Convergence. I’ve been a tech reporter for more than 16 years and can honestly say I’ve never made it through an entire week without hearing the word at least one.

First, there was the convergence of the PC and the phone, which took around ten years of research and development and the invention of voice-over-Internet protocol, or VoIP, to bring to fruition. Then came the convergence of PCs and TVs, an ongoing saga that seems finally to be occurring thanks to better broadband and Hulu. Then there was the print/web convergence, which lead to thinner magazines.

In the corporate world, the next big convergence point will occur when the networks for controlling heaters, air conditioners and lights in offices are connected to the networks that manage the environment for data centers, or even the networks for IT assets like PCs, servers, networks and storage systems, according to many.

HVAC systems right now are controlled generally on relatively autonomous networks based around standards like BacNet and equipment from Johnson Controls, Honeywell and Siemens. By putting everything onto one network, a COO or CIO could then have full visibility into a company’s energy consumption, operations, computer networks and even phone networks via a single console or application.

Interestingly, some building management companies like Redwood Systems have begun to get a foot in the door by landing contracts to control the lights and other appliances in data centers, which are often the most valuable real estate that a company owns.

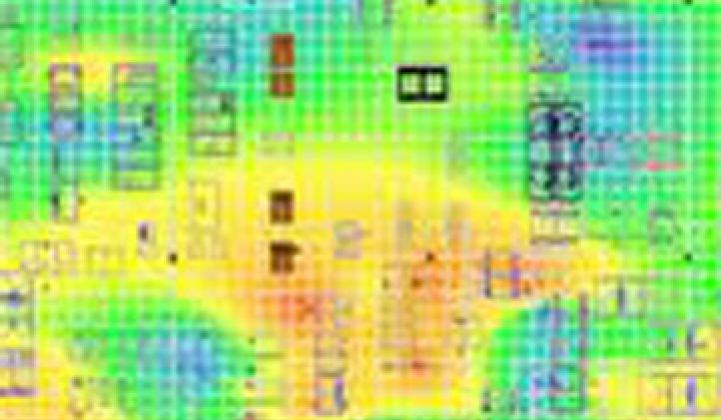

Conversely, SynapSense and other companies that analyze and manage the micro-climates and environment in data centers have crafted plans to migrate from the glass house to entire buildings. If it’s good enough for the data center, the argument goes, it should be good enough for general office space. Arch Rock, a company that specializes in data center monitoring and communications that got gobbled up by Cisco last month, will follow a similar path. (The picture shows a thermal map generated by SynapSense.)

But data center and office space networks may not fully become one just yet. Why? In general, it costs about $25 per square foot to manage general commercial office space, according to Nth Power’s Rodrigo Prudencio, who spoke at the Data Center Energy Summit sponsored by the Silicon Valley Leadership Group last week. (Nth Power invested in SynapSense.)

It costs $100 per square foot to manage data center space because the tools must micro-manage their environments within finer temperature, humidity and pressure ranges. In other words, these tools are tweaked for different environments. Building controls could go up-market, and data center controls could go down-market, but it will take work.

The data center is also a more established market. Sentilla and Federspiel Controls started as building control applications and shifted to the data center.

The next step -- bridging the gap between systems that control the office or data center environments and the systems that directly touch servers and other computers -- will be even more daunting. The recent Stuxnet worm that attacked a Siemens facilities application showed how building controls could potentially make IT assets vulnerable, says Mike Dauber, a VC at Battery Ventures. (Battery invested in Redwood.) Scenarios like this give CIOs the willies.

Some data center management companies have already said they don’t plan on expanding into the wider office world. Power Assure, which makes an application that swaps workloads between servers to reduce power, says office space doesn’t require that much management intelligence. Instead, the company will expand next into managing storage devices.

In the end, convergence between office space and data centers is an appealing idea and will take place to some degree, but it make take just as long as it did in electronics.