Since its implementation in 2006, the 30 percent solar Investment Tax Credit (ITC) has been the main federal policy mechanism to support deployment of solar installations in the U.S. With the ITC set to be stepped down to 10 percent after 2016, GTM Research is undertaking preliminary analysis of what the U.S. solar market looks like in a post-ITC world.

In comparing the U.S. market by state and market segment, the most appropriate metric is the levelized cost of energy (LCOE), which measures the total generation cost in dollars per kilowatt-hour over the lifetime of a PV system. Looking at energy cost, as opposed to capital cost, allows us to assess the competitiveness of solar versus traditional generation.

We modeled both residential and commercial LCOE for twenty state markets, including Arizona, Colorado, California, Connecticut, Delaware, Florida, Hawaii, Illinois, Massachusetts, Maryland, New Jersey, New Mexico, Nevada, New York, North Carolina, Ohio, Oregon, Pennsylvania, and Texas.

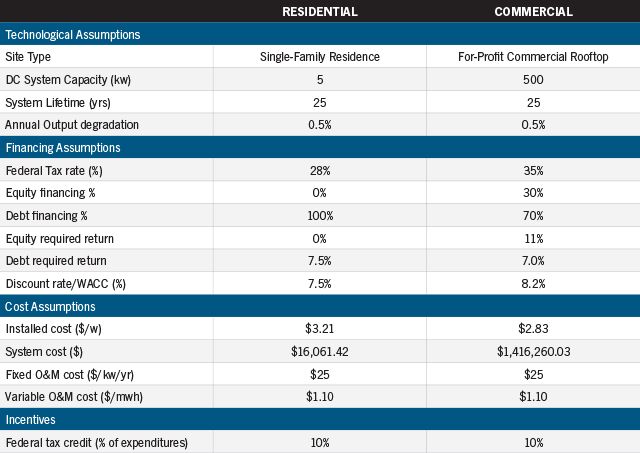

Our LCOE analysis includes the following assumptions for residential and commercial systems in 2017:

Source: GTM Research

Insolation, retail electricity prices, and sales tax rates were varied by state. For the purpose of simplicity, annual installed cost estimates were held constant across geographical markets, though, as evidenced in GTM Research’s Quarterly U.S. Solar Market Insight Reports, there is some variability in prices across states. For 2017, we applied a 10 percent ITC with no additional state incentives. While it is possible that some state-level incentives will still be available in out years, we are intentionally conservative in regards to solar policy in order to paint a “worst-case” scenario.

To assess the viability of distributed generation across state markets from 2017 onward, we compared the LCOE to average retail electricity prices with an assumed annual increase of 1.5 percent.

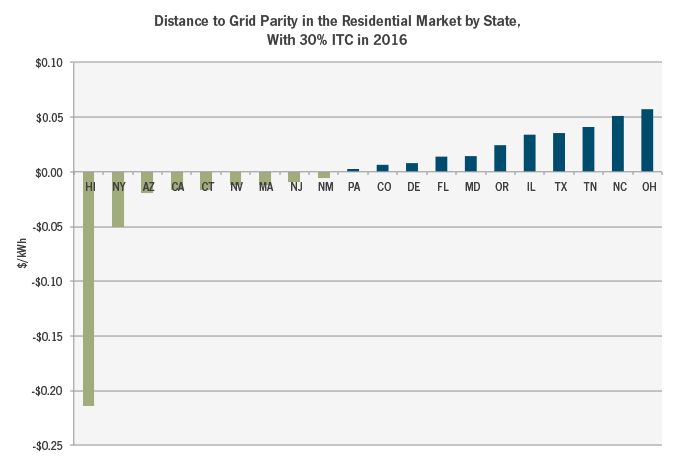

Prior to the expiration of the 30 percent ITC in 2016, our model shows price convergence for nearly half of the twenty states evaluated in the residential market.

