It’s going to be wind and biomass, and it’s going to cost some money.

Those are the (mostly) unsurprising conclusions of a new report from the Congressional Budget Office, The Results of Renewable or Clean Electricity Standards, that examines how the standard might be implemented on a national scale.

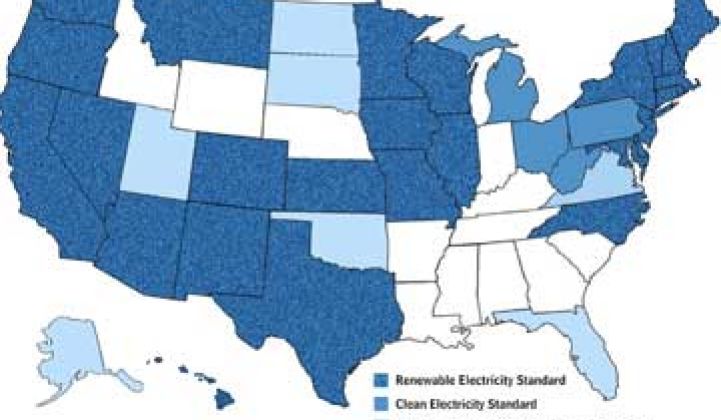

Using various models, the CBO assessed seven different scenarios for the standards. The study found that, depending on the structure of the policy, such as whether non-renewables (natural gas) would be worth partial credits or if alternative compliance payments were allowed, there were very different outcomes. But any national standard, the authors argued, would be better than the state-by-state approach that is currently happening.

The CBO borrowed models from the National Renewable Energy Lab, Resources for the Future and the Energy Information Administration to assess the various outcomes. There was a great deal of variation, given that there are endless options when it comes to producing a RES or CES. Overall, the CES, which includes options like natural gas-fired power plants and potentially nuclear, received more of an enthusiastic thumbs-up because of its flexibility. Here are some of the findings:

- Electricity prices would increase in nearly every region for each scenario, whether it’s a CES or RES and whether or not there are alternative compliance payments. The increase, however, averages around 2 percent to 4 percent more than what customers pay now, which is less than an extra cent per kilowatt-hour if you take into account the national average of $0.097/kWh. In some scenarios, especially for the Midwest, costs could come down.

- The overlap of state and federal policies would be problematic, but the study implies that if credits could be used to comply with both standards, and that utilities would have to meet whichever was more stringent, it would allow both local and federal governments to define their own sets of rules.

- Any successful scheme would have to include unrestricted trading where credits are bought and sold by utilities independently of electricity generation with which they are associated.

- Including options, such as natural gas-fired plants or even certain energy efficiency measures would help meet more stringent standards. In that case, alternative options could be worth just a fraction of a credit compared to wind or solar.

- Neither an RES nor a CES will be as effective as a cap-and-trade program.

The CBO report is noncommittal in its findings. Essentially, it informs Congress that these programs can be whatever they want them to be: weak, heavy-handed, flexible or rigid. Although it proclaims strongly that a federal program is better than 31 different programs, which is what the U.S. has today, it does not go so far as to provide any clear path as to what an effective federal policy must include.

Some people in the renewable industry, including Arno Harris, CEO of solar developer Recurrent Energy, which got bought by Sharp Solar last fall, think that a CES could be good for renewables.

“In the first ten years [of a CES], there won’t be any nuclear,” Harris told Greentech Media in January. “Policy is going to matter an awful lot in 2011.”

Unlike electric vehicles or the new MPG standards, switching the mix of electricity generation will not contribute to getting the country off of foreign fossil fuels. But without a federal standard, slow changes may be all that transpire. Renewable generation recently is closing in on nuclear and coal generation recently dropped to a 30-year low. That trickle of change, coupled with state action, might be all that can be expected right now given the political climate.