Cumulative emissions from the past five decades reached 1.125 trillion metric tons last year. This has resulted in a temperature increase of more than 1 degree Celsius from pre-industrial levels, and it's had a tangible impact on the environment: bush fires in Australia, continued Arctic ice melting and increasingly extreme weather events worldwide.

What would it take to see faster change? Wood Mackenzie’s latest Accelerated Energy Transition Outlook seeks to answer that question.

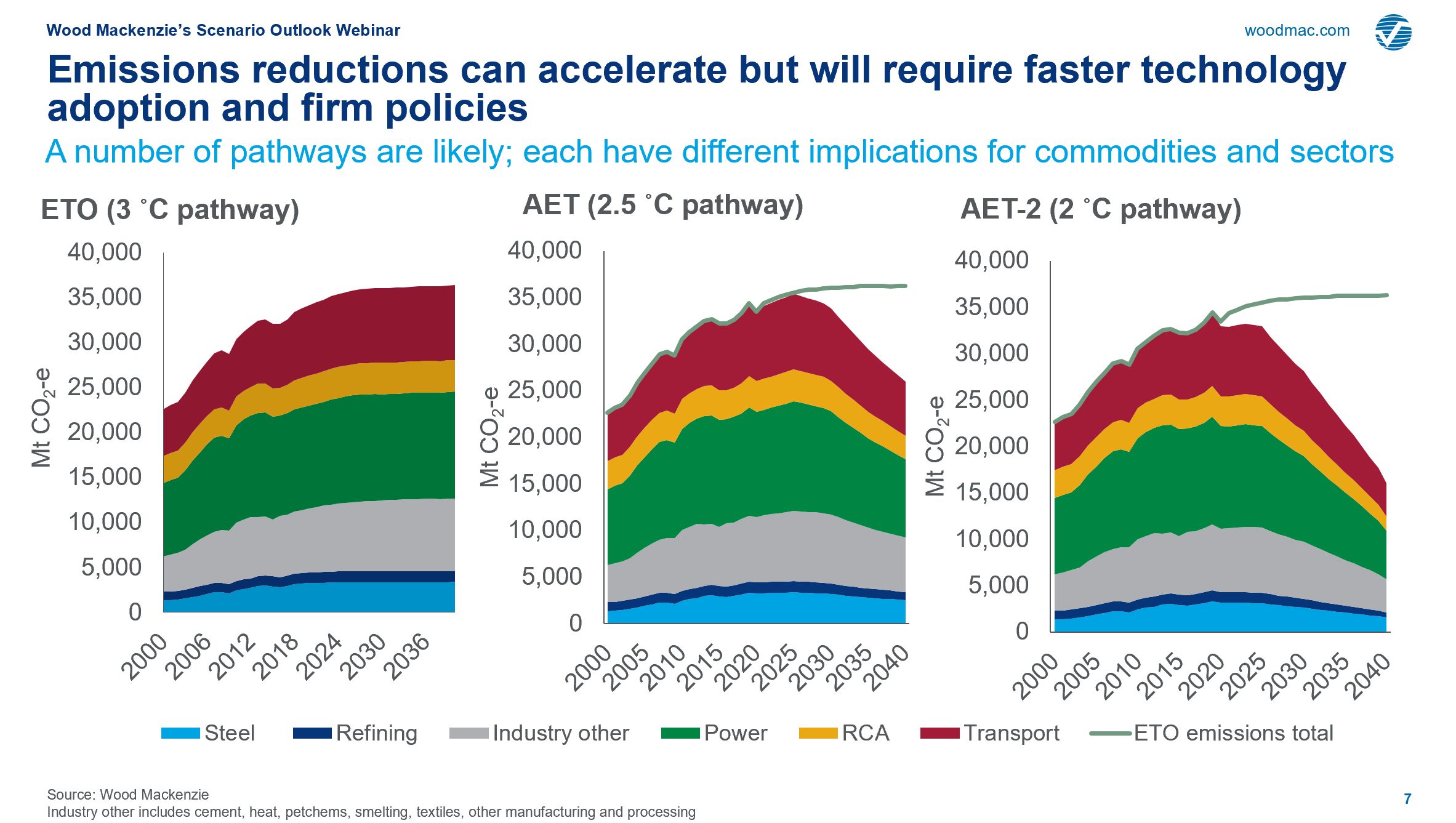

We still maintain our base case that the globe is on a 3-degree Celsius trajectory and that the long-term energy mix will remain dominated by hydrocarbons.

