Energy efficiency programs are the hidden powerhouse behind many current trends in the electric utility industry.

Electricity demand has been largely flat in the U.S. for the past 10 years, in no small part due to electricity efficiency programs funded by utility customers in nearly all states. Appliance and equipment energy efficiency standards are also having a big impact, along with tighter building codes, tax credits and finance programs.

These programs, in turn, have had a ripple effect on investment across the sector, with impacts on the future of generation, transmission and distribution system decisions. In recent years, there has been a wave of power plant retirements, as generators are squeezed between low natural-gas prices, declining costs of wind and solar, environmental and other regulatory costs, and nearly flat demand due to energy efficiency gains.

To provide insight on the future impacts of electricity efficiency programs funded by utility customers, Lawrence Berkeley National Laboratory did a bottom-up assessment of likely futures for spending and savings in all U.S. states.

The new study includes three scenarios — low, medium and high cases — for 2030, with projections of spending and savings for interim years. We combined a thorough review of the literature with over 50 interviews of program administrators, state regulators and efficiency experts.

Regional variation and low generation costs

Electricity efficiency programs have been funded by utility customers for decades. They totaled about $5.8 billion in 2016, and are saving 0.75 percent of U.S. electricity demand each year. Earlier research from Berkeley Lab showed that these programs delivered savings at a cost to utility program administrators of 2.5 cents per kilowatt-hour, on average, between 2009 and 2015.

