which we consider different than simply running a legacy utility business)

- Having a market cap of greater than $20 billion

Note: There are four companies that are both Top 10 Vendors and Big Fish: ABB, IBM, Siemens and Toshiba (via Landis+Gyr). At the same time, there are other giants that we currently consider Big Fish, such as GE, and Cisco, that did not make this year’s Top 10 Vendor List.

To purchase The Networked Grid 150: The End-to-End Smart Grid Vendor Ecosystem Report and Rankings today, click here. Please note: to ensure GTM provides a way to get a useful reference report such as this to a broader audience, we have priced this report substantially lower than our normal rates.

You can receive this report for FREE by registering for The Networked Grid 2012. The Networked Grid 2012 is Greentech Media's 4th annual two-day smart grid summit to be held in Raleigh-Durham, North Carolina on April 4-5, 2012. Click here to learn more.