However, our two new scenarios outline two possible pathways for lower emissions globally.

The Accelerated Energy Transition (AET) reflects the potential for heightened preferences across society to meet the challenges presented by climate change. This is our realistic assessment of how the transition could progress much faster. It is a 2.5-degree pathway.

But obviously this is not enough. For the first time, we've also created a scenario to quantify how the world can shift to a 2-degree trajectory — what we label AET-2.

In our analysis, we’ve posed the question: How can markets scale zero-carbon energy more rapidly?

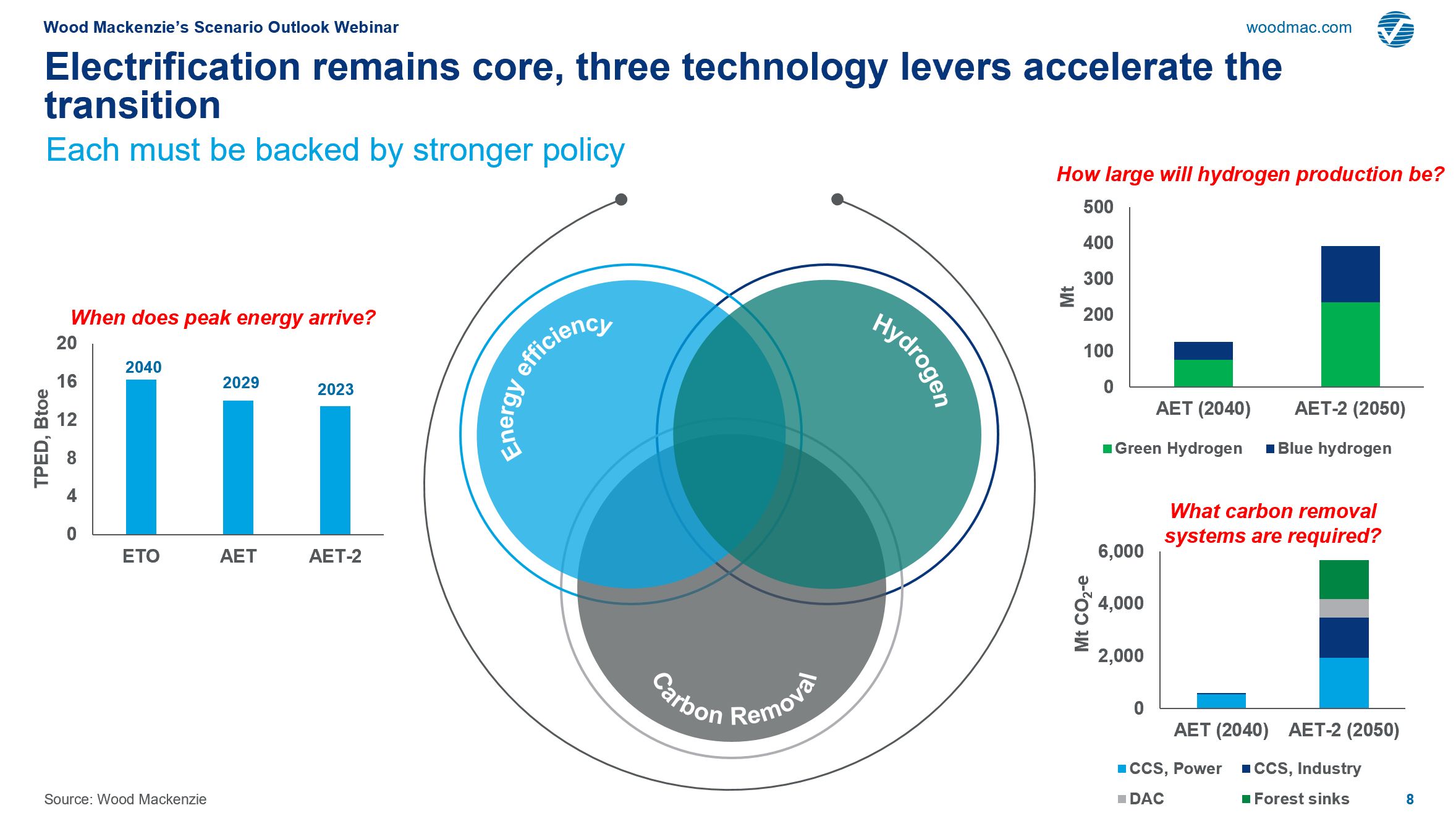

Electrifying energy markets is one solution, but that needs to be enabled by three factors.

Less energy needs to be consumed across both of our scenarios.

In our Energy Transition Outlook (ETO), peak energy demand arrives in 2040; in the AET, it's 2029. For a 2-degree world, energy demand will need to peak much sooner — in just three years' time, by 2023.

How could it happen so quickly? All of the consumer-led growth across Asia-Pacific, hydrocarbon-led industrial activity in the lower 48 U.S. states, and an expansion of energy access in some markets — all would need to come from electricity, mainly renewables. And when you use more electricity to meet your energy needs, the demand curve flattens, which means less fossil fuel combustion and significantly lower losses from production to final consumption.

One area we examined more closely was energy efficiency. In our ETO, we broadly assume efficiency improvements of 1 to 2 percent each year; in the AET, we increased these to around 3 to 4 percent per year, and they are higher still in the AET-2 scenario, increasing to 6 percent across all markets.

Carbon prices

The world still needs a carbon price or a market mechanism; otherwise, the shift in investments will be slow.

In our Accelerated Energy Transition, we state that global carbon prices of around $40/ton CO2e are in the zone of what’s politically palatable. For a 2-degree world, this must be extended to $110/ton. This range of carbon prices provides markets with new price signals to spur investments in new zero-carbon technologies.