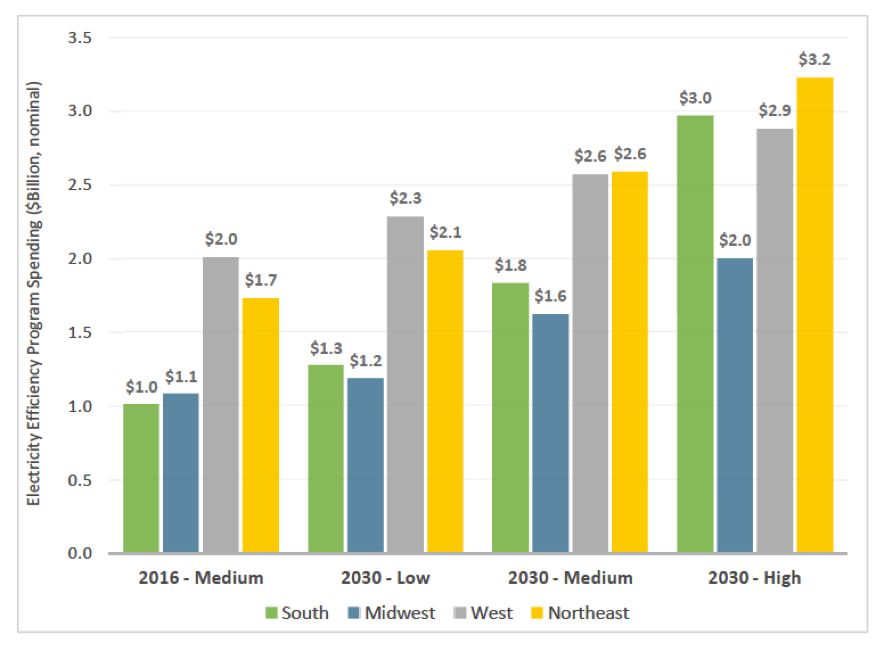

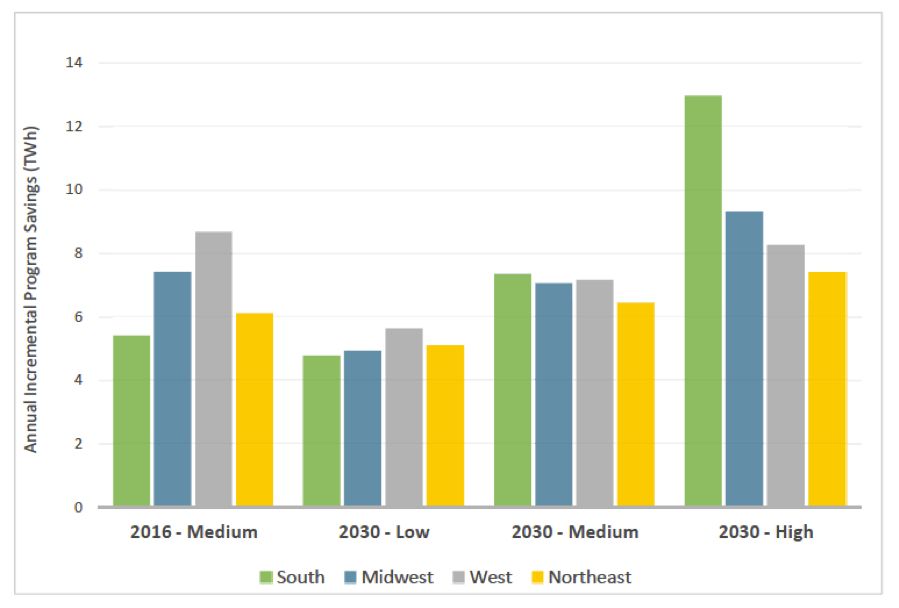

Looking forward, in all three of our study scenarios we expect current funding levels to continue through 2030, even in the low case. In the high case, budgets could double by 2030 ($11.1 billion). Our medium scenario projects funding of $8.6 billion in 2030, an increase of more than 45 percent.

Electricity Efficiency Program Spending by Region in 2016 vs. 2030 Scenarios

Apart from our projections of dollars spent and electricity saved, there are some important dynamics and trends to watch out for.

First, regional trends are a notable variable in the future of electricity efficiency programs. The South has the biggest potential for energy efficiency gains both in terms of spending and savings, since most states in that region haven’t had big programs in the past. Will they step up efforts to capture it?

The Northeast, California and the Pacific Northwest, meanwhile, have long been leaders on efficiency, with the highest funding levels and biggest savings. But after so many years, to what extent are cost-effective savings tapped out? Has most of the low-hanging fruit been picked, or will we reap new crops of low-cost efficiency technologies and services?

Second, low generation costs will be important. For many years, a portfolio of electricity efficiency programs was nearly always cheaper than supply-side resources. But low natural-gas prices, more efficient gas turbines and declining prices for wind and solar are challenging the economic case for some energy efficiency programs in parts of the U.S. More renewable resources could also mean that a new priority for energy efficiency program designs is to help integrate wind and solar.

Annual Incremental Program Savings by Region in 2016 vs. 2030 Scenarios

Indeed, energy efficiency program managers are already paying more attention to time-varying value and locational value, controllable loads, grid-interactive efficient buildings and bundling demand-side options such as energy efficiency, demand response, distributed generation and storage, and electric vehicles in order to provide grid services.

These trends are likely to become even more important going forward, creating a need for more sophisticated data collection and analysis and new opportunities for distributed energy resources. (Listen to the recent Energy Gang podcast on how energy efficiency is evolving into a real-time grid resource.)

A changing environment

The impacts of efficiency programs are also influenced by complementary strategies such as appliance and equipment efficiency standards and building energy codes. Congress authorized the U.S. Department of Energy to update appliance, equipment and lighting standards for many products in the Energy Independence and Security Act of 2007, which are now starting to kick in. State and local governments continue to refresh and update building codes, to keep up with new technologies and prices.

As these new and updated standards take effect, some voluntary efficiency program strategies may become less effective. For instance, the most cost-effective efficiency programs now deal with lighting, delivering 45 percent of all residential program savings between 2009 and 2015. But as recently enacted federal standards for lighting take effect and as the lighting market continues to transform — such as the amazing cost drops and increased penetration of LEDs — efficiency programs for lighting will have to evolve.

Many utility efficiency programs have aimed at creating a permanent market transformation for targeted technologies. Now some of those markets have indeed been transformed. The success of residential lighting programs suggests that program administrators will have to look for additional technical opportunities for saving electricity.

Structural changes to the U.S. economy are likely to drive down energy demand in general. The Energy Information Administration estimates that U.S. energy intensity has decreased from 12,000 to 6,000 Btu per dollar of economic activity from 1980 to 2015, and will be 4,000 Btu per dollar in 2040. The agency forecasts electricity growth to be 0.59 percent per year through 2030, half the rate of growth since 1990.

On the other hand, electrification trends could drive up demand for power, such as electric vehicles heat pumps, and industrial applications. An Electrification Futures Study from the National Renewable Energy Laboratory found that demand growth could rise to 1.2 percent per year through 2050 in a “medium” scenario, largely from increased electricity demand from the transportation sector. Increased electrification could also provide new opportunities for the adoption of high-efficiency technologies and may require policymakers to rethink some of their guidelines and screening criteria for energy efficiency technologies and programs.

The estimates of projected spending and savings in our study suggest a wide range of potential trajectories for electricity efficiency going forward. In addition to the inherent uncertainty of predicting the future, many drivers will be out of the control of program administrators and state regulators, such as broader market conditions and interactions with other energy policies.

But the factors that they do control will require an ongoing assessment of program designs, budgets and other regulatory decisions. Times are certainly changing in the electric power sector, and energy efficiency thinking will have to change to keep pace.

***

Chuck Goldman and Lisa Schwartz are members of the Electricity Markets and Policy Group at Lawrence Berkeley National Laboratory.