Source: GTM Research

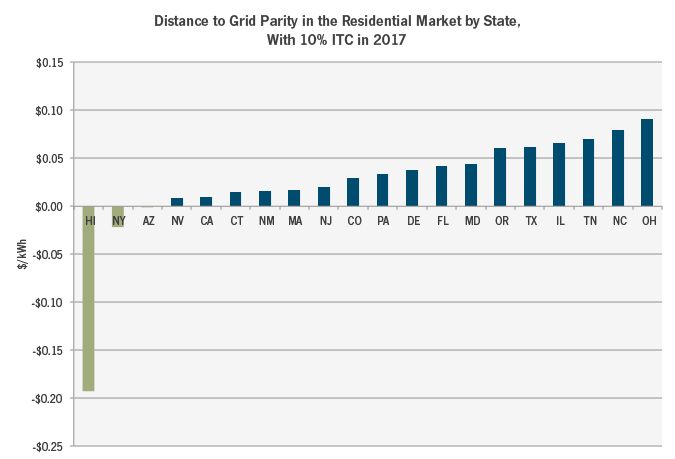

In 2017, post-ITC, we expect only three residential state markets to have solar generation costs below grid prices: Hawaii, New York, and Arizona. However, fourteen state markets will have generation prices approximating grid prices, with a delta between LCOE and retail electricity rates of less than $0.05 per kilowatt-hour.

Source: GTM Research

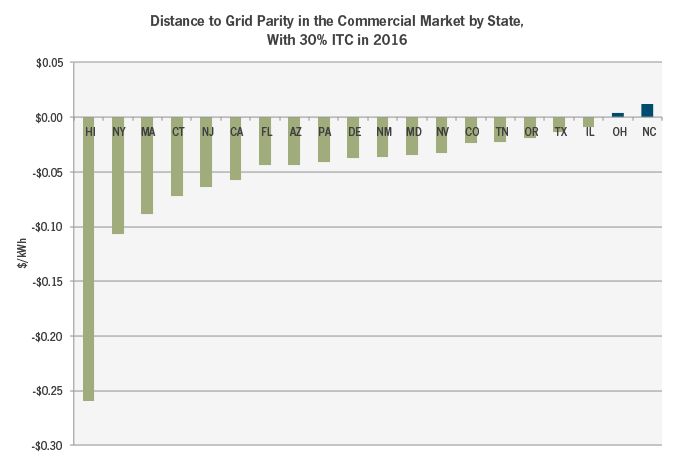

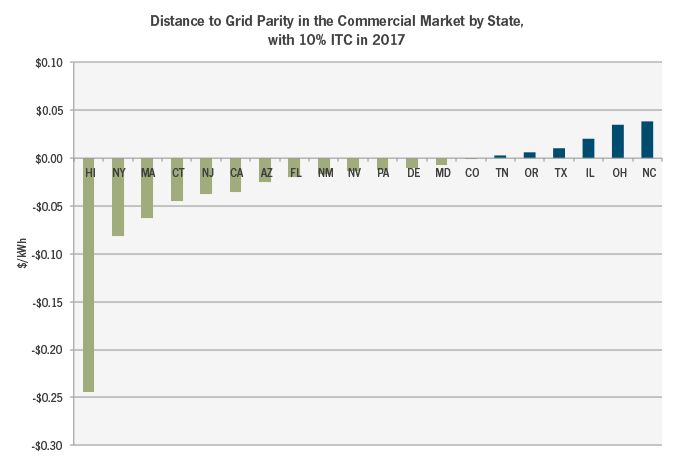

Looking to the commercial market, we see substantially higher penetration of solar at, or below, grid prices. With the 30 percent ITC in 2016, solar generation costs in eighteen of the twenty state markets analyzed will be below grid prices, while all states will be less than $0.01 per kilo-watt hour away from grid parity.

Source: GTM Research

After the ITC is stepped down to 10 percent in 2017, 70 percent of the states analyzed have a project LCOE below retail electricity prices. Additionally, all twenty states evaluated still see solar price convergence toward traditional energy, with a delta between LCOE and grid price below $0.05 per kilowatt-hour. Based on these estimates, GTM Research expects PV to be an economically viable option for commercial customers in 2017, despite the step-down of the ITC from 30 percent to 10 percent.

Source: GTM Research

Please note that these estimates represent our first preliminary analysis of the U.S. distributed generation market following the expiration of the 30 percent ITC. Going forward, we’ll look to evaluate the impact several factors can have on this model, including variations in system prices, electricity rates, and financing costs.

We realize that the 2016 ITC expiration may not take place as currently planned. In a more preferable scenario, the ITC would step down over time, allowing for a gradual, rather than sudden, shift in these numbers and an even more promising outlook for solar as an economic generation option in certain residential and commercial markets from 2017 onwards.

For more information on GTM Research’s U.S. solar market analysis, contact [email protected].

***

Meet the author of this piece, Analyst Carolyn Campbell, and the rest of the GTM Research team at this year's U.S. Solar Marketing Insight in San Francisco on Oct 29-30. Go here for more details