Assuming these carbon prices, large-scale carbon removal becomes economical. In our AET case, we see the need for around 600 Mt of carbon capture and sequestration (CCS), focused mostly on the power sector. But broad carbon removal becomes absolutely necessary in a 2-degree world, with CCS, direct air capture and forest sinks all helping to lower emissions over the next 30 years.

Hydrogen

The hydrogen economy is taking off.

In both scenarios, we see a large push for wind, solar and storage developments — this leads to a surge in these investments, causing dramatically lower power-generation costs around the world. Ample power supply and improvements in electrolyzer efficiency create the conditions for the hydrogen economy to expand dramatically, addressing up to 10 percent of global demand in our AET-2 case.

This is critical, because as an energy carrier, hydrogen has so much potential across so many sectors: processing, logistics, energy storage, fuel source for energy-intensive manufacturing, power-to-X (gas, ammonia, etc.), and finally, fuel-cell vehicles.

Power sector implications

The power sector is critical to the energy transition, as it provides the conditions and incentives to decarbonize energy demand at a much faster pace than the path outlined in the ETO forecast.

We are expecting that costs for zero-carbon technologies will decline by 40 to 50 percent over the next 20 years. Our scenarios assume cost assumptions fall at a faster rate than in our base case, leading to a surge in zero-carbon power capacity additions.

In our scenarios, we looked at the dispatch logic — and the impact on commodities — differently than we have before.

In several large energy markets, companies are changing where they deploy capital. Deployments of renewables-plus-storage are displacing the need for new gas-fired capacity. This is happening in the U.S. power market right now, and it is a trend that could accelerate in other markets.

That’s why, in our scenarios, we quantified a broader and faster rollout of this trend.

The shift in power sector investment is so important because it increases the zero-carbon electricity supply. One implication is that this provides the conditions for green hydrogen to take flight, creating large-scale power supply at low prices. Green hydrogen provides a new supply source that can help to decarbonize the heavy-duty transport, industrial and residential sectors.

The future of commodities

Commodities are not affected uniformly in our scenarios. Coal, oil and gas see declining demand, and as such the marginal cost of supply will fall too, driving down prices. The issue is that we will still need to build new supply because existing assets’ contribution will diminish more rapidly.

Gas

We tested the boundaries around gas demand in two ways, looking at the power sector and at industry.

On the power side, many of the gas capacity investment needs that we see in the long term are for peaking investments; in our scenario analysis, we see peaking demand being met by a combination of renewables and long-duration batteries.

Hydrogen has a large impact on our gas demand forecasts across the industrial and residential-commercial sectors. Our approach was to estimate total hydrogen production; we then quantified the potential for hydrogen displacement across major industrial and residential-commercial subsectors that are difficult to decarbonize.

Blending hydrogen into existing pipeline networks will facilitate demand. We estimate that pipeline networks can be blended with up to 20 percent hydrogen (by volume) to overcome technical and safety concerns.

Taking these conditions into consideration — that is, new power-sector economics and an alternative for gas for heating and industry — we arrive at a materially different future for gas.

We are already seeing some buyers becoming more conscious of the source of their gas supply. It’s often the case that upstream gas production is emissions-intensive, which will need to be decarbonized, thus resulting in higher costs.

Otherwise, this approach is likely to be unacceptable in geographies that are tough on regulations. It could be argued that the EU Green Deal and Taxonomy don’t bode well for gas demand in Europe.

Oil

To arrive at a 2-degree trajectory, we had to make some major assumptions around oil demand drivers, and transport in particular, resulting in oil demand peaking by 2023.

In our base case, there are 300 million EVs on the road, displacing about 5 million barrels per day (mb/d).

This displacement is higher across our scenarios — we have a range of between 700 million to 950 million EVs in the AET and AET-2 cases, displacing 10 and 25 mb/d, respectively. There are two critical levers: First, autonomous electric vehicles increase exponentially in the scenarios; all-electric vehicles have around five times the utilization rate of traditional internal-combustion engine cars. Second, we assume strict enforcement of existing fuel-efficiency standards and that the efficiency of ICE engines improves dramatically.

There are several other factors that could see EVs expand faster than our base case. One of the game-changers we assume is inductive charging on major highways and in cities. The ability to charge while an EV is in motion would lead to a sizable surge in EV sales.

Coal

Thermal coal has been challenged by lower utilization, local policies and decreased funding for some time — indeed, coal demand already peaked around 2014.

The critical distinction with our scenario analysis is that coal assets do not have to close prematurely prior to the end of their asset life. Because our carbon price assumptions incentivize carbon removal, and CCS in particular, coal still has a place in the energy mix.

For example, we forecast CCS adoption picking up in Asia to avoid plant closure before end of lifespan, circumventing heavy employment losses in mining. Across each scenario, China and India are the only two markets with sizable coal use in power generation in 2040.

In our 2-degree scenario, coal-related emissions fall to 21 percent of global emissions by 2040 — compared to 27 percent in the AET and 38 percent in the ETO.

A lower emissions pathway is possible — but it will require an enormous shift in priorities, government policies in markets that matter, and investment. And starting today.

However, care must also be taken to ensure that energy supply is not at risk. The world is on a delicate path because cumulative emissions are already at the 1-degree level.

We need not only to mitigate future emissions by using more zero-carbon energy but also to adapt to what is already in the air by deploying removal projects.

***

Learn more about Wood Mackenzie's Accelerated Energy Transition Outlook here and watch the on-demand webinar here, including a 15-minute Q&A with the report authors.

David Brown is Head of Markets & Transitions, Americas for Wood Mackenzie and Prakash Sharma is Head of Market & Transitions, Asia-Pacific.